Sequencing Market Report Scope & Overview:

Get More Information on Sequencing Market - Request Sample Report

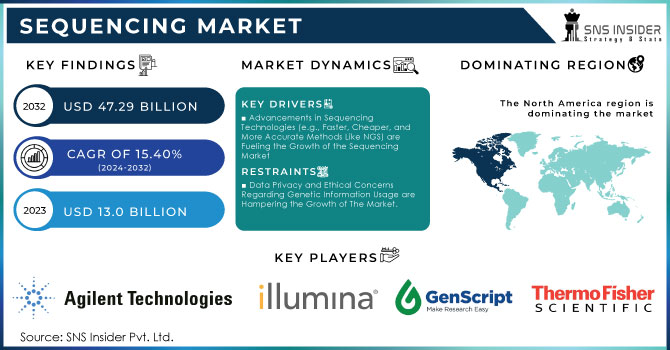

The Sequencing Market Size was valued at USD 13.0 Billion in 2023, and is expected to reach USD 47.29 Billion by 2032, and grow at a CAGR of 15.40% Over the forecast period of 2024-2032.

The healthcare industry is experiencing growth due to the increasing incidences of cancer and the rising demand for pharmacogenomics. Key market players are investing in the industry, and there is a growing number of collaborations and joint ventures among them, which is expected to create opportunities for market growth. For instance, in June 2022, Illumina Inc. and the Allegheny Health Network agreed to evaluate the impact of in-house Comprehensive Genomic Profiling (CGP) on patient care. The rise in inherited cancers is predicted to increase the need for modern gene editing techniques such as CRISPR-Cas gene technology, which have provided new dimensions in the treatment of cancers through various gene therapies. For example, in September 2022, a team of investigators at the University of California presented a study on the 'Clinical translation for the management of inherited retinal diseases, which requires precision genome editing agents'.

The current generation of high-throughput sequencing technologies, such as NGS and microarrays, has generated massive amounts of genomic data. However, the rapid growth in data generation from DNA sequencing and datasets like Electronic Health Records (EHRs) has created significant challenges as well as opportunities for identifying biologically or clinically important signals, such as PheWAS and GWAS for detecting genotype-phenotype associations. Several market players are focusing significantly on collaborations, expansions, acquisitions as well as major capital investments to boost the research associated with rare diseases and support drug discovery. For example, in December 2023 CCM Biosciences revealed they would introduce a new business unit called 5Prime that zeroes on next-generation DNA sequencing and beyond. This group will concentrate on molecular diagnostics and enzyme-based engineering using DNA-based biotechnology.

MARKET DYNAMICS:

Drivers

-

Continuous technological advancements, such as next-generation sequencing (NGS) and third-generation sequencing (TGS), have significantly improved accuracy, speed, and affordability.

Sequencing the human genome was previously a costly endeavor, running up to USD 100 million in 2001. Today, sequencing costs approximately USD 200, making it increasingly feasible for use in research and clinical care. In addition, increased demand for personalized medicine, prompted by the rising incidence of genetic diseases and cancer, is driving the use of sequencing technologies. The growth of direct-to-consumer genetic testing services, like those provided by 23andMe and AncestryDNA, has also increased the market. Moreover, government funding and programs, including the NIH's All of Us Research Program, fund sequencing research and uses. The use of artificial intelligence and cloud computing in sequencing data analysis also boosts growth, facilitating easier management of large amounts of genetic data. Growing applications in agriculture, forensic science, and infectious disease studies, especially for monitoring COVID-19 variants, underscore the increasing significance of sequencing technologies. Pharmaceutical firms using sequencing for drug development and discovery are further fueling the market, with strong growth opportunities due to innovations and rising adoption in various industries.

Restraints

-

Sequencing technologies still require substantial initial investments in equipment, reagents, and computational infrastructure.

The price of high-throughput sequencers such as Illumina NovaSeq is up to USD 1 million, constituting a financial barrier to adoption by small research institutes and start-ups. Furthermore, sequencing produces tremendous data, and their interpretation is an intricate task necessitating specific bioinformatics software and expertise. Many clinicians do not have training for the proper utilization of sequencing information in the practice of clinical care, hampering adoption into day-to-day diagnostics. Genetic data privacy regulations and ethical issues also function as a restraint, with differences in policies between nations posing compliance problems for international businesses. Storage and maintenance of large sequencing data also contribute to operational expenses, with genomic data storage estimated to outpace those of YouTube and Twitter in a few years. In addition, sequencing mistakes, including false positives or low coverage areas, can result in misdiagnosis, restricting confidence in the technology. Although sequencing has huge potential, these technical, financial, and regulatory hurdles hold it back from extensive use, especially in lower-income healthcare systems where cost is still a major issue.

Opportunities

-

The sequencing market presents vast opportunities in precision medicine, where genetic insights enable targeted therapies for cancer, rare diseases, and inherited conditions.

The growing adoption of liquid biopsy—blood tests that are not invasive and pick up circulating tumor DNA (ctDNA)—is a game-changer, with the market size estimated to reach USD 10 billion by 2030. Infectious disease surveillance is also improved through sequencing, as seen through the COVID-19 pandemic, where real-time sequencing was used to monitor rising variants. The field of microbiome sequencing is another high-margin space with applications in gut health, probiotics, and disease prevention. In addition, agri-genomics is picking up pace, making it possible to create genetically engineered crops with increased yield and resistance to disease. Growth in synthetic biology, in which sequencing is key to DNA synthesis as well as genome editing, also broadens the market. AI-based bioinformatics tools integrated into genetic analysis improve accuracy and efficiency, shortening turnaround times for diagnostic purposes. In addition, the increasing interest in consumer genomics, where firms such as Nebula Genomics provide full genome sequencing at a cost of less than USD 300, democratizes genetic information. With these applications continuing to grow, collaboration among pharma companies, biotech, and AI-powered startups forms a successful ecosystem that leads to ongoing innovation and development in sequencing technology.

Challenges

-

One of the biggest challenges facing the sequencing market is the ethical implications of genetic data usage.

Concerns regarding the privacy of data, possible abuse of genetic information by employers or insurers, and the danger of genetic discrimination slow down its widespread use. The Genetic Information Nondiscrimination Act (GINA) covers some types of discrimination in the United States but is not very strong in most other countries. Another issue is the absence of standardized procedures for sequencing data analysis and interpretation, which results in variability between laboratories and research centers. This variation impacts reproducibility and reliability, curtailing clinical applications. Also, the inclusion of sequencing in mainstream medicine demands sizable regulatory approvals, with bodies such as the FDA placing rigorous criteria on clinical-grade sequencing tests. The enormous amount of sequencing data also poses cybersecurity issues since breaches could reveal sensitive genetic data. A 2021 cyberattack against DNA testing company GEDmatch compromised more than 1.4 million user profiles, demonstrating the risks at stake. Additionally, the ethical controversy of human genome editing, including CRISPR-based treatments, makes regulatory approvals and public acceptance more complicated. Resolving these issues needs a joint effort from governments, industry stakeholders, and ethics committees to guarantee the safe and responsible use of sequencing technologies.

MARKET SEGMENTATION ANALYSIS:

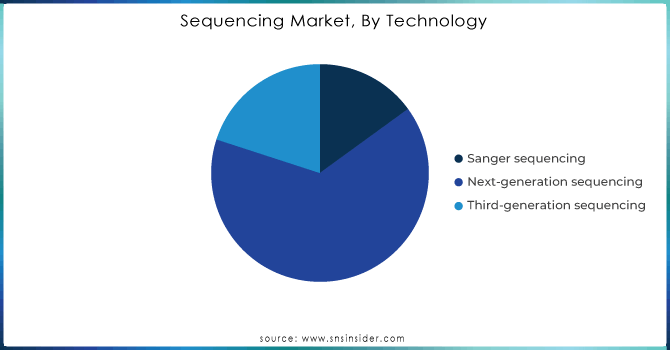

By Technology

The sequencing technology segment was dominated by Next-Generation Sequencing (NGS), which held a market share of 65% in 2023. NGS has become the preferred choice due to its ability to process multiple samples with high throughput in a single run, making it suitable for various fields such as genomics, cancer research, and personalized medicine. The HiSeq method is currently favored for research or clinical projects requiring analysis of large numbers of DNA strands due to its cost-effectiveness and scalability, as it can sequence millions of strands simultaneously. Newer methods with higher throughput, like NGS, have surpassed Sanger sequencing, which now represents a smaller fraction of the market. However, Sanger sequencing is still widely used for high-accuracy applications, such as small-scale clinical diagnostics. Single-molecule real-time (SMRT) and Nanopore Sequencing, both third-generation sequencing technologies, hold around 20% of the market share due to their provision of long-read sequences in real-time, despite having higher costs per run compared to NGS. Due to the abundance of new technologies, NGS stands out as a versatile and essential tool for wide-ranging applications in research across various disciplines, setting a new standard for genomic-based investigations and medical applications.

Need any customization research on Sequencing Market - Enquiry Now

By End-User

In 2023, Research institutions held the largest market share, accounting for 54%. This growth is attributed to the molecularization and discovery of new channels, enabling researchers to gain insights into genetic material, thereby identifying potential drug targets and gaining a deeper understanding of disease pathways. The reduced sequencing costs and wider accessibility of this technology have contributed significantly to its growth.

Next-generation sequencing, once expensive and limited to prestigious institutions, has now become more affordable for academic labs. As a result, these tools are being made available to universities and research institutions worldwide, supporting investigations in evolutionary biology and cancer genomics. Sequencing has diverse applications, including cancer research, mutation identification in tumors, and personalized treatment solutions. These advancements have deepened our understanding of cancer at a molecular level, aiding in risk assessment, early diagnosis, and treatment. Consequently, sequencing has emerged as a vital tool in cancer therapeutics and diagnostics.

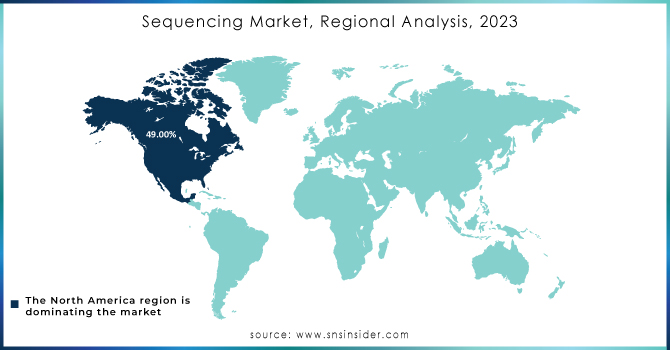

REGIONAL ANALYSIS:

The North American region dominated the market with 49% of the share in 2023 in the sequencing market. This is advantageous due to the involvement of research institutes and pharmaceutical giants. The increasing understanding of the profound implications of genetic expression for human health means that genomics is now an essential part of disease research and drug discovery. Collaborative efforts related to the applications of genomics are evident, such as Illumina's collaboration with Nashville Biosciences, LLC, a subsidiary of Vanderbilt University Medical Center, to facilitate drug development and establish clinical genomic resources.

The U.S. sequencing market is expected to expand in the coming years as a result of the rising incidence of cancer in the country. The American Cancer Society, Inc. estimates that more than 2 million new cancer cases will be diagnosed, with around 611,720 deaths from cancer anticipated by 2024. As precision medicine becomes more important in cancer treatment, the ability to sequence an individual's genes provides a deeper understanding of the genetic mutations driving the cancer. This enables doctors to tailor targeted therapies based on the genetic profile of the tumor, thus increasing the demand for sequencing technology in clinical and diagnostic applications.

KEY PLAYERS:

-

Illumina: HiSeq, MiSeq, NovaSeq, NextSeq

-

Thermo Fisher Scientific: Ion Torrent Genexus, Ion Torrent S5 XL, Applied Biosystems 3730 DNA Analyzer

-

BGI Genomics: DNBSeq, BGISeq-500, BGISeq-50

-

Pacific Biosciences: Sequel IIe, Sequel II

-

Oxford Nanopore Technologies: MinION, GridION, PromethION

-

Roche Sequencing Solutions: 454 Sequencing System, MinION (through a partnership with Oxford Nanopore)

-

Agilent Technologies: SureSelect, SureTarget, SureSeq

-

Qiagen: GeneRead, QIAseq, GeneGlobe

-

PerkinElmer: GeneAmp PCR System, QuantStudio

-

GenScript Biotech Corporation: TruSeq, Nextera, HaloPlex

-

Macrogen: NGS-based sequencing services

-

Genewiz: NGS-based sequencing services

-

Eurofins Genomics: NGS-based sequencing services

-

Beckman Coulter: GeneAmp PCR System, QuantStudio (through a partnership with Thermo Fisher Scientific)

-

Fluidigm Corporation: C1 Single-Cell System, Access Array

-

10x Genomics: Chromium Single-Cell System, GemCode Technology

-

MGI Tech Co., Ltd.: DNBSeq, BGISeq-500, BGISeq-50 (through a partnership with BGI Genomics)

-

Nanopore Technologies: MinION, GridION, PromethION (through a partnership with Oxford Nanopore)

-

Azenta Life Sciences: NGS-based sequencing services

-

Sanger Sequencing Technology: Sanger sequencing platforms (e.g., ABI 3730 DNA Analyzer).

RECENT DEVELOPMENTS

-

In December 2023, Illumina Inc. partnered with HaploX to reduce the hassle of importing expensive sequencing instruments from the US. This partnership resulted in Align being locally manufactured in China.

-

In March 2023, Illumina Inc. introduced its Illumina Complete Long Read technology, which represents a significant advancement for NGS (Next-Generation Sequencing) as it enables long and short reads to be generated on the same instrument.

-

In July 2023, Illumina Inc. introduced the QIAseq Normalizer Kits for research use. This method is popular for different DNA libraries, as it is convenient, fast, and cost-effective, providing the best-quality results from NGS runs.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 13.0 Billion |

| Market Size by 2032 | US$ 47.29 Billion |

| CAGR | CAGR of 15.40% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology: Sanger sequencing, Next-generation sequencing (NGS) & Third-generation sequencing. • By Application: Healthcare, Agriculture, Forensic science, Environmental science & Industrial applications. • By End-User: Research institutions, Pharmaceutical and biotechnology organizations, Government agencies & Others. |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Illumina, Thermo Fisher Scientific, BGI Genomics, Pacific Biosciences, Oxford Nanopore Technologies, Agilent Technologies, Qiagen, PerkinElmer, GenScript Biotech Corporation, Macrogen & other players |