Dermatology Imaging Devices Market Key Insights:

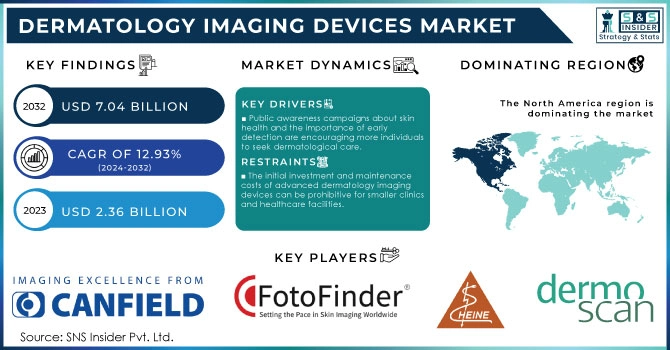

The Dermatology Imaging Devices Market size was valued at USD 2.36 billion in 2023 and is expected to reach USD 7.04 Billion by 2032, growing at a CAGR of 12.93% from 2024-2032. The dermatology imaging devices market is projected to grow at a rapid pace owing to factors like technological developments, rise in awareness about skin disorders, and increase in number of patients with skin diseases.

Get More Information on Dermatology Imaging Devices Market - Request Sample Report

The increased diagnostic utility to dermatologists under the name of innovations in imaging technology, high resolution digital imaging, dermatoscopy, and 3D imaging systems are all contributing to improved detection of skin conditions like melanoma and other skin cancers. To illustrate, there has been an increasing focus on the role of AI-powered imaging technologies, such as actinic keratosis detection solutions developed by companies such as DermTech, that are improving skin lesion analyses and clinical outcomes. Apart from advancements in technology, the increase of skin diseases among patients is an important factor that drives the market growth. Skin diseases affect nearly 900 million people worldwide, making the development of portable and efficient diagnostic tools highly important according to a report by World Health Organization (WHO). In addition, the rising geriatric population is increasing the prevalence of skin-related diseases and hence propelling the need for dermatology imaging devices. According to a recent report, almost 40% of older adults had at least one skin disorder, creating a need for advanced imaging technologies to treat these disorders. Additionally, Factors driving the growth of telehealth include an escalating need for accessible healthcare, particularly in rural communities, and the increasing prevalence of chronic diseases that necessitate continuous management. Technological improvements, such as better internet access and the development of mobile health applications, enable remote consultations. The COVID-19 pandemic has also played a significant role in advancing telehealth, enhancing comfort levels among patients and providers regarding virtual care. Additionally, expanding insurance coverage for telehealth services supports its growth, alongside the ongoing emphasis on cost reduction and improved patient outcomes.

Market growth is additionally driven by several government initiatives that emphasize skin health awareness and provide improved access to dermatology care. Campaigns to promote awareness about skin cancer and regular skin assessment are motivating a larger population to consult dermatologists, which in turn increases use of imaging devices. These trends have been manifesting recently in market developments. For Instance, In 2023, Siemens Healthineers released its new AI-powered dermatology imaging solution to quickly assess skin conditions while providing actionable information to clinicians, bridging the gap between an evolving technological landscape and traditional dermatological practices.

In conclusion, the dermatology imaging devices market is anticipated to continue on an upward trajectory owing to favorable factors such as technological developments in the field of dermatology devices, rising prevalence of skin diseases, and efforts for creating awareness about these medical conditions.

Market Dynamics

Drivers

-

Public awareness campaigns about skin health and the importance of early detection are encouraging more individuals to seek dermatological care.

-

Enhancements and services in both developed and developing regions are improving access to advanced dermatology imaging technologies.

-

Supportive government policies and improving skin disease management and access to dermatological services are positively impacting market growth.

The rise of the dermatology imaging devices market is driven by favorable government policies to advance skin disease management and access to dermatological services. Around the world, governments are waking up to skin health problems and trying their best to encourage developments in dermatology. These efforts frequently comprise financing for research, support for medical devices, and public health campaigns related to skin illness awareness. For instance, potentially one of the best examples is replacement national skin cancer prevention programs that document early detection from screening. These programs incentivize the use of advanced imaging technologies (for example, dermatoscopes and high-resolution imaging devices), allowing health care providers to diagnose skin conditions with more precision and efficiency. These initiatives also make certain that the medical community is prepared to use the newest imaging technologies by stimulating training and education of health care providers, improving patient care even more.

And if that's not enough, governments often give a hand to developing healthcare infrastructure in many underserved areas. Dermatology with telemedicine and remote diagnostics can allow patients to reach natural dermatological services, such as if they are in a blessed rural spot or somewhere further out of urban regions. Facilitating such rapid uptake is essential to early diagnosis and treatment, thereby benefiting patient outcomes considerably. Additionally, governments are also implementing policies to improve the quality of healthcare system and it will grow market by raising demand for innovative dermatology imaging devices. The introduction of imaging technologies into EHR systems enhances the capture and follow up of data on patients and their outcomes, leading to increased adoption by more healthcare facilities.

By implementing such supportive government policies and initiatives to reduce the impact of skin diseases, the overall dermatology imaging devices market will grow due to improved management of such diseases and increased access to dermatological services. They aid in the dissemination of better imaging technology and ultimately lead to improved health outcomes for patients with dermatologic disease.

Restraints

-

The initial investment and maintenance costs of advanced dermatology imaging devices can be prohibitive for smaller clinics and healthcare facilities.

-

Certain imaging devices may have limitations in accuracy and sensitivity, impacting their adoption in clinical settings.

-

There is a lack of trained dermatologists and technicians skilled in using advanced imaging technology, which can hinder effective implementation.

The dermatology imaging devices market encounters notable challenges due to a shortage of trained dermatologists and technicians skilled in advanced imaging technologies. As practices increasingly incorporate sophisticated tools such as high-resolution digital cameras, dermatoscopes, and confocal microscopes, the demand for qualified personnel intensifies. However, many healthcare facilities struggle to find professionals capable of effectively operating and interpreting the results generated by these complex devices. This skills gap stems from several issues, primarily the rapid pace of technological advancement that often outstrips the training programs available. Traditional dermatology education frequently does not cover the latest imaging techniques, leading to a workforce that is knowledgeable in fundamental dermatological practices but lacks the expertise needed for advanced imaging. According to a report from the American Academy of Dermatology, many residency programs are inadequate in preparing dermatologists for contemporary practices, including digital imaging and teledermatology.

Moreover, the lack of ongoing professional development opportunities in this domain exacerbates the issue. As imaging technology evolves, continuous education and training become essential for dermatologists and technicians to stay updated with best practices and new tools. Without adequate training programs, many practitioners may hesitate to adopt new technologies, fearing they lack the skills to utilize them effectively.

The consequences of this skills deficit are significant. It limits the successful integration of advanced imaging devices in clinical settings and jeopardizes the quality of patient care. Misuse of imaging technologies can lead to incorrect diagnoses, delayed treatments, and ultimately poorer patient outcomes. To address this training shortfall, enhancing educational offerings through specialized workshops and fostering collaborations with technology manufacturers is crucial. Such initiatives could lead to substantial improvements, benefiting both practitioners and patients in the dermatology imaging devices market. In conclusion, bridging the skills gap in dermatology imaging is vital for effectively incorporating advanced technologies into clinical practice. This focus is crucial for ensuring improved patient care and maximizing the benefits of innovative imaging solutions.

Market Segment Analysis

By Modality

In 2023, the dermatoscope segment led the market with a significant revenue share of 41.42%. These specialized instruments are essential in dermatology for examining the skin and detecting anomalies or changes in growth patterns. Dermatoscopes enhance visibility of the skin's surface, allowing for detailed assessments. Their non-invasive nature, painless functionality, and diagnostic precision in identifying skin conditions, along with their ease of use for monitoring skin lesions over time, have driven their widespread acceptance among healthcare professionals. They are instrumental in the early detection of skin cancer and other dermatological disorders. Key features such as polarized and non-polarized lighting options, adjustable magnification, and capabilities for capturing images for further analysis are expected to keep these devices at the forefront in the upcoming forecast period.

The digital photographic imaging segment is projected to achieve the fastest growth rate during the forecast period. This technology leverages digital cameras to capture and electronically store images, becoming indispensable for diagnosing and monitoring skin conditions globally. High-resolution digital cameras empower dermatologists to identify and track skin changes over time. Noteworthy products in this segment include MoleScope, FotoFinder, and Canfield VISIA. Additionally, the rise of total body photographic imaging systems, which capture high-resolution images of the entire body, is likely to boost market expansion. Prominent examples of such systems include VECTRA WB360, IntelliStudio, and DermaGraphix, created by Canfield Scientific, Inc. The DermaGraphix body mapping solution offers dermatologists a comprehensive view of a patient's skin condition through detailed, high-resolution imaging of the whole body.

By Application

In 2023, the skin cancers segment led the market with a notable revenue share of 48.63%, driven largely by the high incidence of skin cancers globally. In 2023, approximately 97,610 new cases of melanoma are expected to be diagnosed in the United States, making melanoma represent 5% of all new cancer diagnoses, This indicates a continued rise in the incidence of skin cancers, emphasizing the importance of early diagnosis and treatment. For instance, Derma Medical Systems' MoleMax HD system uses digital dermoscopy to capture high-resolution skin images, assisting dermatologists in detecting early signs of skin cancer. Similarly, the Vivascope 1500 from Caliber Imaging and Diagnosis employs confocal microscopy to produce cellular-level images, allowing for the identification of abnormal cells indicative of skin cancer.

The plastic and reconstructive surgery segment is expected to witness the highest CAGR in the upcoming forecast period. This growth is fueled by the rising adoption of minimally invasive surgical techniques and technological advancements in relevant devices. As cosmetic surgeries gain popularity, the necessity for precise imaging to achieve optimal surgical results is increasingly critical. Moreover, the launch of specialized products designed specifically for plastic and reconstructive procedures is likely to further enhance market growth in this segment throughout the forecast period.

Regional Analysis

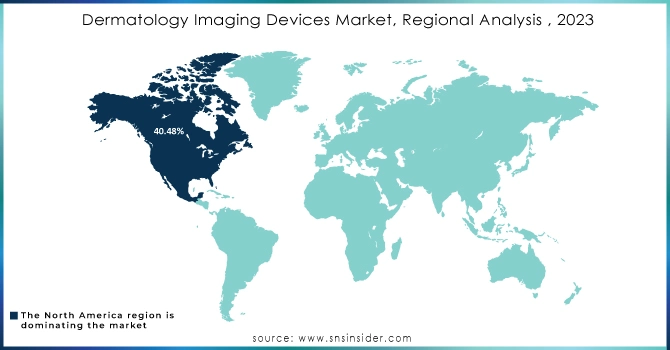

North America dominated the dermatology imaging devices market with a revenue share of 40.48% in 2023 The growth of the dermatoscopes market can be attributed to the factors such as growing prevalence of skin disorders and skin cancer, increasing awareness regarding early diagnosis and treatment along with high availability advanced technologies such as Dermatoscope products that enhance dermatologists diagnostic efficiency. Combined, these factors have led to a huge increase in demand for dermatology imaging devices throughout the region.

The dermatology imaging devices market in Asia Pacific is expected to record the highest compound annual growth rate (CAGR) of 13.97% during 2024–2032. The growth is mainly due to the increasing prevalence of skin diseases and rising awareness regarding skincare coupled with technological advancements in dermatological imaging. Moreover, the increasing disposable income of consumers in this region is anticipated to fuel the demand for these devices. Furthermore, the booming medical tourism sector in this region, especially in India, Singapore and Thailand is expected to offer lucrative growth opportunities to the market players over the forecast period. Market dynamics supporting growth of dermatology imaging devices in China are driven by technological breakthroughs and enhancement traditional healthcare infrastructure as well. The continuous advancements in imaging systems, combined with increasing healthcare costs have enabled easier investigational dermatology services to patients. Additionally, a burgeoning middle class and an increasing awareness of skin health will fuel demand for these services.

Japan dermatology imaging devices market is anticipated to grow with the fastest CAGR throughout the forecast period, owing to factors such as rise in geriatric population, rise in skin diseases coupled with technological advancement. Along with rising awareness for skin cancer, the minimised diagnostic need is further fuelling the demand for non-invasive diagnostics. The market is also being aided by government healthcare policies to support these products and an increase in dermatology clinics and hospitals.

Need Any Customization Research On Dermatology Imaging Devices Market - Inquiry Now

Key Players:

The major key players are

-

Dermatology Medical Systems - MoleMax HD

-

Caliber Imaging and Diagnosis - Vivascope 1500

-

Canfield Scientific, Inc - Canfield VISIA

-

FotoFinder Systems GmbH - FotoFinder ATBM (Advanced Total Body Mapping)

-

Heine Optotechnik GmbH - Heine Delta 20 Dermatoscope

-

DermoScan - DermoScan C-20

-

3Derm Systems - 3Derm Imaging System

-

Brigham and Women's Hospital - Brigham Dermatology Imaging System

-

Genesis Medical Imaging - Genesis Medical Imaging Solutions

-

MoleScope (by MelaFind) - MelaFind Imaging Device

-

Nikon Corporation - Nikon Digital Dermatoscope

-

MedX Health Corp - DermSecure

-

Stratasys Ltd. - Stratasys 3D Printing for Medical Applications

-

Hologic, Inc. - AquaScan Ultrasound Imaging System

-

Olympus Corporation - Olympus Evis Exera III

-

Siemens Healthineers - Acuson Sequoia Ultrasound System

-

GE Healthcare - LOGIQ E10 Ultrasound System

-

Thermo Fisher Scientific - Thermo Scientific Apreo

-

Canon Medical Systems - Aplio i-series Ultrasound System

-

Ricoh Company, Ltd. - Ricoh IM C Series Multifunction Printers

OEMs

-

Germitec

-

Zeiss

-

Schneider Kreuznach

-

Leica Microsystems

-

Schott AG

-

Fujifilm

-

Keyence

-

Medtronic

-

Panasonic

-

Hoya Corporation

-

Canon Inc.

-

Ametek

-

BASF

-

Covalent Materials Corporation

-

Nikon Corporation

-

Rohde & Schwarz

-

Honeywell

-

Merck Group

-

Nippon Electric Glass Co.

-

Fujifilm

Recent Developments

-

In February 2024, GE HealthCare and the European Society of Radiology (ESR) renewed their collaboration for the upcoming European Congress of Radiology (ECR), which will take place from February 28 to March 3 in Vienna, focusing on the theme "Next Generation Radiology."

-

In January 2024, GE HealthCare revealed its acquisition of MIM Software, a leading provider of AI-powered solutions for medical imaging analysis. MIM Software is known for its expertise in radiation oncology, molecular radiotherapy, diagnostic imaging, and urology across various healthcare environments. GE HealthCare plans to utilize MIM Software's cutting-edge imaging analytics and digital workflows to enhance innovation and patient care in multiple healthcare sectors worldwide.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.36 Billion |

| Market Size by 2032 | USD 7.04 Billion |

| CAGR | CAGR of 12.93% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Modality (Digital Photographic Imaging, Optical Coherence Tomography (OCT), Dermatoscope, High Frequency Ultrasound, Others) • By Application (Skin Cancers, Plastic and Reconstructive Surgery, Others) • By End-Use (Hospitals, Dermatology Centers, Specialty Clinics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Dermatology Medical Systems, Caliber Imaging and Diagnosis, Canfield Scientific, Inc., FotoFinder Systems GmbH, Heine Optotechnik GmbH, DermoScan, 3Derm Systems, Inc., Brigham and Women's Hospital, Genesis Medical Imaging, MoleScope (by MelaFind), Nikon Corporation |

| Key Drivers | • Public awareness campaigns about skin health and the importance of early detection are encouraging more individuals to seek dermatological care. • Enhancements and services in both developed and developing regions are improving access to advanced dermatology imaging technologies. |

| RESTRAINTS | • The initial investment and maintenance costs of advanced dermatology imaging devices can be prohibitive for smaller clinics and healthcare facilities. • Certain imaging devices may have limitations in accuracy and sensitivity, impacting their adoption in clinical settings. |