Diabetic Food Market Report Scope & Overview:

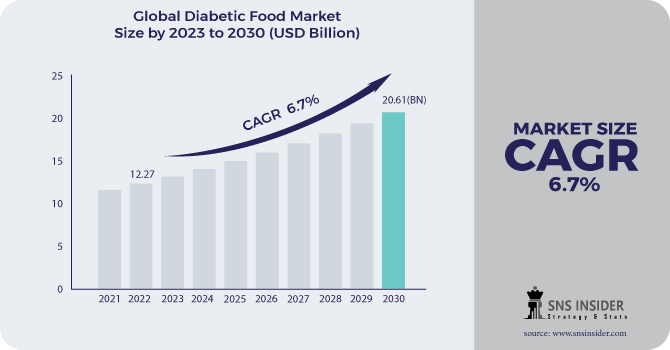

Diabetic Food Market Size was valued at USD 12.27 billion in 2022 and is expected to reach USD 20.61 billion by 2030, and grow at a CAGR of 6.7% over the forecast period 2023-2030.

Over the past few years, the market for foods for diabetics has seen substantial growth. Global demand for diabetic dietary products is mostly driven by rising diabetes prevalence. In addition, as a preventative measure to avoid diabetes, health-conscious consumers are expressing interest in low-calorie food products.

Due to the increased health consciousness around the world, consumers in several regions, including North America, Europe, Asia Pacific, and the Rest of the World , are demonstrating interest in diabetic food products. The market for diabetic food products is being positively impacted by both the growing number of health complications brought on by blood glucose increases and the aging of the population. Over the course of the projected period, it is anticipated that the aforementioned reasons would spur market expansion for diabetic foods worldwide.

Market Dynamics:

Driving Factors:

-

The rising diabetic population.

The market for diabetic foods has been driven by demand from the growing diabetic population, which has resulted in developments like low-sugar and whole-grain products. The industry has grown to incorporate a variety of diabetic-friendly products as consumers become more health-conscious. Consumers should exercise caution and knowledge when it comes to nutritional claims, though. This pattern reflects a wider shift toward more individualized food choices and healthier eating practices.

-

Manufacturers have continually used innovation to create foods that are both aesthetically pleasing and suitable for people with diabetes.

Restraining Factors:

-

The price of the products is quite excessive in the diabetic market.

The market expansion for diabetic foods may be hampered by their comparatively high cost. It creates difficulties for affordability, restricts consumer access to the market, and could make customers reluctant as a result of perceived unfair price. This restriction may encourage people to select more reasonably priced normal foods, which may have an effect on how they manage their health. Manufacturers can solve this by looking into low-cost production techniques and working with healthcare professionals to improve accessibility and inform consumers about the importance of these specialty items.

-

Managing the many rules and regulations that govern nutritional labeling, specific diabetes-related claims, and health claims in general.

Opportunities:

-

Expanding familiarity with the Diabetic Food items and the rising utilization of sugar substitutes.

The market for diabetic foods is experiencing substantial growth due to rising sugar substitute use and increased consumer knowledge of diabetic dietary options. The market for diabetic-friendly goods is growing as more consumers become familiar with these specialty foods. Additionally, the growing popularity of sugar alternatives presents a special opportunity for the creation of low-sugar and sugar-free choices that will meet the demands of people who are controlling their diabetes. This tendency fits well with the general movement towards healthy eating practices and the need for substitutes that effectively control blood sugar levels.

-

Increasing the customer base by looking into neglected markets with rising diabetes rates.

Challenges:

-

Low awareness in general public is a major hurdle.

The general public's lack of awareness of diabetic food is one of the market's major obstacles. The significance and advantages of specialist diabetic food products may not be fully understood by many people, including those who have diabetes. This lack of knowledge may prevent potential customers from appreciating the benefit of these goods in managing their illness and making healthier eating decisions, which could limit the market's potential for growth.

-

Reducing distribution barriers to make diabetic-friendly products available to customers in a variety of locations, including rural ones.

Impact of Covid-19:

The COVID-19 pandemic is influencing Diabetic food through monetary and social framework shocks, food framework disturbances, and holes in fundamental wellbeing and nourishment administrations inclusion. In low-and centre pay nations, food frameworks should adjust and reinforce food and nourishment security following COVID-19.

IMPACT OF RUSSIAN UKRAINE WAR:

The impact of the Russia-Ukraine war on the market for diabetic food includes supply chain disruptions, probable trade restrictions, and economic uncertainty, which results in scarcity and higher prices. The management of diabetes may be hampered by conflicting healthcare priorities, price instability, and a shift away from research priorities, while access to and innovation in diabetic dietary products may be hampered.

During the first half of 2023, Nestlé, the company behind confectionery and NesCafe drink prices increased by 9%. During the second quarter, beverages average selling prices increased 10%. The cost of diabetic food increased 5.7% during the first half of the year.

Disruptions in the supply chain resulted in a shortage of ingredients or higher prices. Economic instability is altering consumer spending patterns, which results in a decline in the market for specialized foods. The cost of imported goods is increasing due to currency fluctuations. Consumer preferences is changing in favour of necessities, which is impacting demand for diabetes products. Access to certain foods restricted by import and export regulations. Supply availability may be impacted by the strain on the healthcare system.

IMPACT OF ONGOING RECESSION

The diabetic food market is experiencing a mixed response to the recent recession. Although consumers are gravitating toward more affordable solutions, the increased health consciousness is also driving up demand for high-end diabetic goods. Market trends change when customer tastes change to reflect the present state of the economy.

During the ongoing recession, the price of confectionery increased by 7.7%, and there will likely be further increases. Prices for 11 different snack kinds increased by 12.2 % on average at Confectionery. The Consumer Price Index shows that during the first half of 2023, food inflation increased by 5.7%.

Key Market Segmentation:

By Product type:

-

Confectionery

-

Snacks

-

Bakery Products

-

Dairy Products

-

Others

By Distribution Channel type:

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online

-

Others

.png)

REGIONAL ANALYSIS

Due to the rising prevalence of diabetes and obesity in North American nations, particularly the US, North America presently holds the largest market share in the global diabetic food market and is predicted to continue to do so during the projection period. The prediabetes or diabetes affects more than 100 million persons in the United States. aging population growth of North America, as well as a predicted rise in the region's population adopting a healthy lifestyle to support the market expansion for diabetic meals.

The market for diabetic food is anticipated to expand at the fastest rate in Asia Pacific during the forecast period. It is anticipated that the growing populations of diabetics with high cholesterol, chronic renal disease, and obesity in nations like China and India will have a favourable impact on regional demand. Due to a high demand for these products, the dairy and confectionery industry is expected to grow rapidly in the Asia Pacific, supporting the expansion of the local diabetic food market.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players:

Nestlé, Unilever, The Kellogg Company, Conagra Brands, Inc., Fifty 50 Foods, Inc., Mars Inc., Tyson Foods, Sushma Gram Udyog, The Hershey Company, Hain Celestial Group.

Conagra Brands, Inc-Company Financial Analysis

RECENT DEVELOPMENT

-

In February 2022, Kate Farms, a manufacturer of glucose, will support 1.2 organic, plant-based Nutrition Shakes launched in North America for diabetes.

-

Nestlé, a manufacturer of food and beverages, introduced its first pre-diabetes program in Malaysia in December 2021. The program includes Nestle GlucoSmart, a unique food supplement that can be added to meals as part of a balanced diet to help maintain normal blood glucose levels after a meal.

-

New GLUCODOWN "enhanced water" drink mixes that were introduced by Glucose Health, Inc. in December 2021 are now sold on Amazon in the North American market.

-

To help people with diabetes and prediabetes manage their blood sugar, the Splenda sweetener brand introduced Splenda Diabetes Care Shakes in June 2020.

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 12.27 Billion |

| Market Size by 2030 | US$ 20.61 Billion |

| CAGR | CAGR 6.7% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product (Confectionery, Snacks) • by Distribution Channel (Supermarkets & Hypermarkets, Online) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Nestlé, Unilever, The Kellogg Company, Conagra Brands, Inc., Fifty 50 Foods, Inc., Mars Inc., Tyson Foods, Sushma Gram Udyog, The Hershey Company, Hain Celestial Group |

| Key Drivers | • The rising diabetic population. • Manufacturers have continually used innovation to create foods that are both aesthetically pleasing and suitable for people with diabetes. |

| Market Opportunities | • Expanding familiarity with the Diabetic Food items and the rising utilization of sugar substitutes. • Increasing the customer base by looking into neglected markets with rising diabetes rates. |