Cystic Fibrosis Market Report Scope & Overview:

Get more information on Cystic Fibrosis Market - Request Sample Report

The Cystic Fibrosis Market Size was valued at USD 10.36 Billion in 2023 and is expected to reach USD 56.72 Billion by 2032, growing at a CAGR of 20.80% over the forecast period of 2024-2032.

The Cystic Fibrosis market is evolving, influenced by several critical factors. Our report highlights the impact of regulatory approvals and policies, examining how evolving regulations affect treatment options and drug availability. It also offers insights from ongoing clinical trials, which provide a glimpse into future therapies and their market potential. The cost implications of Cystic Fibrosis treatments are explored, addressing the financial challenges faced by healthcare systems and patients. In addition, our report presents epidemiological data on Cystic Fibrosis prevalence, analyzing the global and regional distribution of the disease and its impact on market dynamics. Lastly, we discuss global health initiatives targeting Cystic Fibrosis, emphasizing international efforts to improve awareness, treatment access, and overall patient outcomes.

The US Cystic Fibrosis Market Size was valued at USD 3.92 Billion in 2023 and is expected to reach USD 21.73 Billion by 2032, growing at a significant CAGR over the forecast period of 2024-2032.

The United States Cystic Fibrosis market is experiencing steady growth, driven by advancements in drug development, increased funding, and strong regulatory support. The Cystic Fibrosis Foundation (CFF) plays a crucial role in funding research and expanding treatment accessibility. Breakthrough therapies, such as CFTR modulators from Vertex Pharmaceuticals, have significantly improved patient outcomes. Additionally, the FDA's fast-track approvals for innovative treatments accelerate market expansion. Rising healthcare investments and collaborations between pharmaceutical firms and research institutions further propel growth. Increased newborn screening programs and expanded insurance coverage are also enhancing early diagnosis and treatment adoption across the country.

Market Dynamics

Drivers

-

Integration of Smart Health Monitoring Devices for Real-Time Cystic Fibrosis Disease Management

The integration of smart health monitoring devices is transforming Cystic Fibrosis disease management by allowing patients to track their lung function, oxygen saturation, and medication adherence in real time. Wearable biosensors and digital spirometers are helping patients and healthcare providers detect early signs of pulmonary exacerbations, reducing hospitalization rates. Companies like NuvoAir and Spiro Health have developed AI-powered lung monitoring systems, enabling remote consultations and early intervention strategies. These technologies offer personalized insights into lung function trends, helping physicians adjust treatment plans proactively. The Cystic Fibrosis Foundation (CFF) has invested in digital health innovations, aiming to improve patient outcomes by making self-monitoring tools more accessible. Additionally, smartphone apps integrated with wearable spirometers help patients adhere to treatment regimens by sending medication reminders and tracking daily symptoms. The increasing adoption of remote healthcare solutions is also bridging gaps in access to specialized Cystic Fibrosis care, particularly in rural or underserved areas. As digital health technologies continue to evolve, they have the potential to enhance long-term disease management and overall quality of life for Cystic Fibrosis patients.

Restraints

-

Limited Representation of Minority Populations in Clinical Trials for Cystic Fibrosis Drug Development

A critical restraint in the Cystic Fibrosis Market is the underrepresentation of minority populations in clinical trials, leading to treatment disparities. Historically, Cystic Fibrosis has been perceived as a condition that predominantly affects Caucasians, causing clinical research to focus primarily on European-descent populations. However, African American, Hispanic, and Asian communities also have cases of Cystic Fibrosis, yet their genetic variations remain largely understudied. As a result, many CFTR modulator therapies may not be as effective in these groups due to genetic differences influencing disease progression and treatment response. The National Institutes of Health (NIH) and Cystic Fibrosis Foundation have recognized this gap, launching initiatives to increase clinical trial diversity. However, recruitment challenges persist due to lack of awareness, language barriers, and historical mistrust in medical research among underrepresented groups. Without inclusive clinical studies, treatment advancements may not address the full spectrum of genetic variations, leaving certain patient demographics without optimized care. Addressing this issue requires targeted outreach, patient education programs, and genetic studies tailored to diverse populations to ensure equitable access to effective Cystic Fibrosis treatments.

Opportunities

-

Growing Focus on Nutritional and Gut Microbiome Research to Enhance Cystic Fibrosis Treatment Outcomes

A promising opportunity in the Cystic Fibrosis Market is the growing focus on nutrition and gut microbiome health, which can significantly impact disease progression and treatment efficacy. Studies indicate that imbalanced gut microbiota in Cystic Fibrosis patients contributes to chronic inflammation, nutrient malabsorption, and immune system dysfunction. The National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) is funding research to explore how probiotics, dietary modifications, and enzyme supplementation can optimize gut health, leading to better patient outcomes. Additionally, many Cystic Fibrosis patients experience severe pancreatic insufficiency, making it difficult for them to absorb essential vitamins, minerals, and fats. This has driven pharmaceutical companies to develop personalized nutritional supplements and enzyme-replacement therapies that can be tailored to individual metabolic needs. Improved dietary interventions can enhance lung function, reduce hospitalizations, and improve overall quality of life. The increased integration of dietary science into Cystic Fibrosis treatment regimens presents a major opportunity for innovation, bridging the gap between nutritional therapy and pharmaceutical treatment to provide comprehensive disease management.

Challenge

-

Emerging Environmental and Occupational Health Concerns Affecting Cystic Fibrosis Patients' Respiratory Health

A growing challenge in the Cystic Fibrosis Market is the impact of environmental and occupational health hazards on patients’ respiratory function. Exposure to air pollution, industrial chemicals, and indoor allergens significantly worsens lung function in Cystic Fibrosis patients, increasing the risk of hospitalization and disease progression. Research from the American Lung Association (ALA) indicates that rising levels of airborne pollutants can trigger excessive mucus production, inflammation, and bacterial infections, exacerbating Cystic Fibrosis symptoms. Additionally, occupational exposure to chemical irritants in industries such as manufacturing, construction, and agriculture can have long-term effects on lung health, particularly for Cystic Fibrosis carriers who may not be diagnosed until later stages. As global air pollution levels continue to rise, healthcare organizations are advocating for stronger environmental policies to reduce harmful airborne contaminants. Efforts to improve workplace air quality, regulate industrial emissions, and educate patients on respiratory protection are crucial in addressing this challenge. Integrating environmental health policies into Cystic Fibrosis treatment plans can help mitigate external respiratory risks, ensuring better disease management and patient outcomes.

Segmental Analysis

By Therapy Type

In 2023, Cystic Fibrosis Transmembrane Conductance Regulator (CFTR) Modulators dominated the Cystic Fibrosis Market, accounting for approximately 50% of the market share. CFTR modulators, such as Trikafta, Kalydeco, Orkambi, and Symdeko, have revolutionized Cystic Fibrosis treatment by directly targeting the underlying cause of the disease rather than just managing symptoms. The U.S. FDA’s approval of Trikafta in 2019 marked a significant breakthrough, as it expanded treatment access to over 90% of Cystic Fibrosis patients. Organizations such as the Cystic Fibrosis Foundation (CFF) have played a crucial role in funding research and advocating for broader accessibility. Additionally, Vertex Pharmaceuticals, the leading manufacturer of CFTR modulators, has reported strong revenue growth, further solidifying the dominance of this segment. The continuous advancement in personalized medicine, genetic testing, and combination therapies is expected to drive further adoption of CFTR modulators, maintaining their market leadership in the coming years.

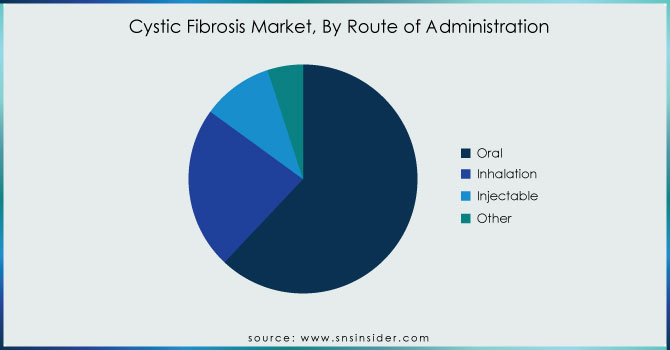

By Route of Administration

The oral route of administration dominated the Cystic Fibrosis Market in 2023, holding a market share of approximately 61%, primarily due to the widespread use of CFTR modulators and pancreatic enzyme replacement therapies (PERT), which are predominantly available in oral formulations. CFTR modulators such as Kalydeco, Orkambi, and Trikafta are taken orally, offering convenience, patient compliance, and long-term disease management benefits. Additionally, PERT drugs like Creon and Zenpep are essential for managing pancreatic insufficiency in Cystic Fibrosis patients. The preference for oral medications is reinforced by regulatory approvals and reimbursement policies in North America and Europe, ensuring broader accessibility. According to the Cystic Fibrosis Foundation, over 70% of Cystic Fibrosis patients require enzyme replacement therapy, further driving the demand for oral medications. While inhalation and intravenous therapies remain essential for severe lung infections, the ease of administration, patient adherence, and continuous innovation in oral formulations contribute to this segment’s dominance.

By Age Group

The adult segment dominated the Cystic Fibrosis Market in 2023, accounting for approximately 65% of the market share, primarily due to increased life expectancy and better disease management strategies. With the introduction of advanced CFTR modulators and improved respiratory therapies, the median survival age of Cystic Fibrosis patients has significantly increased. According to the Cystic Fibrosis Foundation Patient Registry (CFFPR), over 50% of the U.S. Cystic Fibrosis population comprises adults. The rising prevalence of late-stage diagnosis, particularly in mild genetic mutations, also contributes to this segment's dominance. Additionally, adults require long-term, comprehensive treatment regimens, driving the demand for CFTR modulators, mucolytics, and enzyme therapies. Many government and private healthcare programs, such as Medicare and Medicaid in the U.S., provide financial assistance for adult patients, ensuring continued access to high-cost treatments. The growing emphasis on personalized therapies and gene editing advancements further supports the dominance of this segment.

By Distribution Channel

In 2023, retail pharmacies & drug stores dominated and held the largest share in the Cystic Fibrosis Market, accounting for approximately 55% of the market. The availability of CFTR modulators, mucolytics, and enzyme therapies in retail pharmacies has significantly increased due to partnerships between pharmaceutical companies and large pharmacy chains like CVS Health and Walgreens in the U.S. Many insurance providers and government healthcare programs encourage prescription fulfillment through retail pharmacies for cost-effective distribution. Additionally, specialty pharmacies, which provide patient counseling and medication adherence programs, have contributed to increased reliance on retail pharmacy services. According to the National Association of Chain Drug Stores (NACDS), nearly 90% of U.S. citizens live within five miles of a retail pharmacy, making accessibility a crucial factor in this segment’s dominance. While hospital pharmacies remain critical for emergency care, the convenience, affordability, and accessibility of retail pharmacies position them as the leading distribution channel in the Cystic Fibrosis Market.

Need any customization research on Cystic Fibrosis Market - Enquiry Now

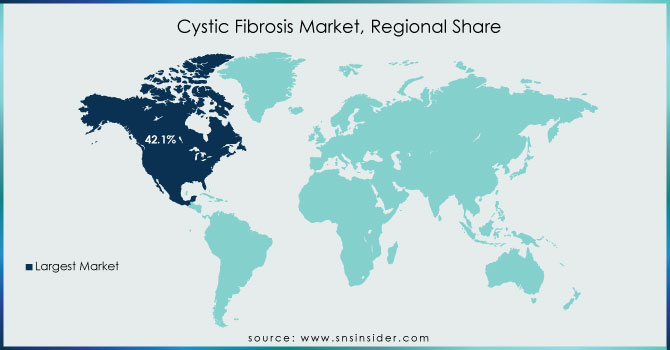

Regional Analysis

North America dominated the Cystic Fibrosis Market in 2023, holding a market share of around 47%, driven by strong government support, high healthcare expenditure, and the presence of key pharmaceutical companies such as Vertex Pharmaceuticals and AbbVie. The United States accounted for the largest share, supported by the FDA’s continuous drug approvals, robust reimbursement policies, and advanced research funding from organizations like the Cystic Fibrosis Foundation (CFF) and National Institutes of Health (NIH). The Cystic Fibrosis Foundation’s Therapeutics Development Network is the largest CF clinical trials network worldwide, significantly contributing to new drug development and patient access to cutting-edge treatments. Canada also plays a crucial role, with nonprofit organizations like Cystic Fibrosis Canada advocating for better treatment accessibility. The high prevalence of Cystic Fibrosis in North America, with approximately 40,000 cases in the U.S., combined with government funding for CF research, contributes to market dominance. Furthermore, initiatives like the Orphan Drug Act provide incentives for pharmaceutical companies to develop novel treatments, ensuring North America remains the leading region in the Cystic Fibrosis Market.

Moreover, the Asia Pacific region emerged as the fastest-growing region in the Cystic Fibrosis market, with a significant growth during the forecast period, driven by rising awareness, improving healthcare infrastructure, and increasing diagnostic capabilities. Although Cystic Fibrosis is less common in Asian populations, recent advancements in genetic screening and newborn testing programs in countries like China, India, and Japan have led to earlier detection and improved treatment rates. The Japanese government’s rare disease initiatives and China’s expansion of rare disease reimbursement policies are significantly driving market growth. Moreover, pharmaceutical companies are expanding their presence in the Asia Pacific region to address the growing patient population. India, for instance, has witnessed an increase in CF-related research projects, supported by organizations such as the Indian Council of Medical Research (ICMR). Additionally, collaborations between international pharmaceutical companies and regional healthcare providers are making CF treatments more accessible. The rising adoption of CFTR modulators in Asia-Pacific hospitals and the increasing focus on gene therapy research position this region as the fastest-growing market for Cystic Fibrosis treatments.

Key Players

-

AbbVie Inc.

-

Alcresta Therapeutics, Inc.

-

AlgiPharma AS

-

AstraZeneca PLC

-

Bayer AG

-

CHIESI Farmaceutici S.p.A.

-

Elucigene Diagnostics by Delta Diagnostics (UK) Limited

-

F. Hoffmann-La Roche AG

-

Galapagos NV

-

Genentech, Inc.

-

Gilead Sciences, Inc.

-

GlaxoSmithKline Plc.

-

Johnson & Johnson Services, Inc.

-

Mylan N.V.

-

Novartis AG

-

NovaBiotics Ltd.

-

Pfizer Inc.

-

Pharmaxis Ltd.

-

PTC Therapeutics, Inc.

-

Vertex Pharmaceuticals Incorporated

Recent Developments

-

January 2025: Lupin received USFDA approval for its generic version of a cystic fibrosis treatment, offering an affordable alternative to existing therapies for patients. The approval supports efforts to improve access to high-cost medications in the U.S. market.

-

March 2025: UCLA researchers developed an inhalable gene-editing therapy aimed at correcting cystic fibrosis mutations. The innovative treatment uses fat-based particles to deliver gene-editing tools directly to lung stem cells, offering a potential cure for patients who don’t benefit from current therapies.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 10.36 Billion |

| Market Size by 2032 | USD 56.72 Billion |

| CAGR | CAGR of 20.80% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Therapy Type (Cystic Fibrosis Transmembrane Conductance Regulator (CFTR) Modulators, Gene Therapy, Mucolytics, Pancreatic Enzyme Replacement Therapy (PERT), Others) •By Route of Administration (Oral, Inhalation, Intravenous) •By Age Group (Adult, Pediatric, Elderly) •By Distribution Channel (Retail Pharmacies & Drug Stores, Online Pharmacies, Hospital Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Vertex Pharmaceuticals Incorporated, Gilead Sciences, Inc., AbbVie Inc., GlaxoSmithKline Plc., F. Hoffmann-La Roche AG, Novartis AG, AstraZeneca PLC, Mylan N.V., Teva Pharmaceutical Industries Ltd., Bayer AG and other key players |