Telehealth and Telemedicine Market Report Scope & Overview:

Get more information on Telehealth and Telemedicine Market - Request Free Sample Report

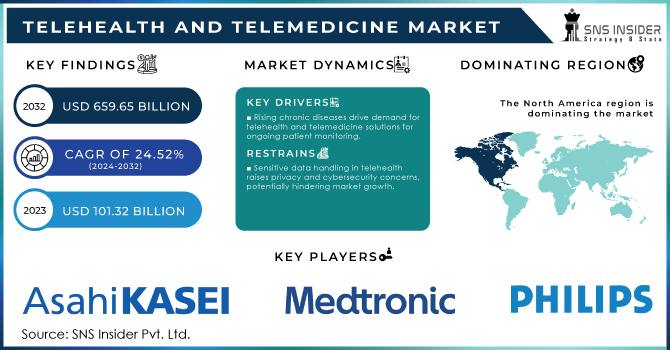

The Telehealth and Telemedicine Market Size was valued at USD 101.32 Billion in 2023, and is expected to reach USD 659.65 Billion by 2032, and grow at a CAGR of 24.52%.

The acceptance of telehealth services from patients, physicians, as well as government bodies, are fueling this market across all regions. By using certain applications and video consultations, the patient could communicate with a doctor in another dislocated place without going to hospitals or clinics for healthcare access. Similarly, other market players such as Apple (U.S.), Google (UK), and IBM (U.S.) have been working continuously to offer a brilliant user experience with mobile health solutions provided on different subscription plans together with security for data. These factors are expected to increase the market over the estimated period.

The number of services in telehealth is increasing pretty fast with cardiology, behavioral health, and radiology as well as consultations online, etc. Rising venture capital is enabling this circle, soon to be further strengthened by new entrants such as online consult services. Philips Virtual Care Management was one such solution launched by Royal Philips in March 2023. It consists of a series of adaptive tools and services enabling different parties in healthcare from health systems, payers, and providers to employers to effectively interact with patients. In addition, personalization of healthcare services is improved by incorporating artificial intelligence and machine learning algorithms. Increasing government initiatives favoring the implementation of telehealth too are propelling growth in the market along with telehealth adoption. One such example is expected to be the expansion of the e-healthcare model in India with measures like the National Digital Health Mission (NDHM). This empowers digital health innovation.

MARKET DYNAMICS:

KEY DRIVERS:

-

The Rising Incidence of Chronic Diseases Such as Diabetes, Cardiovascular Diseases, And Respiratory Disorders Necessitates Ongoing Patient Monitoring, Driving the Demand for Telehealth and Telemedicine Solutions.

-

The Development of Advanced Communication Technologies, such as 5G Networks, AI, And IoT, Enhances the Capabilities of Telehealth Services, Making Them More Accessible and Effective.

RESTRAINTS:

-

Varying Regulations Across Regions, Including Licensing Requirements and Reimbursement Policies, Pose Significant Barriers to The Widespread Adoption of Telehealth Services.

-

The Handling of Sensitive Patient Data in Telehealth Platforms Raises Concerns About Data Privacy and Cybersecurity, which can Hinder the Market's Growth.

OPPORTUNITY:

-

There is a Significant Potential for Growth in Emerging Markets Where Healthcare Infrastructure Is Underdeveloped. Telehealth can Bridge Gaps in Healthcare Access, Particularly in Rural and Remote Areas.

-

The Integration of AI And Machine Learning in Telemedicine can Enhance Diagnostic Accuracy, Personalize Patient Care, Optimize Treatment Plans, And Present New Opportunities for Innovation and Market Growth.

KEY MARKET SEGMENTATION:

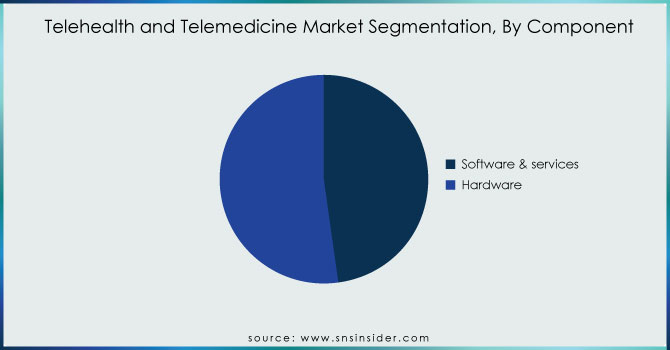

By Component

By component, the services segment held the largest market share of 48% in 2023. The increasing demand for telehealth applications to manage chronic diseases and timely monitoring; technological advancement in digital infrastructure and hardware components; and an increase in internet users & smartphone penetration are expected to drive segment growth. In fact, in April 2023, Providence teamed up with Conversa and introduced a program called AI-10 that allows for remote patient monitoring (RPM) as well as responsive virtual care to manage chronic disease across numerous clinics within the health system. Additionally, the ever-changing digital world is likely to be a catalyst for increased demand for such recruits.

The software segment is expected to witness the fastest growth over the forecast period However, the Healthcare IT solutions sub-segment is anticipated to witness significant growth due to supportive government initiatives and increasing demand for advanced technological support in healthcare. Another example of a similar nature is when the National Health Authority (NHA) in India integrated 52 digital health applications with its Ayushman Bharat Digital Mission (ABDMr) scheme as of July 2022.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Mode of Delivery

By mode of delivery, the web-based segment accounted for a value share of not more than 46% in 2023. The rise of web-based platforms via online delivery models which provide an instant solution to patients is driving growth in the healthcare industry. With the utilization of internet protocols, users can be given web-based solutions via various types of Web servers. An internet connection, a data administrator, a web server as well as a software coding system that includes four main components are also solutions. The advantages of the internet and web services allow for access to even remote areas using just a computer or monitoring device.

The fastest-growing mode of the delivery segment is cloud-based thereafter to on-premises, among these the factors driving were rising trends in the adoption of solutions supporting digital health by both healthcare providers and patients along with leading players focusing on technologically advanced solutions. Fujitsu, in March 2023 unveiled a cloud-native platform that enables the collection and use of health data for digital transformation in the medical field.

By Application

The radiology segment led the market in 2023 with a share of an impressive 12.9%. This leads to higher sales in the segment, supported by other factors such as PACS adoption, integration of AI with teleradiology, and R&D focusing on eHealth. Koninklijke Philips N.V., for instance, introduced its new ultrasound systems and AI-enabled cloud solutions for radiology efficiency and improving clinical output in November 2023.

The psychiatry segment is expected to witness the fastest CAGR over the projected period, due to the rising number of patients suffering from stress, anxiety, and mental illness. Additionally, the increasing use of telepsychiatry by individuals suffering from mental illness treatment has increased market growth over the projection period. Telepsychiatry services enable affordable, easily accessible, and convenient means of receiving mental health care. The role of telepsychiatry services helped the American Psychiatric Association in improving patient satisfaction and care.

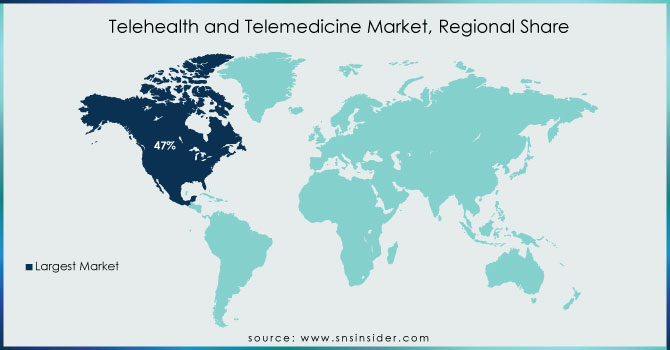

REGIONAL ANALYSIS:

North America held 47% in 2023 Owing to the escalating number of patients suffering from chronic diseases and the substantial acceptance rate for advanced healthcare technologies, the telemedicine market share in the United States is showcasing a remarkable growth trajectory across the healthcare domain. Telemedicine adoption has done wonders for care management, improving quality of life among patients and saving healthcare money. In addition, the growing adoption of mobile technology by end users increasing patient home care approval increased health expenses, and lowered hospital visits will drive the forecast telemedicine market.

Canadian health expenditure meanwhile grew from USD 301.5 billion in 2020 to USD 308.1 billion in 2021, according to the Canadian Institute of Health Information report released in 2021 for all provinces and territories contributing data. Likewise, The US cost the health system roughly USD 4.3 trillion in 2022 according to a report from Centres for Medicare and Medicaid Services (CMS)— one more increment of about USD173 billion over what was spent on healthcare during the previous year; Therefore, the rise in healthcare expenditure is expected to generate massive opportunities for telehealth and drive market growth.

KEY PLAYERS:

The key market players are Asahi Kasei Corporation, Medtronic, Koninklijke Philips N.V., Siemens Healthineers, Cerner Corporation, Cisco Systems, GE Healthcare, Teladoc Health, American Well, and other players.

RECENT DEVELOPMENTS

-

In August 2023, Spark Biomedical started offering telehealth services as a way to increase patient access to opioid withdrawal treatment through the new Ascent product line. Sparrow Ascent (a subsidiary of Footprints to Recovery) is education, and medication management combined with therapy for those struggling with opioid use disorder. The recovery method uses medicine along with counseling and support services for long-term results.

-

Teladoc Health, Inc. launched Chronic Care Complete in February 2022 which is a comprehensive solution that helps physicians manage chronic conditions better than before. This novel approach is created to focus on improving the health results of people experiencing long-lasting wellness issues.

| Report Attributes | Details |

| Market Size in 2023 | US$ 101.32 Billion |

| Market Size by 2032 | US$ 659.65 Billion |

| CAGR | CAGR of 24.52% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component (Software & Services, Hardware) •By Mode of Delivery (Cloud-based, On-premise) •By Application (Teleconsultation, TeleICU, Telestroke, Teleradiology, Telepsychiatry, Teledermatology, Other) •By End User (Providers, Payers, Patients, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Asahi Kasei Corporation, Medtronic, Koninklijke Philips N.V., Siemens Healthineers, Cerner Corporation, Cisco Systems, GE Healthcare, Teladoc Health, American Well, and other players. |

| Key Drivers | •The Rising Incidence of Chronic Diseases Such as Diabetes, Cardiovascular Diseases, And Respiratory Disorders Necessitates Ongoing Patient Monitoring, Driving the Demand for Telehealth and Telemedicine Solutions. •The Development of Advanced Communication Technologies, such as 5G Networks, AI, And IoT, Enhances the Capabilities of Telehealth Services, Making Them More Accessible and Effective. |

| RESTRAINTS | •Varying Regulations Across Regions, Including Licensing Requirements and Reimbursement Policies, Pose Significant Barriers to The Widespread Adoption of Telehealth Services. •The Handling of Sensitive Patient Data in Telehealth Platforms Raises Concerns About Data Privacy and Cybersecurity, which can Hinder the Market's Growth. |