Dehydrated Potato Market Report Scope & Overview:

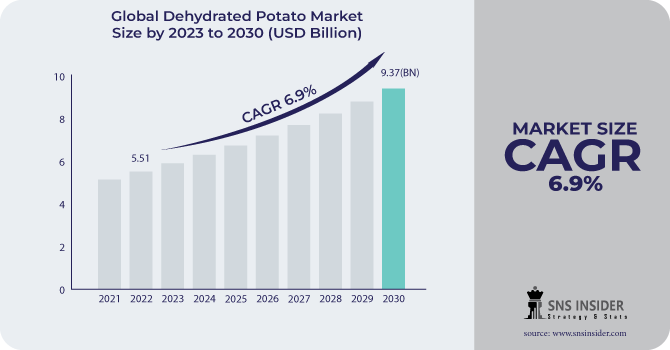

The Dehydrated Potato Market size was USD 5.51 billion in 2022 and is expected to Reach USD 9.37 billion by 2030 and grow at a CAGR of 6.9 % over the forecast period of 2023-2030.

Potatoes that are dehydrated by eliminating the majority of their moisture are used to make dehydrated potatoes. The potatoes are preserved during this process, and they become portable and simple to store. In order to prepare a range of foods, including french fries, potato chips, and mashed potatoes, dehydrated potatoes can be reconstituted by mixing them with water or milk.

Based on Form, the Dehydrated Potato Market is segmented into Flakes, Powder, Dice, Shreds, and Others. The powder segment dominated the global market with the highest CAGR of 8.5 % in 2022. In a variety of food preparations, such as ready-to-eat meals, baked goods, and other dishes, potato powder is frequently employed as a thickening ingredient.

Based on Nature, the market is segmented into organic and conventional potatoes. The conventional potatoes market category dominated the global market in 2022. Due to the wide range of applications for the commodity, commercial suppliers now offer dried potatoes in their most natural form. The conventional category is anticipated to represent a sizable portion of the global market.

MARKET DYNAMICS

KEY DRIVERS

-

Increased demand for ready-to-eat products

One of the primary drivers of the dehydrated potato market is the increased demand for Ready-To-Eat and convenience foods. These foods are simple to prepare and eat, which appeals to consumers who are looking for time-saving options. Consumers' increasing disposable income and rising urbanization have increased their spending on processed and Ready-To-Eat foods. Many Ready-To-Eat and convenience meals, such as potato chips, crisps, and instant mashed potatoes, contain dehydrated potatoes.

RESTRAIN

-

Fluctuation in prices of potato

The demand for dehydrated potatoes fluctuates with the season, the climate, the state of the economy, and consumer preferences. Additionally, the war has hampered Ukrainian exports, which has resulted in potato scarcity for a particular period. This is particularly valid for countries that depend heavily on Ukraine as a source of potatoes. Prices have increased as a result of this supply chain interruption. Since the beginning of the conflict, potato prices have risen.

OPPORTUNITY

-

Growing applications in the Processed food industry

Dehydrated potatoes are found in a wide range of processed foods, including instant mashed potatoes, frozen french fries, and potato chips. They are also found in soups, sauces, and other ready-to-eat dishes. Because of the increased demand for convenience foods, the processed food business is fast expanding. Dehydrated potatoes are an excellent fit for this demand since consumers want cuisine that is quick and easy to prepare. Dehydrated potatoes are also high in nutrients like carbs, fiber, and vitamins.

CHALLENGES

-

Growing health concerns about processed food

Customers are becoming more aware of the health dangers associated with processed foods, particularly dried potatoes. Eating processed foods increases your chance of heart disease, overweight, and other health problems, according to some research. As a result, customers may be unwilling to purchase processed foods such as dried potatoes. According to an International Food Information Council poll, 78% of Americans are aiming to consume more fresh fruits and vegetables, while 68% are concerned about the healthfulness of their meals.

IMPACT OF RUSSIA UKRAINE WAR

According to data issued by the FAO, Ukraine produced 210 million tonnes of potatoes in 2021, placing the nation as the third largest producer in the world. Potato prices in Kyiv doubled from $0,17/kg to $0,34/kg as soon as the Russian aggression began, and they are currently at least 25–30% more than they were a year ago. First off, because of the occupation of the primary producing areas, the availability of domestically cultivated early potatoes will be reduced. Second, due to anticipated supply limitations, potato prices will be much higher right from the start of the marketing season.

IMPACT OF ONGOING RECESSION

The recession had a significant influence on dehydrated potato demand. Ukraine is one of the largest potato producers, accounting for approximately 7% of global output. interruption in the supply chain has resulted in supply interruption, which has resulted in price increases. Potato prices have been climbing since the beginning of the war and are expected to continue. Potato prices are predicted to rise 5-10% in 2023 as a result of a mix of reasons including the Russia-Ukraine conflict, rising fertilizer prices, and a poorer global economy.

MARKET SEGMENTATION

By Form

-

Flakes

-

Powder

-

Dices

-

Shreds

-

Others

By Nature

-

Organic

-

Conventional

By Distribution Channel

-

Food Services

-

Retail Channel

.png)

REGIONAL ANALYSIS

The Asia Pacific Dehydrated Potato Market held a 46% share of the market in 2022. In addition, India’s and China’s dehydrated potato markets had the greatest market share. The potato is an essential product grown in this region as a source of food and revenue, particularly for farmers in mountainous locations with poor soil quality. The rising usage of potato starch as a binding ingredient in biscuits, dough, sauce, and cake mixes, and stew thickening is driving up demand in the region. Dehydrated potato flakes are utilized as snack ingredients in retail mashed potato products, while potato flour is used to bind meat mixes and thicken soups and gravies.

Europe's regional dehydrated potato industry retained a substantial market share in 2022. The United Kingdom is expected to outpace other countries due to rising demand for prepared foods and snacks, as well as the expansion of the region's fast-food business. The increase in the number of working people has increased the demand for convenience foods and aided the growth of this sector of the economy. The Dehydrated Potato Market in the United Kingdom grew the fastest in the European region, while the German Dehydrated Potato Market held the largest market share.

The North American food processing business in the United States is quickly expanding, which benefits regional market growth. As demand for instant salads and soups grows, the United States has the region's greatest market share. For consumers worried about additives, potato manufacturers in the United States offer clean-label dehydrated solutions.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Dehydrated Potato Market are McCain Foods, s, Lamb Weston, Augason Farms, Pacific Valley Foods, Birkamidon, J.R. Short Milling, Idaho Supreme Potatoes, Idahoan Foods, Rohstoffhandels GmbH, Rixona B.V., and other key players.

Lamb Weston-Company Financial Analysis

RECENT DEVELOPMENTS

In 2023, Pringles announced the addition of four new Harvest Blends flavors to its Sweet Potato Chips range, which contain dehydrated ingredients.

In 2022, McCain purchased Lutosa, a potato processing company, and established a new flakes plant in Belgium. McCain Foods has invested USD 44.7 million in the venture. The new plant would assist in fulfilling the growing global demand for dehydrated items, improving working conditions, and expanding product offerings.

In 2022, The Texas A&M Potato Breeding Program introduced two new potato varieties into the French fry market. The breeding facility has determined that the COTX08063-2Ru variety potato clone has a high starch and high gravity species. The demand for French fries is rising in Texas, which has led to increased production of high-starch potatoes that make tasty French fries. Additionally, processed foods like chips and dry potatoes are made with these potatoes.

| Report Attributes | Details |

| Market Size in 2022 | US$ 5.51 Billion |

| Market Size by 2030 | US$ 9.37 Billion |

| CAGR | CAGR of 6.9 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Form (Flakes, Powder, Dices, Shreds, and Others) • By Nature (Organic and Conventional) • By Distribution Channel (Food Services and Retail Channel) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | McCain Foods, s, Lamb Weston, Augason Farms, Pacific Valley Foods, Birkamidon, J.R. Short Milling, Idaho Supreme Potatoes, Idahoan Foods, Rohstoffhandels GmbH, Rixona B.V. |

| Key Drivers | • Increased demand for ready-to-eat products |

| Market Restrain | • Fluctuation in prices of potato |