Display Material Market Size & Trends:

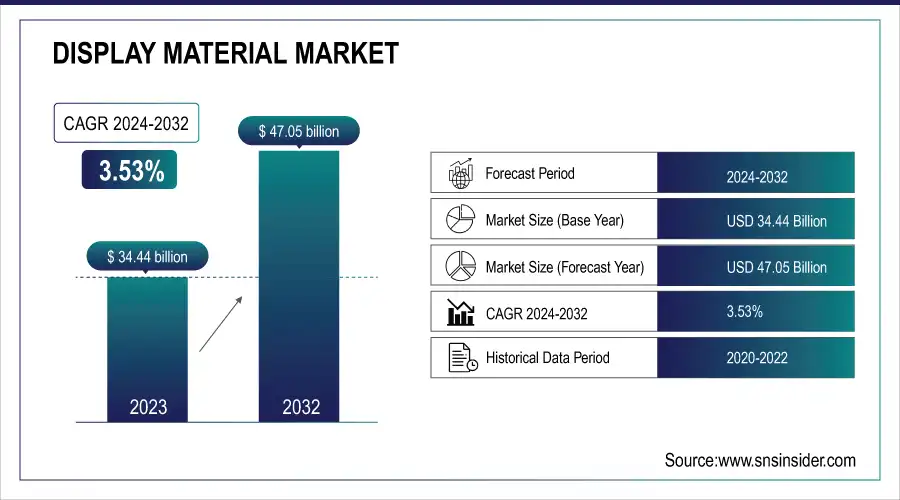

The Display Material Market was valued at USD 34.44 Billion in 2023 and is projected to reach USD 47.05 Billion by 2032, growing at a CAGR of 3.53% from 2024 to 2032. Key drivers fueling this growth include the rising demand for high-performance displays in consumer electronics, increasing adoption of OLED and quantum dot technologies, and ongoing innovation in flexible and foldable displays.

To Get more information on Display Material Market - Request Free Sample Report

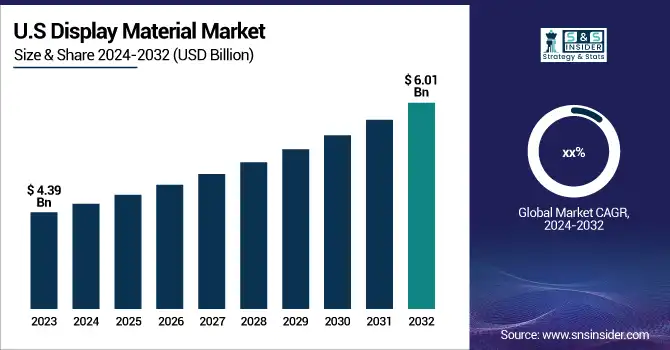

Additionally, statistical trends such as the growing adoption rate of advanced displays across automotive, medical, and wearable sectors reflect increasing end-user interest in quality and efficiency. In the U.S., the market stood at USD 4.39 billion in 2023 and is expected to reach USD 6.01 billion by l2032. The lifecycle and replacement rates of display panels are also shortening due to rapid tech upgrades, driving material consumption. Environmental impact metrics highlight a shift toward sustainable and recyclable materials. However, the market faces challenges from supply chain disruption frequency, particularly in sourcing rare earth elements and advanced substrates, which require close monitoring and strategic management.

Display Material Market Dynamics:

Drivers:

-

Advanced Display Materials Fueled by the Surge in Smart Wearables and AR/VR Devices

The increasing penetration of smart wearables and AR/VR devices is significantly driving the demand for advanced display materials. As consumers and industries embrace wearable technologies like smartwatches, fitness bands, and immersive AR/VR headsets, there is a rising need for lightweight, flexible, high-resolution, and energy-efficient displays. These devices require compact screens with excellent visual clarity, responsiveness, and durability to function seamlessly in dynamic environments. Additionally, AR/VR devices demand materials that support high refresh rates, wide viewing angles, and minimal latency to enhance user experience and reduce motion sickness. The shift towards flexible OLED and microLED technologies in wearables and headsets is further pushing innovation in display materials. Moreover, increasing investments in the metaverse and immersive tech experiences are fueling R&D in specialized materials that enable curved, transparent, and foldable displays.

Restraints:

-

Technological integration challenges, including hardware compatibility and high costs, hinder display material market adoption.

The integration of advanced display materials into existing electronic devices presents a significant challenge for manufacturers. As technologies such as OLED, MicroLED, and quantum dots advance, aligning them with legacy hardware and software systems becomes increasingly complex. Manufacturers must adapt to differing interface standards, power requirements, and thermal management needs, which often necessitate redesigning device architectures or investing in costly system overhauls. Additionally, ensuring compatibility across a wide range of devices from smartphones and tablets to AR/VR headsets and automotive displays requires rigorous testing and engineering efforts. These hurdles not only extend time-to-market but also increase development expenses, making it difficult for smaller or resource-constrained companies to adopt cutting-edge display technologies. Moreover, inconsistent standards across the industry add to the integration burden, slowing down innovation and broader adoption. Addressing these integration issues is essential for unlocking the full potential of next-generation display materials across consumer and industrial applications.

Opportunities:

-

Smart Mobility Boosting Demand for Advanced Automotive Display Materials

The rapid digital transformation within the automotive industry is significantly increasing the demand for innovative display materials. Modern vehicles now integrate multiple digital interfaces including dashboards, infotainment systems, and head-up displays (HUDs)—to enhance user experience, safety, and connectivity. This shift is driving the need for high-performance display materials that are not only durable and heat-resistant but also offer excellent sunlight readability for clear visibility in varying lighting conditions. As electric and autonomous vehicles gain traction, automakers are prioritizing displays that can withstand extreme environmental conditions while maintaining sharp visuals and long lifespans. This trend presents a lucrative opportunity for material manufacturers to supply cutting-edge solutions tailored to automotive standards.

Challenges:

-

Burn-In and Lifespan Limitations Hindering OLED Display Adoption

OLED display technologies face significant challenges related to limited lifespan and burn-in, which hinder their broader adoption. Burn-in occurs when static images—like logos or icons—are displayed for extended periods, leading to permanent discoloration or ghosting. This issue arises from the organic compounds used in OLEDs, particularly the blue emitters, which degrade faster than red and green, causing uneven color performance over time. High brightness usage accelerates this degradation, making OLEDs less suitable for applications demanding long-term image stability, such as automotivel displays and digital signage. Despite offering superior contrast, color accuracy, and flexibility, OLEDs struggle to match the durability of LCDs. Manufacturers are developing improved materials and compensation technologies to address these issues, but burn-in remains a key technical hurdle in expanding OLED’s commercial and industrial applications.

Display Material Industry Segment Analysis:

By Technology

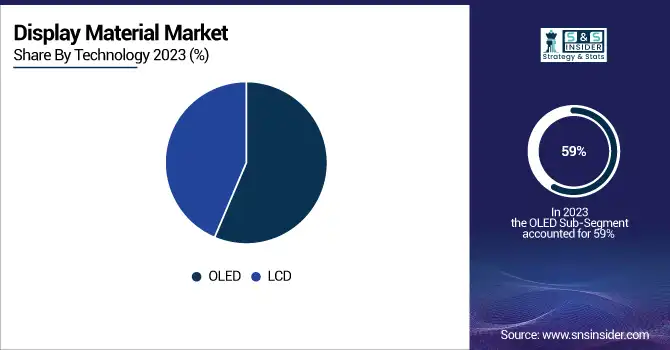

In 2023, the OLED segment dominated the global display material market, accounting for approximately 59% of total revenue. This leadership is driven by OLED’s superior display qualities, including deep contrast ratios, faster response times, and flexibility, which make it ideal for high-end smartphones, TVs, wearables, and automotive displays. The growing demand for premium visual experiences and the shift toward thinner, lighter, and energy-efficient screens have further fueled OLED adoption across various sectors. Major electronics manufacturers continue to invest in OLED technology due to its scalability and visual performance, despite concerns over burn-in and lifespan. With continued innovation in material science and production techniques, the OLED segment is expected to maintain its strong market presence in the coming years.

The LCD segment is projected to witness the fastest growth in the display material market from 2024 to 2032, driven by its cost-effectiveness, technological improvements, and widespread use in TVs, monitors, laptops, industrial panels, and automotive displays. Unlike OLED, LCDs offer longer lifespans and are less prone to burn-in, making them suitable for applications requiring long-term reliability. The integration of mini-LED backlighting is also enhancing LCD performance, offering better contrast and brightness at lower costs. Emerging markets, growing demand for affordable electronics, and continued investments in display infrastructure are further propelling LCD material demand. As manufacturers optimize production and introduce energy-efficient LCD variants, the segment is expected to remain highly competitive and experience strong growth across both consumer and industrial display applications.

By Component

In 2023, the substrate segment dominated the display material market, capturing around 30% of total revenue due to its critical role in determining display performance, durability, and overall device structure. Because displays are composed of multiple layers, and that active materials need to be deposited over substrates, thus, mechanical stability is also a key feature of substrates. With OLED, LCD and flexible display technology soaring, so too is demand for superior substrates like glass and flexible plastic. Their significance escalates within nascent applications such as foldable smartphones, automobile dashboards, and high-resolution televisions. Substrate manufacturers are on the cutting edge developing solutions for thermal resistance, transparency and flexibility. As display technologies continue to trend toward lighter, thinner, and more durable formats, the substrate segment is also expected to be the powerhouse segment of the display materials ecosystem.

The polarizer segment is expected to experience steady growth in the display material market from 2024 to 2032, driven by increasing demand for high-contrast, energy-efficient displays across smartphone, TV, monitor, and automotive in the segment. They control light transmission and enhance visibility in different lighting conditions, which is especially true for LCD and OLED displays. With the evolution of display technologies, the demand for high-performance polarizers with enhanced durability, low thickness, and superior optical clarity continues to increase. The market is also being driven by the growing adoption of sunlight-readable outdoor displays and automotive infotainment systems. Ongoing innovations in multi-functional and anti-reflective polarizer films are also helping to drive the growth of the segment, ensuring that it will remain relevant in an evolving display landscape.

By Application

In 2023, the smartphone and tablet segment dominated the display material market, accounting for approximately 42% of total revenue. This leadership is driven by the massive global demand for high-resolution, energy-efficient, and visually appealing screens in personal devices. With billions of smartphones and tablets in use worldwide, manufacturers are continually investing in advanced display materials like OLED, AMOLED, and LTPS LCD to enhance brightness, color accuracy, and responsiveness. The trend toward bezel-less, foldable, and high-refresh-rate screens further boosts demand for premium display materials. Additionally, the rollout of 5G and AI-driven functionalities increases screen-on time, reinforcing the need for durable and efficient displays. This segment is expected to maintain strong momentum, supported by continuous innovation and consumer preference for enhanced mobile visual experiences.

The smart wearables segment is projected to be the fastest-growing sector in the display material market from 2024 to 2032, fueled by rising consumer demand for health monitoring, fitness tracking, and always-on connectivity features. Devices such as smartwatches, fitness bands, and AR glasses are increasingly adopting advanced display technologies like flexible OLEDs, microLEDs, and low-power reflective displays to ensure visibility, energy efficiency, and comfort. As wearables become more compact and stylish, manufacturers are prioritizing ultra-thin, bendable, and durable materials that support innovative form factors. The push for personalized healthcare and real-time data access is also accelerating adoption globally. With continuous advancements in display integration and materials science, the smart wearables segment is set to drive significant material innovation and market expansion over the next decade.

Display Material Market Regional Analysis:

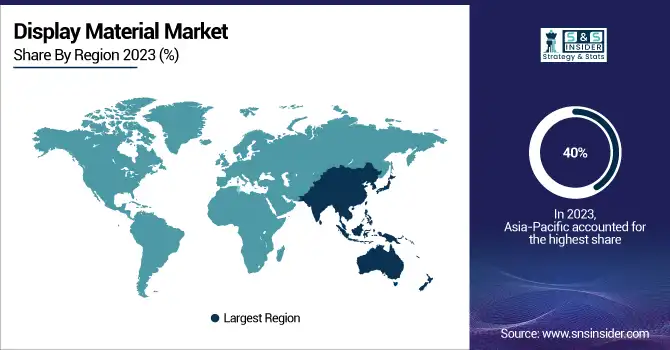

In 2023, the Asia-Pacific region led the global display material market, capturing around 40% of total revenue, driven by its robust electronics manufacturing ecosystem, high consumer demand, and strong presence of leading display panel producers in countries like China, South Korea, Japan, and Taiwan. The region benefits from advanced production facilities, cost-effective labor, and rapid technological innovation, especially in OLED, LCD, and flexible display technologies. Government support, increasing investments in R&D, and rising demand for smartphones, TVs, automotive displays, and wearables contribute to sustained growth. Asia-Pacific is also home to key supply chain players, making it a hub for both material sourcing and final product assembly. This dominant position is expected to continue, supported by expanding consumer markets and industrial display applications.

North America is projected to witness the fastest growth in the display material market from 2024 to 2032, driven by rapid advancements in display technologies, increasing adoption of high-end consumer electronics, and growing demand across automotive, healthcare, and industrial sectors. The region’s strong presence of tech giants, coupled with high consumer purchasing power, fuels continuous upgrades in smartphones, tablets, wearables, and smart home devices—boosting demand for advanced display materials like OLED, microLED, and quantum dots. Additionally, the expanding electric and autonomous vehicle market is increasing the need for durable, high-visibility displays. Significant investments in R&D and display innovation, along with government initiatives supporting domestic semiconductor and electronics manufacturing, further propel regional growth. North America’s focus on premium and next-generation displays ensures its position as a key growth driver in the global market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Major Players in Display Material Market along with their Products:

-

Corning Incorporated (U.S.) – Glass substrates, cover glass (e.g., Gorilla Glass)

-

DIC Corporation (Japan) – Polarizing films, OLED emissive materials

-

DowDuPont Inc. (U.S.) – Encapsulants, optical adhesives, films

-

Hitachi Chemical Co., Ltd. (Japan) – Display adhesives, conductive films, alignment layers

-

Idemitsu Kosan Co., Ltd. (Japan) – OLED emitters, transport layers

-

Innolux Corporation (Taiwan) – LCD panels, TFT modules

-

Japan Display Inc. (Japan) – LTPS LCDs, OLED displays

-

JNC Corporation (Japan) – Liquid crystal materials for LCDs

-

Kyulux, Inc. (Japan) – TADF materials, hyperfluorescence OLED compounds

-

LG Chem, Ltd. (South Korea) – Polarizers, OLED materials, optical films

-

Lumileds Holding B.V. (Netherlands) – Display-grade microLEDs, lighting components

-

Merck KGaA (Germany) – Liquid crystals, OLED materials, quantum dots

-

Nanoco Technologies Limited (U.K.) – Cadmium-free quantum dots

-

Nitto Denko Corporation (Japan) – Polarizers, anti-reflective films, optical bonding films

-

Samsung Display Co., Ltd. (South Korea) – OLED panels, QD-OLED displays

-

Sumitomo Chemical Co., Ltd. (Japan) – OLED materials, polarizing films, photoresists

list of Potential Customers in the Display Material Market

-

Samsung Display Co., Ltd.

-

LG Display Co., Ltd.

-

BOE Technology Group Co., Ltd.

-

Innolux Corporation

-

Japan Display Inc.

-

AU Optronics Corp. (AUO)

-

TCL CSOT (China Star Optoelectronics Technology)

-

Sharp Corporation

-

Visionox

-

Tianma Microelectronics Co., Ltd.

-

Apple Inc.

-

Sony Corporation

-

Panasonic Corporation

-

Xiaomi Corporation

-

Huawei Technologies Co., Ltd.

-

Oppo

-

Vivo

-

Lenovo Group Ltd.

-

ASUS

-

HP Inc.

-

Dell Technologies Inc.

Recent Development:

-

On March 26, 2025, Corning Incorporated launched Gorilla® Glass Ceramic, a new transparent and strengthenable cover material. Corning Expands Display Durability Portfolio with Gorilla® Glass Ceramic for Enhanced Drop Performance

-

On February 8, 2024, Hitachi High-Tech Corporation announced a successful PoC using Chemicals Informatics (CI) and Materials Informatics (MI), achieving over 80% workload reduction in metal thin film material development.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 34.44 Billion |

| Market Size by 2032 | USD 47.05 Billion |

| CAGR | CAGR of 3.53% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (OLED, LCD) • By Component (Substrate, Polarizer, Liquid Crystals, Colour Filter Layer, Backlighting Unit, Others) • By Application (Smartphone & Tablet, Television, Smart Wearables, Signage/Large Format Display) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Corning Incorporated (U.S.), DIC Corporation (Japan), DowDuPont Inc. (U.S.), Hitachi Chemical Co., Ltd. (Japan), Idemitsu Kosan Co., Ltd. (Japan), Innolux Corporation (Taiwan), Japan Display Inc. (Japan), JNC Corporation (Japan), Kyulux, Inc. (Japan), LG Chem, Ltd. (South Korea), Lumileds Holding B.V. (Netherlands), Merck KGaA (Germany), Nanoco Technologies Limited (U.K.), Nitto Denko Corporation (Japan), Samsung Display Co., Ltd. (South Korea), and Sumitomo Chemical Co., Ltd. (Japan). |