Extruded Snacks Market Report Scope & Overview:

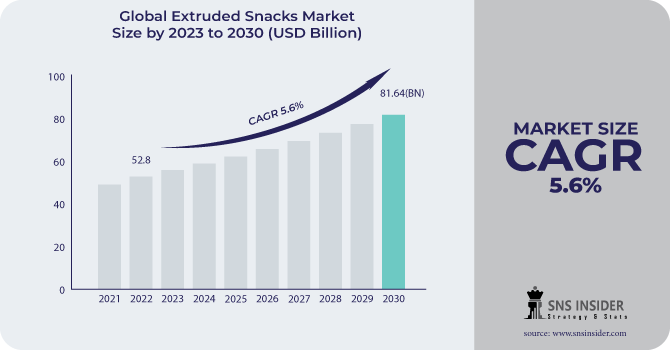

The Extruded Snacks Market size was USD 52.8 billion in 2022 and is expected to Reach USD 81.64 billion by 2030 and grow at a CAGR of 5.6 % over the forecast period of 2023-2030.

Extruded snacks are a form of processed food produced by pressing a mixture of components through a die. Starch, Cereal flour, Water, and flavorings are common constituents. Extrusion cooks the components and provides them with their distinctive form and texture.

Due to the widespread consumption of potato-based extruded products, such as chips and pallet snacks, potato-based extruded snacks dominated the extruded snacks market in 2022. Approximately 62% of the potatoes grown in the United States are sold as chips, French fries, and other potato products, according to the United States Census Bureau.

The demand for wholesome and nutrient-dense snacks among the young population around the world is expected to grow at a CAGR of 4.2% in terms of volume from 2022 to 2027. Due to its great nutritional value, tapioca is commonly consumed in Asia, Africa, and Latin America, in a variety of ways.

Supermarkets/hypermarkets have emerged as the most important sales channels, owing to rising consumer demand for healthy snacks in a range of tastes, combined with a long shelf life, which is pushing this distribution channel. Furthermore, supermarket and hypermarket behemoths such as 7Eleven, Walmart, SPAR, Carrefour, and Lidl have massive food store chains with a global client base.

MARKET DYNAMICS

KEY DRIVERS

-

The rising popularity of snacks to support market

Snacks are increasingly being consumed as part of daily meals as well as processed food. Several reasons are driving this tendency, including People increasingly opting for ready-to-eat and convenient food options. Snacks are a convenient and quick method to acquire a meal or snack on the road. Customers are looking for snacks with pleasant organoleptic qualities. The savory nibbles are eaten at tea and breakfast times, as well as throughout the day.

RESTRAIN

-

The technical and operational issues

Temperature, pressure, and screw speed are all extrusion process characteristics that influence end-product quality. To attain the desired texture, flavor, and nutritional profile, manufacturers must carefully adjust these factors. The moisture content of the components has a considerable impact on the extruded product's texture and cooking qualities. The product will be sticky and difficult to process if the moisture content is too high. The product will be brittle and may not cook evenly if the moisture content is too low. Meeting consumer demand for healthy snacks is another difficulty, as is meeting regulatory obligations.

OPPORTUNITY

-

Accelerating investments in innovation and the development of novel products

Manufacturers are developing new extrusion technologies that will allow them to create extruded foods with distinct textures, flavors, and nutritional profiles. This is promoting innovation in the extruded snack sector.

Consumers currently look for clean labels such as non-GMO, gluten-free, allergen-free, and Vegan, as well as nutritional information on snack packages. Consumers also seek protein and fiber-rich foods, which presents manufacturers with enormous potential to introduce unique flavors and forms into their product offerings.

CHALLENGES

-

Raising awareness of health and wellness for consumers

-

Stringent regulatory requirements

Extruded snacks must meet a variety of regulatory criteria, including those about food safety, labeling, and nutrition. These standards can be complex and expensive to meet, making it difficult for manufacturers to bring new items to market. The Food and Drug Administration (FDA) of the United States regulates extruded snacks under several statutes, including the Federal Food, Drug, and Cosmetic Act (FD&C Act) and the Food Safety Modernization Act (FSMA). Extruded snacks must be safe, nutritious, and correctly labeled, according to the FDA.

IMPACT OF RUSSIA UKRAINE WAR

The war has resulted in huge price increases for commodities such as wheat, corn, and sunflower oil, which are utilized in the manufacture of extruded snacks. The battle has disrupted extruded snack supply lines, making it impossible for manufacturers to obtain the ingredients and packaging required to produce their goods. Following the commencement of the conflict, the Food and Agriculture Organization's (FAO) food price index, which analyzes international prices of the most widely traded food commodities, reached its peak in March 2022. Export limitations affect 55% of palm oil exports, 36% of wheat exports, 78% of sunflower oil exports, and 6% of soybean oil exports in terms of overall trade in individual products.

IMPACT OF ONGOING RECESSION

Recessions have had a substantial impact on the market for extruded snacks. Extruded snack prices have risen as a result of export limitations on food products. In most cases, inflation reduces demand for extruded snacks. This is because during recessions, customers tend to cut back on discretionary expenditure, and extruded snacks are frequently viewed as non-essential commodities. Furthermore, food and gasoline prices would rise by 3% in 2022 and 2.3% in 2023. Food prices had already risen in some nations by February-March 2022. Food prices in Egypt, for example, are expected to rise by 17% in February 2022. Food price increases have an indirect impact on extruded snacks.

MARKET SEGMENTATION

By Type

-

Simply Extruded

-

Expanded

-

Co-extruded

By Raw Material

-

Potato

-

Corn

-

Wheat

-

Rice

-

Tapioca

-

Mixed Grains

By Distribution Channel

-

Supermarket/Hypermarket

-

e-commerce

-

others

.png)

REGIONAL ANALYSIS

Europe led the market in 2022 with a share of more than 40.0% based on volume. The health benefits of such items are important to customers in the United Kingdom, but Germany is one of the fastest-growing natural and organic healthy foods marketplaces. Snacking during social occasions, on-the-go, or general snacking is driving demand for extruded snacks in Europe. Furthermore, customers are gradually migrating away from unhealthy products and toward healthier alternatives, such as wheat and cereal snacks. Wholegrain wheat and other cereals, along with pulse flours, nuts, and organically processed grains, are becoming more popular in snacks.

Asia Pacific is anticipated to emerge as the fastest growing region, expanding at a revenue-based CAGR of 5.5% from 2022 to 2027 owing to a large population base in countries, such as China and India. Furthermore, due to corporate culture, social gatherings with beverages and snacks are significantly rising in Asian countries, creating new doors for extruded snacks in the regional market.

The demand for foods that can be consumed on the go has greatly expanded in the North American region in recent years. The rise in the number of people entering the labor sector has increased consumer demand for convenience food products. The market for snacks is greatly impacted by the rising demand for ready-to-eat foods that support wellness.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

PepsiCo, Inc., ITC Limited, Mondelez International, JFC International, Calbee, Inc., Gruo Bimbo, Kellogg Company, Lorenz Snack World, Cambell Soup Company, General Mills, Inc., and other key players are mentioned in the final report.

Mondelez International-Company Financial Analysis

RECENT DEVELOPMENTS

In 2023 G&S Foods intends to expand from its Extrude snack foods. G&S Foods, a US manufacturer of private snack foods, has disclosed plans for a sizable snack food business in Pennsylvania, where it is based.

In 2022 SnackCraft LLC, a business unit of Unismack SA with its headquarters in Greece and a line of confections, will establish its first US location in Michigan. Up to 185 jobs could be created at the new SnackCraft factory, which is projected to result in an overall capital investment of $41.75 million.

In 2021 Producer of RO extruded corn snacks Gusto considers establishing a facility abroad. The most challenging year in the history of the corporation for which Romanian puffcorn Gusto is produced has begun. However, it continues to invest in new manufacturing facilities and international development (10 million euros this year alone), and it is considering establishing a facility abroad.

| Report Attributes | Details |

| Market Size in 2022 | US$ 52.8 Billion |

| Market Size by 2030 | US$ 81.64 Billion |

| CAGR | CAGR of 5.6% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By type (Simply Extruded, Expanded, Co-extruded) • By Raw Material (Potato, Corn, Wheat, Rice, Tapioca, Mixed Grains) • By Distribution Channel (Supermarket/Hypermarket, e-commerce, and others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | PepsiCo, Inc., ITC Limited, Mondelez International, JFC International, Calbee, Inc., Gruo Bimbo, Kellogg Company, Lorenz Snack World, Cambell Soup Company, General Mills, Inc. |

| Key Drivers | • The rising popularity of snacks to support market |

| Market Opportunity | • Accelerating investments in innovation and the development of novel products |