Foot Orthotic Insoles Market Size & Overview:

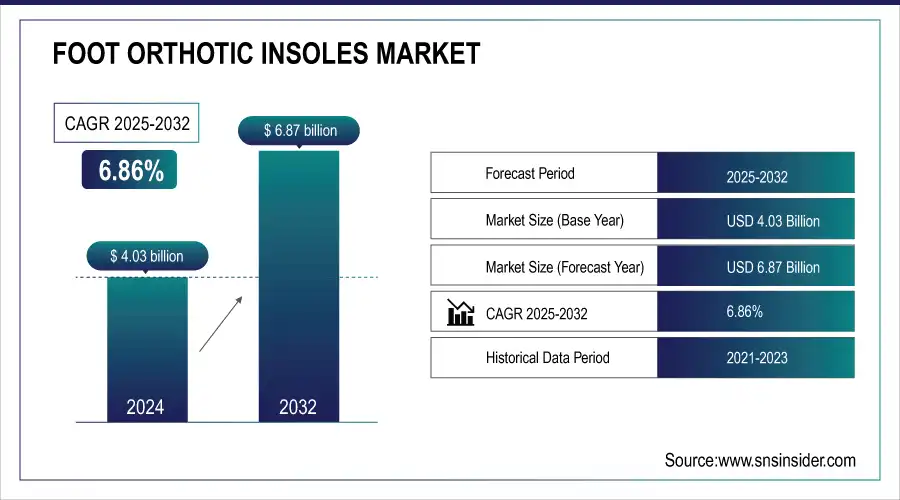

The Foot Orthotic Insoles Market was valued at USD 4.03 Billion in 2025E and is projected to reach USD 6.87 Billion by 2033, growing at a compound annual growth rate (CAGR) of 6.86% from 2026 to 2033.

This report insights the need for orthotic insoles is being driven by the rising incidence and prevalence of foot diseases such as flat feet and plantar fasciitis. The study looks at consumer and prescription patterns in several geographical areas, highlighting differences in product preferences and acceptance. It also looks at innovation trends and technological developments, such as the creation of personalized 3D-printed insoles and sensor-enabled smart insoles. Analysis of consumer preferences and purchasing patterns also highlights the trend toward eco-friendly, comfort-driven, and performance-enhancing orthotic solutions as well as the growing role of e-commerce in product distribution.

Market Size and Forecast:

-

Market Size in 2025E: USD 4.03 Billion

-

Market Size by 2033: USD 6.87 Billion

-

CAGR: 6.86% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get More Information on Foot Orthotic Insoles Market - Request Sample Report

The U.S. Foot Orthotic Insoles market size was valued at an estimated USD 1.55 billion in 2025 and is projected to reach USD 2.65 billion by 2033, growing at a CAGR of 5.2% over the forecast period 2026–2033. Market growth is driven by the increasing prevalence of foot-related disorders such as plantar fasciitis, flat feet, and diabetic foot complications, along with rising awareness of preventive foot care. Growing adoption of customized and 3D-printed orthotic solutions, expanding use among athletes and active individuals, and recommendations from podiatrists and orthopedic specialists are accelerating market expansion. Additionally, advancements in materials technology, improved comfort and durability, and wider availability through retail and e-commerce channels further support the steady growth outlook of the U.S. foot orthotic insoles market during the forecast period.

Key Foot Orthotic Insoles Market Trends

-

Rising adoption of customized and 3D-printed insoles for personalized comfort and foot health.

-

Increasing awareness of foot health and posture correction, particularly among working professionals and athletes.

-

Growing prevalence of diabetes, obesity, and musculoskeletal disorders, driving demand for therapeutic orthotics.

-

Expansion of sports and active lifestyle segments, emphasizing performance-enhancing and shock-absorbing insoles.

-

Technological integration of smart insoles and wearable sensors for gait analysis and pressure monitoring.

-

Rising preference for eco-friendly and sustainable materials in insole manufacturing.

-

Increasing online retail penetration and direct-to-consumer (D2C) sales models.

Foot Orthotic Insoles Market Growth Drivers

-

The increasing prevalence of foot-related disorders, growing awareness about foot health, and advancements in technology.

The need for orthotic insoles has increased as a result of the rise in ailments like arthritis, flat feet, and plantar fasciitis. For example, more than 10% of people worldwide have foot issues, and many are looking for practical treatments like custom orthotics. The market is expanding due to technological advancements like gait analysis and AI-powered 3D scanning, which have reduced the cost and increased accessibility of foot orthotic treatments. Additionally, foot orthotics are easily accessible to customers because of the growing awareness of preventative healthcare and the growth of e-commerce platforms. The need for tailored solutions has also increased as a result of the global aging population.

Foot Orthotic Insoles Market Restraints

-

High costs associated with custom orthotics and limited insurance coverage remain significant barriers to market growth.

The initial cost of custom-made insoles, which can reach USD 300, deters many buyers and limits their accessibility for lower-income groups. Further limiting affordability is the fact that foot orthotics are frequently not covered by health insurance programs in many nations. In certain areas, where foot health problems are frequently underdiagnosed or ignored, a lack of awareness further limits the market. Additionally, a lack of regulations in the production of inexpensive insoles may result in inferior products that do not offer the required support, making customers reluctant to spend money on foot orthotic treatments.

Foot Orthotic Insoles Market Opportunities

-

The increasing use of digital health technologies, including AI-driven 3D scanning and gait analysis.

This makes it possible for businesses to offer personalized insoles at more affordable costs, increasing their reach among customers. Additionally, there is a great chance for foot orthotic companies to meet these needs given the rising incidence of chronic diseases like diabetes, which frequently result in foot issues. Additionally, the emergence of e-commerce platforms has opened up new avenues for worldwide distribution, enabling companies to connect with clients in far-flung locations. These elements, along with the rising need for foot wellness and preventative healthcare products, present significant potential opportunities for producers of foot orthotics.

Foot Orthotic Insoles Market Challenges

-

The growing competition from low-cost, mass-produced alternatives that often lack the personalized touch of custom orthotics.

Some customers are unhappy with prefabricated insoles because, despite being less expensive, they do not provide the same degree of comfort and support as personalized solutions. Additionally, poor quality control and the spread of inferior products are caused by the absence of defined norms in the foot orthotics production process. This presents a big obstacle for businesses trying to keep their reputations and customers' trust. A significant obstacle is the scarcity of qualified experts who can accurately evaluate and recommend foot orthotics. The efficient distribution of bespoke orthotics is hampered by a lack of certified podiatrists in some areas. Additionally, the market is highly competitive with alternative therapies like physical therapy and surgery, which can discourage some customers from choosing orthotic insoles.

Foot Orthotic Insoles Market Segment Analysis

By Material

In 2025, the thermoplastics sector accounted for 58.8% of the market. In comparison to other materials, thermoplastics are more cost-effective, flexible, and lightweight, which accounts for their dominance. Since thermoplastics are so versatile, they can be used in a wide range of applications, especially in the orthopedic and medical domains. Their widespread use is further facilitated by their simplicity of shaping and reusability. Furthermore, improvements in material science have made thermoplastics stronger and more durable, which makes them a better option than conventional materials. The segment's dominance has been reinforced by the rising demand for ergonomic and patient-specific solutions.

However, it is anticipated that the composite carbon fiber market will expand at the fastest rate. Because of their superior performance over traditional materials, durability, and high strength-to-weight ratio, composite carbon fibers are becoming more and more popular. These fibers are perfect for long-term use in high-performance applications because of their exceptional resilience to wear and tear, especially in the sports and healthcare sectors. The growing use of carbon fiber composites in specialist medical and rehabilitation equipment is anticipated to support its explosive expansion in the upcoming years as technical advancements continue to spur innovation.

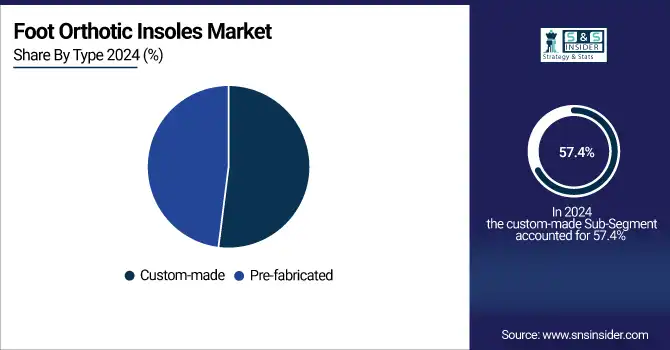

By Type

In 2025, the custom-made segment dominated as the leading segment with 57.4% of the market share. The individualized fit, increased comfort, and greater performance of custom-made solutions make them popular. Better functionality and patient results are ensured by these items, which are specially designed to satisfy particular needs. Their use has been spurred by the rising incidence of musculoskeletal conditions as well as increased knowledge of the advantages of customized remedies. Further bolstering industry expansion are developments in digital scanning and 3D printing technologies, which have improved the accessibility and efficiency of custom manufacturing. It is anticipated that custom-made items will continue to dominate the market as the need for extremely specific and patient-centric solutions grows.

It is projected that the prefabricated category will increase at the fastest rate. Because of their instant availability, cost, and convenience, prefabricated solutions are a desirable choice for both patients and healthcare professionals. Among the many customers served by these items are those who need basic solutions without a lot of customization. Prefabricated medical and orthopedic devices are becoming more and more popular because of their affordability and growing demand from emerging economies. This trend is anticipated to fuel the segment's expansion soon.

By Distribution Channel

In 2025, the market was dominated by the hospitals and clinics segment, which held a 41.2% share. Hospitals and clinics are the biggest distribution channels because they are the first-place patients go to when they need medical help. A major factor in the segment's domination is the legitimacy and experience of healthcare facilities, where patients receive individualized treatment regimens and expert advice. Furthermore, a variety of medical technologies and tailored solutions are available in hospitals and clinics, improving patient outcomes. The growing need for specialized healthcare services and the rising incidence of chronic diseases serve to further solidify this segment's dominance.

The drugstore sector is anticipated to increase at the fastest rate. Drug stores give customers an easy way to buy orthopedic and medical supplies without having to go to the hospital. The development of retail pharmacies and the popularity of over-the-counter (OTC) medical products have both fueled the segment's expansion. Additionally, the demand for medical products sold in pharmacies has increased due to consumers' growing preference for self-care and home-based therapies. The drugstore industry is expected to increase significantly in the upcoming years due to the quick expansion of pharmacy chains and the incorporation of e-commerce.

Foot Orthotic Insoles Market Regional Analysis

North America Foot Orthotic Insoles Market Insights

North America was the dominant region in the foot orthotic insoles market in 2025, Due to several factors, including a strong healthcare infrastructure, rising healthcare awareness, and the need for more individualized healthcare solutions. The US has the most market share in this area because of its sophisticated medical technology, extensive use of digital health solutions, and rising rates of foot-related conditions such as arthritis, flat feet, and plantar fasciitis. Aetrex Worldwide and Hanger Inc. are two significant market participants that further reinforce the industry dynamics. The need for foot orthotics is also driven by North America's aging population and growing knowledge of preventive healthcare.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Asia Pacific Foot Orthotic Insoles Market Insights

The foot orthotic insoles market is increasing significantly in the Asia Pacific region, mostly as a result of an aging population, improved disposable incomes, and more healthcare awareness. Because more people are experiencing foot-related problems and because healthcare is becoming more preventive, countries like China, India, Japan, and South Korea are seeing a sharp increase in demand for foot orthotics. Both custom-made and prefabricated foot orthotics are growing in popularity as the area continues to urbanize and upgrade its healthcare facilities. The Asia Pacific market is also anticipated to be driven in the upcoming years by the expanding middle class and rising awareness of the value of foot health.

Europe Foot Orthotic Insoles Market Insights

Europe holds a significant share in the Foot Orthotic Insoles Market in 2025, driven by growing awareness of foot health, posture correction, and lifestyle-related disorders. Countries such as Germany, the U.K., and France are witnessing increased adoption of custom and 3D-printed orthotics, supported by podiatry clinics, sports rehabilitation centers, and healthcare providers. Rising prevalence of diabetes and obesity further fuels demand for therapeutic insoles, while innovative materials and smart insole technologies are gaining traction across the region.

Latin America (LATAM) Foot Orthotic Insoles Market Insights

The LATAM Foot Orthotic Insoles Market is gradually expanding due to rising healthcare awareness, increased disposable income, and growing sports and active lifestyle adoption. Brazil, Mexico, and Argentina are emerging as key markets, with increased demand for custom orthotics and prefabricated insoles for both therapeutic and lifestyle applications. Partnerships between healthcare providers and orthotic manufacturers are enhancing accessibility, while online and retail distribution channels support regional growth.

Middle East & Africa (MEA) Foot Orthotic Insoles Market Insights

The MEA region is showing increasing interest in foot orthotic insoles, driven by urbanization, rising lifestyle-related foot disorders, and healthcare infrastructure development. Countries such as the UAE, Saudi Arabia, and South Africa are seeing adoption in both clinical and lifestyle segments, including sports and occupational use. Awareness campaigns, local partnerships, and investments in advanced orthotic solutions are expected to boost market penetration across the region.

Foot Orthotic Insoles Market Competitive Landscape

Stride Soles

Stride Soles is a healthcare technology company specializing in foot care solutions, focusing on AI-driven and tele podiatry-enabled orthotic innovations.

-

In December 2024, Stride Soles launched an advanced tele podiatry platform, offering podiatrist-designed custom orthotics through AI-driven smartphone 3D scanning and gait analysis. This solution provided a faster, more affordable, and clinically robust alternative to traditional in-clinic orthotics, transforming access to professional-grade foot care.

Foot Orthotic Insoles Market Key Players

-

Reckitt Benckiser Group PLC: Scholl Orthotic Insoles

-

Hanger Inc.: Hanger Custom Orthotics

-

Ottobock SE & Co. KGaA: Agilium Freestep

-

Össur hf: Formfit Orthotics

-

Algeo Limited: Slimflex Simple

-

Bauerfeind AG: ErgoPad series

-

Groupe Gorgé: Prodways PODO range

-

Colfax Corporation: Keen Utility K-30 Insole

-

Superfeet Worldwide Inc.: Superfeet Green

-

Materialise NV: Phits Insoles

-

Blatchford Group Limited: Linx Foot Orthotics

-

Implus Footcare LLC: Sof Sole Insoles

-

Aetrex Worldwide, Inc.: Lynco Orthotics

-

Footbalance System Ltd.: Footbalance 100% Custom Insoles

-

Tynor: Tynor Flat Foot Insole

-

Digital Orthotics Laboratories Australia Pty Ltd.: Custom Foot Orthotics

-

Thuasne: Malleo Dynastab Boa

-

Foot Science International: Formthotics

| Report Attributes | Details |

|---|---|

|

Market Size in 2025E |

USD 4.03 billion |

|

Market Size by 2033 |

USD 6.87 billion |

|

CAGR |

CAGR of 6.86% From 2026 to 2033 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2033 |

|

Historical Data |

2022-2024 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Material [Thermoplastic, Composite Carbon Fiber, Others] |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

|

Company Profiles |

Reckitt Benckiser Group PLC, Hanger Inc., Ottobock SE & Co. KGaA, Össur hf, Algeo Limited, Bauerfeind AG, Groupe Gorgé, Colfax Corporation, Superfeet Worldwide Inc., Materialise NV, Blatchford Group Limited, Implus Footcare LLC, Aetrex Worldwide, Inc., Footbalance System Ltd., Tynor, Digital Orthotics Laboratories Australia Pty Ltd., Thuasne, Foot Science International. |