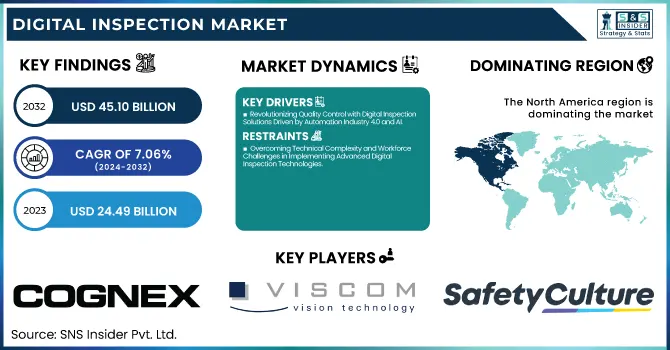

Digital Inspection Market Size & Trends:

The Digital Inspection Market Size was valued at USD 24.49 Billion in 2023 and is expected to reach USD 45.10 Billion by 2032 and grow at a CAGR of 7.06% over the forecast period 2024-2032. The growing need for precision, efficiency, and regulatory compliance is propelling the digital inspection market for diverse uses across evolving industry verticals. Improvements in performance Accurate devices Improvements to high-resolution imaging, cloud-enabled inspection through the Internet of Things (IoT), and cloud-enabled analytics are enhancing performance.

To Get more information on Digital Inspection Market - Request Free Sample Report

The use of AI and automation has enhanced real-time fault detection, predictive maintenance, and adaptive learning capabilities. For specific inspection traditional methods are being replaced by new-age technologies, thanks to better 3D metrology, non-destructive testing (NDT), and machine vision which are helping improve accuracy and throughput while reducing the possibility of human error. Such improvements enable the market to grow as a whole and make inspection smarter, more scalable, and more economically efficient across sectors.

The U.S. market for Digital Inspection was valued at USD 6.37 Billion in 2023 and is expected to attain a CAGR of 6.73% between 2024 and 2032. The U.S. market for digital inspection is driven by stringent product quality regulations, high adoption of advanced manufacturing, increased automation, growing use of AI-enabled inspection solutions for defect detection, and strong industrial digitization initiatives.

Digital Inspection Market Dynamics

Key Drivers:

-

Revolutionizing Quality Control with Digital Inspection Solutions Driven by Automation Industry 4.0 and AI

The rise of automation and Industry 4.0 has also driven demand for digital inspection solutions across industries, with growing quality control, lower defects, and improved efficiency. The demand for advanced inspection technologies is further driven by stringent regulatory compliance and safety standards prevalent across the automotive, aerospace, and, oil & gas industries. The increasing adoption of AI, machine learning, and IoT in the digital inspection space also improves real-time defect identification and predictive maintenance, resulting in lower downtime and operational costs. As the semiconductor and electronics industry continues to grow exponentially, there is an increasing demand for precision inspection systems to ensure product integrity at miniaturized levels.

Restrain:

-

Overcoming Technical Complexity and Workforce Challenges in Implementing Advanced Digital Inspection Technologies

Some of the key factors restraining the market growth are the rise in technical complexity and the integration of digital inspection systems. Specialized expertise, combined with the ability to integrate seamlessly with existing manufacturing processes, is required when implementing more advanced inspection technologies such as machine vision driven by AI, 3D metrology, or non-destructive testing (NDT). This represents a major challenge across several industries, especially small and medium enterprises (SMEs) that are facing a deficit of qualified personnel, alongside the extensive training that would be needed in many cases, to enable the use of these technologies. Furthermore, parsing between distinct hardware and software solutions poses an additional barrier to achieving a seamless, automated inspection pipeline.

Opportunity:

-

Expanding Opportunities in Digital Inspection with 3D AI Cloud Solutions and Growing Industrial Automation

This market provides ample space considering the advent of 3D inspection and AI-based inspection solutions. With cloud-based Digital inspection and remote monitoring being the new normal, an increasing shift in the trend creates newer opportunities for Scalable and Economical solutions. There is also a growing acceptance of non-destructive testing (NDT) in sectors like aerospace and infrastructure development which is creating huge opportunities. In addition, several economies in Asia-Pacific and Latin America are emerging, indicating an increasing opportunity owing to industrialization, ongoing smart manufacturing initiatives, and rising investments in automation technologies in these regions.

Challenges:

-

Addressing Data Security Privacy and Standardization Challenges in AI and IoT-Enabled Digital Inspection

Data security and privacy issues related to the cloud and using AI-driven inspection solutions are other pertinent challenges. The growing dependency on IoT-enabled digital inspection systems has made businesses prone to cybersecurity attacks, data breaches, and theft of intellectual property. Also, compliance with stringent data protection laws continues to be a major obstacle, especially for sensitive industries such as aerospace and defense. Further, the lack of standardization of digital inspection protocols across industries creates barriers to widespread adoption, resulting in inefficiencies around implementation and interoperability between different inspection technologies.

Digital Inspection Market Segments Analysis

By Dimension

The 3D accounted for a dominant portion of the global market in 2023, with a 63.2% cumulative share, and is projected to reach the fastest CAGR over the forecast period from 2024 to 2032, due to the high precision, accuracy, and capacity of creating large surface and structural data sets (the product of the 3D measurement technologies), making easier quantitative analysis. Market growth can be attributed to the rising adoption of AI-based 3D inspection systems in various industries including automotive, aerospace, electronics, and pharmaceuticals among others. In contrast to legacy 2D inspection, 3D inspection is capable of full defect detection, accurate measurements, and in-line quality control, and is a crucial component of modern manufacturing and industrial automation.

By Technology

Machine vision is the most prominent technology segment, which accounted for 47.7% of the digital inspection market in 2023 due to widespread application in automation quality control, defect detection, and high-throughput inspection in the automotive, electronics, and manufacturing industries, among others. With the higher adoption of AI-driven Vision systems, deep learning algorithms have improved the accuracy level as well as assisted in providing a real-time analysis while reducing human interference. With its high precision and automation capabilities, machine vision has become a common choice among manufacturers that require large-scale production lines.

The non-destructive testing (NDT) segment is anticipated to fast CAGR throughout 2024-2032 owing to increasing application in safety-critical industries such as aerospace, oil & gas, and infrastructure. The rising demand for structural health monitoring, predictive maintenance, and stringent safety regulations is expected to drive the adoption of NDT. Continuous innovation in ultrasonic, radiographic, and thermographic inspection techniques will continue to raise the demand for the market.

By Component

The hardware segment topped the digital inspection market in 2023, accounting for 56.7% of the market share, attributed to the high consumption volumes for cameras, sensors, scanners, and other equipment used in inspection systems. A rise in demand for machine vision, 3D metrology, and non-destructive testing (NDT) solutions has driven the need for improved hardware components. Precise inspection hardware is the backbone of various high-precision industries like automotive, aerospace, and electronics, where engineers leave no one unturned to assure quality, test metrics, and compliance with safety standards.

From 2024-2032, the software segment is predicted to develop at a most file-breaking CAGR, propelled using exploitation in AI, system studying, and cloud-based inspection solutions. Digital Inspection Software Continues to Evolve With the growing capabilities of real-time data analytics, automation, and predictive maintenance, digital inspection software is also evolving. With the trigger to Smart Manufacturing and Industry 4.0, different solutions will come into prominence but overall software-driven solutions will be the most powerful enablers optimizing efficiency and increased defect detection accuracy.

By Vertical

The largest digital inspection market segment in 2023 was manufacturing, which accounted for 31.6% of the market share, driven by a greater implementation of automated quality control, defect detection, and precision inspection in industrial production. Over the last few years, the demand for digital inspection solutions has increased, owing to the growing adoption of Industry 4.0, robotics, and smart manufacturing to improve efficiency and reduce errors. From automotive to aerospace to consumer goods, manufacturers are adopting machine vision, 3D metrology, and non-destructive (NDT) testing to ensure quality, reduce waste, and meet strict regulatory standards.

During the period 2024-2032, the electronics and semiconductor sector is anticipated to reach a maximum CAGR due to the miniaturization of electronic components, increasing demand for high-precision inspection, and rapid development of semiconductor fabrication. Automated optical inspection (AOI) and metrology systems are being used in conjunction with AI-powered inspection solutions that are increasing in adoption to ensure defect-free production in chips, circuits, and electronic assemblies consequently increasing the market opportunity being held by such solutions.

Digital Inspection Market Regional Outlook

North America held the largest share of the digital inspection market in 2023 at 34.8%, owing to the large presence of technologically advanced manufacturing, aerospace, and automotive industries. Increasing adoption of AI-based machine vision systems, stringent quality regulations, and large investments in Industry 4.0 and automation have led to growth in this region. Cognex Corporation (U.S.) and General Electric (U.S.) are a few of the prominent market players steering innovative digital inspection solutions. For instance, Tesla relies heavily on machine vision, and automated optical inspection (AOI) in its Gigafactories to achieve high levels of precision in EV manufacturing. Likewise, Boeing uses non-destructive testing (NDT) technologies to inspect aircraft components to ensure they are structurally sound and safe to operate.

The Asia Pacific region is anticipated to witness the highest growth rate over the forecasted duration of 2024-2032 due to swift industrial growth, a fast-growing adoption of smart manufacturing, and robust government initiatives supporting automation specifically across China, Japan, and India. The electronics and semiconductor industry is one of the major propellers TSMC (Taiwan Semiconductor Manufacturing Company) is one of the companies utilizing 3D metrology and AI-powered inspection to deliver defect-free semiconductors. We are seeing this strategy in place in China where BYD and Huawei are ramping up machine vision and an AI-based inspection process for improved quality control in automotive and consumer electronics manufacturing. Market expansion will be largely fuelled in this area by the still-strong manufacturing base and the growing demand for high-precision inspection systems.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Digital Inspection Market are:

-

Cognex Corporation (In-Sight)

-

Viscom AG (3D AOI Systems)

-

SafetyCulture (iAuditor)

-

UVeye (Vehicle Inspection Systems)

-

Wabtec Corporation (Remote Visual Inspection Solutions)

-

Axonator (Digital Inspection Software)

-

MISTRAS Group (Smart NDT Solutions)

-

Nikon Metrology (XT H 225 ST)

-

Zetec (UltraVision)

-

SPECTOR (ThermoScan)

-

Shenzhen Sipotek Info Technology Co., Ltd. (Automated Optical Inspection Machines)

-

Olympus Corporation (OmniScan X3)

-

GE Inspection Technologies (Mentor Visual iQ)

-

Carl Zeiss AG (ZEISS Metrotom)

-

Hexagon AB (Leica Absolute Tracker)

Recent Trends

-

In January 2025, Cognex launched the DataMan 290 and DataMan 390 barcode readers, featuring AI-driven decoding, enhanced lighting, and intuitive setup to improve efficiency in industrial applications.

-

In September 2024, Viscom Inc. introduced the iX7059 PCB Inspection XL and iX7059 One, featuring cutting-edge 3D X-ray and AI-driven AOI technology to enhance defect detection and quality assurance in electronics manufacturing.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 24.49 Billion |

| Market Size by 2032 | USD 45.10 Billion |

| CAGR | CAGR of 7.06 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Dimension (2D, 3D) • By Technology (Machine Vision, Metrology, NDT) • By Component (Hardware, Software, Services) • By Vertical (Manufacturing, Electronics and Semiconductor, Oil & Gas, Aerospace & Defense, Automotive) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cognex Corporation, Viscom AG, SafetyCulture, UVeye, Wabtec Corporation, Axonator, MISTRAS Group, Nikon Metrology, Zetec, SPECTOR, Shenzhen Sipotek Info Technology Co., Ltd., Olympus Corporation, GE Inspection Technologies, Carl Zeiss AG, Hexagon AB. |