Flexible Paper Market Report Scope & Overview:

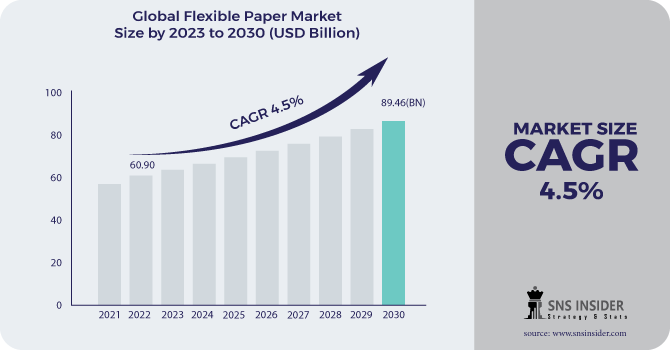

The Flexible Paper Market size was USD 73 billion in 2023 and is expected to reach USD 111.1 billion by 2032 and grow at a CAGR of 4.8% over the forecast period of 2024-2032.

Get more information on Flexible Paper Market - Request Sample Report

Flexible paper market is primarily driven by the growing need for paper-based packaging. The increase in demand is primarily due to increased awareness of environmental issues and the need for sustainable packaging solutions globally. The new generation of consumers especially in the developed markets are becoming increasingly aware of the harm that plastic waste can have on the environment, thus leading to the desire for eco-friendly solutions. This has generated a preference shift towards sustainable preference such as a preference for biodegradable, recyclable, and usually made from renewable resource material which is related to paper-based preference that fits on the growing trend of sustainability. And, paper packaging is being adapted as a realistic & eco-friendly solution, especially within food & beverages, e-commerce, and retail industries.

Additionally, a lot of brands are switching to paper-based materials that consumers demand to obtain more sustainable products as well as making it required to comply with stringent regulations and prohibitions on single-use plastics. From food wrappers to shipping boxes, there is a wide variety of paper-based products driven largely by the fact that paper is inexpensive and can be used in different applications. The increase in e-commerce has also contributed to this demand as packaging products in paper provides a perfect shipping solution, as it reduces the carbon footprint of transportation.

The European Paper Recycling Council reports that the recycling rate of paper packaging in Europe reached 82.6% in 2021, highlighting the increasing use and recycling of paper-based packaging in the region.

This trend of digital printing for packaging holds significant importance for the growth of the flexible paper market as it provides various advantages in compliance with changing consumer and brand demands. With the aid of digital printing, high-quality, full-color, customized printing with low set-up and run costs can be carried out on paper packaging without the requirement of traditional printing plates, making it economic for short runs and individualized packaging. Brand owners, especially in sectors like food & beverages, cosmetics & retail, would like to develop unique attention-grabbing packaging that would engage consumers. On top of that, digital printing shortens turnaround times and enables quicker design changes, while prints on-demand lead to less waste and a smoother supply chain process. As consumers become more concerned about product design and branding, digital printing offers the ability to provide personalized, limited-edition packaging to gain a competitive edge.

The U.S. Department of Commerce highlights that digital printing in packaging has grown significantly due to the demand for more sustainable and customized products. According to the 2021 National Association for Printing Leadership (NAPL) report, digital printing’s share in the overall printing market has been increasing, with packaging and label printing particularly benefiting from this technology.

Flexible Paper Market Dynamics

-

Increasing the use of flexible packaging in the pharmaceutical industry drives the market growth.

Flexible packaging for pharmaceutical products is one of the main factors boosting growth for the flexible paper market. Flexible packaging, including pouches, wraps, and blister packs, provides a variety of benefits over traditional rigid packaging, which encourages its use for pharmaceutical products. This change is largely due to the need for lower-cost, lightweight, and compact packaging alternatives. As a result, it weighs less and is cheaper to manufacture than rigid packaging but also requires less space and weight to transport. Moreover, flexible packaging offers excellent barrier properties, which helps protect sensitive pharma products from outside environmental influences including moisture, oxygen, and light to prolong shelf life and ensure product integrity. Flexible packaging is simple to customize therefore, pharmaceutical companies can quickly change their packaging designs to comply with regulatory standards, optimize patient compliance, and increase brand recognition. In addition to this, the trend towards sustainable practices in the pharmaceutical industry, with an emphasis on less plastic waste and greater recyclability, has fuelled demand for paper-based flexible packaging.

The U.S. Department of Commerce’s International Trade Administration (ITA) reports that the U.S. pharmaceutical packaging market is embracing flexible materials, driven by the need for cost-effective, secure, and eco-friendly packaging solutions.

Restraint

-

Government regulations and laws may hamper the market growth.

Government regulations and laws safeguard the safety and quality of raw materials and packaging materials to be used and are imperative for the natural environment and sustainability of flexible paper markets, but they also pose opportunities and threats to the growth of the market. This may include stringent regulation on materials like banning certain chemicals from packaging or requiring lengthy testing and certification processes, adding to production costs and slowing time-to-market. For instance, packaging materials in the pharmaceutical industry must comply with stringent requirements to guarantee the quality of drugs, which, in turn, becomes a restriction to grow more innovative in packaging designs. Packaging laws that promote recyclability or biodegradability solutions may necessitate investments in new technologies or manufacturing processes from manufacturers, resulting in a high cost. In addition to that, storage and transportation of these materials may be affected by environmental regulations such as prohibitions against single-use plastics or mandates for recyclable content, which could force manufacturers toward alternative materials or practices, but that will take time and be difficult.

Flexible Paper Market Segmentation

By Packaging Type

Pouches held the largest market share around 42% in 2023. This is owing to their versatility, cost-effectiveness, convenient lightweight packaging, and rising demand for sustainable packaging solutions. Owing to several advantages offered by pouches over the conventional packaging formats such as cans or bottles, pouches are used across industries including food & beverages, pharmaceuticals, personal care, etc. Because they are lightweight, they are more portable, take up less room, and will cost less to produce and move than a bulk product. Pouches also have great barrier properties that protect contents from moisture, air, and light which helps increase shelf life and maintain product quality. The customizability of pouches in shapes, sizes, and styles also adds to its popularity quotient, as brands can customize their pouches and stand apart from the other brands on the store shelf and use them as per the specific needs of consumers.

By Technology

Flexography held the largest market share around 38% in 2023. Flexography is one of the efficient, versatile, and high-quality printing technologies suitable for printing on many flexible packaging substrates in the flexible packaging market. Flexography is a printing type that uses flexible relief plates, which does allow for quicker turnaround times, along with fast-drying inks, good for high volume runs and for a broad range of substrates (getting placed on items like paper, plastic and foil). Due to its versatility in printing on a wide range of substrates with high clarity and accuracy at high speeds, it is widely used in food and beverages, pharmaceutical, and consumer goods industries. Flexography is also very cost-efficient, especially for bulk printing, it takes less time to set up, and it can print long runs of continuous products without the need for process changeovers.

By Embellishing Type

Hot coil held the largest market share around 49% in 2023. It is due to its resistivity, adaptability, and strength to provide effective sealing and protection of various products. The hot coil sealing describes the process here packaging materials are bonded with the help of heated rollers. This process is extremely valuable in forming secure, tamper-evident seals required for various applications across numerous industries including food, pharmaceuticals and consumer goods. Sealing here serves the purpose of packaging not getting opened during the handling, storage and transport of goods, which is a way of ensuring quality of the product and increasing its shelf life. Hot coil method is highly advantageous in sealing diverse materials such as papers, films, and laminates and therefore can be used for different packaging applications. The processing times and efficiency are also fast, and this is important for large-scale manufacturing's. In addition, the hot coil sealing technology is a low-cost scalable process, thus making it easier for both small and large manufacturers to adopt.

.png)

Get Customized Report as per your Business Requirement - Request For Customized Report

Flexible Paper Market Regional Analysis

Asia Pacific held the largest market share around 46% in 2023. It is owing to the growing middle class, rapid industrialization and demand for packaged goods in the region. Countries such as China, India, and Japan are some of the largest players in flexible packaging that house some of the biggest manufacturing hubs in the world. Flexible paper packaging is benefitting tremendously from the surging e-commerce industry, increasing disposable incomes, and the growing consumer preference towards convenient, sustainable, and innovative packaging alternatives in the region. Moreover, as a result of government initiatives to curb plastic waste in Asia-Pacific countries, sustainable methods are being adopted which will further drive the demand for paper-based and recyclable packaging materials. These learnings, coupled with the region's capacity to produce at low-cost and the presence of mass manufacturing and supply-chain network, has cemented its position in the global market. Emerging as a vital growth arena for flexible packaging, the Asia-Pacific market benefits from both a larger consumer pool and an escalating investment wave for packaging research and development and sustainable products.

Key Players

-

Mondi Group (Kraft paper, Barrier paper)

-

Sealed Air Corporation (Bubble Wrap, Cryovac packaging)

-

Sappi Global (Gloss paper, Coated paper)

-

Sabert (Takeout containers, Foodservice packaging)

-

Amcor Limited (Flexible pouches, Rigid containers)

-

Sonoco Products Company (Paperboard packaging, Flexible films)

-

Huhtamaki OYJ (Foodservice packaging, Flexible films)

-

DS Smith (Recycled paper, Corrugated packaging)

-

Wihuri (Packaging solutions, Paper products)

-

Coveris Holding SA (Flexible films, Rigid packaging)

-

Berry Global Inc. (Flexible packaging, Tapes and labels)

-

WestRock (Paperboard, Corrugated packaging)

-

Tetra Pak (Liquid food packaging, Carton packaging)

-

Smurfit Kappa (Corrugated packaging, Paper-based solutions)

-

Stora Enso (Packaging board, Wood products)

-

Chesapeake (Printed packaging, Label solutions)

-

Koch Industries (Packaging films, Adhesives)

-

Mölnlycke (Medical packaging, Surgical drapes)

-

Huhtamaki (Food packaging, Beverage cups)

-

RPC Group (Plastic and paper packaging, Injection-molded packaging)

Recent Development:

-

In 2024, Amcor announced the development of AmLite Ultra Recyclable, a flexible, high-barrier packaging that is recyclable and designed for the food industry. This packaging is a key part of Amcor's ongoing efforts to develop sustainable packaging solutions by reducing plastic waste.

-

In 2023, Mondi launched a new paper-based packaging solution for the food industry, designed to be fully recyclable and reduce the environmental impact of packaging waste. The product focuses on replacing plastic with sustainable paper-based alternatives, aligning with Mondi’s commitment to the sustainable packaging trend.

-

In 2023, DS Smith unveiled Recycled Corrugated Packaging with enhanced durability and strength for e-commerce businesses. This packaging is made from 100% recycled content and is fully recyclable, supporting the circular economy.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 73 Billion |

| Market Size by 2032 | USD 111.1 Billion |

| CAGR | CAGR of 4.8% From 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Packaging Type (Pouches, Rollstock, Shrink Sleeves, Wraps, Others) • By Technology (Rotogravure, Flexography, Digital Printing, Others) • By Embellishing Type (Hot Coil, Cold Coil, Others) • By Application (Food, Spirits, Healthcare, Beauty & Personal Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Mondi Group, Sealed Air Corporation, Sappi Global, Sabert, Amcor Limited, Sonoco Products Company, Huhtamaki OYJ, DS Smith, Wihuri, Coveris Holding SA |

| Drivers | • Increasing the use of flexible packaging in the pharmaceutical industry drives the market growth |

| Restraints | • Government regulations and laws may hamper the market growth. |