Frozen Food Market Report Scope & Overview:

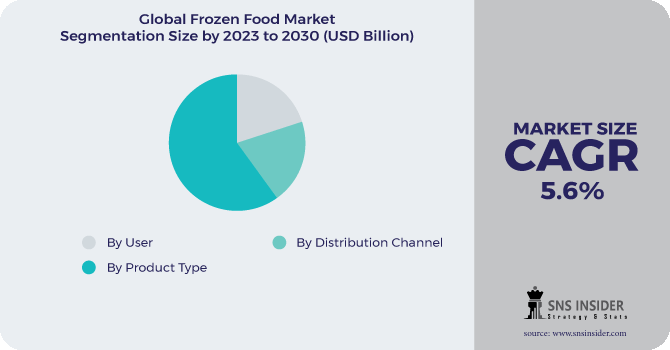

Frozen Food Market Size was esteemed at USD 295.68 billion out of 2022 and is supposed to arrive at USD 457.22 billion by 2030, and develop at a CAGR of 5.6% over the forecast period 2023-2030.

Frozen food is characterized as food items that are safeguarded under low temperatures and utilized over an extensive stretch. The item market contains different food items, including prepared suppers, vegetables, organic products, potatoes, meat and poultry, fish, and soup. Frozen prepared dinners further incorporate bundled prepared to-eat food varieties, bread kitchen, bites, and treats. Business purchasers like lodgings, caterers, cafés, and cheap food chains are among the significant clients of frozen food items that incorporate frozen vegetables and organic products, potatoes, and non-veg items.

.png)

Frozen meat and poultry and fish are among the most regularly utilized staple things across North America and Europe. Europe is the biggest market for frozen pastry shops and sweets. The retail frozen food industry is developing and is in its early stage in business sectors like India. Nonetheless, it has seen a consistent development over a couple of years.

Extension being utilized of frozen food things by beasts as McDonald KFC's, Pizza Hut, Subway, and Frozen Potatoes goes probably as a basic driver of the overall frozen food market. Additionally, the use of these items by various end clients like full-administration eateries, lodgings and resorts, and speedy help cafés is supposed to drive the development of this market.

Market Dynamics:

Driving Factors:

-

Rising interest in comfort food.

-

The rising pattern of work across the globe.

Restraining Factors:

-

Rising inclination for new and normal food items.

-

Colossal deficiency of food things inferable from the upset store network.

Opportunities:

-

Digitalization of the retail business.

-

The customers' inclinations towards Ready-to-Eat (RTE) food items.

Challenges:

-

Absence of cold chain framework in creating economies.

Impact of Covid-19:

The conventional Indian taste ranges have pushed organizations to foster more Indian variations inside frozen food varieties like samosas, cutlets, kebabs, and parathas. Coronavirus extraordinarily affected the eatery organizations, giving more force to frozen food varieties. The frozen vegetable is the second-biggest fragment, becoming because of the all-year accessibility of occasional vegetables in frozen design. Metropolitan regions represent 80% of the interest in frozen food. The homegrown utilization of frozen meat and fish is little however developing.

Impact of the Ukraine and Russia war:

The conflict in Ukraine has cut off key stock chains and added flooding costs for overwhelmed organizations attempting to move items all over the planet, which are then given to purchasers. Keeping exchange open for food, fuel, and compost is pivotal to containing the expansion in food frailty both inside Ukraine and all around the world.

Market Estimations:

By Product Type:

Based on item type, the prepared dinners section is the biggest income generator in the ongoing situation, trailed by frozen meat and poultry items. This is credited to the flood being used of frozen pizza coverings, bread, and frozen pastry shop items, which goes about as a critical driver of the prepared dinners section. Frozen potatoes fragment is supposed to develop the quickest.

By User:

My client, the food administration industry portion ruled the market and is supposed to go on all through the frozen food market conjecture period. This is ascribed to the way that the food administration industry is among the significant buyers of frozen food sources. The food administration industry incorporates inn networks, drive-through eateries, cash and convey outlets cooks, and other business purchasers. Moreover, the notoriety of frozen food in the food administration area is expanding, as they can be put away and utilized throughout a significant period, which saves functional expenses.

Market Segmentation:

By Product Type:

-

Ready meals

-

Frozen seafood

-

Frozen meat & poultry

-

Frozen fruit & vegetables

-

Frozen potatoes

-

Frozen soups

By User:

-

Foodservices industry

-

Retail users

By Distribution Channel:

-

Offline

-

Online

Regional Analysis:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

District-wise, Europe was the unmistakable market that represented the greatest offer. Enormous spending abilities of customers and monetary soundness are a portion of the significant explanations behind the development of the item market in the European district. Likewise, the bustling way of life of shoppers goes about as a key element driving the frozen food market development. The frozen prepared to-have sound breakfast section has acquired prominence lately, attributable to ascend in wellbeing cognizant buyers in the area. Europe has been one of the most beneficial business areas for frozen food, inferable from how it is home to different food and bread shop beasts.

Key Players:

Aryzta A.G, Ajinomoto Co. Inc., Cargill Incorporated, General Mills Inc., Jbs S.A., Kellogg Company, The Kraft Heinz Company, Nestle S.A., Conagra Brands, Inc., Associated British Foods Plc.

Aryzta A.G-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 295.68 Billion |

| Market Size by 2030 | US$ 457.22 Billion |

| CAGR | CAGR 5.6% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product Type (Frozen Ready Meals, Frozen Meat & Poultry, Frozen Seafood, Frozen Vegetables & Fruits, Frozen & Refrigerated Soups and Frozen Potatoes) • by User (Food Service Industry and Retail Users) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, +D11UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Aryzta A.G, Ajinomoto Co. Inc., Cargill Incorporated, General Mills Inc., Jbs S.A., Kellogg Company, The Kraft Heinz Company, Nestle S.A., Conagra Brands, Inc., Associated British Foods Plc. |

| Key Drivers | •Rising interest in comfort food. •The rising pattern of work across the globe. |

| Market Restraints | •Rising inclination for new and normal food items. •Colossal deficiency of food things inferable from the upset store network. |