Remote Patient Monitoring Market Report Scope & Overview:

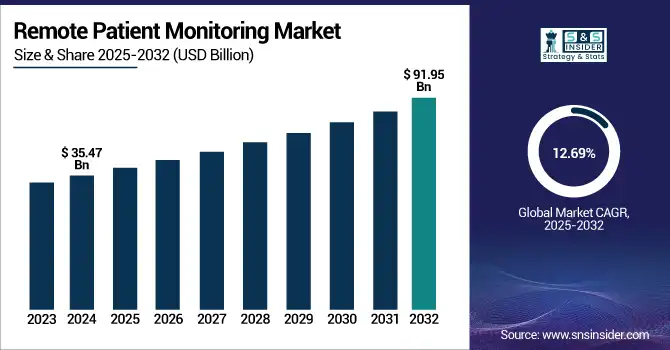

The Remote patient monitoring market size was valued at USD 39.97 billion in 2024 and is expected to reach USD 103.95 billion by 2032 growing at a CAGR of 12.69%, over the forecast period of 2026-2033.

The global remote patient monitoring market is growing rapidly due to the ever-increasing burden of chronic diseases across the globe, the growing healthcare expenditure, and the trend of home-based care environments. Remote real-time health tracking characteristics of some wearable devices and the advancement of connectivity technology have started to enhance health outcomes. The market growth is further aided by rising government support and reimbursement policies, as well as an increasing elderly population globally. With a greater focus on preventive care and digital health adoption within healthcare systems, RPM adoption will only accelerate across geographies.

To Get more information on Remote Patient Monitoring Market - Request Free Sample Report

The U.S. remote patient monitoring market size was valued at USD 14.33 billion in 2024 and is expected to reach USD 36.25 billion by 2033, growing at a CAGR of 12.30% over the forecast period of 2026-2033.

In North America, the remote patient monitoring market is primarily driven by the US, which has an advanced healthcare infrastructure and a developed digital health ecosystem that enables a strong adoption of connected medical technologies. The organization is benefiting from favourable reimbursement policies and support from government agencies, and this is among the other factors that have made RPM integration faster throughout the hospitals, home care, and chronic disease management programs.

Remote Patient Monitoring Market Size and Forecast:

-

Market Size in 2025E: USD 39.97 Billion

-

Market Size by 2033: USD 103.95 Billion

-

CAGR: 12.69% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Remote Patient Monitoring Market Trends

-

Technological advancements including wearables, IoT, AI, and cloud-based platforms are driving the adoption of remote patient monitoring by enabling real-time data collection, anomaly detection, and scalable healthcare solutions.

-

The Masimo W1 Medical Watch, FDA 510(k) cleared in August 2024, demonstrates how AI-driven wearable devices are transforming the capabilities of remote patient monitoring systems.

-

The shift towards home healthcare is accelerating as patients and providers prefer cost-effective home-based monitoring, reducing hospital burden and improving patient comfort.

-

Strong government support, such as the Centers for Medicare & Medicaid Services approving 133 Hospital-at-Home programs across 37 states by April 2024, is boosting adoption of RPM solutions.

-

Data privacy and security concerns, including risks of cyberattacks, unauthorized access, and compliance challenges with HIPAA and GDPR, remain key restraints to the widespread adoption of remote patient monitoring.

Remote Patient Monitoring Market Drivers

-

Technological Advancements are Propelling the Market Growth

Wearables, IoT, AI, and cloud, always evolving. Devices and algorithms are constantly evolving to become more functional, more accurate, cheaper, cloud cloud-based platforms. Such technologies facilitate real-time data gathering and assessment, and remote monitoring of patients' health metrics. They provide support for early anomaly detection using advanced algorithms, followed by the necessary interventions required. The combination of these technologies is what makes RPM solutions: Reliable, easy to use, and scalable, which will lead to broader adoption among healthcare settings.

Masimo W1 Medical Watch Masimo W1 Medical Watch — FDA 510(k) cleared in August 2024 for real-time health monitoring via the Masimo SafetyNet Telemonitoring System. This innovation is a prime example of AI implementation in wearable technology for RPM.

-

Shift Towards Home Healthcare is Accelerating the Market Growth

Patients and healthcare providers are increasingly opting for home care over hospitals. The movement is pushed through by the comfort level, comfort, and economic aspects of home healthcare. This trend is primarily fuelled by RPM, allowing patients to be monitored continuously outside of the clinical setting and to receive timely medical attention while removing the burden of overcapacity healthcare facilities. The ongoing COVID-19 pandemic catalyzed this transition even further, as the clinical community began looking for remote care solutions that require less physical interaction.

By April 2024, the Centers for Medicare & Medicaid Services (CMS) granted 133 H@H (Hospital at Home) programs across 37 states, incorporating health systems that were able to integrate H@H programs successfully. Studies show that patients are 30% less expensive when looked after at home compared to staying in a hospital when monitored care is available.

According to a nationally representative survey conducted by MSI International, 80% of Americans indicated they were willing to use RPM, referring to its implementation into medical care, and half (46%) believed RPM should be an integral part of providing medical care. Also, 65–70% were willing to enroll in RPM programs to monitor vital signs.

Remote Patient Monitoring Market Restraint

-

Safety and Privacy of Data are Restraining the Market from Growing

The risks associated with collecting, transmitting, and storing sensitive patient health information using RPM devices. Since RPM devices are always collecting personal medical data and are reachable over a network, they are prone to cyberattacks, unauthorized access, or data leakage. This creates a serious privacy and legal problem because the U.S. has laws such as HIPAA, and Europe has laws such as GDPR that are designed to protect patient privacy. Such concerns can inhibit healthcare providers and consumers from fully embracing RPM technologies until they believe that data security initiatives are strong and up to regulatory standards.

Remote Patient Monitoring Market Segmentation Analysis

By Component

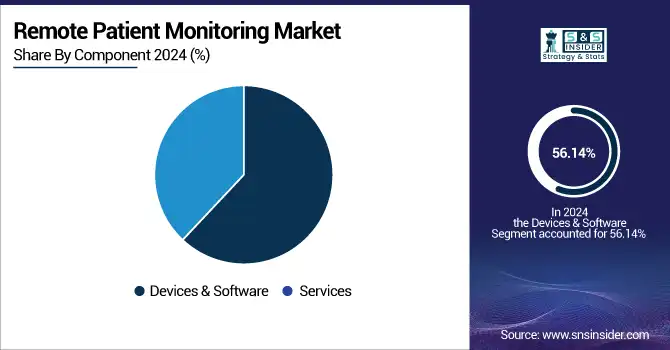

In 2025, the devices & software segment dominated the remote patient monitoring market share with a 56.14%, owing to the high adoption of wearable and connected devices such as blood pressure monitors, glucose meters, pulse oximeters, and ECG trackers. These devices constitute the backbone infrastructure of RPM, as they facilitate immediate health data collection and transmission. Also, the development of software platforms facilitating data integration, analytics, and remote diagnostics reinforced the resilience of this segment during the pandemic, owing to the need for efficient and technology-driven patient monitoring solutions.

The services segment is anticipated to have the fastest growth throughout the forecast period. Rapid technological advancements, such as the high development cost of developing an RPM solution this growth, driven by the increasing demand for Stationery and Lifestyle, which includes patient onboarding, patient-device management, and technical support. To reduce costs and improve care coordination and outcomes, healthcare providers and payers will increasingly need support from service providers for RPM infrastructure and patient engagement, particularly in home-based and chronic disease management programs.

By Application

The cardiovascular diseases segmental domination in the remote patient monitoring market in 2025, with a 36.52% market share, was due to the higher global burden of cardiovascular diseases such as hypertension, heart failure, and arrhythmias. These conditions demand frequent checks of the vital signs- blood pressure, heart rate, and oxygen saturation- that RPM technologies are well suited to deliver. Rationale for Remote Patient Management in Cardiology need for early detection with timely intervention in cardiac events and the rising penalty for cardiovascular hospital readmission, has resulted in rapid receptivity of RPM in cardiac care.

Over the forecast period, the fastest growth rate is expected for the diabetes segment with the highest CAGR. The world population suffering from diabetes is increasing, and the need for self-management and lifestyle changes is also growing, which is boosting the demand for remote glucose monitoring devices and connected insulin management systems. The recent trends of digital therapeutics and mobile health apps developed for diabetes care are making RPM more widely available and effective for patients and healthcare professionals, therefore boosting this segment adoption at an incredible pace.

By End-User

The hospitals segment held the largest share of the remote patient monitoring market in 2025, with 47.5% market share, due to hospitals' established infrastructure and clinical expertise to support the integration of advanced monitoring technologies into routine care. Similar to the first phase post-COVID-19 pandemic, hospitals made greater use of RPM for assessing patients with chronic diseases and patients who had recently been discharged from the hospital to alleviate readmissions and improve outcomes. Its dominance was further bolstered by the use of RPM in intensive care units (ICUs), where around-the-clock and high-accuracy measurements increase the ability of hospitals over other settings to efficiently and effectively monitor patients, post-operative care, and cardiology departments.

In the forecast period, the home healthcare settings segment will experience the fastest growth rate due to increasing demand for home-based care and the initiatives for lower costs of healthcare services. Remote patient monitoring (RPM) gives patients, particularly the elderly and those with chronic conditions, constant monitoring without frequent visits to the hospital. Due to advancements in wearable technology, user-friendly devices, and better connectivity over the years, which have allowed patients and caregivers to manage health conditions at home effectively. This movement follows global developments in health care delivery that favour the provision of client-centered, more comfortable, and cost-efficient care.

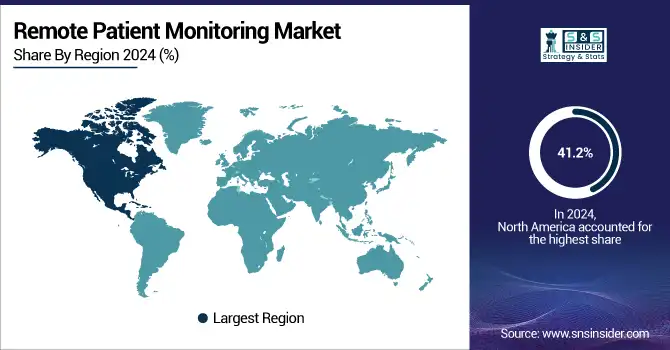

Remote Patient Monitoring Market Regional Insights:

North America Remote Patient Monitoring Market Share and Growth

North America dominated the remote patient monitoring market with a 41.2% market share in 2025 due to the advanced healthcare infrastructure, greater acceptance of digital health technologies, and the presence of leading RPM solution providers. For instance, supportive government initiatives in the region, such as Medicare reimbursement for remote monitoring services in the U.S., have accelerated implementation across hospitals and home care settings. Furthermore, the increasing occurrence of chronic diseases such as heart failure and diabetes has fueled the need for continuous monitoring solutions, further cementing North America as the leader in the global RPM market.

Asia Pacific Remote Patient Monitoring Market Forecast

Asia Pacific is the fastest-growing RPM market with a 13.56% CAGR over the forecast period due to changing dynamics of digitization of the healthcare system, rising awareness towards preventive care, coupled with increasing prevalence of chronic diseases. Telemedicine and connected care technologies in nations such as China, India, and Japan, developing economies, are investing extensively in telemedicine and connected care technologies in response to the accessibility challenges of rural and elderly populations. The strong penetration of smartphones and wearable health devices, as well as government initiatives to improve healthcare services, is also boosting the growth of RPM solutions in the region.

Europe Remote Patient Monitoring Market Trends

The remote patient monitoring market is witnessing substantial growth in the European region. The region is witnessing some momentum driven by a fast-growing aged population, as well as increasing visible chronic diseases such as diabetes and cardiovascular diseases, with about 30% global RPM penetration. Germany, the U.K., and France are at the forefront of this innovation and deployment effort, bolstered by public health structures, strong reimbursement models, and telehealth investments. The COVID-19 pandemic accelerated further adoption of this technology by incentivizing healthcare players to deploy RPM solutions to help providers manage their patient care more effectively in nontraditional clinical settings.

AI, Cloud, and Wearable Devices Boost Remote Patient Monitoring Market in Europe

Further driving the growth of Europe's RPM ecosystem, artificial intelligence-based analytics, cloud-based platforms, and wearable sensors are leading towards the futuristic, data-driven, personalized medical care. The need for digital transformation is bolstered by the collaboration between tech companies and healthcare providers themselves, delivering innovative RPM models to meet regional healthcare demands. Strong regulatory environments and investments in digital health infrastructure continue to ensure Europe will maintain a positive growth partnership with North America and Asia-Pacific.

Latin America Remote Patient Monitoring Market Outlook

Despite moderate growth, the remote patient monitoring market in Latin America is mostly bolstered by the high prevalence of chronic diseases, including diabetes and cardiovascular diseases. Increased internet and mobile penetration, a growing predisposition for telehealth, are some of the doors being opened for the adoption of RPM.

Middle East and Africa Remote Patient Monitoring Market

The Middle East and Africa (MEA) region is slowly adopting the RPM technologies. Growing aging populations and urbanization are creating new demand for home-based care, prompting healthcare providers to look out for remote monitoring solutions. The expansion of RPM services is also supported by governments to digitize healthcare and public-private partnerships.

Get Customized Report as per Your Business Requirement - Enquiry Now

Remote Patient Monitoring Market Key Players

-

Medtronic

-

GE Healthcare

-

Abbott Laboratories

-

Boston Scientific

-

Masimo

-

AliveCor

-

iRhythm Technologies

-

Biotronik

-

Health Recovery Solutions (HRS)

-

Optimize Health

-

Cadence Care

-

Athelas

-

Accuhealth

-

CareSimple

-

Clear Arch Health (Medical Guardian)

-

CoachCare

-

Xealth

-

Dexcom

Remote Patient Monitoring Market Competitive Landscape

Royal Philips, headquartered in Amsterdam, Netherlands, is a global leader in health technology with a strong focus on connected care solutions. The company plays a pivotal role in the Remote Patient Monitoring (RPM) market, offering advanced platforms that integrate telehealth, wearables, and cloud-based analytics. Philips’ Philips HealthSuite platform and its RPM solutions enable continuous patient monitoring for chronic diseases, home care, and hospital settings. With strategic collaborations with healthcare providers and investments in AI-driven analytics, Philips is driving digital transformation in healthcare. Its strong presence in North America, Europe, and Asia Pacific positions it as a key player shaping the future of the RPM industry.

-

April 2024 – Royal Philips, a global health technology leader, announced a strategic collaboration to combine SmartQare's innovative solution, viQtor, with its world-class clinical patient monitoring platforms. The alliance is intended to enable the next generation of continuous patient monitoring across hospitals and home settings, with an initial introduction in Europe.

Boston Scientific Corporation, headquartered in Marlborough, Massachusetts, USA, is a leading medical device manufacturer with a strong presence in cardiovascular, neurology, and chronic disease management solutions. The company is actively contributing to the Remote Patient Monitoring (RPM) market through its implantable cardiac devices, digital health tools, and connected care platforms that enable real-time monitoring of patients with heart failure and arrhythmias. By integrating data-driven insights, cloud-based solutions, and partnerships with healthcare providers, Boston Scientific is enhancing remote care and improving patient outcomes. With a robust global footprint and continued investments in digital health, the company is positioned as a key player in advancing RPM adoption worldwide.

-

July 2024 – Boston Scientific launched a digital solution that is profoundly expanding cardiac care accessibility, from interior South Africa to the far-flung Azores islands. The platform facilitates healthcare professionals to reach out to international experts at any moment, even in the event of power failures, so as to ensure uninterrupted access to vital intelligence and advanced support, ultimately enhancing cardiac care in geographically remote communities.

Remote Patient Monitoring Market Report Scope:

Report Attributes Details Market Size in 2025E USD 39.97 Billion Market Size by 2033 USD 103.95 Billion CAGR CAGR of 12.69% From 2026 to 2033 Base Year 2025E Forecast Period 2026-2033 Historical Data 2022-2024 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments •By Component (Services, Devices & Software)

• By Application (Cardiovascular Diseases, Respiratory Diseases, Diabetes, Musculoskeletal Diseases, Others)

• By End-user (Hospitals, Home Healthcare Settings, Ambulatory Care Settings, Long-Term Care Centers)Regional Analysis/Coverage North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). Company Profiles Philips Healthcare, Medtronic, GE Healthcare, Abbott Laboratories, Boston Scientific, Masimo, AliveCor, Omron Healthcare, iRhythm Technologies, Biotronik, Health Recovery Solutions (HRS), Optimize Health, Cadence Care, Athelas, Accuhealth, CareSimple, Clear Arch Health (Medical Guardian), CoachCare, Xealth, Dexcom