Bioplastic Packaging Market Report Scope & Overview:

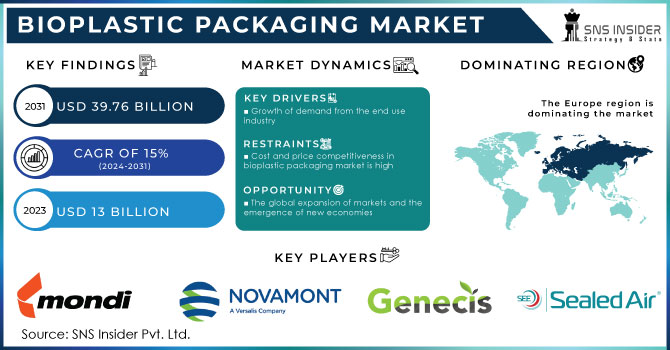

The Bioplastic Packaging Market was valued at USD 17.27 billion in 2023 and is projected to reach USD 67.48 billion by 2032, expanding at a CAGR of 16.17% over the forecast period of 2024 to 2032. Increasing consumption of renewable and bio-based products, a growing demand from flexible packaging industries as well as the exceptional characteristics of bioplastic such as less carbon footprint and faster decomposition than plastics are factors that contribute to market growth. However, some of the market growth has been hindered by the price competitiveness of bio plastic packaging in comparison to traditional plastics.

Get More Information on Bioplastic Packaging Market - Request Sample Report

Due to the growing demand for bioplastic packaging in the food and consumer goods industries, the USA market for bioplastic packaging is estimated to increase significantly over the forecast period. Consequently, in the projection period demand is expected to be further stimulated by Bioplastic Packaging.

The global production capacity of bioplastics is expected to increase from 2.13 million tonnes in 2020 to approximately 4.8 million tonnes in 2030, according to the European Bioplastics Association. In 2020, the organization said, 1,229 metric tons of biodegradable bioplastics and 885 metric tons of bio-based non-biodegradable bioplastics were made.

Germany produces around 6.30 million tonnes of plastic waste per year, which is about 410 million tonnes worldwide, according to the FEA statistics. Generally, it takes between 500 and 1000 years for a plastic bottle to decompose. These results illustrate the need to use bioplastics in rigid packaging products such as bottles, tubes, cups, cutlery, blisters and others that could lead to a significant decrease of decomposition time.

MARKET DYNAMICS

KEY DRIVERS:

-

Growth of demand from the end use industry

Bioplastic packaging is being demanded in a number of sectors, e.g. food and beverages, healthcare, consumer goods etc. In response to consumer demand for an ecotoxic and sustainable packaging solution, manufacturers in these sectors are increasingly making use of bioplastics in their packaging.

RESTRAIN:

-

Cost and price competitiveness in bioplastic packaging market is high

Compared with traditional plastics made from fossil fuel, bioplastics are often more expensive to produce. The cost of raw materials, production processes and technological developments for bioplastics may reduce their economic competitiveness to an extent which is likely to limit their widespread use in price sensitive markets.

OPPORTUNITY:

-

The global expansion of markets and the emergence of new economies

There is considerable growth potential for expanding the bioplastic packaging market in emerging economies. The favorable environment for the introduction of Sustainable Packaging solutions is due to increasing disposable incomes, urbanization and awareness in these regions concerning issues related to the environment.

CHALLENGES:

-

Feedstock availability and competition with food resources

The production of bioplastics is mainly dependent on agricultural sources such as corn, sugarcane and soya which are capable of competing with food crops for land and resources. To ensure food security and sustainability it is necessary to balance feedstock use in bioplastics with food production.

IMPACT OF RUSSIAN UKRAINE WAR:

The market for bioplastic has been affected in many ways by the war. Firstly, there was a disruption in the bioplastic raw material supply chain. Major exporters of wheat, corn and other crops that are used for the production of bioplastics are Russia and Ukraine. The war had led to a scarcity of such raw materials and an increase in their prices. As a consequence, bioplastics are more expensive to produce and therefore less profitable for the market. Before the Russian invasion, Russia and Ukraine accounted for 30% of the world wheat trade.

In 2022, wheat prices are set to rise by a total of 38%, on top of 32% in 2021. World inflation will increase the risk of food scarcity or even starvation in underdeveloped countries, making these prices a driving force for world inflation.

IMPACT OF ONGOING RECESSION:

During the recession, businesses are spending less on bioplastic packaging and a lot of them are cutting back. The cost of bioplastics is relatively higher compared to standard plastic, so businesses have made it a practice to switch to conventional plastic packaging for the sake of saving money. During the recession, consumers are cutting back on spending and therefore buying cheaper products even if they're made in conventional plastic packaging. This has led to a decrease in consumer demand for bioplastic packaging.

KEY MARKET SEGMENTS

By Material

-

Biodegradable

-

Non-Biodegradable

On the basis of material, the biodegradable segment accounted for 55.5% of the revenue market share in 2022, driven by growing demand for bioplastics in various end use sectors, which is expected to support their needs during the assessment phase. Polylactic acid, starch mixture, PBAT, PBS, PHA, polycaprolactone and cellulose acetate are also biodegradable plastics. The largest segment for revenue of the biodegradable products category in 2022 was starch blends and PBATs.

By Packaging Type

-

Flexible

-

Rigid

The Flexible Packaging sector accounted for the greatest market share of 58.2% in 2022, on the basis of type. The demand for Bioplastics in flexible packaging is expected to increase as a result of advances in the manufacture of bio plastics technologies, use of case ready packaging and better packing practices. Moreover, in particular with regard to snack foods and beverages there is a high demand for flexibility packaging.

By Application

-

Food & Beverages

-

Pharmaceutical

-

Consumer Goods

-

Cosmetics

-

Others

On the basis of its applications, food and beverages accounted for a market share of 60.5% in 2022. The increasing demand for packed food, as well as the growing popularity of quick service restaurants is a factor that drives the market. Manufacturers are expected to step up their capacity in order to cope with the increasing demand for packed foods, which is likely to lead to an increased market for flexural packaging over the forecast period.

REGIONAL ANALYSIS

The European bioplastics packaging market generated the highest revenue in 2022 with a 35.5% share. In view of the existence of stringent environmental law, friendly legislation and rising consumer awareness about environment issues, it is expected that this area will further experience significant growth over the coming years.

Furthermore, it is expected that the demand for bioplastics will increase in the assessment period due to government initiatives such as EU decisions limiting overall consumption of single use plastic products. As part of a sweeping law against plastic waste that pollutes beaches and seas, the European Parliament voted to ban single use plastics products such as cutlery and straws in 2019. It is estimated that from July 2021 onwards the ban on plastics with only one use will enter into force.

Asia Pacific region is expected to show the fastest growth over the forecast period due to rise in disposable income. Due to rise in the disposable income there is increasing demand for the packaged food products. China held the largest market share and India is experiencing the fastest growth rate.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Bioplastic Packaging market are Genecis, Mondi, Sealed Air, Novamont S.p.A, Coveris, Amcor Plc, Transcontinental Inc, Constantia Flexibles, CJ Biomaterials, Inc, Alpha Packaging and other players.

RECENT DEVELOPMENT

-

March 2023, The Amazon Climate Pledge Fund has invested in the biotech firm Genecis, which is run by a scientist named Luna Yu. The company, Genecis, uses recycled materials such as kitchen scraps to create biodegradable plastics PHA which can be adapted for use in traditional packaging.

-

August 2023, CJ Biomaterials, Inc., a leading producer of polyhydroxyalkanoate biopolymers and a division of South Korea based CJ CheilJedang, is working with Riman Korea to combine its patented PHA technology with polylactic acid to create packaging for Riman's premium line of IncellDerm products.

| Report Attributes | Details |

| Market Size in 2023 | US$ 17.27 Bn |

| Market Size by 2032 | US$ 67.48 Bn |

| CAGR | CAGR of 16.17 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material (Biodegradable, Non-Biodegradable) • by Packaging Type (Flexible, Rigid) • by Application (Food & Beverages, Pharmaceutical, Consumer Goods, Cosmetics, Others), |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Genecis, Mondi, Sealed Air, Novamont S.p.A, Coveris, Amcor Plc, Transcontinental Inc, Constantia Flexibles, CJ Biomaterials, Inc, , Alpha Packaging |

| Key Drivers | • Growth of demand from the end use industry |

| Key Restraints | • Cost and price competitiveness in bioplastic packaging market is high |