Flat Steel Market Report Scope & Overview:

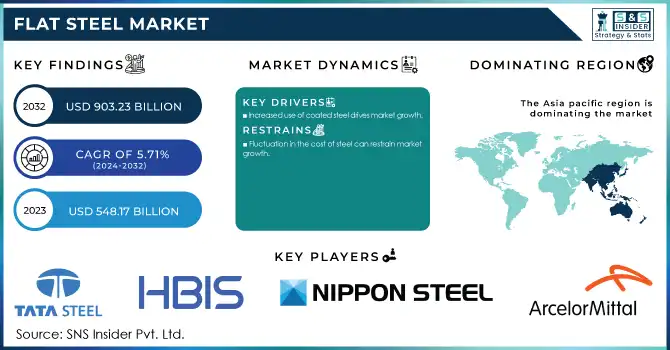

The Flat Steel Market was USD 548.17 billion in 2023 and is expected to reach USD 903.23 billion by 2032, growing at a CAGR of 5.71% over the forecast period of 2024-2032.

Get E-PDF Sample Report on Flat Steel Market - Request Sample Report

The expansion of the renewable energy sector is one of the key factors driving the flat steel market, as the growing implementation of wind and solar energy requires effective durable performance materials in a host of reliability-critical applications. Flat steel is also used to make solar panel frames, wind turbine towers, and support structures. Flat steel is a commonly used material for providing strength, corrosion resistance, and cost-effectiveness. Global governments are spending on renewable energy projects to achieve sustainability goals which increases demand for flat steel. As an example, the U.S. DOE and the European Union Green Deal are targeting large increases in wind and solar capacity, which will support increased demand for flat steel due to infrastructure needs. Furthermore, the increased attention towards hydrogen-based steel production in renewable energy applications is influencing the market and the major steel producers are focusing on producing sustainable steel by investing in sustainable production methods to match the global needs for carbon neutrality.

This transition has been driven by policies such as the European Green Deal, which aims for a 55% reduction in emissions by the end of the decade and carbon neutrality by 2050. Additionally, the revised Renewable Energy Directive, adopted in 2023, raises the EU's binding renewable energy target for 2030 to a minimum of 42.5%.

Flat steel is increasingly used in industries such as railways and highways, and with government spending heavily to develop infrastructure across the globe over the next few years the demand for these goods is expected to grow. Flat steel is an important raw material for rail tracks, bridges, highway guardrails, and structural parts, benefiting from high strength, good durability, and corrosion resistance. The U.S. Infrastructure Investment and Jobs Act (IIJA) of 2021, for example, provided $110 billion in various ways to increase steel demand as a key material for roads, bridges, and other large-scale infrastructure uses. Likewise, India will increase railway line capacity via the National Rail Plan(NRP) to increase capacity, by 2030, which will result in steel demand through track expansion and modernization. And enhanced demand is further boosted thanks to initiatives such as the European Union's Connecting Europe Facility (CEF) 2021-2027 with €33.7 billion dedicated to rail and road network upgrades. The continuous expansion of urbanization and industrialization is expected to keep increasing the demand for durable and resilient transportation infrastructure, thereby driving the growth in the flat steel market.

Flat Steel Market Dynamics

Drivers

Increased use of coated steel drives market growth.

The availability of coated steel is one of the largest drivers in the flat steel market because industries are demanding more long-lasting materials with durability against environmental scenarios. Galvanized steel and pre-painted steel are a popular class of coated steel that provides superior corrosion resistance, making them suitable for use in applications including construction, automotive, and appliances. Besides, the increasing demand for sustainability in construction and energy-efficient structures, coated steel further drives its demand by prolonging the life of structures and minimizing maintenance requirements. Moreover, improvement of vehicle performance both in aesthetics and durability is a major driving force for coated steel adoption within automotive end use, functional, lightweight, and corrosion resistance. Coated steel is used to meet government regulations related to sustainability (e.g. EU's REACH regulation). The flat steel market is further boosted by long-term coated steel demand, productive investment in infrastructure, and smart cities-based infrastructure.

Restraint

Fluctuation in the cost of steel can restrain market growth.

The price volatility of steel is a major challenge to the minimum growth of the flat steel market as it makes sure there is ambiguity among the manufacturers and end users. Different factors affect steel prices such as raw material and energy prices, global supply chain snarls, and geo-political tension. As discussed earlier, the prices of key raw materials for steel production, such as iron ore and coking coal will directly have an impact on production costs if they continue to rise. Widespread volatility contributes to uncertainty with greater difficulty for manufacturers to keep end-users well informed on price stability creating interruptions in the construction cycle or the need to reduce costs and demand for flat steel in construction, automotives, and industrials. Moreover, trade tariffs and anti-dumping measures by governments in the path of exports in steel imports also result in price fluctuations, creating challenges for companies heavily dependent on steel for financial planning.

Flat Steel Market Segmentation

By Product

Plates held the largest market share 68% in 2023. It is widely used across applications such as construction, shipbuilding, automotive, manufacturing, and other industries, which are categorized as heavy industries. Due to their high stress and extreme condition capabilities, these thick, flat steel products are commonly used for structural components in infrastructure projects, such as bridges, buildings, and other industrial machinery. In shipbuilding, steel plates are essential in the production of sizeable ships, such as oil tankers, commercial vessels, and offshore platforms. Steel plates are also widely used in the automotive industry to manufacture body panels, frame components, and other essential parts because of their strength, durability, and impact resistance. The growing industrialization of countries will always see a market for steel plates because of the requirement for these platess in both basic infrastructure as well as larger industrial uses, the demand is only assisted through government investments into industrial infrastructure.

By End-Use

Building & Construction held the largest market share around 54% in 2023. Due to its strength, durability, and versatility, steel is a primary material used for structural components such as beams, columns, reinforcement bars, and roofing. An increasing number of flat steels is also driven by the worldwide expansion of urbanization and population, with the growing demand for new buildings, bridges, highways, and other facilities. The ramp-up of government initiatives and investments in infrastructure such as the U.S. Infrastructure Investment and Jobs Act (IIJA), as well as China’s Belt and Road Initiative, also spurs demand for steel in construction. In addition, growing attention toward energy-efficient buildings has increased the adoption of light weight high-strength steel which enhances energy efficiency without compromising on structural stability.

Flat Steel Market Regional Analysis

Asia pacific has the highest share of flat steel market share around 52% in 2023. It is owing to the rapid industrialization and urbanization trend in the region coupled with the rising demand from major end-use industries including construction, automotive, and infrastructure. Steel consumption and production is high in the countries of China, India and Japan as China is the world largest producer of steel and also a big player in global steel exports. Government-driven infrastructure projects, especially in China and India (the Belt and Road Initiative in the former, and the Smart Cities Mission in the latter) have created an enormous demand for flat steel for construction and heavy industries in the region. The region, particularly in China and India, has also seen a strong growth in automotive steel demand across a multitude of body panels, frames, and other essential parts. Growing smart city initiatives and the expansion of the renewable energy sector in the region are also promoting steel consumption owing to the need of these sectors having long-lasting materials for construction and energy infrastructure. In addition, elements like cheaper labor, lower-priced raw materials, and penetration of steelmakers in countries such as China and South Korea have further solidified the region's supremacy in the flat steel sector. Thanks to this industrial demand, as well as government investments to bring the production capability online, Asia-Pacific is the highest market pair for flat steel.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

-

ArcelorMittal

-

Tata Steel

-

Nippon Steel Co.

-

Ezz Steel

-

Voestalpine Group

-

ThyssenKrupp Steel Europe

-

Yiep Corp.

-

Metals USA

-

JFE Steel Corporation

-

Steel Dynamics, Inc.

-

SSAB

-

United States Steel Corporation

-

ArcelorMittal Nippon Steel India

-

Baosteel Group

-

Hyundai Steel

-

POSCO India

-

Reliance Steel & Aluminum Co.

Recent Development:

-

In 2024, ArcelorMittal announced a USD 1 billion investment in a new low-carbon steel plant in the European Union to meet increasing demand for sustainable steel and reduce carbon emissions from its steel production.

-

In 2023, HBIS Group expanded its production capacity for high-performance steel by acquiring a significant stake in a Chinese steel mill, aiming to cater to the automotive and renewable energy sectors.

-

In 2023, Ezz Steel upgraded its production facility with the installation of new galvanizing lines to increase its output of high-quality galvanized steel used in construction and automotive applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 548.17 Billion |

| Market Size by 2032 | USD 903.23 Billion |

| CAGR | CAGR of5.71% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Sheets & Coils, and Plates) •By End User (Building & Construction, Automotive & Aerospace, Railways & Highway, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ArcelorMittal, Tata Steel, HBIS Group, Nippon Steel Co., Ezz Steel, Voestalpine Group, ThyssenKrupp Steel Europe, Yiep Corp., POSCO, Metals USA, JFE Steel Corporation, Steel Dynamics, Inc., SSAB, United States Steel Corporation, ArcelorMittal Nippon Steel India, Nucor Corporation, Baosteel Group, Hyundai Steel, POSCO India, Reliance Steel & Aluminum Co. |

| Key Drivers | •Increased use of coated steel drives market growth. |

| Restraints | •Fluctuation in the cost of steel can restrain market growth. |