D-dimer Testing Market Size & Report Overview:

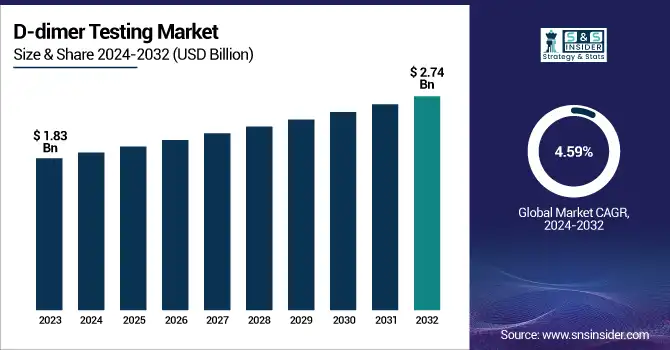

The D-dimer Testing Market was valued at USD 1.83 billion in 2023 and is expected to reach USD 2.74 billion by 2032, growing at a CAGR of 4.59% over the forecast period 2024-2032. The report accentuates reimbursement and healthcare expenditure patterns geographically, determined by different insurance coverage policies and government healthcare budgets. The research discusses technological developments in D-dimer testing, such as the creation of high-sensitivity assays, point-of-care testing, and automation to improve accuracy and efficiency. It also discusses regulatory and compliance trends, with changing guidelines influencing market entry, standardization, and test approval procedures. The growing emphasis on the early detection of thrombotic disorders, combined with the growing burden of cardiovascular disease, is also propelling demand for D-dimer testing globally.

To Get more information on D-dimer Testing Market - Request Free Sample Report

The U.S. D-dimer Testing Market was valued at USD 0.43 billion in 2023 and is expected to reach USD 0.59 billion by 2032, growing at a CAGR of 3.58% over the forecast period 2024-2032. In the United States, the market is growing due to escalating healthcare spending, a robust regulatory environment for diagnostic growth, and expanded use of rapid testing products in emergency and outpatient facilities.

D-dimer Testing Market Dynamics

Drivers

-

The increasing prevalence of thrombotic disorders such as deep vein thrombosis (DVT), pulmonary embolism (PE), and disseminated intravascular coagulation (DIC).

As per the CDC, around 900,000 cases of DVT and PE are seen each year in the U.S. alone, driving the demand for D-dimer testing. The increasing geriatric population, which is at higher risk for clotting disorders, also helps drive market growth. The increased use of point-of-care (POC) testing is also transforming the market, providing immediate results in emergencies, thereby enhancing clinical decision-making. The use of automated and highly sensitive immunoassays, including Fluorescence Immunoassays (FIA) and Latex-enhanced Immunoturbidimetric Assays, is improving diagnostic efficiency and precision. Growing education regarding early thrombotic event detection, promoted through government programs and healthcare initiatives, is another strong driver of growth. In addition, advances in technology, including AI-based diagnostic platforms, are making result interpretation easier, decreasing turnaround times, and enhancing test sensitivity. The growth of D-dimer testing outside of hospitals to ambulatory care and home testing environments is also driving market growth. Furthermore, the growing incidence of cardiovascular diseases and COVID-19-related coagulopathies has further increased demand, as D-dimer levels are often tracked in critically ill patients to evaluate clotting risk and response to treatment.

Restraints

-

The D-dimer testing market faces restraints, particularly due to high false-positive rates, which can lead to unnecessary imaging tests and additional healthcare costs.

Research shows that D-dimer tests are only 40-60% specific, so false positives are frequent, particularly in diseases such as infections, pregnancy, and cancer. This makes them less reliable as an independent diagnostic test. The second significant limitation is the absence of standardization in test methods among various laboratories and manufacturers, resulting in inconsistencies in test results. Furthermore, the price of advanced testing technology, i.e., enzyme-linked immunosorbent assays (ELISA) and fluorescence immunoassays (FIA), is prohibitive to adoption, especially in low-income countries. The reimbursement practices of D-dimer tests are not uniform, curbing access for patients in some healthcare systems. Finally, the lack of experienced laboratory personnel to perform and interpret complex immunoassay-based D-dimer tests is a challenge to effective market penetration. Regulatory hurdles, such as rigorous FDA and CE approval procedures, also hinder the launch of new and innovative testing kits. Additionally, excessive dependence on hospital-based labs for D-dimer testing limits the popular adoption of point-of-care (POC) tests, consequently constraining the market potential for decentralized diagnostic solutions.

Opportunities

-

The growing adoption of point-of-care (POC) D-dimer testing presents a significant opportunity, particularly in emergency settings where rapid diagnosis is critical.

The rising home healthcare and self-testing device trend is creating new growth opportunities, and manufacturers are working on portable D-dimer analyzers for off-site patient monitoring. The increasing incidence of chronic diseases like cardiovascular conditions, cancer, and sepsis is also increasing the demand for regular coagulation testing, and the market opportunity is expanding beyond the acute thrombotic event. Moreover, the combination of artificial intelligence (AI) and machine learning (ML) in diagnostic procedures is anticipated to improve test precision and effectiveness, lowering diagnostic errors. The growth of automated high-throughput analyzers in the clinical laboratory setting is also presenting opportunities for next-generation D-dimer testing platforms investment by companies. Another key growth driver is the growing uptake of D-dimer testing in emerging markets, where healthcare infrastructure is being enhanced, and governments are spending on sophisticated diagnostic solutions. Hospital partnerships with diagnostic firms to widen the reach of low-cost, high-sensitivity testing kits are also driving market growth. In addition, continued research into new biomarkers for coagulation disorders may result in the creation of next-generation multi-analyte panels that further increase the clinical usefulness of D-dimer testing and expand its diagnostic uses.

Challenges

-

The D-dimer testing market faces several challenges, particularly limited awareness and accessibility in developing regions, where diagnostic infrastructure is still evolving.

One such issue is still the shortage of trained personnel capable of performing and interpreting high-sensitivity immunoassays in resource-constrained environments. Test result variability due to differences among brands and methodology is another severe challenge, allowing healthcare professionals limited confidence in basing diagnoses on D-dimer levels as an unvarying diagnostic criterion. The reagents' and consumables' short shelf life further contributes to operational difficulties for laboratories, resulting in raised costs and wastage. Additionally, the trend towards alternative diagnostic techniques, e.g., imaging tests (CT pulmonary angiography), represents a competition challenge, particularly in high-income nations where healthcare facilities have a preference for direct imaging rather than biochemical testing. Regulatory barriers, such as high approval barriers to new assays, slow product introductions and market access for emerging vendors. Furthermore, the decreasing profitability of testing in the laboratory environment owing to price pressures and reimbursement reductions is slowing the growth of the market. Last but not least, the difficulty of distinguishing D-dimer elevations caused by thrombotic disorders from other inflammatory conditions remains a key clinical limitation, influencing the utility and specificity of D-dimer testing in everyday practice.

D-dimer Testing Market Segmentation Insights

By Product

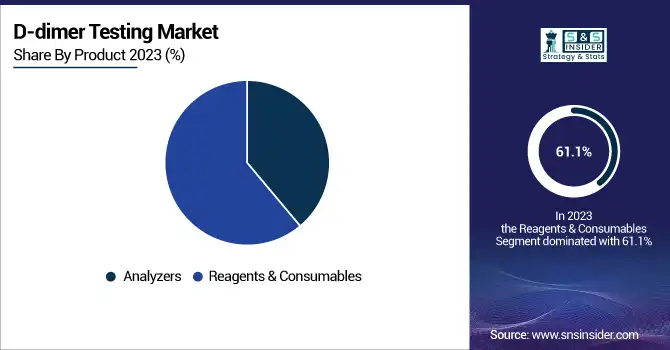

The Reagents & Consumables segment held the majority of the D-dimer testing market in 2023, with a share of 61.1% of the total market. The strong demand for reagents and consumables is fueled by their repetitive utilization in diagnostic tests, growing test volumes, and the widening use of point-of-care (POC) testing kits. On the other hand, the segment of Analyzers is anticipated to witness the highest growth rate during the forecast period. The higher uptake of automated and high-throughput analyzers within clinical laboratories is driving demand, as these devices increase testing efficiency and minimize turnaround time.

By Test Type

The Clinical Laboratory Tests segment was the market leader with a revenue share of 59.5% in 2023. The reason for this leadership is that laboratory-based tests are more accurate and reliable, and they are still the gold standard for D-dimer testing in diagnostic centers and hospitals. Nevertheless, Point-of-Care Tests (POCT) are also expected to advance at the highest rate. The increasing demand for bedside and rapid testing, especially in emergencies, is propelling the implementation of POC tests, facilitating faster decision-making and treatment initiation.

By Method

The Enzyme-linked Immunosorbent Assay (ELISA) market share was the largest in 2023 at 39.6%. ELISA is still the first choice because of its sensitivity and specificity, and hence it is the most commonly used methodology for laboratory-based D-dimer testing. Conversely, Fluorescence Immunoassays (FIA) are poised to expand the most rapidly. The growing movement towards FIA-based rapid diagnostic tests is driven by their capability to deliver accurate results with reduced turnaround times, especially in decentralized healthcare environments.

By Application

The Deep Vein Thrombosis (DVT) segment led the market in 2023 with a share of 34.4%. DVT has the highest incidence of cases and is now much more screened for due to higher awareness and early screening programs, attributing heavily to its leading position. In the meantime, Disseminated Intravascular Coagulation (DIC) is poised to exhibit the fastest rate of growth. Growing sepsis-associated coagulation disorders and increased ICU admissions have driven greater demand for D-dimer testing in critically ill patients.

By End-Use

The Hospitals segment dominated the D-dimer testing market in 2023 with a 32.8% revenue share. Hospitals are the main hubs for D-dimer testing because of the large patient flow, sophisticated diagnostic facilities, and coordination with emergency care for thrombotic conditions. Diagnostic Centers are expected to develop at the highest rate. The growth of independent diagnostic laboratories, growing hospital outsourcing of tests, and a growing trend towards walk-in diagnostic services are fuelling this segment's growth at a high pace.

D-dimer Testing Market Regional Analysis

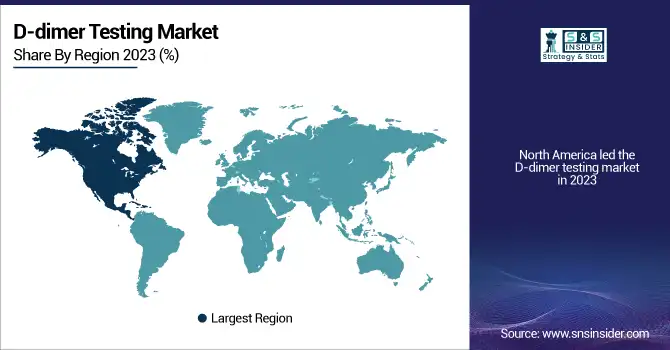

North America led the D-dimer testing market in 2023 with its strong established medical infrastructure, the strong burden of thrombotic disease, and increased uptake of the latest diagnostic technology. The U.S. leads because deep vein thrombosis (DVT) and pulmonary embolism (PE) disease are rising fast among approximately 900,000 patients each year. Strong reimbursement policies in the region and the presence of powerful diagnostic players like Abbott, Siemens Healthineers, and Roche Diagnostics also contribute to the region. The increasing use of point-of-care (POC) D-dimer testing in emergency departments is further driving the market growth.

Europe is the next major market, driven by an aging population and rising government initiatives towards the early diagnosis of coagulation disorders. The region also experiences a high demand for high-sensitivity immunoassays and laboratory analyzers that are automated. On the other hand, Asia-Pacific is the region with the fastest growth, with a predicted increase in demand for D-dimer testing due to increased healthcare spending, enhanced diagnostic infrastructure, and growing awareness of thrombotic disorders. The increasing number of cardiovascular diseases and cancer-associated thrombosis in China, India, and Japan is a key driver. Also, rising investments in point-of-care diagnostics and fast-testing solutions in developing economies are fueling the speedy market growth in this region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the D-dimer Testing Market

-

Biomedica Diagnostics

-

Abbott

-

Thermo Fisher Scientific Inc.

-

WERFEN

-

HORIBA, Ltd.

-

SEKISUI Diagnostics

-

BIOMÉRIEUX

-

QuidelOrtho Corporation

-

Diazyme Laboratories

Recent Development

-

In Feb 2023, Carolina Liquid Chemistries Corp. (CLC) and Diazyme Laboratories, Inc. partnered to expand the test menu on the Diazyme DZ-Lite c270 benchtop clinical chemistry analyzer, adding 25 new assays to its existing portfolio of over 50 CLIA-categorized tests, enhancing diagnostic capabilities, including D-dimer testing.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.83 billion |

| Market Size by 2032 | USD 2.74 billion |

| CAGR | CAGR of 4.59% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Analyzers, Reagents & Consumables] • By Test Type [Clinical Laboratory Tests, Point-of-Care Tests] • By Method [Enzyme-linked Immunosorbent Assay (ELISA), Latex-enhanced Immunoturbidimetric Assays, Fluorescence Immunoassays, Others] • By Application [Deep Vein Thrombosis (DVT), Pulmonary Embolism (PE), Disseminated Intravascular Coagulation (DIC), Others] • By End-Use [Hospitals, Academic & Research Institutes, Diagnostic Centers, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Siemens Healthcare, Biomedica Diagnostics, Abbott, Thermo Fisher Scientific Inc., WERFEN, HORIBA Ltd., SEKISUI Diagnostics, F. Hoffmann-La Roche Ltd, BIOMÉRIEUX, QuidelOrtho Corporation, Diazyme Laboratories. |