Crypto ATM Market Report Scope & Overview:

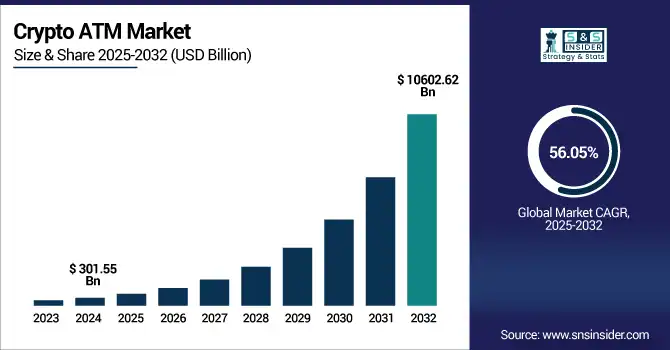

The Crypto ATM market size was valued at USD 301.55 million in 2024 and is expected to reach USD 10602.62 million by 2032, expanding at a CAGR of 56.05% over the forecast period of 2025-2032.

To Get more information on Crypto ATM Market - Request Free Sample Report

The Crypto ATM Market expands and grows as Cryptocurrency usage becomes more mainstream. The increasing need for safe and easy ways to buy and sell cryptocurrency. These ATMs allow users to purchase or sell digital currencies such as Bitcoin, Ethereum, and Litecoin using cash or debit cards. Maximum contribution to the market is from North America, the U.S. in particular, and Asia Pacific is the fastest-growing region. One-way ATMs remain the rule, but two-way ATMs are also now part of the equation. Among services, hardware presently holds the largest market share, but software is closing in, driven by the need for better security and compliance. As regulatory landscapes continue to mature and crypto is further adopted, growth for the market is expected to come from new adoption and tech advancement.

According to research, in 2024, 18% of crypto ATMs were built using environmentally friendly materials, and new-generation models cut energy consumption by 30%. Also encouraging is that over 12% of machines around the world now support multi-coin functionality, which will further grow the utility and help foster the adoption of fintech.

The U.S crypto ATM market size reached USD 100.50 million in 2024 and is expected to reach USD 3346.47 million in 2032 at a CAGR of 55% from 2025 to 2032.

Early adoption of digital currency, increased installed base, and presence of leading crypto ATM market companies in the region keep the U.S. at the forefront of the worldwide market. The nation has a mature digital payment ecosystem and regulatory advancements in several states on its side. Rising consumer interest in decentralized finance (DeFi), deployment at retail and hospitality venues, and the need for real-time, secure crypto transactions are some of the factors driving growth. Usability is being improved with recent technology developments like two-way transaction capabilities, biometric authentication, and better UIs. In addition, the existence of a mature fintech industry is conducive to open innovation and market deepening in urban areas.

Market Dynamics

Drivers:

-

Rapid Shift to Biometric, Multi-Currency, and Two-Way Functionality Boosts Consumer Adoption of Crypto ATMs.

The widespread introduction of biometric authentication (such as fingerprint and facial recognition), integration of two-way fiat-to-crypto and crypto-to-fiat operations, and support for multiple cryptocurrencies have significantly enhanced usability and confidence. These recent changes have reduced transaction friction and fraud exposure. To meet user needs for a secure and seamless kiosk experience, operators now use NFC-enabled interfaces and advanced KYC/AML protocols.

According to research, in 2024, over 87% of crypto ATMs featured facial recognition or biometric ID verification for enhanced fraud prevention, while 73% incorporated real-time transaction monitoring systems to ensure compliance with anti-money laundering (AML) regulations.

Restraints:

-

Restrictive Regulatory Compliance Requirements and Increased Fraud Prevention Protocols May Limit Market Expansion in Certain Regions.

Stringent KYC/AML requirements, uneven state-level money services licensing, and the recent wave of ATM targeted scams are all conspiring to make it very costly to remain compliant for operators. Townships including Stillwater and St. Paul have outlawed crypto ATMs after incidents of fraud, and in the U.K., regulators have prosecuted the illegal operators. These changes present operational challenges and delay the rollout for issuers who are unable to navigate shifting legal regimes.

Opportunities:

-

Strategic Partnerships With Retail and Hospitality Sectors Present High-Growth Opportunities for ATM Network Expansion.

Collaborations between ATM providers and shopping malls, gas stations, hospitality venues, and transit hubs are opening new deployment channels. Retail integration boosts foot traffic and adoption, while joint programs such as co-branded loyalty incentives and co-location agreements are emerging. Recent expansions in Australia and the U.S. reflect this trend, signaling scalable growth potential through venue-based strategic alliances.

Challenges:

-

Persistent Consumer Scams via QR Code and Kiosk-Based Fraud Remain a Critical Challenge to Public Trust and Market Integrity.

Criminals are also focusing on crypto kiosks where they employ phony QRs that lure users to send money to scam wallets. Bitcoin ATM scam recorded losses amounting to more than USD 110 million from 2023 to 2024, according to the FTC, and it is the seniors who suffer the most. Such endemic threats to security diminish user confidence and may, in turn, encourage a strengthening of regulations and drive operators towards the use of more sophisticated fraud detection tools and awareness campaigns.

Segment Analysis

By Type

The one-way crypto ATMs, accounting for 65.38% of revenue in 2024, are driven by their simplicity and lower deployment costs. These kiosks focus on fiat-to-crypto purchases, attracting casual buyers and first-time users. Companies are offering modular one-way models with cloud-based management, integrating features for instant Bitcoin purchases and enhanced security. The segment continues to benefit from increasing cryptocurrency awareness and mainstream acceptance, with many retail chains opting for these machines to introduce users to the crypto ecosystem.

Two-way ATMs supporting both buy and sell transactions are experiencing a 56.97% CAGR due to rising user demand for flexible crypto access. Compact models featuring multi-note withdrawals and biometric authentication are becoming popular. These machines appeal to active traders and those seeking liquidity. Providers are launching advanced models with real-time exchange support and fiat handling. Their growing adoption aligns with the broader crypto ATM market trend, as financial services evolve toward comprehensive and user-centric crypto infrastructure.

By Offering

Hardware leads the market, contributing 74.93% of revenue, due to substantial demand for physical kiosk deployment. Manufacturers are introducing ruggedized models with enhanced screens, bill recyclers, and smart safes to improve security and operational efficiency. These developments reduce maintenance costs and improve user experiences. Deployments in high-traffic areas like malls and gas stations amplify this crypto ATM market growth. Strategic partnerships with retail chains and continuous innovations in kiosk design support the dominance of the hardware segment.

The software segment is growing at a 57.14% CAGR. Providers are enhancing remote management apps to support software updates, transaction monitoring, and compliance automation. The rising need for fraud detection, KYC/AML enforcement, and seamless UI/UX is driving software upgrades. As kiosks become more advanced, operators are bundling robust software suites with hardware, reinforcing the market’s shift toward integrated, secure, and scalable solutions.

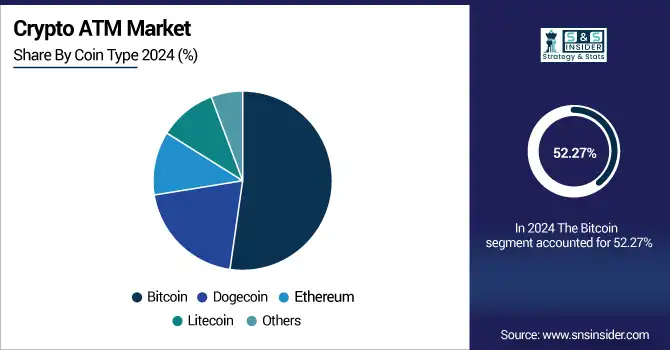

By Coin Type

Bitcoin holds the largest revenue share at 52.27% due to its global recognition, market liquidity, and widespread acceptance. Most crypto ATMs prioritize Bitcoin transactions and offer continuous firmware updates for seamless operation. As the first and most trusted digital asset, Bitcoin continues to serve as the entry point for most users. Ongoing product updates and increased machine penetration support Bitcoin’s continued relevance and dominance in the market.

Ethereum’s segment is growing at a 58.92% CAGR, driven by its use in DeFi platforms, smart contracts, and stablecoins. ATM providers are adding Ethereum compatibility and allowing token swaps, responding to user demand for access beyond Bitcoin. Increased network activity and ecosystem growth support the rising relevance of Ethereum in retail environments. This segment contributes to market diversification, offering broader utility and investment opportunities through crypto ATMs.

By Application

Crypto ATMs deployed in restaurants and hospitality spaces account for 31.02% of total revenue in 2024. These locations benefit from steady foot traffic, tech-savvy clientele, and longer dwell times. Businesses are integrating compact ATMs into cafes, hotels, and lounges to offer additional value and convenience to patrons. Recent trends include biometric verification and screen customization for branding. The segment helps normalize crypto use in everyday transactions, enhancing visibility and customer engagement.

Commercial spaces are growing at a 57.15% CAGR as shopping malls, retail stores, and convenience chains integrate crypto ATMs into their facilities. Retailers are leveraging these machines to attract a new customer base, boost foot traffic, and diversify payment options. Co-location strategies and partnership-based deployments are on the rise. ATMs with loyalty program integration, mobile wallet sync, and touchscreen interactivity are becoming common, contributing significantly to market expansion in this segment.

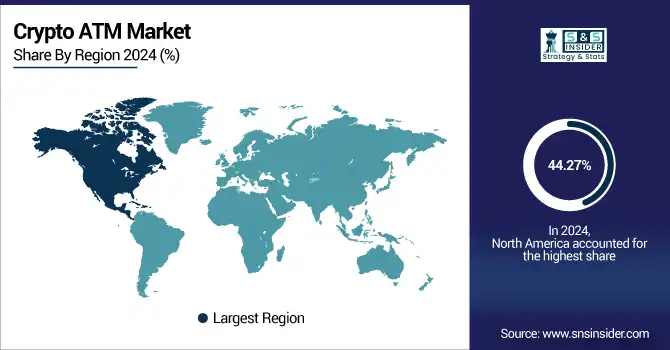

Regional Analysis

North America accounted for 44.27% of the crypto ATM market share in 2024, making it the dominant region. The growth is driven by early adoption of cryptocurrency, favorable regulatory frameworks, and strong digital infrastructure. The presence of major players like Bitcoin Depot, Coinme, and Coinsource, along with dense ATM deployment in retail, fuel stations, and entertainment venues, further supports regional dominance.

The United States leads the North American market due to the highest number of installed crypto ATMs, advanced financial infrastructure, and early regulatory clarity that encourages innovation and investment.

Europe is growing steadily, driven by increasing tourism, cross-border payment demand, and greater crypto accessibility in countries like Germany, Austria, and Switzerland. Governments are gradually adopting crypto-friendly policies, and the deployment of ATMs in hospitality and travel hubs is rising. Germany dominates the European market with supportive fintech regulations, strong banking-crypto integrations, and active deployments of crypto ATMs in public and commercial locations.

Asia Pacific is projected to grow at the fastest CAGR of 55.71%. Rising crypto adoption in tech-driven economies like Japan and South Korea, combined with large unbanked populations and government interest in digital currency, is propelling growth.

Japan leads the region with a highly regulated crypto market, rapid digital adoption, and increasing crypto ATM placements in metro stations and retail areas.

The Middle East & Africa and Latin America are rapidly developing markets for crypto ATMs driven by growing interest from the financial sector in blockchain technology and digital financial systems, and a drive toward financial inclusion. Youth participation, remittance demands, and the lack of traditional banking services are key drivers, and regulatory and ATM deployments, particularly in countries such as the UAE and El Salvador, have made these countries regional leaders.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players of the crypto ATM market are Bitcoin Depot Inc., RockItCoin, Genesis Coin Inc., Byte Federal Inc., Bitaccess, Lamassu Industries AG, Coinsource, GENERAL BYTES, Coinme, Bitstop, and others.

Key Developments

-

In January 2024, Bitcoin Depot revealed its intention to surpass 8,000 kiosk installations by adding a further 400 machines. The company also increased its retail presence through expanded Circle K partnerships, improving access across major U.S. locations.

-

In February 2024, Bitcoin Depot enhanced its international presence with collaborations in Latin America and the Caribbean region by partnering with MoneyGram and CiNKO to facilitate crypto-based remittance services, with the goal of increasing financial inclusion and border crossing transaction accessibility in the underserved market.

-

In May 2024, Coinme shifted to a Crypto-as-a-Service model by embedding its API within networks such as Coinstar. The strategic move amplified its coverage to almost 10,000 kiosks and drove retail sales over USD 1 billion.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 301.55 Million |

| Market Size by 2032 | USD 10602.62 Million |

| CAGR | CAGR of 7.10% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (One Way, Two Way) •By Offering (Hardware, Software) •By Coin Type (Bitcoin, Dogecoin, Ethereum, Litecoin, Others) •By Application (Commercial Spaces, Restaurants & Other Hospitality Spaces, Transportation Hubs, Standalone Units, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Bitcoin Depot Inc., RockItCoin, Genesis Coin Inc., Byte Federal Inc., Bitaccess, Lamassu Industries AG, Coinsource, GENERAL BYTES, Coinme, Bitstop |