Shipbuilding Market Report Scope & Overview:

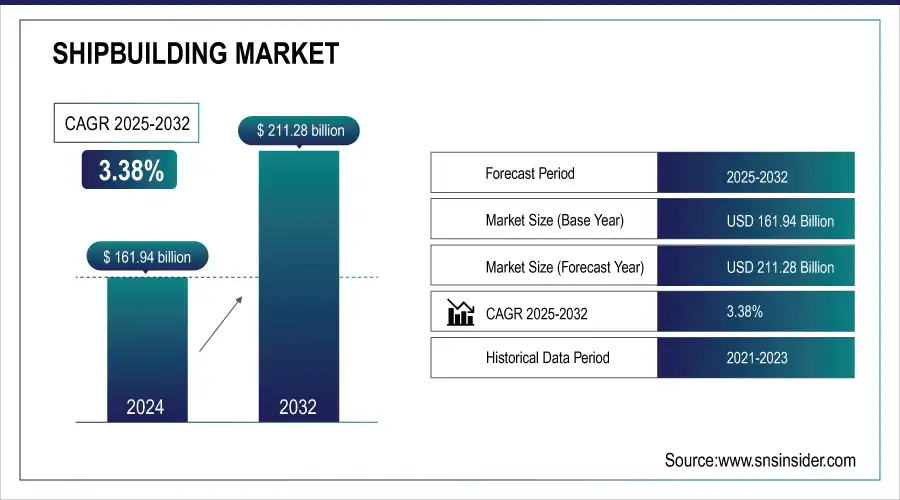

The Shipbuilding Market Size was valued at USD 167.41 billion in 2025 and is expected to reach USD 233.43 billion by 2035 with a growing CAGR of 3.38% over the forecast period 2026-2035.

Shipwrights are another term for shipbuilders. The shipbuilding industry is in charge of the design and construction of ocean-going boats all over the world. Asia-Pacific currently dominates the worldwide shipbuilding sector, followed by Europe, North America, and LAMEA. Asia-Pacific is likely to maintain its worldwide market domination, particularly in China, South Korea, and Japan, because to several distinct advantages such as relatively lower wages, significant government support, and strong forward and backward industry connectivity. Shipbuilding is a very capital-intensive business, hence significant government assistance and political stability are required to survive.

To get more information on Shipbuilding Market - Request Free Sample Report

The shipbuilding market refers to the shipbuilding process, which comprises several procedures such as designing and manufacturing ships and other floating vessels. The market manufactures large ships, particularly seagoing boats, which are used by many industries such as transportation, trading, energy, and military. The Shipbuilding Market even offers products for vessel construction and maintenance. The market is also undergoing technical improvements and upgrades in order to increase trade and transportation. Ships are designed to be versatile for a variety of functions. Increased demand for maritime transportation has higher imports and exports, resulting in increased Shipbuilding Market Growth.

Market Size and Forecast:

-

Market Size in 2025 USD 167.41 Billion

-

Market Size by 2035 USD 233.43 Billion

-

CAGR of 3.38% From 2026 to 2035

-

Base Year 2025

-

Forecast Period 2026-2035

-

Historical Data 2022-2024

Key Shipbuilding Market Trends:

-

Advancements in marine vessel engine technology improving fuel efficiency and reducing environmental impact.

-

Rising demand for ship-borne cargo transportation driven by globalization and international trade growth.

-

Adoption of high-capacity, modern vessels to meet increasing shipping and logistics needs.

-

Implementation of stricter marine safety standards, promoting development of advanced vessel designs.

-

Growing integration of automation and autonomous navigation in sea transportation to enhance efficiency and reduce human error.

Shipbuilding Market Growth Drivers:

Marine Vessel Engines are projected to Create High Demand Opportunities in Shipbuilding Market Growth of the shipbuilding market is sustained by advancements in marine vessel engine technologies that enable fuel efficiency, emissions reduction and sustainable ship operations. In addition, as demand for sea-borne cargo transport increases due to the globalisation and extension of world trade, together with an ever-increasing need of new, large-sized ships, the global shipbuilding market has experienced continuous growth.

Shipbuilding Market Restraints:

The cost prices of transportation and inventory keep fluctuating significantly, involving additional operational costs, which is another underlying challenge in the Shipbuilding Market. Furthermore, increasing attention towards environmental impact of marine vessels in terms of carbon emission, fuel consumption and marine pollution puts strong pressure on ship builders to accept expensive sustainable technologies imposing difficulties for market growth as well as competitiveness.

Shipbuilding Market Opportunities:

The market for shipbuilding is highly opportunistic with the implementation of stringent maritime safety norms, leading to the need for innovative ship designs and safety systems. Furthermore, increasing adoption of automation in the maritime transportation industry, such as smart ships and unmanned navigation systems is likely to fuel the growth opportunities for shipbuilders by increasing operational efficiency, minimizing human error and enhancing overall marine logistics.

Shipbuilding Market Segment Analysis:

By Ship Type

In 2025, container ships accounted for the largest share of the shipbuilding market as a result of growing global trade and need for cost-effective cargo shipping. The passenger ships segment is projected to grow at the highest CAGR during the forecast period, 2025–2035, due to increase in tourism along with expansion of cruise industry and rise in preference for leisure & luxury vessels, which create significant opportunities for shipbuilders across globe.

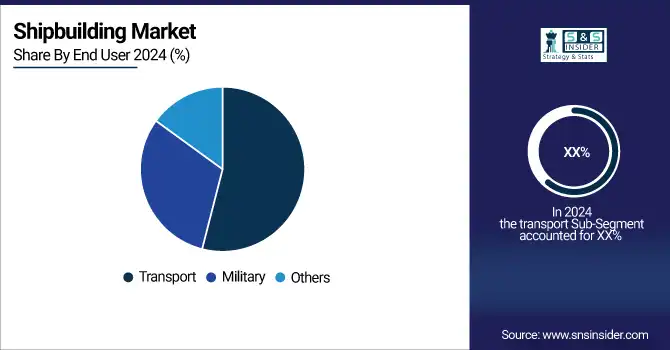

By End User

The transport application segment held the largest share of the shipbuilding market in 2025 due to the demand for commercial cargo and logistics vessels used in international trade. Military segment is projected to record the highest CAGR from 2025 to 2035 due to higher defense budgets and replacement of aging naval fleets with advanced warships, Submarines, and strategic growth in demand for maritime capabilities.

Shipbuilding Market Regional Analysis:

North America Shipbuilding Market Insights

North America’s Naval fleet modernization, defense expenditure as well as the need for sophisticated cargo and passenger carriers are the important factors . Technological improvements, tightening up of safety legislation and growth in offshore energy projects continue to drive the market forward, placing the region at a competitive advantage in both commercial and military shipbuilding.

Need any customization research on Shipbuilding Market - Enquiry Now

Asia Pacific Shipbuilding Market Insights

Global Shipbuilding Market: Regional Analysis Asia Pacific has a significant share in the global shipbuilding market as prominent players operate from this region, increasing international business and efforts to support maritime infrastructure by respective governments drive growth. Demand for container ships, bulk carriers and cruise vessels remains high, while technologically advanced and low-cost manufacturing is driving strong market growth in the region.

Europe Shipbuilding Market Insights

The European shipbuilding market gains from sophisticated engineering methods, strict environmental mandates and quality vessel build. Robust demand for passenger ships, cruise liners and specialized vessels as well as investments in green shipping technologies spur the trend, which helps maintain the region’s reputation for quality and innovation in shipbuilding.

Latin America (LATAM) and Middle East & Africa (MEA) Shipbuilding Market Insights

Growing offshore oil and gas activities, development of new ports infrastructure, and rise in sea borne trade are driving the LATAM and MEA shipbuilding markets. Advancements in naval modernization, merchant shipping and shipbuilding are driving growth with opportunities available within both the commercial and defense sectors of the maritime market.

Shipbuilding Market Key Players:

The Major Players are

-

Oshima Shipbuilding Co. Ltd.

-

Sumitomo Heavy Industries Ltd.

-

Damen Shipyards Group

-

General Dynamics Corporation

-

Huntington Ingalls IndustriesInc.

-

Samsung Heavy Industries Co. Ltd.

-

Hyundai Heavy Industries Co. Ltd.

-

Daewoo Shipbuilding & Marine Engineering Co. Ltd.

-

China State Shipbuilding Corporation (CSSC)

-

Japan Marine United Corporation

-

Imabari Shipbuilding Co. Ltd.

-

STX Offshore & Shipbuilding Co. Ltd.

-

Mazagon Dock Shipbuilders Limited

-

Cochin Shipyard Limited

-

Austal Limited

-

Navantia S.A.

-

Mitsubishi Heavy Industries Ltd-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 167.41 Billion |

| Market Size by 2035 | USD 233.43 Billion |

| CAGR | CAGR of 3.38% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By End User (Transport and Military) • By Ship Type (Bulk Carriers, General Cargo Ships, Container Ships, Passenger Ships and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Korea Shipbuilding & Offshore Engineering Co., Ltd., Mitsubishi Heavy Industries, Ltd., Oshima Shipbuilding Co., Ltd., Sumitomo Heavy Industries, Ltd., Damen Shipyards Group, Fincantieri Group, Bae Systems Plc, General Dynamics Corporation, Huntington Ingalls Industries, Inc., Samsung Heavy Industries Co., Ltd., and other players. |