Distillation Systems Market Report Scope & Overview:

Get More Information on Distillation Systems Market - Request Sample Report

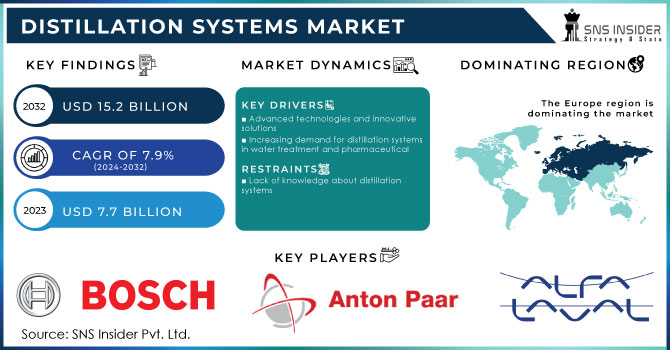

The Distillation Systems Market size was USD 7.7 billion in 2023 and is expected to reach USD 15.2 billion by 2032 and grow at a CAGR of 7.9 % over the forecast period of 2024-2032.

The market for distillation systems is expanding due to increased demand for crude oil, distilled water, and distilled spirits. The two leading application categories of the distillation systems market, which has grown steadily over the previous decade, are petrochemical and biorefineries and water treatment.

Water scarcity is a primary factor driving global demand for distillation units in water treatment applications. The expansion of production industries in developing countries is also supporting the growth of the distillation systems market. By end use, the petroleum and biorefinery segment is set to soar at a 7.8% CAGR during the forecast period.

MARKET DYNAMICS

KEY DRIVERS

-

Advanced technologies and innovative solutions

-

Increasing demand for distillation systems in water treatment and pharmaceutical

Distillation systems are employed in the water treatment sector to clean water for drinking, industrial, and agricultural usage. Demand for distillation systems is being driven by the rising demand for safe and clean water. For instance, according to the World Health Organization (WHO), 2 billion people globally lack access to clean drinking water. Distillation systems can assist in resolving this serious public health concern.

Distillation systems are used in the pharmaceutical sector to manufacture pharmaceutical products such as antibiotics and vaccines. Pharmaceutical product demand is being driven by rising healthcare demand and increased awareness of the benefits of preventive healthcare.

RESTRAIN

-

Lack of knowledge about distillation systems

Distillation systems are complex pieces of machinery that demand a great deal of skill and knowledge to maintain. Lack of understanding of these systems may result in poor operation and maintenance, which may result in issues like spills, leaks, and pollution. Complex distillation system ignorance is more prevalent in developing nations, where there are less educational resources and training sections. The market for distillation systems in these nations may suffer as a result.

OPPORTUNITY

-

Popularity of modular distillation system

-

High demand in the petroleum and biorefinery sector

Petroleum products including gasoline, diesel, and jet fuel are separated and purified in this industry using distillation equipment. They are also employed in the creation of biofuels like ethanol and biodiesel. The demand for distillation systems in this industry is being driven by the rising demand for petroleum-based products. From 2023 to 2030, the demand for petroleum products is anticipated to increase by 2.1% annually. Population increase and economic expansion in developing nations are the main drivers of this expansion.

CHALLENGES

-

High initial investment for installation, maintenance

Distillation systems demand a significant initial expenditure. This is due to the complexity of distillation systems and the large amount of equipment required. The equipment might also degrade over time, necessitating routine repair. Small and medium-sized businesses may struggle with the high initial investment and upkeep expenditures. These businesses may be unable to afford the initial price of distillation systems.

IMPACT OF RUSSIA UKRAINE WAR

Russia and Ukraine are large manufacturers of raw materials such as metals, polymers, and chemicals used in distillation systems. The war has hampered the availability of raw materials needed in distillation systems, causing costs to rise. Steel prices have risen by 30% since the start of the war. Russia is a major producer of petroleum, and the war has caused diesel fuel shortages in other countries. Distillation systems are required for petroleum extraction. The war has hampered the supply of key raw commodities, resulting in greater prices and scarcity.

IMPACT OF ONGOING RECESSION

The recession has impacted the distillation systems market. During inflation surge in prices of materials used in distillation systems like Metal, Plastic, Rubber, and Glass may lead to a decrease in production capacity. Steel, stainless steel, and copper are common metals used in distillation systems. According to the World Steel Association, steel demand in developed countries declined significantly in 2022 due to monetary tightening and rising energy costs. Following a 6.2% drop in 2022, it is predicted to rise by 1.3% in 2023. Also, a 3.2% recovery is expected in 2024.

MARKET SEGMENTATION

By Type

-

Steam

-

Fractional

-

Vacuum

-

Multiple-effect (MED)

-

Others

By Operation

-

Continuous

-

Batch

By Application

-

Water treatment

-

Petroleum & biorefinery

-

Food and Beverages

-

Pharmaceuticals

-

Cosmetics

-

Chemicals

-

Others

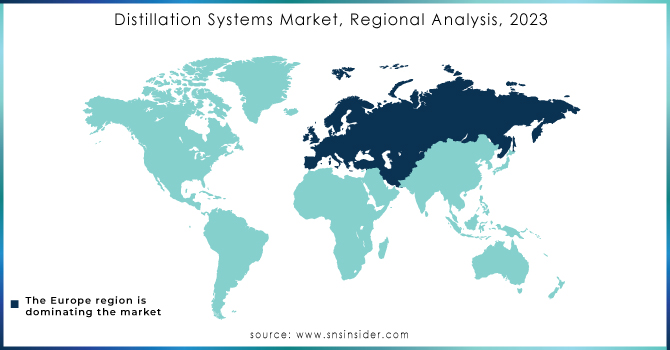

REGIONAL ANALYSIS

Europe region held the fastest-growing market in 2022. The UK distillation systems market is predicted to register at 7.7% CAGR during the forecasting period. The growth of the market in this region is driven by the increasing demand for environmental protection and the growing pharmaceutical industry.

The Asia Pacific market for distillation systems has grown rapidly. Rapid industrialization and urbanization in countries such as India, China, South Korea, and others has driven the distillation systems growth. Technological developments in this region as a result of infrastructure development present a possible opportunity for innovation in the production of distillation systems, boosting their cost-effectiveness and output.

North America is expected to have a significant market due to the growing demand for clean water and growing awareness about the consumption and importance of clean water. During the projected period, the market for distillation systems in the United States is expected to grow at a 7.7% CAGR. The distillation systems industry in the United States is expected to be worth $2.9 billion by 2033.

Need any customization research on Distillation Systems Market - Enquiry Now

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Alfa Laval, SPX FLOW, Core Laboratories, Anton Paar, Praj Industries, L&T Hydrocarbon Engineering, EPIC Modular Process Systems, BÜFA Composite System, Bosch Packaging Technology., FENIX Process Technologies Pvt. Ltd., Kevin Enterprises Pvt. Ltd., and Tianjin Univtech Co. Ltd., and other key players are mentioned in the final report.

RECENT DEVELOPMENTS

In 2023, KIPIC took to Twitter to announce the activation of the final petroleum product distillation plant no. 21 at its AI Zour plant in Kuwait.

In 2022, Irish Distillers announced a USD 250 million investment in the development of additional distilleries in Midleton Co. Cork. To meet global demand and provide continuous production capacity for the company's portfolio of Irish whiskeys.

In 2021, Quintis Sandalwood was aware that outdated distillation techniques needed to be changed in order to meet the rising demand for oil in a more sustainable manner.

| Report Attributes | Details |

| Market Size in 2023 | USD 7.7 Billion |

| Market Size by 2032 | USD 15.2 Billion |

| CAGR | CAGR of 5.0 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Steam, Fractional, Vacuum, Multiple-effect (MED), Others) • By Operation (Continuous, Batch) • By Application (Water treatment, Petroleum & biorefinery, Food and Beverages, Pharmaceuticals, Cosmetics, Chemicals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Alfa Laval, SPX FLOW, Core Laboratories, Anton Paar, Praj Industries, L&T Hydrocarbon Engineering, EPIC Modular Process Systems, BÜFA Composite System, Bosch Packaging Technology., FENIX Process Technologies Pvt. Ltd., Kevin Enterprises Pvt. Ltd., and Tianjin Univtech Co. Ltd. |

| Key Drivers | • Advanced technologies and innovative solutions • Increasing demand for distillation systems in water treatment and pharmaceutical |

| Market Challenges | • High initial investment for installation, maintenance |