Crawler Camera System Market Size & Industry Insights:

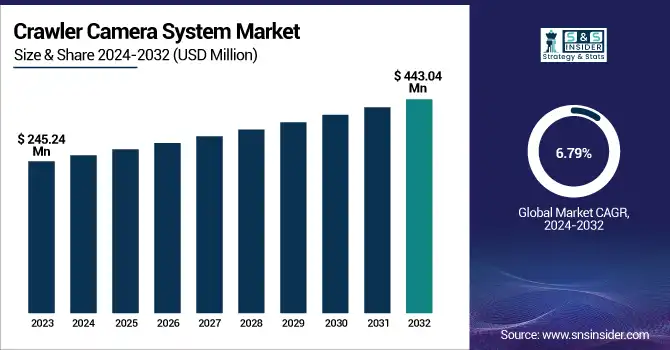

The Crawler Camera System Market size was valued at USD 245.24 Million in 2023 and expected to reach USD 443.04 Million by 2032, growing at a CAGR of 6.79% during 2024-2032. The important factor fueling this growth is the technological adoption of artificial intelligence (AI), automation, and real-time data analytics that helps enhance the accuracy of inspection, efficiency, and data-processing abilities. The growing demand for durable, low-maintenance equipment has led to an increase in crawler camera systems as an efficient solution for enhancing operations while keeping costs low.

Moreover, strict regulatory and compliance requirements in industries such as wastewater management, construction, and infrastructure inspection are driving the adoption of these systems to comply with safety and legal standards. Crawler cameras explore uncharted territories in a manner not just ensuring their safety, but that of the human resources controlling them, reducing the human factor of exposure, and where applicable, for the environment itself with all this fast recovering the cost of the crawler camera. These combined factors leads to considerable market growth.

To Get more information on Crawler Camera System Market - Request Free Sample Report

Crawler Camera System Market Dynamics:

Drivers:

-

Meeting Stringent Industry Regulations with Advanced Crawler Camera Systems for Safe and Compliant Inspections

Stringent regulations in sectors like construction, wastewater management, and utilities are pushing the demand for crawler camera systems. Governments and regulatory bodies enforce rigorous standards for infrastructure inspections to ensure safety, environmental protection, and operational efficiency. For example, in wastewater management, regulations require frequent inspections of pipes and sewage systems to detect potential blockages, cracks, or leaks that could lead to contamination or system failures. Crawler camera systems provide a non-invasive, accurate, and real-time inspection method, ensuring compliance with these regulations. These systems offer clear, high-quality data, essential for compliance reporting and avoiding penalties. As regulations become stricter, businesses rely more on advanced inspection technologies to maintain legal compliance, mitigate risks, and ensure safe operations. This growing need for compliance and risk management further drives the adoption of crawler camera systems in various industries.

Restraints:

-

Impact of Limited Battery Life on the Efficiency of Crawler Camera Systems in Remote Inspections

One main constraint for crawler camera systems is their limited battery life, particularly in expansive or remote environments where recharging options may be limited. Batteries can power flying or driving robots, if we need to send them for inspection to long oil pipelines or (deep) underground structures, we cannot depend on batteries to last long due to long time in flight and existence there. This requires short charging times or the use of external power supplies, leading to interruptions in the inspection and decreased productivity overall. In some situations, crawler cameras must be returned to a charging station, resulting in downtime and delay. Furthermore, ensuring a continuous supply of electricity is a logistical hassle at remote sites that lack point-of-entry. During an extensive inspection, providing battery life and power supply can be expensive, and these constraints can lead to increased operational costs.

Opportunities:

-

Enhancing Crawler Camera System Efficiency through AI Integration and Automation

AI-enabled software and automation provide a major opportunity for increasing efficiency in crawler camera systems for inspections. For example, the use of augmented reality can improve data analysis by rapidly locating cracks, leaks, or blockages to enable better assessments in a real time monitoring system. Automation speeds up inspections even more, allowing systems to function almost all the time with little supervision, which minimizes the requirement of manual watch on the working to let operators focus on more complicated activities. Not only does this speed up the complete inspection process but also leads to better decision-making with more consistent/reliable data. It can also help by detecting trends, or nd future maintenance needs, and prevent expensive downtimes by enabling the tool for proactive repair. Therefore, incorporating AI and automation-influencing technologies in crawler camera systems helps gain a competitive advantage through enhanced operational efficiency and decreased human error.

Challenges:

-

Overcoming Environmental and Operational Challenges in Crawler Camera Systems

Crawler camera systems can face significant environmental and operational limitations, especially when deployed in harsh conditions. Extreme temperatures, whether excessively high or low, can impact the functionality of the system’s components, including the camera, motors, and sensors, leading to performance degradation or even failure. High humidity levels can cause condensation inside the system, damaging electronics or interfering with image quality. Additionally, underwater or highly corrosive environments present challenges in terms of waterproofing, durability, and the potential for rust or material breakdown. These environmental factors can limit the crawler camera's operational range, requiring specialized protective measures or frequent maintenance, which can increase operational costs and downtime. Consequently, ensuring reliable performance in such extreme conditions remains a critical challenge for the widespread adoption and use of crawler camera systems in various industries

Crawler Camera System Market Segmentation Overview:

By Application

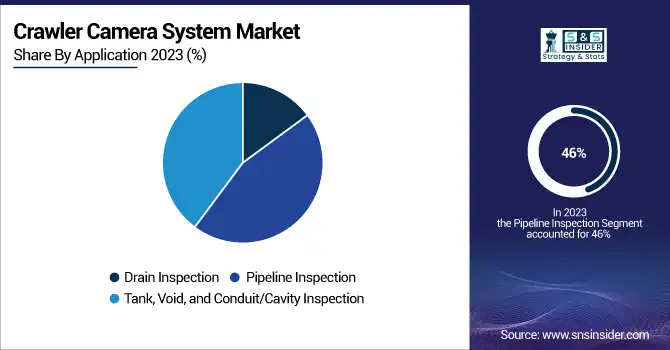

The pipeline inspection segment dominated the Crawler Camera System Market, accounting for around 46% of the revenue in 2023. This is primarily due to the increasing demand for efficient inspection solutions in industries such as oil and gas, water supply, and wastewater management. Crawler camera systems are especially effective in pipeline inspection because they can navigate through narrow or hard-to-reach areas and can supply real-time video footage and data on the condition of the pipeline. This allows for early detection of problems like corrosion, leaks, and blockages, so reducing the need for expensive repairs and avoiding the risk of hazards. As the infrastructure ages and the demand for stringent safety and environmental regulations increase, crawler camera systems are now an essential part of pipeline inspection organizations to maintain the integrity and efficiency of the pipelines.

The drain inspection segment is the fastest-growing in the crawler camera system market from 2024 to 2032. This growth is fueled by rising urbanization, the need to rehabilitate aging infrastructure, and the demand for efficient and cost-effective methods of maintaining drainage systems. Drain inspection typically requires specialized crawler camera systems capable of maneuvering through a variety of pipes, and the newest models can take on complex and tight pipes to detect blockages, cracks, or signs of corrosion. This segment is also experiencing growth due to the increasing need for proactive maintenance and early identification of problems to prevent costly repairs. Furthermore, municipal authorities are increasingly preparing for the adoption of advanced inspection technologies under regulatory pressure and environmental concerns, making crawler camera systems a critical part in keeping functional drainage infrastructure.

By End Use

In 2023, the municipal segment dominated the largest share of revenue in the Crawler Camera System Market, accounting for around 49%. This is driven mainly by an increasing demand for inspection and repair of civic infrastructure, including sewer lines, stormwater drains, and water pipeworks. And municipalities are being pressured to repair crumbling infrastructure, to stop leaks, to comply with the environment. Using crawler camera systems is a low-cost, non-destructive method with which municipalities can inspect their underground systems and pinpoint issues such as blockages, corrosion or other structural damage before they cause major safety problems. With rising urbanization and aging infrastructure, the demand for sophisticated inspection technology in the municipal sector is anticipated to continue to increase, fuelling the expand of the market.

The industrial segment is expected to be the fastest-growing in the Crawler Camera System Market from 2024 to 2032. Increasing demand for preventive maintenance and audit in various industrial sectors including manufacturing, oil & gas and chemical processing, is driving the growth of the market. While crawler camera systems offer industries a proven, effective and affordable approach to the inspection of pipelines, tanks and other vital infrastructure. As the safety concerns, regulatory pressures, and proactive maintenance requirement to prevent the expensive downtimes on rise, crawler camera systems are being used increasingly in different industrial sectors for performing non-invasive inspections.

Crawler Camera System Regional Outlook:

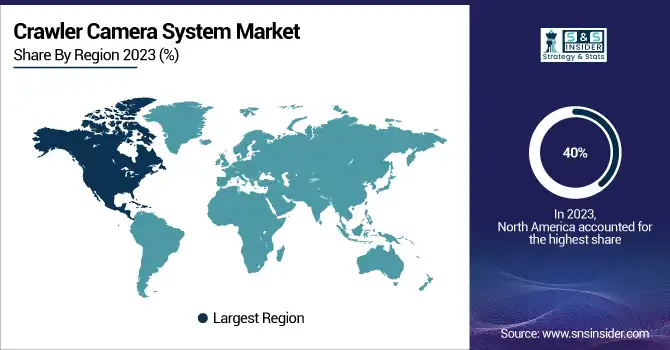

North America held the largest share of the revenue in the Crawler Camera System Market, accounting for around 40% in 2023. This prevalence is owing to the robust infrastructure growth, high-rate technology adoption, and strict regulation in the regions like waste-water management, construction, oil & gas. A growing demand for efficient inspection solutions like crawler camera systems for infrastructure maintenance relies on the urban and industrial geography of the U.S. and Canada, which are highly developed. The increasing emphasis on safety, downtime reduction, and regulatory compliance has driven industries to adopt crawler camera systems for thorough and non-destructive inspections. Moreover, the presence of major crawler camera system manufacturers in North America has led to a well-functioning market, hence expected to boost the growth of the crawlers camera system market in the region.

The Asia-Pacific region is expected to witness the highest growth in the Crawler Camera System Market during the forecast period from 2024 to 2032. This growth is driven by rapid urbanization, increasing infrastructure projects, and the rising demand for efficient inspection solutions in sectors like construction, wastewater management, and oil & gas. Countries like China, India, and Japan are investing heavily in infrastructure maintenance, creating a significant demand for advanced inspection technologies like crawler camera systems. Moreover, the region’s expanding industrial sector, coupled with technological advancements, further accelerates the adoption of these systems. As regulatory requirements for safety and environmental compliance strengthen, the Asia-Pacific market is poised to become a key driver of the global crawler camera system market in the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Some of the Major Players in Crawler Camera System Market along with their Product:

-

Deep Trekker Inc. (Canada): Remotely Operated Vehicles (ROVs), Crawler Camera Systems, Mini-ROVs.

-

Hyundai (South Korea): Excavators, Crawler Machinery, Construction Equipment.

-

JCB (United Kingdom): Crawler Excavators, Backhoe Loaders, Construction Machinery.

-

AM Industrial (USA): Crawler Camera Systems, Inspection Equipment, Inspection Robots.

-

iPEK International GmbH (IDEX) (Germany): Crawler Camera Systems, Mobile CCTV Inspection Systems, High-resolution Cameras.

-

CUES Inc. (USA): CCTV Inspection Systems, Pipeline Inspection Robots, Portable Cameras.

-

Eddyfi (Canada): Crawler Camera Systems, Non-destructive Testing Equipment, Remote Visual Inspection Systems.

-

Kummert GmbH (Germany): Crawler Camera Systems, Inspection Robots, High-resolution Inspection Cameras.

-

Minicam Limited (United Kingdom): Crawler Camera Systems, Pushrod Inspection Cameras, Portable CCTV Systems.

-

Rausch USA (USA): Crawler Camera Systems, CCTV Inspection Systems, Robotic Inspection Vehicles.

-

Inspector Systems (Germany): Crawler Camera Systems, Robotic Systems, Specialized Inspection Equipment.

-

Subsite Electronics (USA): Pipeline Inspection Systems, Utility Locators, Inspection Cameras.

List of suppliers who provide raw materials and components for the crawler camera systems market:

-

Teledyne DALSA

-

Sony Corporation

-

OmniVision Technologies

-

Lenzkes Industries GmbH

-

Melles Griot (Coherent Inc.)

-

Panasonic Corporation

-

FLIR Systems

-

Texas Instruments

-

Leuze Electronic

-

Nikon Corporation

Recent Development:

-

4th July 2024: At the Hillhead show in the UK on 25 June 2024, Hyundai unveiled the 100-tonne HX1000A L and 80-tonne HL985A Stage V crawler excavators, along with the 35-tonne HL985A wheel loader, the company’s largest machine of this type. These heavy-duty machines are designed for mines, quarries, and bulk earthmoving, offering high productivity and reduced total cost of ownership.

-

Feb 10 2025, CUES & AI: Transforming Infrastructure With GraniteNet Sewer Inspection Software The increasing need for efficient sewer management has spurred innovation in the crawler camera system market. CUES’ GraniteNet, an AI-powered software, integrates with crawler cameras to streamline inspections, enhance data processing, and improve infrastructure repair decision-making.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 245.24 Million |

| Market Size by 2032 | USD 443.04 Million |

| CAGR | CAGR of 6.79% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Drain Inspection, Pipeline Inspection, Tank, Void, and Conduit/Cavity Inspection) • By End Use (Industrial, Commercial, Municipal, Residential) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Deep Trekker Inc. (Canada), Hyundai (South Korea), JCB (United Kingdom), AM Industrial (USA), iPEK International GmbH (Germany), CUES Inc. (USA), Eddyfi (Canada), Kummert GmbH (Germany), Minicam Limited (United Kingdom), Rausch USA (USA), Inspector Systems (Germany), Subsite Electronics (USA). |