Epigenetics Market Size Analysis:

The Epigenetics Market size was valued at USD 15.2 Billion in 2023 and is expected to reach USD 66 Billion by 2032, growing at a CAGR of 17.7% over the forecast period 2024-2032.

Get More Information on Epigenetics Market - Request Sample Report

The epigenetics market is mainly driven by the increasing government funding for research and development and rising advancements in precision medicine. According to the National Institutes of Health (NIH), federal funding for epigenetic research has surged to $1.2 billion in 2023, reflecting the growing recognition of epigenetics' potential in understanding complex diseases and developing targeted therapies. This investment is driving innovation and accelerating the advancement of new epigenetic methods and therapies. As the presence of government boosts to increase scientific research and to get better healthcare consequences are anticipated for driving market growth further ensure widened opportunities for epigenetic technologies adoption.

The increasing need for developing methods to understand gene regulation beyond DNA sequencing to help in the progress of disease research and personalized medicine is boosting market growth. Both growing and established companies are making huge investments in the market. For instance, in January 2024, Moonwalk Biosciences, a biotechnology startup, raised USD 57 million in seed and Series A funding to advance its epigenetic profiling and engineering platform. The market growth due to the increasing incidence of cancer around the globe is also projected to enhance the market growth. According to the PAHO (Pan American Health Organization), 20 million new cases and 10 million deaths due to cancer are registered in 2023. It is estimated that the total number of new cancer cases will rise to 30.1 million by 2041. Early detection of cancer at the initial stage is important to manage the disease and to reduce the mortality rate. Studies reveal that epigenetic drugs inhibit enzymes, such as HDMs and DNMTs, and can cure disorders like cancer and brain diseases only when it is used in combination with other therapies.

Global Epigenetics Market Dynamics

Drivers

-

Significant breakthroughs in understanding epigenetic mechanisms have fuelled research and innovation, driving demand for epigenetic tools and therapies.

-

The increasing prevalence of genetic disorders and cancers that are influenced by epigenetic changes has spurred interest in epigenetic research and therapeutic solutions.

-

The shift towards personalized medicine and targeted therapies leverages epigenetic insights to tailor treatments to individual genetic profiles, enhancing market growth.

-

Enhanced funding and grants from governments and private organizations for epigenetics research have accelerated the development of novel epigenetic therapies and diagnostics.

Research and development (R&D) innovations are playing a critical role in sourcing the current enhanced epigenetics market. In recent years, significant progress in understanding the role of epigenetics in gene expression and disease mechanisms has led to transformative developments in diagnostics and therapeutics. For example, the Human Epigenome Project which concluded in 2020, have produced maps of epigenetic changes across many human cell types which revealed valuable information on how such modifications impact health and disease. The results of this large-scale mapping have laid the foundation for additional investigations and studies, leading to more specific therapies utilizing epigenetic alterations.

Governmental initiatives have had a great impact on the facilitated developments within the industry. In the United States, the National Institutes of Health have been supporting epigenetics through their National Institutes of Health (NIH) Epigenomics Program. In 2023, over $200 million of NIH funds were allocated to the given research area, focusing on the mechanisms of epigenetics of various diseases, including cancer, neurological disorders, and cardiovascular diseases. Apart from the clinical application, the funding also supported basic research, thus, creating new technological tools in the area. The European Commission, through its Horizon Europe program which has committed €95.5 billion spent in the area of research and innovation through 2021-2027 has also spent a considerable amount on genomics and epigenetics. This has created a favorable ground for advanced research studies and international collaboration, driving further advancements in epigenetic science and its applications.

Restraints

-

The complexity and high cost of developing epigenetic therapies and diagnostic tools can limit market growth and accessibility.

-

Stringent regulatory requirements and uncertainties regarding the approval and commercialization of epigenetic-based products can slow market advancement.

-

The relatively nascent stage of epigenetics as a field may result in limited awareness among healthcare providers and patients, hindering market penetration.

-

Ethical issues surrounding genetic manipulation and concerns about privacy related to genetic information can pose challenges to market growth and acceptance.

One of the most significant challenges for the epigenetics market is the regulatory uncertainty that applies to the approval and commercialization of epigenetic-based products. Regulatory uncertainty is a process whereby regulatory bodies develop stringent requirements in order to qualify the dissemination of new products such as new therapies or diagnostics, and in the process become a source of hindrance. Regulatory instability relative to new therapies hampers the dynamism of new discoveries and as a result slows down the dynamism of these products. Specifically, the epigenetics field relies on related sophisticated fields where regulatory agencies strive to ensure the safety of the new products. Safety mandates that the process of approval be based on extended validation and clinical trial and validation to ensure safety and efficacy. Further to this, the advancement in the field leads to changes in existing regulations and acts as a significant barrier. The downside of the issue is that it affects profitability as it prolongs the process of getting these products accepted and launched internationally. Moreover, it increases the risk levels for companies expanding the epigenetics products across different regions.

Epigenetics Market Segmentation Analysis

By Product

In 2023, the reagents segment dominated the market and accounted for more than 33% of the global revenue of the epigenetics market. This significant share is due to the widespread use of reagents in epigenetic research, particularly histone and DNA modifiers. These reagents are essential in the study and manipulation of epigenetic mechanisms, which presuppose the change of gene expression without alteration of DNA sequence. They are used in the research of epigenetic regulation and have both research and therapeutic applications. Many of the key players of the industry, such as Promega Corporation, offer a wide choice of reagents for epigenetics, for example, kits to analyze DNA methylation, histone modification, and RNA transcription. This segment has such high growth because a wide range of products is supplied by the large companies, which guarantees stability and a continuous flow of customers.

The services segment grows with the highest compound annual growth rate 2024-2032. Epigenetics services include sequencing, analysis, and consultation services. They implement advanced techniques, such as ChIP-seq, bisulfite sequencing, and other tools for DNA methylation profiling. Many researchers and research centers do not have an opportunity to conduct such analyses independently and acquire the services of organizations that specialize in them. The use of high-throughput sequencing technologies and other advanced tools increased the demand for services capable of supplying reliable and complex epigenomic data.

By Technology

The DNA methylation segment led the epigenetics market in 2023, accounting for over 44% share of global revenue. The dominance of this segment can be attributed to the critical role of DNA methylation in the control of gene expression. DNA methylation is a type of epigenetic change that occurs across various biological processes, such as the development, aging, and pathogenesis of diseases. Analyzing the pattern of DNA methylation is important for the understanding of complicated diseases, such as various types of cancer, and offers immense opportunities for use in precision medicine, making it a key area of focus in epigenetics research and therapeutic development.

It is anticipated that the histone acetylation segment will experience the highest CAGR of 18% between 2024 and 2032. The reasoning behind this growth is the newly introduced effective methods that have increased the productive capacity of the technology. Moreover, a strong scientific base has been accumulated with respect to the therapeutic benefits of the histone acetylation technology that relates to such complications as solid tumors, inflammation, leukemia, viral infections, and others. This finding is expected to assist in the further penetration of the technology, leading to its active adoption in clinical and research settings and boosting the market growth in the forecast period.

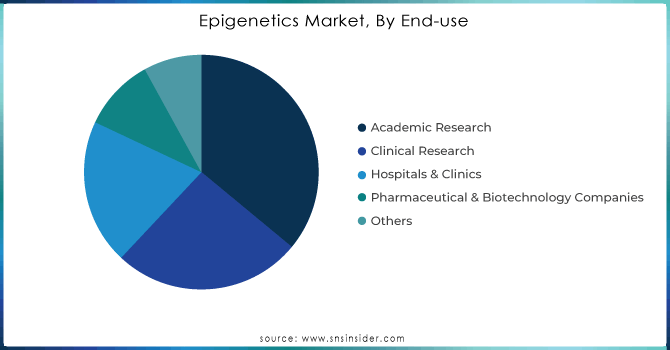

By End-use

In 2023, the academic research segment dominated the market and held over 36% revenue share. The broad implications of epigenetics in numerous fields such as medicine biology and genetics, give universities the lead in research. The complexity and depth of epigenetic mechanisms stimulate academic curiosity and research. The potential for epigenetics to provide insights into disease mechanisms, development processes, and personalized medicine continues to drive growth in this area.

The clinical research segment will be among the fastest growing, with a CAGR of 17% over the forecast period. The clues emerging as a result of epigenomic research into mechanisms of disease and the highly valued promise of delivering personalized medicine to patients are responsible for propelling the trend forward. The role that epigenetics plays in pinpointing and validating therapeutic targets is becoming increasingly important as it becomes a critical service delivered by CROs. Researchers cannot generate an effective treatment without integrating epigenetic research. In particular, the dynamic interaction between the exo-genomic environment and the endo-genomic program is unveiled by epigenetics. The need to know how environmental factors affect the genome is extremely important. CROs use these insights to evaluate medications' anticipated effects, predict patient responses, and refine preclinical studies. The rise of preclinical results will fuel a tremendous increase in the clinical research segment.

Need any customization research on Epigenetics Market - Enquiry Now

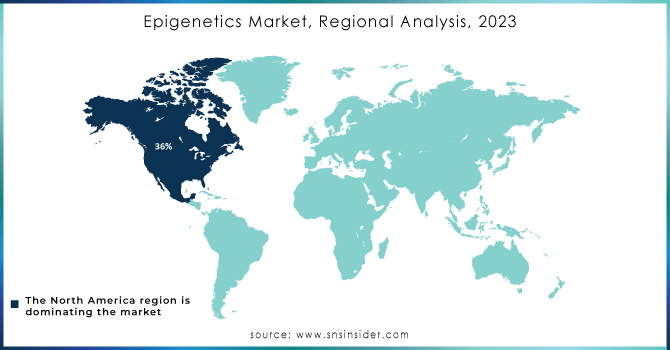

Regional Insights

In 2023, North America was at the forefront of the epigenetics market with over 36% share, due to the prevailing public awareness, advanced medical facilities, and significant investment in R&D. The high prevalence rate of chronic diseases and substantial investment in epigenetic research by key players, such as Thermo Fisher Scientific, Element Biosciences, Dovetail Genomics, Illumina, and Promega Corporation, will continue to drive the regional market. Moreover, the U.S. market is expected to be fostered owing to the frequency of chronic illnesses and increased investments. For example, in November 2021, Chroma Medicine invested USD 125 million in epigenetic editing technology to support overall market growth.

Asia Pacific region is projected to grow with a significant annual growth rate of 16.5% from 2024 to 2032. The growth is attributed to the rising demand for genome editing technologies and the high incidence of genetic infections in India and Australia. Besides, companies such as Epigenic Therapeutics are generating interest in advanced gene modulation therapies, having raised USD 32 million in Series A funding by August 2023, thereby, becoming a lucrative destination for investment. In 2023, the China market will flourish rapidly due to the strong regulatory framework concerning genetically modified organisms and those developed through epigenetics. The Japanese market, as well, is anticipated to grow rapidly due to the high demand for sophisticated synthetic biology solutions for a plethora of epigenetics for research and development.

Epigenetics Market Key Players

-

Roche Diagnostics (NimbleGen SeqCap EZ Library, LightCycler® 480 II System)

-

Bio-Techne (HDAC Assay Kits, EpiTect® ChIP qPCR Arrays)

-

Thermo Fisher Scientific, Inc. (MethylCode™ Bisulfite Conversion Kit, EZ DNA Methylation-Gold™ Kit)

-

Zymo Research Corporation (EZ DNA Methylation-Lightning Kit, ChIP DNA Clean & Concentrator™)

-

Eisai Co. Ltd. (Belinostat, Tazemetostat)

-

Epizyme, Inc. (Tazverik®, EPZ-5676)

-

Novartis AG (Panobinostat, Entinostat)

-

Active Motif, Inc. (ChIP-IT® High Sensitivity Kit, Histone H3 Acetylation Antibodies)

-

Dovetail Genomics LLC (Dovetail Hi-C Kit, Micro-C XL Kit)

-

Illumina, Inc. (Infinium MethylationEPIC BeadChip, TruSeq Methyl Capture EPIC Library Prep Kit)

-

Promega Corporation (HDAC-Glo™ Assay, EpiMax™ Methylation Assay Kit)

-

Abcam plc. (ChIP-seq Kits, DNA Methylation Assay Kits)

-

Bio-Rad Laboratories, Inc. (Droplet Digital™ PCR System, iScript™ DNA Synthesis Kits)

-

Enzo Life Sciences, Inc. (DNA Methylation ELISA Kit, HDAC Fluorometric Activity Assay Kit)

-

Syndax Pharmaceuticals (Entinostat, SNDX-5613)

-

Agilent Technologies, Inc. (SureSelectXT Methyl-Seq, GeneSpring GX)

-

CellCentric (CCS1477, p300/CBP inhibitors)

-

AsisChem Inc. (HDAC Inhibitors, Epigenetic Modulator Compounds)

-

Domainex (Small molecule epigenetic inhibitors, Epigenetic screening services)

-

PerkinElmer Inc. (LabChip® GX Touch™ Nucleic Acid Analyzer, EpiLux® Histone Methyltransferase Assay Kits)

Recent Developments in the Epigenetics Market

-

In July 2023, Chroma Medicine, Inc. and Sangamo Therapeutics, Inc. signed a licensing agreement for the development of epigenetic medicines associated with the use of zinc finger proteins for recognizing specific DNA sequences.

-

In April 2023, the National Cancer Center and Eisai created a collaboration for progressing clinical studies of the anticancer agent tazemetostat.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 15.2 Billion |

| Market Size by 2032 | USD 66 Billion |

| CAGR | CAGR of 17.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Reagents, Kits {ChIP sequencing kit, Whole Genomic Amplification kit, Bisulfite Conversion kit, RNA sequencing kit, Others}, Instruments, Enzymes, Service • By Application (Oncology {Solid tumors, Liquid tumors}, Non-oncology oncology {Inflammatory diseases, Metabolic diseases, Infectious diseases, Cardiovascular diseases, Others}) • By Technology (DNA Methylation, Histone Methylation, Histone Acetylation, Large non-coding RNA, MicroRNA modification, Chromatin structures) • By End-use (Academic Research, Clinical Research, Hospitals & Clinics, Pharmaceutical & Biotechnology Companies, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Roche Diagnostics, Bio-Techne, Thermo Fisher Scientific, Inc., Zymo Research Corporation, Eisai Co. Ltd., Epizyme, Inc., Active Motif, Inc., Dovetail Genomics LLC, Illumina, Inc., Promega Corporation, Abcam plc., Bio-Rad Laboratories, Inc., Enzo Life Sciences, Inc., Syndax Pharmaceuticals, Agilent Technologies, Inc., CellCentric, AsisChem Inc., Domainex, PerkinElmer Inc. |

| Key Drivers | • The increasing prevalence of genetic disorders and cancers that are influenced by epigenetic changes has spurred interest in epigenetic research and therapeutic solutions. • The shift towards personalized medicine and targeted therapies leverages epigenetic insights to tailor treatments to individual genetic profiles, enhancing market growth. |

| RESTRAINTS | • The complexity and high cost of developing epigenetic therapies and diagnostic tools can limit market growth and accessibility. • Stringent regulatory requirements and uncertainties regarding the approval and commercialization of epigenetic-based products can slow market advancement. |