EPC Engineering Procurement and Construction Market Report Scope & Overview:

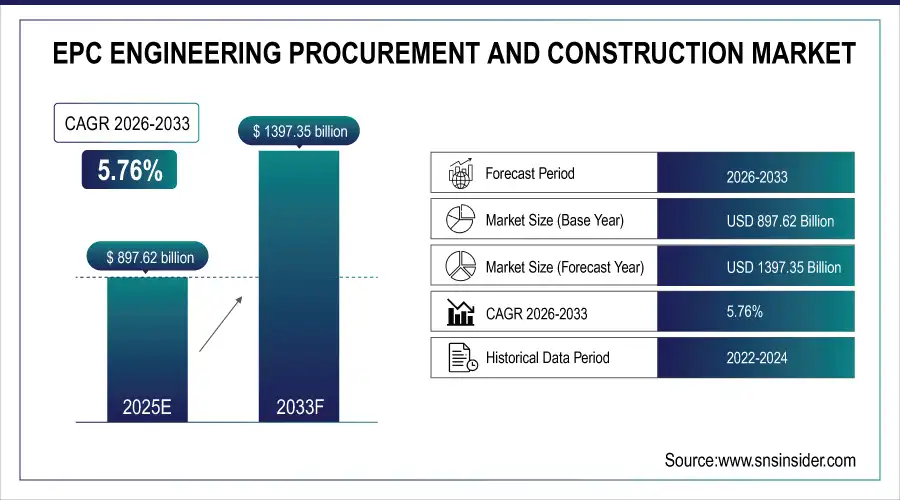

The EPC Engineering Procurement and Construction Market was valued at USD 897.62 billion in 2025E and is expected to reach USD 1397.35 billion by 2032, growing at a CAGR of 5.76% from 2026-2033.

The EPC Engineering Procurement and Construction Market is growing due to rising global infrastructure development, increasing investments in oil, gas, and energy sectors, and expanding industrialization. Growing demand for large-scale greenfield and brownfield projects, technological advancements in construction and engineering, and adoption of turnkey solutions enhance efficiency and project execution. Additionally, government initiatives, public-private partnerships, and rising urbanization drive construction activities. Increased focus on renewable energy projects and modernization of industrial facilities further accelerates market growth globally.

Australia's Woodside Energy Group has secured an EPC contract with U.S. engineering firm Bechtel to develop the Louisiana liquefied natural gas (LNG) project. The project's first phase will consist of three production trains with a combined capacity of 16.5 million tons per annum.

The Abu Dhabi National Oil Company (ADNOC) secured $5.5 billion worth of contracts to construct the Ruwais LNG plant, set to more than double the UAE’s LNG output. The plant aims to produce 9.6 million metric tons per annum of LNG, raising ADNOC’s total capacity to 15 million metric tons per annum.

KEC International Ltd, the flagship EPC company of the RPG Group, announced new orders totaling Rs 1,034 crore across power transmission, civil construction, and cables segments, reinforcing its diverse project portfolio and expanding global reach.

Market Size and Forecast

-

Market Size in 2025: USD 897.62 Billion

-

Market Size by 2033: USD 1397.35 Billion

-

CAGR: 5.76% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on EPC Engineering Procurement and Construction Market - Request Free Sample Report

EPC Engineering Procurement and Construction Market Trends

-

Rising infrastructure development and industrial projects are driving the EPC (Engineering, Procurement, and Construction) market.

-

Growing adoption across energy, oil & gas, power, and transportation sectors is boosting market growth.

-

Integration of digital tools, BIM, and project management software is enhancing efficiency and cost control.

-

Expansion of renewable energy and smart infrastructure projects is fueling demand for EPC services.

-

Increasing focus on timely project delivery, quality assurance, and risk management is shaping market trends.

-

Advancements in modular construction, prefabrication, and sustainable engineering practices are improving project outcomes.

-

Collaborations between EPC contractors, technology providers, and clients are accelerating innovation and global deployment.

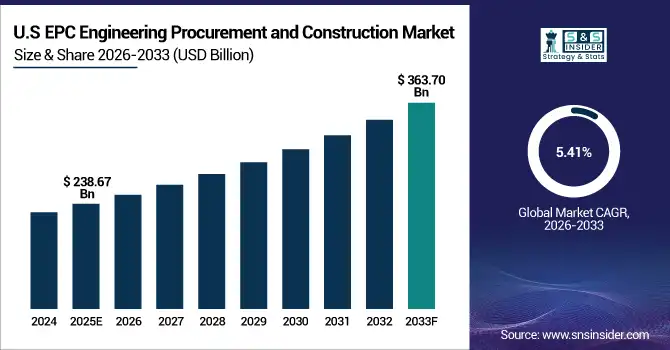

U.S. EPC Engineering Procurement and Construction Market was valued at USD 238.67 billion in 2025E and is expected to reach USD 363.70 billion by 2032, growing at a CAGR of 5.41% from 2026-2033.

The U.S. EPC market is growing due to rising infrastructure investments, expansion of energy and industrial projects, government support for public-private partnerships, adoption of advanced construction technologies, and increasing demand for efficient, turnkey engineering and procurement solutions.

EPC Engineering Procurement and Construction Market Growth Drivers:

-

Growing adoption of renewable energy projects accelerating demand for comprehensive engineering, procurement, and construction services worldwide

The shift toward renewable energy, including solar, wind, and hydroelectric projects, is driving EPC service demand. Governments are incentivizing clean energy infrastructure, promoting large-scale projects that require integrated engineering, procurement, and construction capabilities. These projects involve complex designs, advanced technologies, and timely execution, making EPC providers crucial for successful delivery. Additionally, increasing private sector investment in sustainable energy solutions and public-private partnerships expands the market for turnkey services. EPC companies offering specialized expertise in renewable energy, project management, and procurement efficiency are positioned to capture high-value contracts and long-term project pipelines globally.

-

China's Solar Expansion: In 2023, China installed 120 GWac of utility-scale photovoltaic (PV) capacity, marking a 275% increase from 2022, driven by lower module prices and enhanced construction of renewable energy infrastructure, including land approval and interconnection for utility-scale projects.

-

U.S. Energy Storage Growth: The United States installed approximately 7.7 GWh (2.5 GWac) of energy storage onto the electric grid in the first half of 2023, reflecting a 32% year-over-year increase due to advancements in utility-scale and residential deployments.

-

U.S. Federal Tax Credits: The Inflation Reduction Act extends the Investment Tax Credit (ITC) of 30% and the Production Tax Credit (PTC) of $0.0275/kWh through at least 2025 for projects meeting prevailing wage and apprenticeship requirements for installations over 1 MW AC, promoting renewable energy system development.

-

Cedar Creek Energy: Cedar Creek Energy specializes in solar energy projects, providing full-service EPC solutions, highlighting the importance of specialized EPC contractors in successful renewable energy system deployment.

EPC Engineering Procurement and Construction Market Restraints:

-

Fluctuating raw material costs and supply chain disruptions creating uncertainty in engineering, procurement, and construction projects worldwide

Volatile prices of steel, cement, and other construction materials impact EPC project budgets, timelines, and profitability. Global supply chain disruptions due to geopolitical tensions, transportation delays, or raw material shortages create challenges in timely project execution. EPC contractors face increased operational costs, risk of contract penalties, and difficulties maintaining project quality. Currency fluctuations and import dependencies further exacerbate cost pressures. These factors hinder investment decisions and may delay project approvals. Companies must implement effective procurement strategies, supplier diversification, and cost-control measures to mitigate financial risk, but persistent volatility continues to restrain market growth.

EPC Engineering Procurement and Construction Market Opportunities:

-

Technological advancements in digitalization, automation, and smart construction enabling more efficient and cost-effective EPC project delivery

The adoption of Building Information Modeling (BIM), IoT, AI, and automation in construction and engineering improves project accuracy, resource management, and efficiency. EPC companies can optimize design, procurement, and scheduling processes, reducing costs and risks. Smart construction technologies allow real-time monitoring, predictive maintenance, and improved safety management. Advanced project management software enhances collaboration between stakeholders, ensuring timely execution. Clients increasingly demand technology-driven solutions for complex industrial and infrastructure projects. EPC firms leveraging digital tools and automation gain a competitive advantage, enhancing service quality, minimizing errors, and tapping into opportunities for high-value, large-scale projects globally.

|

Technology / Approach |

Company |

Overview |

Impact |

|

Building Information Modeling (BIM) |

Siemens |

Integrates BIM throughout building lifecycle from planning to operation, providing digital representation of facility characteristics. |

Enhances stakeholder collaboration and decision-making across all phases of a facility. |

|

Automation and Smart Construction |

Bechtel |

Utilizes offsite manufacturing techniques for next-gen data centers, prefabricating components in controlled environments. |

Reduces on-site construction time, improves quality control, and increases schedule predictability. |

|

Automation and Smart Construction |

Siemens |

Offers Smart Engineering Services (SES), an integrated toolchain unifying all project partners within one software framework. |

Streamlines engineering projects, enables seamless integration across disciplines, enhancing efficiency and collaboration. |

|

Digital Twin Technology |

Cadmatic |

eShare platform allows EPCs to control user access to role-specific information in real-time. |

Facilitates real-time monitoring and management, improving operational efficiency and decision-making. |

|

Digital Twin Technology |

Technip Energies |

Integration of iConstruct for 3D modeling since 2019. |

Improves data accuracy, streamlines workflows, and enables seamless access for all stakeholders. |

|

AI and IoT-based Project Management |

Wrench Group |

Uses digital EPC software with AI, drones, and real-time analytics. |

Enables proactive project management, predicts issues, optimizes scheduling, and enhances safety, reducing delays and costs. |

|

BIM and Project Management |

RIB Software |

Offers RIB Candy for estimating/planning and RIB CX for intelligent project management. |

Facilitates efficient project execution, precise cost estimation, real-time collaboration, and streamlined documentation. |

|

Predictive Analytics |

Bechtel |

Implements AI-driven neural scheduling and predictive analytics. |

Optimizes project timelines and resource allocation, anticipates delays, and ensures timely project completion. |

|

Risk Prediction |

STRABAG |

Integrates AI models to forecast potential risks during preconstruction. |

Enables early mitigation strategies, reducing project disruptions and ensuring smoother execution. |

EPC Engineering Procurement and Construction Market Segment Highlights

-

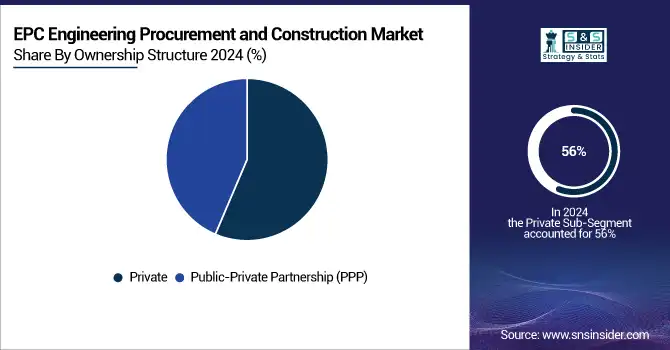

By Ownership Structure, Private dominated with ~56% share in 2025; Public-Private Partnership (PPP) fastest growing (CAGR).

-

By Industry, Oil and Gas dominated with ~36% share in 2025; Infrastructure fastest growing (CAGR).

-

By Service Type, Construction dominated with ~29% share in 2025; Turnkey fastest growing (CAGR).

-

By Contract Value, $10–50 million dominated with ~31% share in 2025; Above $100 million fastest growing (CAGR).

-

By Project Type, Greenfield Projects dominated with ~63% share in 2025; fastest growing (CAGR).

EPC Engineering Procurement and Construction Market Segment Analysis

By Ownership Structure Public, Private segment dominated in 2025; PPP segment expected fastest growth 2026–2033

Private segment dominated the EPC Engineering Procurement and Construction Market in 2025 due to higher investments by private companies, faster project approvals, and strong funding capabilities. Private players often adopt advanced technologies and efficient project management practices, ensuring timely execution and cost optimization, which attracts more projects and drives substantial revenue in the sector globally.

Public-Private Partnership (PPP) segment is expected to grow fastest from 2026 to 2033 as governments increasingly collaborate with private firms to fund large infrastructure projects, share risks, and leverage expertise. Rising urbanization, smart city initiatives, and policy support for PPP projects are accelerating adoption, making this model attractive for executing complex, high-value EPC projects efficiently.

By Industry, Oil & Gas dominated in 2025; Infrastructure segment projected fastest growth 2026–2033

Oil and Gas segment dominated the EPC Engineering Procurement and Construction Market in 2025 due to continuous global energy demand and high-value hydrocarbon projects. Large-scale oil refineries, petrochemical plants, and offshore drilling projects require extensive EPC services, creating significant revenue streams. Established relationships between EPC firms and energy companies strengthen dominance in this industry.

Infrastructure segment is expected to grow fastest from 2026 to 2033 due to government focus on urban development, transportation networks, and smart city projects. Increasing investments in highways, railways, airports, and renewable energy infrastructure create opportunities for EPC firms to execute large-scale, multi-year projects, driving rapid growth in this segment worldwide.

By Service Type, Construction segment led in 2025; Turnkey segment expected fastest growth 2026–2033

Construction segment dominated the EPC Engineering Procurement and Construction Market in 2025 because of ongoing urban development, commercial real estate expansion, and high demand for residential and industrial buildings. Established contractors with proven capabilities secure large-scale construction contracts, contributing to higher revenue generation compared to other service types in the EPC sector globally.

Turnkey segment is expected to grow fastest from 2026 to 2033 as clients prefer end-to-end solutions to minimize coordination risks, reduce project timelines, and ensure quality control. Increasing demand for comprehensive EPC services, including engineering, procurement, and construction in a single contract, is driving adoption of turnkey projects globally.

By Contract Value, $10–50 million segment dominated in 2025; Above $100 million segment projected fastest growth 2026–2033

$10–50 million segment dominated the EPC Engineering Procurement and Construction Market in 2025 due to the prevalence of mid-sized projects that balance manageable risk and substantial revenue. These projects are favored by both private and public clients, offering steady business for EPC companies with efficient resource allocation and predictable returns.

Above $100 million segment is expected to grow fastest from 2026 to 2033 as large-scale mega projects, including energy, infrastructure, and industrial facilities, increase globally. Rising government initiatives, foreign investments, and the complexity of high-value projects drive demand for EPC companies capable of delivering large, integrated solutions efficiently.

By Project Type, Greenfield Projects dominated in 2025; projected fastest growth 2026–2033

Greenfield Projects segment dominated the EPC Engineering Procurement and Construction Market in 2025 due to the high demand for new infrastructure, industrial, and energy facilities. These projects offer EPC companies opportunities for full-scale design, procurement, and construction, allowing better cost control and higher profit margins. The segment is expected to grow fastest from 2026 to 2033 as emerging economies and governments focus on developing new industrial zones, energy plants, and urban infrastructure, creating continuous demand for comprehensive, large-scale greenfield projects globally.

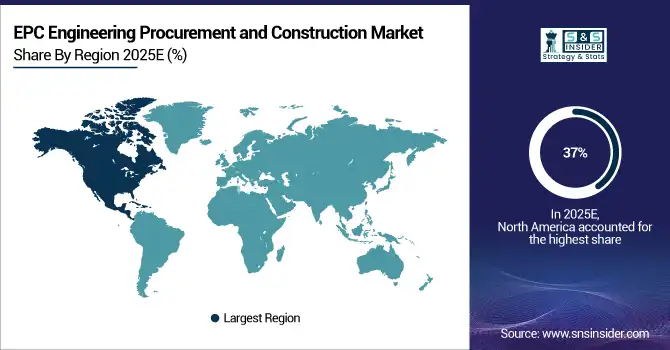

EPC Engineering Procurement and Construction Market Regional Analysis

North America EPC Engineering Procurement and Construction Market Insights

North America dominated the EPC Engineering Procurement and Construction Market in 2025 with the highest revenue share of about 37% due to its well-established industrial infrastructure, high investment in energy and infrastructure projects, and presence of leading EPC companies. Strong government support, robust private sector participation, and advanced technology adoption in construction and project management further strengthen the region’s market dominance, making it the primary hub for large-scale engineering, procurement, and construction projects globally.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific EPC Engineering Procurement and Construction Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 7.31% from 2026 to 2033 due to rapid industrialization, urbanization, and rising government investments in infrastructure and energy projects. Expanding manufacturing sectors, growing demand for greenfield and renewable energy projects, and increasing participation of global EPC contractors in emerging economies are driving market growth in the region, creating significant opportunities for large-scale EPC developments across Asia Pacific.

Europe EPC Engineering Procurement and Construction Market Insights

Europe in the EPC Engineering Procurement and Construction Market is experiencing steady growth due to well-established industrial infrastructure, strong regulatory frameworks, and high investment in energy, chemicals, and infrastructure projects. The presence of leading EPC companies, technological advancements in construction and project management, and a focus on sustainable and renewable energy initiatives are driving market expansion. Collaborative public-private projects and continuous R&D investments further support growth across the region.

Middle East & Africa and Latin America EPC Engineering Procurement and Construction Market Insights

Latin America and Middle East & Africa in the EPC Engineering Procurement and Construction Market are witnessing growth due to increasing investments in oil, gas, and infrastructure projects. Rising government initiatives, urbanization, and industrial expansion are driving demand for EPC services. The adoption of modern construction technologies, strategic partnerships with global EPC players, and focus on renewable energy projects further enhance market opportunities. These factors collectively support steady regional market growth.

EPC Engineering Procurement and Construction Market Competitive Landscape:

Bechtel Corporation

Bechtel Corporation is a global engineering, construction, and project management company, delivering large-scale infrastructure, energy, and industrial projects worldwide. The company specializes in EPC (Engineering, Procurement, and Construction) services for energy, LNG, transportation, and civil infrastructure projects, leveraging advanced project execution strategies, safety protocols, and technology integration to ensure timely and cost-efficient delivery. Bechtel focuses on supporting energy transition and global industrial growth through sustainable and innovative engineering solutions.

-

August 5, 2024: Bechtel secured an EPC contract for Train 4 of the Rio Grande LNG project in Texas by NextDecade Corporation, part of a multi-train LNG export facility.

-

August 5, 2024: Bechtel signed a fixed-price EPC contract with Sempra Infrastructure for Port Arthur LNG Phase 2, focusing on liquefied natural gas export facilities.

Fluor Corporation

Fluor Corporation is a multinational engineering and construction firm providing EPCM services across energy, chemicals, mining, and infrastructure sectors. Known for large-scale, complex projects, Fluor integrates advanced technologies, safety standards, and sustainable practices to deliver efficient project execution. The company’s capabilities include project management, engineering design, procurement, and construction, catering to both conventional and emerging industries, such as renewable energy and pharmaceutical manufacturing.

-

June 27, 2024: Fluor secured an EPCM services contract for Phase One of Northvolt's lithium-ion battery facility in Heide, Germany, valued at €4.5 billion.

-

April 2, 2025: Fluor executed an EPCM services contract for a multi-billion-dollar pharmaceutical facility in Lebanon, Indiana, focused on manufacturing peptide-based drugs for Type 2 diabetes and weight control.

TechnipFMC

TechnipFMC is a global leader in subsea, onshore/offshore, and surface technologies, offering integrated EPCI™ solutions for the oil, gas, and energy sectors. The company provides engineering, procurement, construction, and installation services with advanced subsea production systems and digital solutions, helping clients optimize energy production while improving efficiency and safety. TechnipFMC supports both traditional and low-carbon energy projects, maintaining a strong global presence in offshore and subsea infrastructure.

-

July 18, 2024: TechnipFMC secured a large integrated EPCI™ contract by Energean for the Katlan development in the Mediterranean Sea, utilizing Subsea 2.0® production systems.

-

February 27, 2025: TechnipFMC reported a 9% increase in its backlog to $14.4 billion, with subsea inbound orders expected to exceed $10 billion in 2025.

SNC-Lavalin

SNC-Lavalin is a global engineering and construction company specializing in infrastructure, energy, and mining projects. The company provides EPC services, project management, and consulting across multiple sectors, including oil & gas, transportation, and environmental solutions. SNC-Lavalin emphasizes sustainable project delivery and technical innovation, executing large-scale projects while maintaining rigorous safety and quality standards in complex, high-value environments.

-

September 15, 2024: SNC-Lavalin signed an offshore EPC contract in Qatar worth approximately $4 billion, focusing on subsea services.

McDermott International

McDermott International is an engineering, procurement, construction, and installation (EPCI) company serving the oil, gas, and energy sectors worldwide. The company specializes in offshore and onshore projects, including deepwater oil production and gas infrastructure. McDermott emphasizes technical innovation, safety, and sustainable practices to deliver complex projects efficiently, supporting energy companies in expanding production capacity and optimizing asset performance globally.

-

August 12, 2024: McDermott secured an EPCI contract for a gas project offshore Trinidad and Tobago, enhancing its regional presence.

-

March 5, 2025: McDermott completed an EPCIC project in the Gulf of Mexico for Shell Offshore Inc., marking a significant offshore oil production achievement.

Samsung Engineering

Samsung Engineering is a global engineering and construction company focused on petrochemical, chemical, and industrial projects. The company delivers EPC solutions with advanced engineering expertise, digital tools, and project management capabilities. Samsung Engineering emphasizes efficient project execution, safety, and sustainability, catering to clients in energy, industrial manufacturing, and infrastructure sectors worldwide.

-

November 15, 2024: Samsung Engineering secured a $215 million EPC contract for the Qatar RLP Ethylene Storage Plant, focused on the petrochemical sector.

Larsen & Toubro (L&T)

Larsen & Toubro is a leading Indian multinational engaged in engineering, construction, and technology solutions. The company operates across infrastructure, power, renewable energy, and industrial sectors, providing EPC services and project management solutions. L&T focuses on sustainable development and energy transition initiatives, supporting global industrial growth while integrating digital and green technologies into project delivery.

-

September 2, 2024: L&T engaged a separate renewable EPC business vertical, spun off from its power transmission and distribution segment, focusing on energy transition projects.

-

September 30, 2025: L&T secured a $700 million Sustainability-Linked Trade Facility from Standard Chartered, aligning with its sustainable business practices.

Key Players

Some of the EPC Engineering Procurement and Construction Market Companies

-

Bechtel Corporation

-

Fluor Corporation

-

TechnipFMC

-

SNC-Lavalin Group Inc.

-

McDermott International Ltd.

-

Samsung Engineering Co., Ltd.

-

Larsen & Toubro Limited (L&T)

-

Saipem S.p.A.

-

Petrofac Limited

-

Wood Group PLC

-

KBR Inc.

-

Hyundai Heavy Industries Co., Ltd.

-

Quanta Services, Inc.

-

John Wood Group PLC

-

Technip Energies

-

Sinopec Engineering (Group) Co., Ltd.

-

WorleyParsons Limited

-

Peiyang Chemical Engineering Service Corporation (PCCS)

-

Blattner Energy Inc.

-

Blue Ridge Power

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 897.62 Billion |

| Market Size by 2033 | USD 1397.35 Billion |

| CAGR | CAGR of 5.76% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Project Type (Greenfield Projects, Brownfield Projects) • By Industry (Oil and Gas, Chemicals, Power, Mining, Infrastructure) • By Service Type (Engineering, Procurement, Construction, Turnkey, Operations and Maintenance) • By Ownership Structure (Public, Private, Public-Private Partnership (PPP)) • By Contract Value ($1-10 million, $10-50 million, $50-100 million, Above $100 million) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Bechtel Corporation, Fluor Corporation, TechnipFMC, SNC-Lavalin Group Inc., McDermott International Ltd., Samsung Engineering Co., Ltd., Larsen & Toubro Limited (L&T), Saipem S.p.A., Petrofac Limited, Wood Group PLC, KBR Inc., Hyundai Heavy Industries Co., Ltd., Quanta Services, Inc., John Wood Group PLC, Technip Energies, Sinopec Engineering (Group) Co., Ltd., WorleyParsons Limited, Peiyang Chemical Engineering Service Corporation (PCCS), Blattner Energy Inc., Blue Ridge Power |