OLED Display Market Size & Trends:

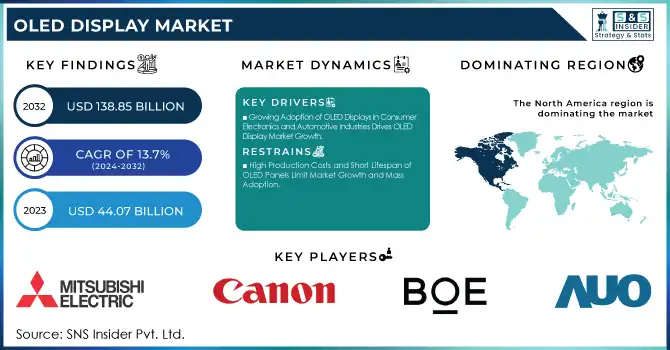

The OLED Display Market Size was valued at USD 44.07 Billion in 2023 and is expected to reach USD 138.85 Billion by 2032 and grow at a CAGR of 13.7% over the forecast period 2024-2032.

The OLED Display Market has witnessed remarkable growth in recent years, driven by its superior display characteristics compared to traditional LCDs. OLED technology is widely used in consumer electronics, automotive displays, medical devices, and industrial applications.

To get more information on OLED Display Market - Request Free Sample Report

Unlike LCDs, OLEDs do not require a backlight, making them thinner, more energy-efficient, and capable of producing vibrant colors with high contrast ratios. With increasing adoption in smartphones, televisions, wearable devices, and automotive displays, the market is expected to experience sustained growth over the coming years.

This surge is primarily attributed to the widespread adoption of OLED technology in consumer electronics, including smartphones, tablets, and televisions, where consumers seek superior image quality and thinner form factors. The automotive industry also contributes to this growth, integrating OLED displays into dashboards and infotainment systems due to their flexibility and clarity.

Additionally, advancements in flexible and foldable screen technologies have opened new avenues for OLED applications, further propelling market expansion. The U.S. government, through agencies like the Department of Energy, has recognized the potential of OLED technology in energy-efficient lighting solutions, supporting research and development initiatives to enhance OLED performance and reduce production costs. This governmental backing underscores the strategic importance of OLEDs in future display and lighting innovations.

OLED Display Market Dynamics

Key Drivers:

-

Growing Adoption of OLED Displays in Consumer Electronics and Automotive Industries Drives OLED Display Market Growth

The OLED display market is experiencing rapid expansion due to its increasing adoption in consumer electronics and automotive applications. OLED technology offers superior display quality, vibrant colors, and high contrast ratios, making it the preferred choice for smartphones, tablets, televisions, and wearable devices. Major smartphone manufacturers, including Apple and Samsung, are integrating OLED displays into their premium devices, further propelling market demand.

Additionally, automotive manufacturers are leveraging OLED displays for digital dashboards, infotainment systems, and heads-up displays (HUDs) due to their flexibility, durability, and enhanced visibility in various lighting conditions. The transition toward electric vehicles (EVs) and autonomous driving technologies has further accelerated the adoption of OLED screens in the automotive sector. Moreover, OLED displays contribute to energy efficiency, aligning with sustainability goals set by various governments and organizations. The U.S. Department of Energy has emphasized the benefits of OLEDs in reducing power consumption, further supporting research and development initiatives. With continuous advancements in foldable and rollable OLED technology, the market is expected to witness substantial growth, catering to both premium and mid-range consumer electronics segments. The increasing preference for thin, lightweight, and high-performance displays ensures sustained demand, making OLED a dominant force in display technology.

-

Technological Advancements in Flexible and Transparent OLED Displays Accelerate Market Expansion Across Multiple Sectors

The evolution of flexible and transparent OLED displays has revolutionized the OLED display market, enabling new applications across industries such as retail, healthcare, and smart home solutions. Flexible OLEDs are widely used in foldable smartphones, curved monitors, and wearable devices, offering enhanced durability and design flexibility. Companies like Samsung, LG Display, and BOE Technology are leading the innovation race by introducing next-generation OLED screens with improved bendability and resistance to wear and tear. Transparent OLED displays have also gained traction in retail, automotive, and industrial sectors, offering immersive and futuristic display solutions.

In automobiles, transparent OLEDs are being integrated into augmented reality (AR) windshields and smart windows, enhancing driver experience and safety. Retail stores and museums are deploying transparent OLEDs for interactive digital signage and advertising, creating engaging customer experiences. The U.S. government and research institutions are actively investing in OLED R&D projects, aiming to develop more cost-efficient production methods and expand OLED’s usability beyond traditional displays. As manufacturers focus on reducing OLED production costs while enhancing display performance, the market is poised for sustained growth, with flexible and transparent OLEDs leading the next wave of display innovation.

Restrain:

-

High Production Costs and Short Lifespan of OLED Panels Limit Market Growth and Mass Adoption

Despite its numerous advantages, the OLED display market faces challenges due to high production costs and limited lifespan compared to LCDs. OLED panels require expensive raw materials and complex manufacturing processes, leading to higher production costs and premium pricing. This cost barrier restricts OLED adoption in budget and mid-range consumer electronics, limiting its reach to premium segments.

Additionally, OLED displays are susceptible to burn-in issues, where static images leave permanent marks on the screen over time, affecting display longevity. This concern is particularly significant in smartphones, televisions, and automotive displays, where prolonged usage can degrade screen quality. LCD and Mini-LED technologies, which offer longer lifespans at lower costs, continue to compete with OLED displays, challenging market penetration. The U.S. Department of Energy has acknowledged the need for enhanced OLED durability and cost-effective manufacturing techniques, funding research initiatives to improve OLED efficiency and longevity. While technological advancements in OLED materials and encapsulation techniques aim to address these issues, manufacturers must focus on reducing production expenses and improving OLED lifespan to enhance mass adoption and drive sustained market growth.

OLED Display Market Segmentation Outlook

By Type

In 2023, the Red-Green-Blue OLED (RGB-OLED) segment captured the largest revenue share, accounting for 35% of the OLED display market. This dominance stems from RGB-OLED's superior color accuracy and image quality, making it a preferred choice in high-end consumer electronics like premium smartphones, televisions, and monitors. Companies like LG Display and Samsung Display have been at the forefront of advancing RGB-OLED technology, with LG unveiling its 8K OLED TVs and Samsung releasing new RGB-OLED panels with enhanced brightness and efficiency.

The Active-Matrix OLED (AMOLED) segment is experiencing a robust compound annual growth rate (CAGR) of 15.29% during the forecasted period. This rapid growth is fueled by the increasing adoption of AMOLED displays in smartphones, wearables, and automotive displays due to their power efficiency and thin form factor. Samsung and BOE Technology have led the charge, introducing cutting-edge AMOLED screens with flexible and foldable capabilities, seen in products like the Samsung Galaxy Z Fold and Z Flip series.

By Industry Vertical

In 2023, the Consumer Electronics segment dominated the OLED display market, holding the largest revenue share at 54%. This growth is driven by the increasing demand for OLED technology in premium devices such as smartphones, televisions, and monitors. These products leverage OLED’s ability to provide superior color accuracy, high contrast ratios, and energy efficiency, making it the preferred choice for high-end displays. The growing popularity of OLED smartphones, such as the latest models from Apple, Samsung, and Google, has also contributed to this dominance, as consumers continue to seek advanced, vibrant screens with deeper blacks and improved battery life.

The Automotive segment is witnessing the largest compound annual growth rate (CAGR) of 14.71% during the forecasted period, reflecting the increasing adoption of OLED displays in modern vehicles. Automotive manufacturers, including BMW, Audi, and Mercedes-Benz, are incorporating OLED technology into dashboards, infotainment systems, and tail-light designs due to its ability to offer high brightness, design flexibility, and energy efficiency.

For example, BMW introduced its "iX" electric vehicle featuring a fully integrated curved OLED display for its dashboard, while Audi and Mercedes have been innovating with OLED-based exterior lighting systems for enhanced vehicle aesthetics and visibility.

OLED Display Market Regional Analysis

In 2023, the North American OLED display market held a significant share of 38%, driven by the increasing adoption of OLED displays in smartphones, tablets, and televisions. Major companies, such as Apple and Google, have integrated OLED displays into their flagship devices, boosting consumer awareness and demand. The automotive industry in North America is embracing OLED technology for applications like infotainment systems and digital instrument clusters, contributing to market growth.

Additionally, the growing demand for OLED displays in digital signage and lighting in commercial and residential sectors is driving market expansion. Advancements in OLED technology, such as foldable and rollable displays, are generating excitement and driving adoption.

The Asia Pacific OLED market dominated the global industry in 2023, accounting for the largest revenue share at 15.80%. The region is home to major OLED manufacturers, such as Samsung Electronics and LG Electronics, which drive production and technological advancements. The high demand for consumer electronics, including smartphones and televisions, in countries like India, China, South Korea, and Japan, fuels market growth. The increasing adoption of OLED displays in various applications, such as automotive and wearables, contributes significantly to market expansion. Substantial investments in R&D and manufacturing facilities in the region enhance production capabilities and innovation.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the OLED Display Market are:

-

AU Optronics (AMOLED Display Panels, Flexible OLED Screens)

-

BOE Technology Group (Flexible OLED Displays, OLED TV Panels)

-

Canon Inc. (OLED Microdisplays, OLED Viewfinders)

-

LG Display (OLED TV Panels, Transparent OLED Displays)

-

Mitsubishi Electric Corporation (OLED Automotive Displays, OLED Industrial Screens)

-

Panasonic Corporation (OLED TVs, Professional OLED Monitors)

-

Samsung Display (AMOLED Smartphone Screens, Foldable OLED Panels)

-

Sharp Corporation (OLED Smartphone Displays, OLED TV Panels)

-

Sony Corporation (OLED Professional Monitors, OLED Viewfinders)

-

Sumitomo Chemical Co., Ltd. (OLED Materials, Polymer OLED Displays)

-

Tianma Microelectronics (AMOLED Smartphone Panels, Automotive OLED Displays)

-

Universal Display Corporation (PHOLED Technology, OLED Lighting Solutions)

-

Visionox Technology Inc. (Flexible OLED Screens, Transparent OLED Displays)

-

Wistron NeWeb Corporation (OLED Smart Wearables, OLED Automotive Displays)

-

JOLED Inc. (Printed OLED Displays, Medical OLED Monitors)

Recent Trends

-

In January 2025, Sony announced an extension of the limited warranty on its 27-inch InZone M10S OLED gaming monitors to three years, including coverage for OLED burn-in. This move aims to address customer concerns about burn-in, a common issue with OLED displays, particularly in environments with static images.

-

In January 2025, LG is introducing its revolutionary fully transparent Signature OLED T TV in Australia this year, with an anticipated price exceeding $80,000. Displayed at CES, the 77-inch TV boasts technology enabling the screen to go fully see-through or transition back into a traditional mode. This innovation promises superior 4K picture quality, but only for a high-end consumer market.

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2023 |

USD 44.07 Billion |

|

Market Size by 2032 |

USD 138.85 Billion |

|

CAGR |

CAGR of 13.7 % From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (Passive-Matrix OLED (PMOLED), Active-Matrix OLED (AMOLED), Top-Emitting OLED (TEOLED), White OLED (WOLED), Red-Green-Blue OLED (RGB-OLED), Foldable OLED (F-OLED)) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

AU Optronics, BOE Technology Group, Canon Inc., LG Display, Mitsubishi Electric Corporation, Panasonic Corporation, Samsung Display, Sharp Corporation, Sony Corporation, Sumitomo Chemical Co., Ltd., Tianma Microelectronics, Universal Display Corporation, Visionox Technology Inc., Wistron NeWeb Corporation, JOLED Inc. |

|

Key Drivers |

• Growing Adoption of OLED Displays in Consumer Electronics and Automotive Industries Drives OLED Display Market Growth. |

|

Restraints |

• High Production Costs and Short Lifespan of OLED Panels Limit Market Growth and Mass Adoption. |