Elderly Walker Market Size Analysis:

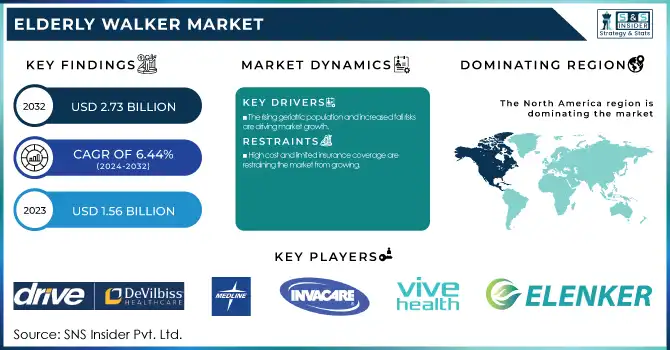

The Elderly Walker Market Size was valued at USD 1.56 billion in 2023 and is expected to reach USD 2.73 billion by 2032, growing at a CAGR of 6.44% from 2024 to 2032.

The report provides insights into the elderly walker market through in-depth statistical insights on important aspects, such as the population that is aging and the prevalence of mobility impairment, pointing to the surging demand for mobility aids. It also discusses adoption rates of elderly walkers across geographies, providing a comparative study of usage across geographies.

To Get more information on Elderly Walker Market - Request Free Sample Report

In addition, the report analyzes elderly walker sales volume by region, charting long-term market trends. In addition, it provides healthcare expenditure on assistive mobility devices, outlining spending behavior across government, commercial, private, and out-of-pocket segments. These considerations offer a thorough and data-driven view of the market environment.

Elderly Walker Market Dynamics

Drivers

-

The rising geriatric population and increased fall risks are driving market growth.

The increasing number of elderly people globally is a key driver of the elderly walker market. The World Health Organization (WHO) estimates that the population aged 60 and older will be 2.1 billion by 2050. With aging comes decreased mobility and higher risks of falls, and hence, assistive devices like walkers become a necessity to ensure independence and safety. Research indicates that a quarter of adults over 65 fall annually, resulting in serious injuries and hospitalizations. Rollators and upright walkers offer stability, minimizing the risk of falls. The increasing awareness of mobility aids and government programs favoring elderly care also support market growth. More recent product advancements, including lightweight foldable rollators and intelligent walkers with safety sensors, continue to increase adoption in aging populations.

-

Advancements in walker design and smart technology are propelling market growth.

Innovations in walker technology have had a major impact on market growth. Standard walkers are increasingly being substituted with new-generation rollators that feature ergonomic handles, integrated brakes, and adjustable height settings. Smart walkers with GPS location tracking, fall detection sensors, and real-time health monitoring features are increasingly popular. Businesses such as UPWalker and ELENKER have introduced new-style upright walkers that encourage improved posture and minimize stress on joints. Furthermore, designers are emphasizing lightweight yet tough materials like carbon fiber and aluminum to enhance mobility. Hybrid designs, which are a combination of rollators and transport chairs, meet the requirements of older people with different mobility levels. These developments meet the growing need for simple and technologically advanced mobility aids, fueling market growth.

Restraint

-

High cost and limited insurance coverage are restraining the market from growing.

The high prices of sophisticated elderly walkers and restrictive insurance reimbursement policies are major impediments to market growth. Although basic walkers are not expensive, technologically sophisticated models, like GPS-tracking smart walkers, ergonomic rollators, and posture-supporting upright walkers, are costly. Most elderly patients, especially in low- and middle-income countries, cannot afford such mobility devices, resulting in low adoption rates. Coverage differs among countries, and several healthcare systems pay only in part or deny particular walker types. Medicare, for example, insures merely plain durable medical equipment (DME), where rollators and knee walkers need to be covered by the patient at his expense. This comes with the caveat of reduced availability to a sizeable proportion of seniors, keeping growth pace modest against the increased need for mobility aids.

Opportunities

-

The growing application of smart technology in mobility products is a high-growth opportunity for the market of elderly walkers.

Advances such as GPS locators, sensor-based fall detection, and mobility assistance using AI are converting typical walkers into cutting-edge healthcare technologies. Brands are launching adaptive walkers with height-adjustable, ergonomic handgrips and lightweight composition to address users' unique needs. Moreover, the growth of telehealth and remote patient monitoring is fueling demand for walkers that connect to digital health platforms. As aging populations value safety and independence, healthcare providers and assistive device companies have the opportunity to grow their business. Strategic partnerships between medical device companies and technology firms can further speed up innovation so that elderly people can have access to advanced mobility devices that can raise their standard of living.

Challenges

-

Lack of Awareness and Reluctance to use mobility aids challenge the market to grow.

Although mobility solutions are increasing in demand, most elderly people are reluctant to use walkers out of social stigma, ignorance, or a desire to be independent. Much of the elderly population perceives mobility aids as evidence of aging or disability and, therefore, is not willing to use them until mobility problems are serious. Furthermore, in most developing nations, low awareness of the advantages of walkers, coupled with cultural attitudes, discourages people from adopting them. Healthcare professionals and caregivers also have an important part to play in informing older people about the significance of early mobilization support for avoiding falls and injuries. Manufacturers need to respond to this obstacle by spending more on awareness-raising campaigns, ergonomic product development that feels less constricting, and campaigns that sell walkers as devices of active and independent living rather than symbols of frailty.

Elderly Walker Market Segmentation Analysis

By Type

The rollators segment dominated the elderly walker market with a 55.13% market share in 2023 because of its better functionality, simplicity, and increasing popularity among seniors. Rollators are different from regular walkers as they have wheels, seats, and braking systems, providing better mobility and convenience to elderly people. As there is a greater emphasis on independence and active aging, seniors opt for rollators for indoor and outdoor mobility. Furthermore, progress in lightweight material and ergonomic technologies has ensured rollators are now more comfortable and secure to use. Mobility-aid demand has increased dramatically, especially in advanced regions such as North America and Europe, whose aging populations and positive reimbursement policies further stimulate take-up. The inclusion of features like adjustable height, storage bins, and foldability has also made rollators extremely popular among the elderly walker crowd.

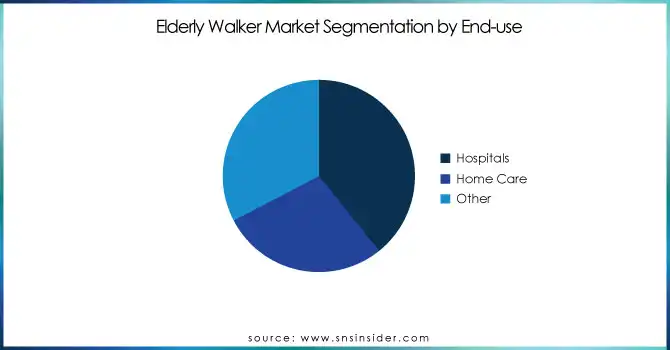

By End-Use

The hospital segment dominated the market with a 39.24% market share in 2023 because of the large number of geriatric patients who need mobility support in post-surgical recuperation and rehabilitation. Hospitals are important in prescribing and dispensing mobility aids, such as walkers and rollators, to recuperating patients from orthopedic surgeries, strokes, and other geriatric conditions. The availability of qualified medical personnel guarantees that patients are prescribed the correct type of walker, with the result that hospital-based sales boost. Government and private hospital funding for durable medical equipment (DME) and insurance reimbursement also support higher adoption in medical facilities. With the hospitals focusing on patient safety and fall prevention programs, the market for sophisticated mobility aids continues to be robust, further solidifying this segment's leadership in the elderly walker market.

The home care segment will witness the fastest growth during the forecast period with a 7.27% CAGR based on the increased preference for aging-in-place and home healthcare services. Most older people would rather be treated at home than in hospitals or care homes, fueling demand for personal mobility devices such as rollators and walkers. The greater availability of home-use walkers that are affordable and lightweight also propels market growth. Technological innovations, including foldable and adjustable height walkers, also improve convenience for users, making home treatment a real possibility. The growth of direct-to-consumer sales channels and e-commerce websites has also increased accessibility, with seniors and caregivers being able to buy walkers with ease. Governments and healthcare organizations are also working towards minimizing hospital readmissions, and home mobility solutions are poised to gain tremendous traction in the forecast years.

Elderly Walker Market Regional Insights

North America dominated the elderly walker market with a 38.25% market share in 2023 because it has an aging population, high healthcare spending, and a well-developed medical infrastructure. The U.S. and Canada have a large percentage of elderly people, with the U.S. Census Bureau predicting that more than 20% of the U.S. population will be 65 years or older by 2030. This population change heightens the demand for mobility devices, such as walkers and rollators. Moreover, robust reimbursement policies like Medicare and private insurance coverage for durable medical equipment (DME) improve access to these devices. The availability of major market players, continuous product innovations, and a well-established distribution network also propel market dominance. Growing awareness regarding fall prevention and mobility assistance for the elderly also supports the extensive use of high-quality, technologically advanced walkers in the region.

Asia Pacific is experiencing the fastest growth in the elderly walker market with 7.54% CAGR throughout the forecast period because of its fast-growing aging population, enhanced healthcare infrastructure, and rising disposable income. Japan, China, and India are among the countries experiencing a growing number of seniors, with Japan possessing one of the highest ratios of seniors in the world. Government support for elderly care, expanding healthcare investment, and raising awareness regarding mobility aids are driving market growth. Also, urbanization and lifestyle shifts are boosting the demand for home healthcare solutions, such as high-end walkers and rollators. The market is also fueled by low-cost product offerings from domestic manufacturers and the increasing use of e-commerce platforms, which enhance the availability of mobility aids to consumers. Consequently, Asia Pacific is becoming a prominent region for future growth in the elderly walker market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Elderly Walker Market Key Players

-

Drive DeVilbiss Healthcare (Nitro Euro Style Rollator Walker, Clever-Lite Walker)

-

NOVA Medical Products (GetGo Classic Rollator Walker, Traveler 3-Wheel Walker)

-

Medline Industries, Inc. (Premium Empower Rollator Walker, Basic Steel Rollator)

-

Invacare Corporation (Dual Release Walker, Rollite Rollator)

-

Hugo Mobility (Elite Rollator Walker, Explore Side-Fold Rollator)

-

Vive Health (Folding Walker, Mobility Upright Walker)

-

ELENKER (Upright Walker, Heavy Duty Upright Walker)

-

UPWalker (Original Upright Walker, UPWalker Lite)

-

OasisSpace (Pneumatic Armrest Walker, Heavy Duty Rollator Walker)

-

Goplus (Foldable Standard Walker, 3-Wheel Rollator Walker)

-

RINKMO (Upright Walker, Rollator Walker with Seat)

-

Beyour Walker (Upright Walker, Standard Walker)

-

Zler (Upright Walker, Folding Rollator Walker)

-

Helavo (Bariatric Walker, Foldable Rollator)

-

Planetwalk (Premium 3-Wheel Rollator, Lightweight Rollator Walker)

-

Healthline (Deluxe Folding Walker, 3-Wheel Rollator Walker)

-

Carex Health Brands (Step 'N Rest Rolling Walker, Trio Rolling Walker)

-

Lumex (Walkabout Lite Rollator, HybridLX Rollator)

-

Roscoe Medical (Deluxe Rollator, Transport Rollator)

-

ProBasics (Aluminum Rollator Walker, Transport Rollator)

Suppliers (These suppliers play a crucial role in supporting the production and maintenance of elderly walkers, ensuring the availability of quality components and accessories essential for mobility aid functionality.) in Elderly Walker Market.

-

HME Medical Shop

-

Medline Industries

-

EZ Walker Rollators

-

ElderStore

-

FRELU GmbH

-

MK Bad & Pflegesysteme GmbH

-

Wheelchair Manufacturers

-

Zler

-

Alibaba Suppliers

-

MedicalExpo

Recent Development in the Elderly Walker Market

-

June 2024: Drive DeVilbiss Healthcare purchased Mobility Designed's line of products, which includes the M+D Comfort Crutch, in a bid to expand its medical equipment product line. Drive DeVilbiss welcomed co-founder Max Younger as Senior Director of Industrial Design & Innovation, where he intended to incorporate innovative designs into their product offerings.

-

September 2024: NOVA Medical Products launched the Test Drive Center Certification to enable retailers to provide in-store trial opportunities for their rollator walkers. The goal of this initiative is to remove the stigma from the use of mobility aids and improve customer experience through hands-on testing.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.56 billion |

| Market Size by 2032 | US$ 2.73 billion |

| CAGR | CAGR of 6.44% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Standard Walkers, Knee Walkers, Rollators) • By End-Use (Hospitals, Home Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Drive DeVilbiss Healthcare, NOVA Medical Products, Medline Industries, Inc., Invacare Corporation, Hugo Mobility, Vive Health, ELENKER, UPWalker, OasisSpace, Goplus, RINKMO, Beyour Walker, Zler, Helavo, Planetwalk, Healthline, Carex Health Brands, Lumex, Roscoe Medical, ProBasics, and other players. |