Needle-Free Injector Market Overview and Size

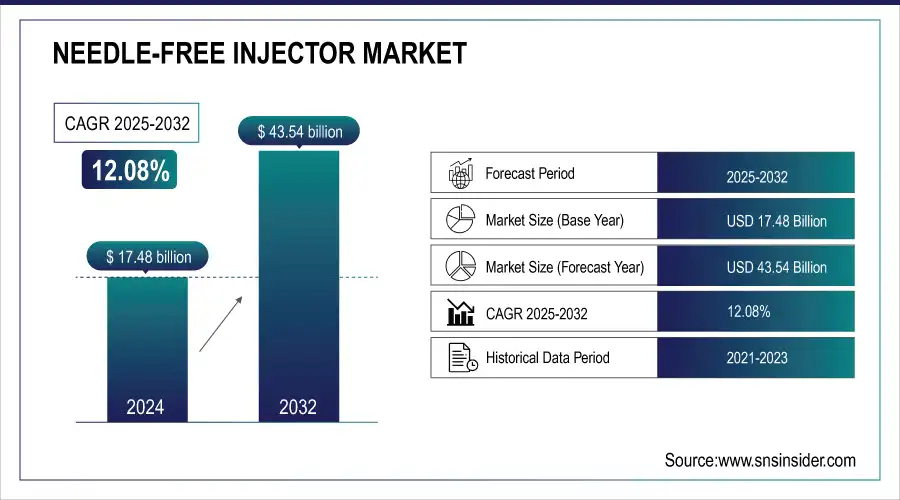

The Needle-Free Injector Market was valued at USD 17.48 billion in 2024 and is expected to reach USD 43.54 billion by 2032, growing at a CAGR of 12.08% from 2025-2032.

The needle-free injectors market is set for substantial growth, driven by rising regulatory approvals, the need for self-administration, and safety advantages over traditional injections. These devices eliminate pain and infection risks while enhancing patient and healthcare provider safety. Companies like Prejex, Polybond, and collaborations such as Scancell with PharmaJet are advancing global distribution and clinical applications. Needle-free injectors also enable at-home administration, reducing hospital visits and healthcare costs. These trends highlight a shift in drug delivery technology and underscore the increasing significance of needle-free injectors in modern healthcare.

To Get More Information on Needle-Free Injector Market - Request Sample Report

Based on the American Nurses Association, it is estimated that 74% of needlestick injuries are caused by contamination and may lead to serious infections. Treating these injuries is costly, with the Centers for Disease Control and Prevention estimating that treatment expenses range between USD 500 and over USD 3,000 per incident.

The CDC also estimates that approximately 385,000 needlestick injuries are reported annually in U.S. hospitals, while the European Agency for Safety and Health at Work reports about one million needlestick injuries globally each year.

With various health funding and insurance programs in place, health expenses in the U.S. reach about 2.4 times the global average and are projected to increase by 68% over the next decade.

Advantages of Needle-Free Injectors Over Traditional Injectors

| Feature | Needle-Free Injectors | Traditional Injectors |

|---|---|---|

| Pain Level | Minimal to no pain | Moderate to high pain |

| Infection Risk | Lower risk of infections | Higher risk due to needle exposure |

| Ease of Use | Simple application, often one-handed | Requires careful handling and technique |

| Waste Management | No sharps waste; environmentally friendly | Generates sharps waste; requires disposal |

| Patient Compliance | Increased compliance due to comfort | Lower compliance due to fear of needles |

Needle-Free Injector Market Trends

-

Rising demand for painless and convenient drug delivery is driving needle-free injector adoption.

-

Increasing use in vaccines, insulin, and biologics is expanding market applications.

-

Advancements in spring-based, jet, and electronic injectors are improving precision and patient compliance.

-

Growing focus on reducing needle-stick injuries and medical waste is boosting adoption in healthcare settings.

-

Home healthcare and self-administration trends are accelerating market growth.

-

Integration with digital tracking and smart devices is enhancing dosage accuracy and monitoring.

-

Collaborations between pharmaceutical companies and medical device manufacturers are fostering innovation.

Needle-Free Injector Market Growth Drivers:

Diabetes and Cosmetic Procedures Fueling Market Growth

The escalating prevalence of diabetes globally further drives the demand for self-injection systems, including needle-free injectors. Patients now seek easier self-medication. Increased chronic diseases combined with increased use of injectables enhance this demand. The motive behind its preference is mainly because injectables include drugs with immediate onset of action and possess superior bioavailability, which is strongly needed in emergencies. With recent technological developments, the acceptance of cosmetic procedures such as skin whitening and body mark removal has significantly transformed. The previous main limitation for market growth was the high costs associated with surgery; however, with the recent introduction of innovative devices such as needle-free injectors, easier acceptance and usage are now possible.

This NFIT is composed of many systems that deliver medicine across the dermis, thereby aiding the pharma industry and mass immunization efforts in less developed countries. This NFIT eliminates the possibility of causing needlestick injury, one of the major risks because CDC believes there are approximately 385,000 needlestick injuries annually in U.S. hospitals. These are found to occur mainly when needles are in use or when they are being disposed of; there is a growing demand for safer alternatives such as needle-free injectors. The cosmetic industry is seeing growth in the adoption of needle-free injectors, which is highly stimulated by high growth in cosmetic procedures. The American Society of Plastic Surgeons (ASPS) reported that in 2023, 25.4 million cosmetic procedures were performed, which comprised 1.6 million surgical procedures and 23.8 million minimally invasive procedures, including neuromodulator injections and hyaluronic acid fillers.

Needle-Free Injector Market Restraints:

High Operating Costs and Sterilization Challenges

High operating costs remain a major challenge in the needle-free injectors market, primarily due to the complexity of manufacturing equipment and stringent sterilization requirements. The production of needle-free injectors demands advanced machinery capable of precise dosing, high-pressure delivery systems, and robust safety mechanisms, all of which incur significant capital and maintenance expenses. In addition, strict sterilization protocols must be followed to ensure patient safety, prevent contamination, and comply with regulatory standards, further increasing operational expenditures. These factors collectively elevate the cost of production and limit scalability, posing a barrier for manufacturers seeking to expand their offerings and maintain competitive pricing in a growing market.

Needle-Free Injector Market Segment Analysis

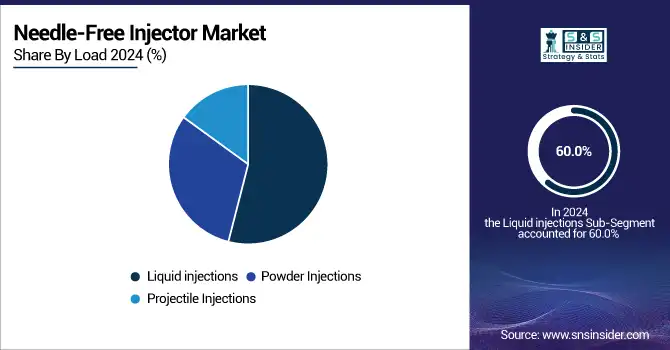

By Load Liquid Injections dominated while Powder Injections are expected to grow fastest

Liquid injections were the most dominant segment, accounting for approximately 60.0% market share in 2024. This is owing to their usage in numerous medical applications, including drug delivery and vaccination. Liquid formulations enjoy an edge over their solid counterparts primarily due to easier administration along with substantial regulation of dosage and immediate bioavailability. The growth in demand for liquid injections is facilitated by the increased prevalence of chronic diseases and the emerging need for effective vaccination strategies. The segment expected to grow the fastest soon is powder injections; this segment is estimated to increase at around 12% CAGR. This growth can be traced to the increased demand for powder formulations that enhance stability and increase shelf life in comparison to liquid-based counterparts. Injections based on powder formulations are useful for biologics and vaccines as they require a great deal of stability to remain effective.

By Technology Spring-Loaded Jet Injectors dominated while Battery-Powered Jet Injectors are expected to grow fastest

Spring-loaded jet injectors held nearly 55.0% market share from 2024. Indeed, their application in vaccine and drug delivery without using needles has increased their appeal, especially in pediatric and needle-phobic populations. A dosing mechanism with no discomfort has made spring-loaded injectors sought after in clinical practice.

The fastest-growing technology segment in the market is battery-powered jet injectors, which is expected to register a 14% CAGR. The increasing adoption trend of battery-powered devices is further fueled by the advancements in technology that are likely to make the devices more user-friendly, portable, and with injection time much faster. In both clinical and home care usage, their capability to administer various formulations with adaptations according to the changing needs of patients would make them very alluring.

By Delivery Site Subcutaneous Injectors dominated while Home Care Settings are expected to grow fastest

Subcutaneous injectors dominate the market due to their ease of use, minimal pain, and suitability for self-administration of drugs. They are widely preferred for chronic disease management, including insulin and biologics, enabling patients to administer medications at home safely. Their efficiency, patient compliance, and lower risk of complications make subcutaneous injectors the leading segment in needle-free delivery systems.

By Application Drug Delivery led while Powder Injections are projected to grow fastest

Drug delivery is the dominant application segment in the needle-free injectors market. These devices facilitate precise, painless administration of therapeutic drugs, particularly for chronic conditions like diabetes and autoimmune disorders. The growing demand for self-administered treatments, coupled with the safety and convenience of needle-free systems, drives the widespread adoption of these injectors in routine medical care.

By End User Home Care Settings dominated while Hospital and Clinical Settings are expected to grow fastest

Home care settings lead the market as patients increasingly prefer self-administration of medications for convenience and cost savings. Needle-free injectors allow safe, effective at-home treatments, reducing hospital visits and enhancing patient independence. This trend is supported by the rising prevalence of chronic diseases and the growing focus on patient-centered healthcare, making home care the dominant end-user segment.

Needle-Free Injector Market Regional Analysis

North America Needle-Free Injector Market Insights

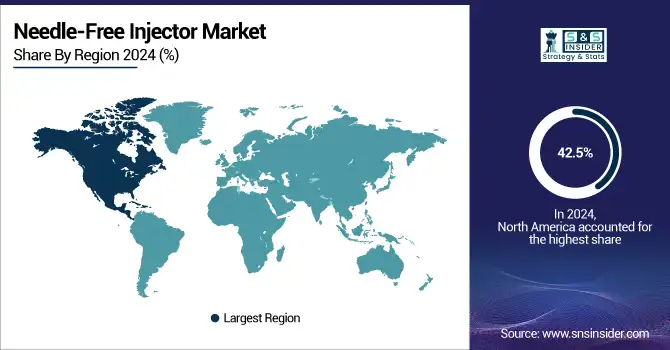

North America was the dominant region in 2023, comprising 42.5%, and is expected to rise in the forecast period mainly because of its important industry players operating from the United States, with the high prevalence of chronic and lifestyle diseases. In addition, the trend to self-administer drugs continues to gain more popularity among the U.S. and Canadian populations, which will also further accelerate regional growth.

Do You Need any Customization Research on Needle-Free Injector Market - Enquire Now

Europe Needle-Free Injector Market Outlook

Europe is anticipated to acquire the second-largest revenue share, with high prospects for a massive compound annual growth rate (CAGR) in this specific segment over the forecasting years. The advancements in medical technology, surging acceptability of needle-free injectors, and high health expenditure levels in the region are some of the principal factors driving this sector.

Asia Pacific: Fastest Growing Needle-Free Injector Market

The Asia Pacific market is expected to hold the highest CAGR value of around 8.16%. Supportive government initiatives, such as encouraging the use of medical devices, growth in the geriatric population, and increasing healthcare expenditures, are factors that can be accredited to the growth in the market. The rise in elderly populations in Asian countries, who have a greater tendency to experience chronic diseases, will also greatly drive the demand for needle-free injectors in this region. Overall, the market for needle-free injectors is well placed to witness healthy growth in these major geographies due to changes in demographics, technological improvements' progress, and transformations in healthcare-based preferences.

Middle East & Africa and Latin America Needle-Free Injector Market Forecast

The Middle East & Africa and Latin America are emerging markets for needle-free injectors, driven by increasing awareness of safe injection practices and rising demand for self-administered therapies. Market growth is supported by improving healthcare infrastructure, government initiatives, and partnerships with global companies to enhance accessibility, making these regions attractive for expansion despite cost and regulatory challenges.

Needle-Free Injector Market Competitive Landscape:

PharmaJet Inc.

PharmaJet Inc. is a leading player in the needle-free injectors market, specializing in jet injection technology for drug and vaccine delivery. The company focuses on providing safe, painless, and efficient alternatives to traditional needle-based injections. PharmaJet’s devices support a wide range of applications, including immunizations and therapeutics, enhancing patient compliance and safety. Strategic collaborations and continuous innovation have strengthened its global presence and advanced needle-free delivery solutions in modern healthcare.

-

2025: PharmaJet signed an MOU with Egypt’s UPA and EVA Pharma to integrate Tropis needle-free delivery into Egypt’s routine immunization. The partnership aims to cut costs by 38%, localize manufacturing, and improve access for immunization campaigns.

-

2025: PharmaJet will present partner data at the World Vaccine Congress showing that needle-free delivery enhances immune response in DNA cancer vaccine trials, demonstrating potential tumor reduction in hard-to-treat populations.

-

2025: PharmaJet partnered with Immuno Cure to use Tropis for administering an experimental HIV therapeutic DNA vaccine (ICVAX) in clinical trials, aiming to improve immunogenicity and enhance the patient experience.

Portal Instruments

Portal Instruments is an emerging player in the needle-free injectors market, focusing on innovative, user-friendly, and sustainable drug delivery solutions. The company specializes in electro-mechanical needle-free injectors that enable precise, painless administration of injectable therapies. By combining advanced technology with patient-centric design, Portal Instruments aims to improve treatment adherence, reduce medical waste, and expand the accessibility of needle-free delivery for a wide range of medications.

-

In 2025, Portal Instruments unveiled the PRIME Nexus reusable needle-free electro-mechanical injector, offering 1 mL and 2.25 mL capacity at the Pre-Filled Syringe Conference, positioning it as a sustainable solution for the growing injectable therapies market.

Crossject

Crossject is a key player in the needle-free injectors market, specializing in the development of Zeneo® auto-injectors that deliver reliable, precise, and painless drug administration. The company focuses on enhancing safety, patient compliance, and ease of use, particularly for emergency and self-administration scenarios. Crossject’s innovative technology ensures consistent delivery depth and minimizes risks associated with traditional needle injections, strengthening its position in global needle-free delivery solutions.

-

In 2025, Crossject’s Zeneo needle-free auto-injector consistently matched 30 mm intramuscular injection depth and exceeded standard needle lengths, reinforcing its reliability for emergency use without misuse or injury risks.

-

In 2024, Crossject and the U.S. Department of Defense renewed their research agreement (CRADA) to advance Zeneo®, developing and evaluating upgraded needle-free injectors for military personnel and first responders.

Key Players in the Needle-Free Injector Technology

-

PharmaJet Inc.

-

Crossject

-

Portal Instruments

-

NuGen Medical Devices

-

Antares Pharma, Inc.

-

PenJet Corporation

-

Medical International Technology Inc.

-

Ferring Pharmaceuticals

-

Pfizer Inc.

-

CSL Limited (Seqirus UK Limited)

-

IntegriMedical

-

ARS Pharma

-

Zogenix

-

QS Medical Technology Co., Ltd.

-

Halozyme, Inc.

-

Caretek Medical

-

Guangzhou Medsinglong Medical Equipment Company Ltd.

-

D'Antonio Consultants International, Inc.

-

AcuShot Needle Free

-

InjexUK

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 17.48 Billion |

| Market Size by 2032 | USD 43.54 Billion |

| CAGR | CAGR of 12.08% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Load (Liquid Injections, Powder Injections, Projectile Injections) • By Technology (Spring-loaded jet injectors, Battery-powered jet injectors, Gas-powered jet injectors) • By Delivery Site (Intra-dermal injectors, Intramuscular injectors, Subcutaneous injectors) • By Application (Drug Delivery, Vaccines, Cosmetic, Others) • By End User (Home Care Settings, Long Term Care Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | PharmaJet Inc., Crossject, Portal Instruments, NuGen Medical Devices, Antares Pharma, Inc., PenJet Corporation, Medical International Technology Inc., Ferring Pharmaceuticals, Pfizer Inc., CSL Limited (Seqirus UK Limited), IntegriMedical, ARS Pharma, Zogenix, QS Medical Technology Co., Ltd., Halozyme, Inc., Caretek Medical, Guangzhou Medsinglong Medical Equipment Company Ltd., D'Antonio Consultants International, Inc., AcuShot Needle Free, InjexUK |