Corrosion Inhibitors Market Report Scope & Overview

The Corrosion Inhibitors Market size was USD 8.67 billion in 2023 and is expected to reach USD 12.72 billion by 2032 and grow at a CAGR of 4.35% over the forecast period of 2024-2032.

To Get more information on Corrosion Inhibitors Market - Request Free Sample Report

It offers detailed analysis of production capacity and utilization rates by type and region for 2023. It includes detailed tracking of raw material price trends and fluctuations across key countries. The report evaluates regulatory frameworks impacting the corrosion inhibitors industry, with specific attention to compliance shifts and environmental restrictions. It further assesses carbon emission data, waste management practices, and sustainability initiatives adopted by major manufacturers. Innovation trends are covered, highlighting R&D investments in eco-friendly and high-performance inhibitor formulations. Additionally, adoption rates of corrosion monitoring software and key features analysis are presented by region, supporting strategic decision-making. This comprehensive dataset supports manufacturers, policymakers, and investors in understanding evolving market dynamics.

The Corrosion Inhibitors market in the United States was Market size was USD 1.41 billion in 2023 and is expected to reach USD 2.17 billion by 2032 and grow at a CAGR of 4.89% over the forecast period of 2024-2032. This is due to its highly developed industrial infrastructure, stringent regulatory framework, and substantial demand across key end-use sectors such as oil & gas, power generation, water treatment, and automotive manufacturing. The country’s extensive pipeline and refinery network, coupled with the presence of aging infrastructure, necessitates the regular use of corrosion inhibitors to ensure operational safety and efficiency. Moreover, strong government enforcement of environmental regulations from agencies like the EPA has encouraged the use of advanced, environmentally friendly corrosion protection solutions. The presence of global industry leaders such as BASF Corporation, Henkel, and Dow Inc., along with ongoing innovation and investment in sustainable corrosion prevention technologies, further strengthens the U.S. market position.

Market Dynamics

Drivers

-

Rising need for asset protection in aging infrastructure and industrial equipment fuels the corrosion inhibitors market growth.

A major driver propelling the corrosion inhibitors market is the growing demand for asset preservation in aging infrastructure, particularly in sectors such as oil & gas, power generation, water treatment, and manufacturing. In the U.S., over 60% of pipelines and industrial assets are more than 30 years old, as reported by the U.S. Department of Transportation in 2023. These aging systems are more prone to corrosion, necessitating regular maintenance and the use of high-performance inhibitors to ensure safety and operational efficiency. Furthermore, industries are increasingly investing in corrosion prevention to avoid costly unplanned shutdowns, environmental incidents, and structural failures. This has spurred demand for advanced, cost-effective, and eco-friendly corrosion inhibitors that can extend the life of critical infrastructure, reduce maintenance costs, and comply with strict environmental regulations.

Restrain

-

Stringent environmental regulations on toxic chemicals limit the growth potential of traditional corrosion inhibitors.

One of the major restraints hampering market expansion is the increasing enforcement of stringent environmental regulations related to the use of hazardous chemicals in corrosion inhibitors. Government agencies such as the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) have restricted the use of certain phosphate-based and chromate-containing inhibitors due to their adverse environmental and health impacts. This has forced manufacturers to either reformulate existing products or invest heavily in the development of greener alternatives. However, eco-friendly formulations often come with higher production costs and may not match the performance of traditional inhibitors in extreme conditions. As a result, the industry faces challenges in striking a balance between regulatory compliance, product performance, and cost-effectiveness, which slows down adoption rates, particularly in developing countries with price-sensitive markets.

Opportunity

-

Rising demand for green and bio-based inhibitors presents lucrative opportunities for sustainable product innovation.

The increasing global emphasis on sustainability and environmental safety has opened up significant opportunities in the development of green and bio-based corrosion inhibitors. With regulatory bodies pushing for lower emissions and less toxic chemicals, industries are shifting towards formulations derived from natural extracts, plant oils, and biodegradable compounds. For example, recent R&D trends have focused on inhibitors based on amino acids, chitosan, and lignin derivatives that offer corrosion protection with minimal environmental impact. Governments and organizations are also offering grants and incentives for sustainable chemical innovations. This transition is particularly gaining momentum in industries such as water treatment and marine coatings, where ecological sensitivity is paramount. The rising adoption of circular economy principles and eco-label certifications in industrial procurement further supports the commercial viability of sustainable corrosion inhibitor products.

Challenge

-

Difficulty in achieving long-term corrosion protection in harsh industrial and marine environments poses a major challenge.

Despite technological advancements, delivering long-lasting corrosion protection in highly aggressive environments remains a key challenge for the market. Sectors like offshore oil & gas, chemical processing, and marine transport operate under extreme conditions involving high salinity, pressure, temperature, and chemical exposure. Traditional inhibitors often degrade over time or fail to provide consistent performance under such stress. Furthermore, the development of high-performance formulations that can endure these harsh conditions while remaining environmentally safe is both technologically complex and cost-intensive. Research into nanotechnology-enhanced and smart-release inhibitors is ongoing but not yet widely commercialized. These performance limitations hinder the ability of corrosion inhibitors to offer reliable, long-term solutions in critical applications, making end-users wary of complete dependence on chemical solutions and prompting investments in supplementary mechanical protection methods.

Segmentation Analysis

By Product

Inorganic pigments held the largest market share around 68% in 2023. It is due to their eco-friendly composition, cost-effectiveness, and compatibility with various industrial applications. These inhibitors, often derived from amines, carboxylic acids, and plant extracts, are increasingly favored for their biodegradability and low toxicity, aligning with global environmental regulations. Unlike their inorganic counterparts, organic inhibitors offer excellent film-forming capabilities, providing effective protection in both aqueous and non-aqueous systems, including oil & gas, water treatment, and metalworking industries. Moreover, advancements in green chemistry have led to the development of high-performance organic inhibitors that can function efficiently under harsh conditions while reducing environmental hazards. With industries prioritizing sustainable solutions and governments incentivizing the adoption of cleaner chemicals, the demand for organic corrosion inhibitors continues to rise, solidifying their dominant position in the global market.

By Type

Oil Based held the largest market share at around 58% in 2023. It is due to their superior long-lasting protection and strong affinity for metal surfaces in harsh environments. These inhibitors are particularly effective in industries like oil & gas, marine, and automotive, where equipment is exposed to moisture, salt, and other corrosive agents. The oil-based formulation forms a hydrophobic barrier that resists water penetration and adheres tightly to metal surfaces, preventing oxidation and corrosion over extended periods. Additionally, oil-based inhibitors perform well under extreme temperatures and pressures, making them ideal for pipelines, offshore platforms, and machinery lubrication systems. Their ease of application and compatibility with existing industrial processes further contribute to widespread adoption. As industries continue to prioritize equipment longevity and operational reliability, the robust performance of oil-based corrosion inhibitors drives their dominance in the market.

By End Use

Oil and Gas held the largest market share, around 32%, in 2023. This is due to the vulnerability of critical infrastructure to corrosion-related damage in the oil and gas sector, the corrosion inhibitors market has been dominated by the oil and gas industry. Pipelines, storage tanks, and drilling equipment, as well as refineries, function in particularly corrosive conditions including saltwater, hydrogen sulfide, and higher temperatures. Due to the serious safety threats, operational interruption, and financial loss that corrosion causes, the industry expends a lot of its resources on solutions to prevent corrosion. The importance of corrosion inhibitors for upstream and downstream operations is evident for asset integrity, equipment longevity, and meeting stringent environmental and safety regulations. In addition, there has been an increase of energy demand on a global scale and oil exploration in offshore and deepwater areas which creates a greater initiative to develop reliable and effective corrosion protection technologies.

Regional Analysis

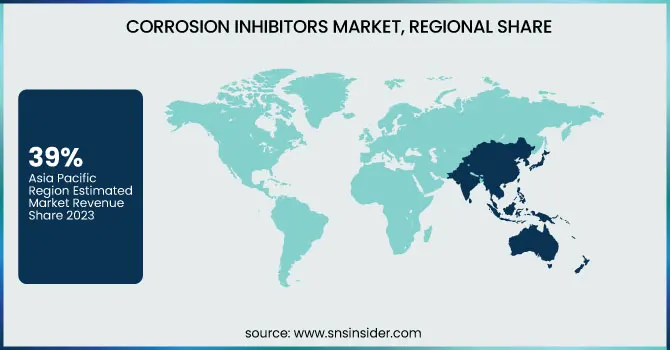

Asia Pacific held the largest market share, around 39%, in 2023. This is due to its rapid industrialization, expansive manufacturing base, and significant investments in infrastructure and energy sectors. Countries such as China, India, Japan, and South Korea have witnessed substantial growth in industries like oil & gas, power generation, construction, and water treatment key areas that demand extensive use of corrosion inhibitors to maintain operational efficiency and reduce equipment wear. Additionally, rising urbanization and the development of smart cities have increased the need for protective coatings and maintenance chemicals. Government initiatives promoting industrial expansion and stricter environmental regulations regarding corrosion-related pollution have further accelerated demand. Moreover, the availability of raw materials and cost-effective manufacturing processes in the region support large-scale production and consumption of corrosion inhibitors, solidifying Asia Pacific's dominant position in the global market.

North America held a significant market share. It is due to its well-established industrial and energy infrastructure, particularly in the oil & gas, chemical processing, and power generation sectors. The United States, being one of the world’s largest producers of oil and natural gas, heavily relies on corrosion protection solutions to extend the life of pipelines, storage tanks, and refinery equipment. Additionally, stringent environmental and safety regulations enforced by agencies like the U.S. Environmental Protection Agency (EPA) have pushed industries toward the use of advanced, eco-friendly corrosion inhibitors. High R&D investments by key players, coupled with technological advancements in formulation and application techniques, further boost the market. The presence of major manufacturers and a mature distribution network ensures steady supply and adoption, reinforcing North America’s significant share in the global corrosion inhibitors market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

BASF SE (Irgamet 42, Basocorr 2500)

-

Cortec Corporation (VpCI-377, VpCI-609)

-

Ecolab Inc. (Nalco 77362, Nalco 72210)

-

Henkel AG & Co. KGaA (BONDERITE L-GP, AQUENCE CS)

-

Ashland Global (Drewgard 251, Drewplus L-493)

-

The Lubrizol Corporation (Carbosperse K-797, LUBRIZOL 677A)

-

Dow Inc. (VERSENE NA2, ACUMER 3100)

-

Solvay (OXYNOX 200, ACTISOL 550)

-

Solenis (Zinc BZT 216, Spectrus NX1100)

-

Daubert Chemical Company (Nox-Rust 9300, Tectyl 300G)

-

LANXESS (Bayhibit AM, Velcorin)

-

Dorf Ketal Chemicals (Doral 2785, Dorchem 364)

-

INOLEX (Lexgard O, LexFeel N5)

-

AkzoNobel (Intergard 251, Resicoat R 4-ES)

-

Italmatch Chemicals (Dequest 2010, Briquest ADPA)

-

GE Water & Process Technologies (CorrShield 100, Spectrus CT130)

-

Chemtreat Inc. (CWT 150, CWT 300)

-

W.R. Grace & Co. (DARACLAR 910, GRACE XDS)

-

ICL Group (FERTINOR M-6, PHOSCHECK)

-

Axalta Coating Systems (Nap-Gard 7-2555, Alesta AM)

Recent Development:

-

In June 2024, BASF introduced a new range of eco-friendly anti-rust solutions tailored for the automotive and manufacturing industries. These innovative products are engineered to deliver high-performance corrosion protection while adhering to strict environmental compliance standards.

-

In May 2024, AkzoNobel launched a new line of marinized corrosion inhibitors designed to improve protection for ships and offshore structures operating in extreme marine conditions. This launch supports the company’s commitment to sustainable growth and environmental responsibility.

| Report Attributes | Details |

| Market Size in 2023 | USD 8.67 Billion |

| Market Size by 2032 | USD12.72Billion |

| CAGR | CAGR of4.35 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Composition (Organic, Inorganic) • By Type (Water Based, Oil Based) • By End Use (Oil and Gas, Power Generation, Metal Processing, Water Treatment, Chemical Processing, Paper and Pulp, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Cortec Corporation, Ecolab Inc., Henkel AG & Co. KGaA, Ashland Global, The Lubrizol Corporation, Dow Inc., Solvay, Solenis, Daubert Chemical Company, LANXESS, Dorf Ketal Chemicals, INOLEX, AkzoNobel, Italmatch Chemicals, GE Water & Process Technologies, Chemtreat Inc., W.R. Grace & Co., ICL Group, Axalta Coating Systems |