Cosmetic Bottle Packaging Market Report Scope And Overview:

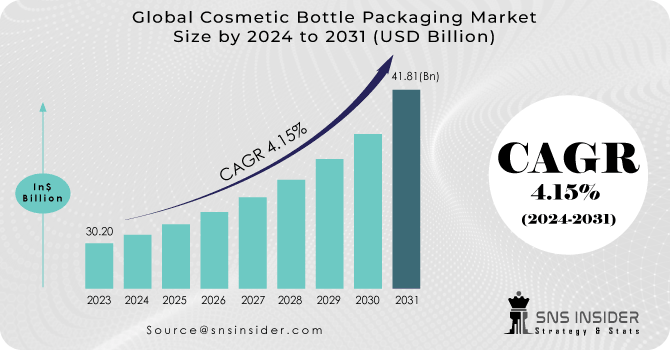

The Cosmetic Bottle Packaging Market Size was valued at USD 30.20 billion in 2023 and is expected to reach USD 41.81 billion by 2031 and grow at a CAGR of 4.15 % over the forecast period 2024-2031.

The global increase in living standards and disposable income, alongside evolving lifestyles, is driving demand for cosmetics, leading to increased sales of cosmetic glass bottles. The pursuit of enhanced personal appearance is a significant factor fueling demand for perfume and cosmetic products, positively impacting the glass Cosmetic Bottle Packaging market. The growing preference for premium and luxurious packaging to elevate customer satisfaction is driving increased purchases, reshaping demand for cosmetic glass bottles in the cosmetics manufacturing sector. Manufacturers are increasingly focused on innovating and customizing Cosmetic Bottle Packaging to meet customer demands, further boosting sales of perfume and other bottles and propelling market growth. Market players are forging long-term partnerships with end-users, tailoring solutions to their specific needs to achieve incremental growth in the glass Cosmetic Bottle Packaging sector. Verescene, a prominent player, recently introduced unbreakable glass bottles capable of withstanding falls from heights of up to 1.8 meters.

Get More Information on Cosmetic Bottle Packaging Market - Request Sample Report

The demand for sustainable solutions is surging as companies seek alternatives to traditional plastics, including non-recyclable thermoset materials commonly used in cosmetics packaging. These materials may encounter restrictions due to government-imposed packaging regulations. Moreover, upcoming region-specific conditions, particularly regarding materials like ABS, are prompting companies to transition to more sustainable options like glass packaging.

MARKET DYNAMICS

KEY DRIVERS:

-

The market's main driving force is the growing demand for beauty products, propelled by an improved lifestyle and a heightened emphasis on personal grooming.

-

Manufacturers providing a range of products, including both standard and customized offerings, cater to diverse customer needs.

The dynamic needs of the cosmetic and beauty industry have compelled manufacturers to opt for Cosmetic Bottle Packaging, expanding their product range with a variety of designs and styles for standard products while also offering personalized options tailored to specific brand requirements. Customized Cosmetic Bottle Packaging fulfil the precise printing needs of cosmetic brands, driving growth in the Cosmetic Bottle Packaging market.

RESTRAIN:

-

For cosmetic packaging types, there is enough alternative on the market.

-

The high initial investment for Cosmetic Bottle Packaging solutions, especially for large projects, hinders market growth.

OPPORTUNITY:

-

New packaging designs and detailed graphics boost bottle aesthetics, creating market opportunities.

-

Growing environmental awareness and the push to cut carbon emissions are driving the uptake of eco-friendly Cosmetic Bottle Packaging solutions.

This heightened consciousness prompts consumers and businesses alike to seek packaging options that minimize environmental impact and promote sustainability. As a result, there is a growing demand for packaging materials made from recycled or biodegradable substances, as well as for packaging designs that prioritize resource conservation and eco-friendly production processes. Manufacturers are thus compelled to innovate and offer sustainable packaging solutions to meet this evolving market demand and align with broader environmental goals.

CHALLENGES:

-

Challenges in the market include high production costs and the fragility of materials like glass, leading to increased transportation expenses and breakage risks.

-

Substantial infrastructure investments, such as grid upgrades and storage facilities, are required to facilitate the integration of Cosmetic Bottle Packaging solutions into current energy systems.

Impact of Russia Ukraine War

The Russia-Ukraine crisis has heavily impacted sectors like the Cosmetic Bottle Packaging market, mainly due to disruptions in the broader packaging industry's supply chains. European perfume and cosmetics manufacturers are facing shortages of key materials, leading to increased production costs, particularly for mass cosmetics producers. Luxury beauty products are also becoming pricier due to higher packaging costs. Despite these challenges, the global beauty products market is projected to surpass its 2019 sales level of $538 billion, indicating continued growth.

Major beauty brands and retailers have halted operations in Russia due to consumer sentiment and the challenges of operating in the country during the crisis. These decisions are seen as necessary responses to the situation. Russia's significant share of the global cosmetics market makes these exits impactful. The packaging industry is also affected by the conflict, with higher energy and commodity prices driving up material costs. Martial law in Ukraine led to the closure of key production facilities, prompting companies to suspend operations or withdraw from the Russian market, impacting global supply chains and raising packaging costs.

Impact of Economic Slowdown

The current economic slowdown has various implications for the Cosmetic Bottle Packaging market, primarily influenced by broader trends in the cosmetic packaging industry. The market is experiencing a shift towards innovative and sustainable packaging solutions, driven by consumer demand for environmentally friendly products. The use of plastics in packaging is expected to significantly increase, with projections suggesting a tripling by 2060, making up 31% of global plastics use. This trend underscores the importance of sustainable practices within the industry.

Economic instability has put the beauty sector under pressure, with supply chain challenges, rising interest rates, and inflation affecting companies across the board. The competitive nature of the industry, accentuated by the rise of celebrity-backed and indie brands, demands heavy investment in product innovation and digital marketing to stay relevant. Brands are also adjusting their strategies to manage inflationary pressures, with a notable increase in beauty product prices. Streamlining inventory and diversifying distribution channels have become crucial for brands to navigate the current economic landscape.

KEY MARKET SEGMENTS

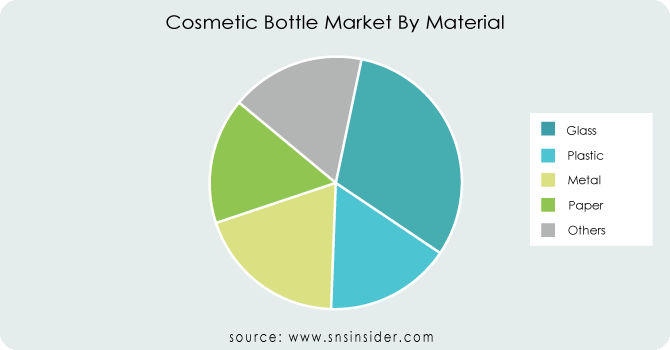

By Material

-

Plastic

-

Metal

-

Glass

-

Paper

-

Others

The glass sector leads the market with share 30.8%, particularly in cosmetics bottles, known for its luxurious and eco-friendly image. Glass is highly recyclable. However, paper and paperboard, along with metal products, are experiencing rapid growth in both market value and volume. Due to shifting consumer preferences, paper and paperboard packaging emerge as the fastest-growing and dominant segment. Paper-based packaging often incorporates techniques like hot stamping and lamination, enhancing product appeal with a touch of luxury.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Capacity

-

<50 ml

-

50-100 ml

-

100-200 ml

-

>200 ml

By Application

-

Haircare

-

Nail care

-

Skin Care

-

Make-up

-

Others

The skincare sector leads the market, driven by growing consumer emphasis on skincare. People are increasingly recognizing the significance of maintaining healthy skin and are willing to spend on skincare products. The rising focus on skincare, coupled with a wide variety of skincare offerings and the demand for tailored packaging and premium options, has elevated its significance.

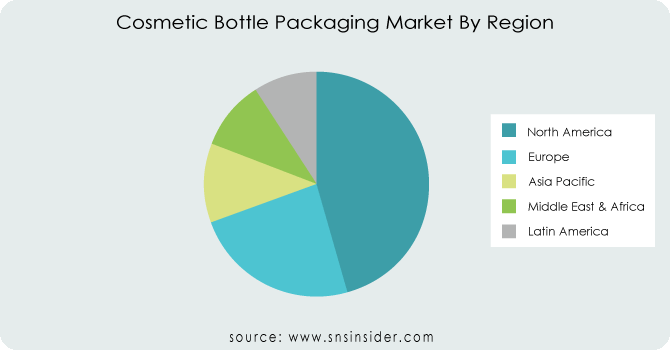

REGIONAL ANALYSIS

The North American Cosmetic Bottle Packaging market is positioned to lead, driven by heightened awareness and lifestyle changes, which have bolstered demand for packaging products and will further fuel market growth in the region. Europe's Cosmetic Bottle Packaging market holds the second-largest market share, attributed to a consumer lifestyle shift towards high-quality products. Within Europe, the German Cosmetic Bottle Packaging market dominates, the U.K. market is the fastest-growing in the region.

The Asia Pacific region, in particular, is expected to see significant growth, driven by increasing consumer awareness of personal care. The growth in economic conditions and disposable income has elevated market conditions. Additionally, China leads the Cosmetic Bottle Packaging market in market share, while India experiences the highest growth rate in the Asia-Pacific region. Skin care is projected to be the fastest-growing segment, highlighting the importance of continuous innovation in packaging for these products.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Some of the major players in the Cosmetic Bottle Packaging Market are F.H. Packaging, LUMSON S.p.A, Smurfit Kappa, Gerresheimer AG, Alpha Packaging, Sonoco Products Company, Quadpack, Sealed Air, SONE Products, Libo Cosmetics and other players.

F.H. Packaging-Company Financial Analysis

RECENT TRENDS

-

In August 2023, Amcor, a prominent packaging firm, disclosed its acquisition of Optiva Packaging Solutions, a key player in cosmetic packaging solutions. This move is poised to enhance Amcor's footprint in the cosmetic packaging industry.

-

In July 2023, Alpla, a prominent plastic packaging manufacturer, revealed the inauguration of a new manufacturing plant in China. This facility will specialize in producing Cosmetic Bottle Packaging and various other types of plastic packaging specifically for the Chinese market.

-

In March 2022, at the MakeUp in Los Angeles tradeshow, WWP Beauty, a leading full-service provider for the global beauty sector, introduced a range of new environmentally sustainable turnkey packaging and accessory collections.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 30.20 Billion |

| Market Size by 2031 | US$ 41.81 Billion |

| CAGR | CAGR of 4.15 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Plastic, Metal, Glass, Paper, Others) • By Capacity (<50>200 Ml) • By Application (Haircare, Nail Care, Skin Care, Make-Up, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | F.H. Packaging, LUMSON S.p.A, Smurfit Kappa, Gerresheimer AG, Alpha Packaging, Sonoco Products Company, Quadpack, Sealed Air, SONE Products, Libo Cosmetics |

| Key Drivers | • The market's main driving force is the growing demand for beauty products, propelled by an improved lifestyle and a heightened emphasis on personal grooming. • Manufacturers providing a range of products, including both standard and customized offerings, cater to diverse customer needs. |

| Challenges | • Challenges in the market include high production costs and the fragility of materials like glass, leading to increased transportation expenses and breakage risks. • Substantial infrastructure investments, such as grid upgrades and storage facilities, are required to facilitate the integration of Cosmetic Bottle Packaging solutions into current energy systems. |