Synthetic Biology Market Report Scope & Overview:

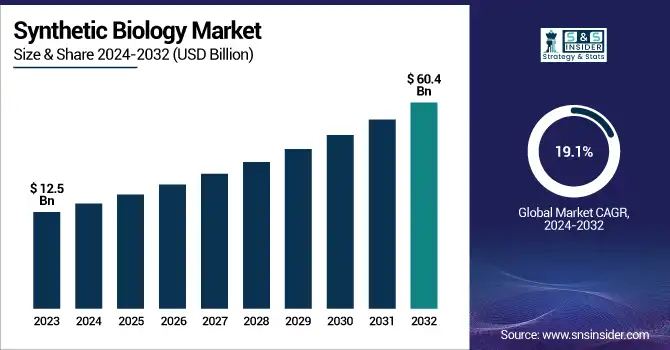

The Synthetic Biology Market Size was valued at USD 12.5 billion in 2023 and is expected to reach USD 60.4 billion by 2032, growing at a CAGR of 19.1% over the forecast period 2024-2032.

To Get more information on Synthetic Biology Market - Request Free Sample Report

The growth of the synthetic biology market is attributed to enhancing government support, forced investments in research and development, and widening applications across diverse market segments. The U.S. government has been a significant contributor to this growth, with the National Institutes of Health (NIH) allocating substantial funds to synthetic biology research. In fiscal year 2023, the NIH invested over $820 million in synthetic biology-related projects, a 15% increase from the previous year. It also spurred innovations in gene editing, biosensors, engineered microorganisms, and more. The Department of Energy (DOE) has also played a crucial role, allocating $250 million in 2023 to synthetic biology initiatives focused on bioenergy and biomanufacturing. These have resulted in advances in the development of sustainable fuel production and bio-based materials.

Meanwhile, the National Science Foundation (NSF) established dedicated Programs in synthetic biology, awarding $150 million in 2023 for interdisciplinary synthetic biology research and education efforts. The number of synthetic biology patents, led by a giant surge in the U.S., increased by 22% in 2023 compared to 2022. Globally, nations such as China and the UK have also increased their investment in synthetic biology. In 2023, China's Ministry of Science and Technology launched a five-year plan to invest ¥10 billion (about $1.5 billion) in synthetic biology R&D. In 2023, the UK government announced a £300 million to synthetic biology initiatives in 2023, focusing on healthcare and agricultural applications. In addition to state-led efforts, there have also been private sector investments, as venture capital funding into synthetic biology startups jumped by $1.2 billion globally in 2023, 30% compared to 2022 reaching a total of $5.5 billion. Combined public-private funding has expedited technology in the field for new therapeutics, sustainable materials, and advanced crop varieties.

Market Dynamics

Drivers

-

Advances In Gene Editing Technologies Such As CRISPR/Cas9 and Synthetic Genomics Have Revolutionized the Field, Making It Possible to Design and Construct New Biological Parts and Systems with Greater Precision.

The development of innovative gene-editing techniques, especially CRISPR/Cas9, and synthetic genomics, has entered synthetic biology into a new phase of innovation. These newly available tools provide an unprecedented level of precision by allowing scientists to design and fabricate new genetic material, pathways, and systems with greater speed and precision. For example, CRISPR/Cas9 makes it possible to edit genomic sequences with pinpoint precision, enabling the ability to edit DNA sequences at specific locations. Even more recently, a study from Nature Biotechnology in 2023 found 98% precision in CRISPR gene editing to correct mutations responsible for Duchenne muscular dystrophy. Similarly, synthetic genomics leverages DNA synthesis and assembly technologies to create entirely new genomes, as demonstrated by the creation of synthetic Mycoplasma laboratorium, a minimal bacterial cell, by the J. Craig Venter Institute.

These advancements are finding applications in fields such as agriculture, where gene-edited crops with enhanced resistance to pests and environmental stressors are being developed. For instance, in CRISPR-based immunotherapy, such as engineering CAR-T cells of cancer, preliminary results from clinical trials targeting acute lymphoblastic leukemia have demonstrated exciting initial findings. In addition, advancements like synthetic genomics are not only revolutionizing but also facilitating faster vaccine development, as evidenced by the prompt establishment of platforms for mRNA vaccines for COVID-19. These technologies allow for precise and efficient genetic modifications and are both accelerating discovery and enabling solutions to complex biological problems.

-

There is Growing Interest in Synthetic Biology for Developing New Therapies, Vaccines, And Diagnostic Tools, Particularly in Personalized Medicine and Regenerative Medicine.

-

Synthetic Biology Holds the Promise of Developing New Vaccines, Treatments, And Diagnostic Tools, Particularly for Diseases That Are Currently Difficult to Address with Conventional Methods.

Restraints

-

The Lack of Standardized Regulations and Guidelines Across Different Countries Can Complicate the Approval and Commercialization Processes for Synthetic Biology Products.

-

The Development of Synthetic Biology Products Often Requires Significant Investment in Research, Development, And Clinical Trials, Which Can Be a Barrier for Smaller Companies and Startups.

The lack of uniform regulations and guidelines around the world regarding the approval and commercialization of synthetic biology products is a huge barrier. Every country has its regime, which differs in terms of breadth, stringency, and transparency from paradigm to paradigm. This inconsistency adds uncertainty for researchers and companies working their way through the complicated routes needed to pursue product development and market entry. Specifically, the United States Food and Drug Administration (FDA) reviews synthetic biology products according to existing frameworks for genetically modified organisms (GMOs), but the European Union has GMO-specific, more stringently implemented directives that can slow the approval process. In 2024, a paper from researchers at the European Bioinformatics Institute showed that more diversity in biosafety and biosecurity between regions delayed joint projects by an average of 18 months. This kind of regulatory fragmentation impairs innovation while raising compliance costs and reducing international market access, especially for resource-constrained start-ups and smaller enterprises. Guidelines for standardization are essential to break down these barriers.

Segment analysis

By Product

Enzymes held for the synthetic biology market share of 35% in 2023, and is expected to dominate during the forecast period. Such a large market share is mainly owing to the versatility of this enzyme and its importance in various applications of synthetic biology. Enzymes serve as essential catalysts in numerous biological processes, making them indispensable tools for genetic engineering, metabolic pathway optimization, and biocatalysis. According to the U.S. Department of Agriculture (USDA) in 2023, the share of agricultural and food applications of enzyme-based applications increased by 18%, reflecting the increasing significance of enzymes in agriculture and food processing. In addition, the Food and Drug Administration (FDA) approved 12 new enzyme-based therapeutics in 2023, which is 50% more than last year, highlighting the growing applications of engineered enzymes in the pharmaceutical field. In 2023, the National Institute of Standards and Technology (NIST) announced a $50 million program focused on standards in synthetic biology, identifying the characterization of enzymes as a major area of need. It is directed towards speeding up the progress in enzyme engineering, facilitating the reproducibility of experiments in synthetic biology. The dominant share for the enzyme segment is also increasing due to the growing adoption of enzyme engineering techniques such as directed evolution and rational design to improve the efficiency and stability of enzymes for industrial applications. According to the U.S. Department of Energy, Bioenergy Technologies Office engineered enzymes have reduced biofuel production costs by 25% in 2023, highlighting the economic role of Enzymes in the renewable energy market.

By Technology

In 2023, the segment that utilizes PCR capture dominated the market, with a 31.0% share. This dominance can be attributed to the fundamental role of Polymerase Chain Reaction (PCR) in synthetic biology research and applications. The capability of PCR to amplify specific DNA sequences at high speed has made it one of the most useful techniques available for gene synthesis, genetic engineering, and diagnostic use. In 2023, a 40% increase in PCR-based diagnostic tests for infectious diseases was reported by the Centers for Disease Control and Prevention (CDC), shining further importance on PCR-based tests as an indispensable technology to protect public health. Additionally, the National Institutes of Health (NIH) funded over 500 research projects utilizing PCR technology in synthetic biology applications in 2023, representing a 25% increase from the previous year. In 2023 alone, the U.S. Patent and Trademark Office (USPTO) granted 300 PCR-related patents relevant to synthetic biology, a 15% annual increase illustrating the continued technological progress of this important area. Growing demand for novel PCR technologies, such as digital PCR and real-time PCR that enable more sensitive and accurate synthetic biology applications, is increasing the revenue share of the PCR segment. The PCR technology has already been used in genetic-based diagnostic tests, and in 2023, the Food and Drug Administration (FDA) approved 8 new PCR-based diagnostic tests, which is representative of the growing role of the technology in personalized medicine. In addition, the National Institute of Standards and Technology (NIST) also initiated a $30 million initiative building standardized PCR protocols to meet the synthetic biology needs in 2023, seeking to enhance reproducibility and accelerate research in the field.

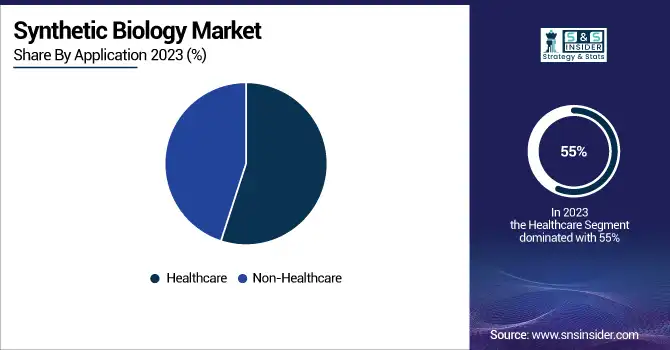

By Application

Healthcare was the largest vertical segment in 2023 holding 55% in 2023. Synthetic biology-based diagnostics provide rapid, real-time, and non-invasive detection of infectious agents, cancer cells, and therapeutics in a very specific or sensitive manner. They describe rational engineering strategies for novel dynamic bio-sensing systems, which consist of a processor embedded with a sensor and reporter. By indication, the segment is driven by a rise in cases of diseases like multiple sclerosis. For example, synthetic biologists at the University of Toronto Engineering are working on personalized stem cells from patient tissues to cure diseases in July 2022. These research initiatives are expected to bolster the growth of this segment.

By End-use

The biotechnology & pharmaceutical companies segment held the largest revenue share of 53% in 2023. The high market share is due to the globalization of synthetic biology techniques for drug discovery, development, and manufacturing processes. Synthetic biology presents unique opportunities to transform medicine, which has led to significant investment in this area by the pharmaceutical industry. According to the U.S. Food and Drug Administration (FDA), the number of Investigational New Drug (IND) applications involving synthetic biology approaches increased by 35% in 2023 compared to the previous year. This suggests that synthetic biology is increasingly becoming part of drug development pathways. According to the National Institutes of Health (NIH), 40 percent of NIH-funded biotechnology research projects in 2023 had some synthetic biology elements, a 15 percent rise over 2022. In addition, the Biotechnology Innovation Organization (BIO) announced that its member companies invested $12 billion in synthetic biology in 2023, a 25% increase over the previous year. This large investment demonstrates the sense of possibility that synthetic biology brings to delivering new therapies. Exports of biotechnology products created with synthetic biology methods increased 20% in 2023 according to the U.S. Department of Commerce, underscoring the economic value of this technology in the pharmaceutical industry. Moreover, in 2023, the Centers for Medicare & Medicaid Services (CMS) authorized payment procedures for five new synthetic biology-based therapies, further incentivizing pharmaceutical companies to invest in this field.

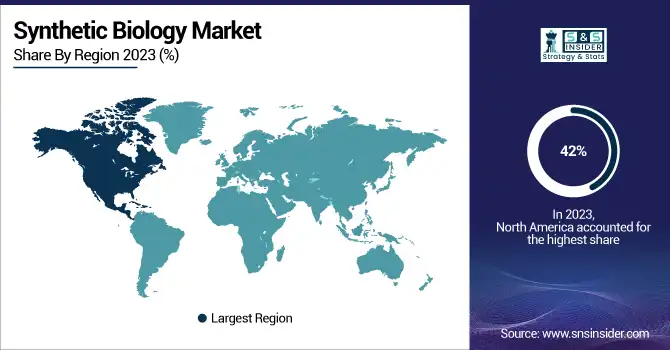

Regional analysis

In 2023, North America held the largest share of the global synthetic biology market with a 42% market share. This dominance of North America is due to its strong research infrastructure base and high government funding, along with the concentration of leading biotechnology companies. According to the latest available numbers, funding for synthetic biology research in North America from the U.S. National Science Foundation (NSF) alone was $1.2 billion in 2023, up 15% from 2022. As a result, innovation and commercialization in the field are further demonstrated by this sizeable investment. The synthetic biology industry had an economic impact of $15 billion in the U.S. GDP in 2023 according to the U.S. Department of Commerce. In 2023, Canada's Innovation, Science and Economic Development department again strengthened the North American position in the market by announcing USD 500 million for synthetic biology initiatives.

On the other hand, the Asia-Pacific region is driven by escalating government support, an increasing biotechnology market, and expanding research capabilities. For example, China's Ministry of Science and Technology noted a 30% growth in the number of synthetic biology patents filed in 2023 compared to 2022 suggesting a deceleration in innovation competition from the region. The Cabinet Office of Japan last week made a ¥100 billion ($900 million) five-year commitment to supporting research and development in synthetic biology starting in 2023. India's Department of Biotechnology found in 2023 that the number of startups in synthetic biology rose by 25% a sign that the entrepreneurial landscape for synthetic biology is expanding. The Australian Government's Innovation and Science Australia agency allocated AUD 200 million to synthetic biology initiatives in 2023, focusing on applications in agriculture and environmental conservation.

Get Customized Report as per your Business Requirement - Request For Customized Report

Recent developments

-

In January 2024, The US-based Rice University founded the Rice Synthetic Biology Institute, with a vision to catalyze collaborative research in synthetic biology for translation into technologies that can serve society.

-

Amyris, Inc. successfully commercialized a sustainable alternative to palm oil derived through synthetic biology in June 2023, therefore eliminating key environmental issues related to palm oil production. This innovation was recognized by the U.S. Department of Agriculture with a $5 million grant awarded to develop commercial-scale production.

-

In January 2023, NREL announced the launch of a synthetic biology project with partners LanzaTech, Northwestern, and Yale to develop biofuel discovery technologies. The project sought genome engineering and machine learning tools to accelerate biofuels and biochemical solutions to carbon-negative production on the same high scale.

-

In May 2023, GenScript Biotech Corporation (sponsor of the SynBioBeta Conference) presented their newest synthetic biology tool and techniques with strategic partner Allozymes alongside a select line-up of KOLs.

Key Players

-

Thermo Fisher Scientific Inc. (GeneArt Gene Synthesis, Invitrogen GeneArt Strings DNA Fragments)

-

Merck KGaA (Sigma-Aldrich Gene Synthesis, CRISPR Cas9 Nuclease mRNA)

-

Agilent Technologies Inc. (SureVector Cloning Kits, Custom Oligonucleotide Synthesis)

-

Danaher Corporation (Integrated DNA Technologies gBlocks Gene Fragments, CRISPR Genome Editing Tools)

-

Ginkgo Bioworks (Cell Programming Services, Custom Microbe Engineering)

-

Amyris Inc. (Biofene® (renewable farnesene), Biossance® Skincare Products)

-

Twist Bioscience (Synthetic Genes, NGS Target Enrichment Solutions)

-

Codexis Inc. (CodeEvolver® Protein Engineering Platform, High-Performance Enzymes)

-

GenScript Biotech Corporation (Gene Synthesis Services, CRISPR Gene Editing Tools)

-

Novozymes A/S (Industrial Enzymes, Microbial Solutions)

-

Synthetic Genomics Inc. (Biofuel Development, Microbial Genomic Services)

-

Precigen, Inc. (UltraCAR-T® Therapies, ActoBiotics® Platform)

-

Poseida Therapeutics (CAR-T Cell Therapies, Gene Engineering Technologies)

-

Synlogic, Inc. (Synthetic Biotic™ Medicines, SYNB1618 for PKU Treatment)

-

Synthego Corporation (CRISPRevolution sgRNA, Engineered Cells)

-

Pivot Bio (PROVEN™ Nitrogen-Producing Microbes, On-Seed Nitrogen Solutions)

-

Agrivida, Inc. (GRAINZYME® Feed Additives, INergy™ Silage Solutions)

-

Impossible Foods Inc. (Impossible™ Burger, Plant-Based Sausage)

-

Insitro (Machine Learning-Based Drug Discovery, Disease Modeling Platforms)

-

Apeel Sciences (Plant-Based Food Coatings, Shelf-Life Extension Solutions)

|

Report Attributes |

Details |

|

Market Size in 2023 |

USD 12.5 Billion |

|

Market Size by 2032 |

USD 60.4 Billion |

|

CAGR |

CAGR of 19.1% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Product (Oligonucleotide/Oligo Pools and Synthetic DNA, Enzymes, Cloning Technologies Kits, Xeno-Nucleic Acids & Chassis Organism), |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Creative Biogene, Thermo Fisher Scientific, Inc., Illumina, Inc., Euro fins Scientific, Novozymes, Merck Kgaa (Sigma-Aldrich Co. Llc), Synthetic Genomics Inc., Codexis, Inc., Synthetic Genomics Inc., Enbiotix, Inc. & other players |

|

Key Drivers |

•Advances In Gene Editing Technologies Such As CRISPR/Cas9 and Synthetic Genomics Have Revolutionized the Field, Making It Possible to Design and Construct New Biological Parts and Systems with Greater Precision. |

|

RESTRAINTS |

•The Lack of Standardized Regulations and Guidelines Across Different Countries Can Complicate the Approval and Commercialization Processes for Synthetic Biology Products. |