Carbon Fiber Market Report Scope & Overview:

Get E-PDF Sample Report on Carbon Fiber Market - Request Sample Report

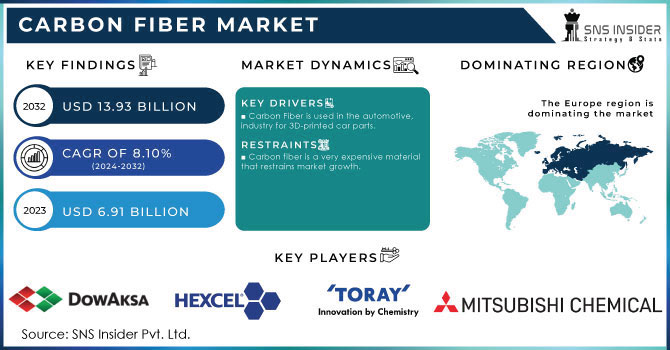

The Carbon Fiber Market Size was valued at USD 6.91 billion in 2023 and is expected to reach USD 13.93 billion by 2032 and grow at a CAGR of 8.10% over the forecast period 2024-2032.

The high strength-to-weight ratio of carbon fiber is driving the growing need for it in the aerospace and defense industries, as it is perfect for making lightweight parts for aircraft. This is essential because the aerospace sector is concentrated on decreasing fuel usage and emissions. According to the U.S. Department of Energy states that cutting an aircraft's weight by 1% could result in fuel savings of around 0.75%. Consequently, carbon fiber is more commonly used in commercial and military plane manufacturing.

Moreover, the Clean Sky 2 initiative from the European Union also increases the need for carbon fiber by promoting sustainable and efficient aircraft technologies. The worldwide defense industry is increasingly incorporating carbon fiber for light armor and structural parts, as countries aim to upgrade their military equipment.

Furthermore, the increasing use of carbon fiber in sports and leisure gear is due to its lightweight and durable attributes, boosting performance significantly. Professional cyclists prefer carbon fiber bicycles due to their enhanced strength and lower weight, which enable increased speed and improved maneuvering abilities.

For instance, in 2023, Trek Bikes launched a new range of carbon fiber mountain bikes that are both lighter and more durable, providing better performance in competitive environments. In the same way, carbon fiber tennis rackets like the 2022 Wilson Pro Staff RF97 offer players improved control and power because of their lighter weight and greater stiffness. These advancements showcase the increasing use of carbon fiber in sports due to the demand for top-notch gear

Additionally, the wind energy industry has emerged as a major carbon fiber user due largely to large turbine blades. The lightweight, but strong properties of carbon fiber make them perfectly suited for the blades allowing them to be longer and more efficient in capturing more wind energy when spinning to generate electricity. Hence it increases the demand for carbon market

MARKET DYNAMICS

KEY DRIVERS:

Carbon Fiber is used in the automotive, industry for 3D-printed car parts.

The lightweight and high-strength qualities of carbon fiber combined with the adaptability of 3D printing enable the production of intricate, personalized parts that are efficient and long-lasting. Carbon Fiber is used to make automobile springs, racing car bodies, golf club shafts, aircraft and spacecraft parts, bicycle frames, fishing rods, sailboat masts, and many other components. Carbon fiber material has led industries to push the boundaries and create new developments for the future of the next generation. For instance,

In 2022, Lamborghini teamed up with Carbon, a digital manufacturing firm, to create 3D-printed carbon fiber components like air vents and spoilers for their supercars, leading to vehicles that are lighter and more aerodynamically effective. This method not only accelerates the manufacturing process but also decreases material wastage, in line with the automotive sector's focus on sustainability. With the ongoing advancements in 3D printing technology, it is anticipated that the utilization of carbon fiber in automotive sectors will increase, leading to more innovations in vehicle design and production.

RESTRAIN:

Carbon fiber is a very expensive material that restrains market growth.

The manufacture of carbon fiber is costly due to intricate procedures and pricey inputs, resulting in a higher cost in comparison to materials such as steel or aluminum. The high cost prevents many industries, like automotive manufacturing, from widely implementing it, as companies in these sectors need to consider both performance and cost-effectiveness. For example, carbon fiber is great for decreasing vehicle weight and improving fuel efficiency. However, its high cost makes it impractical for mainstream vehicles, limiting its use to luxury and high-performance cars. Furthermore, smaller manufacturers may be discouraged from incorporating carbon fiber into their products due to its high cost, which in turn hinders market growth.

MARKET SEGMENTATION

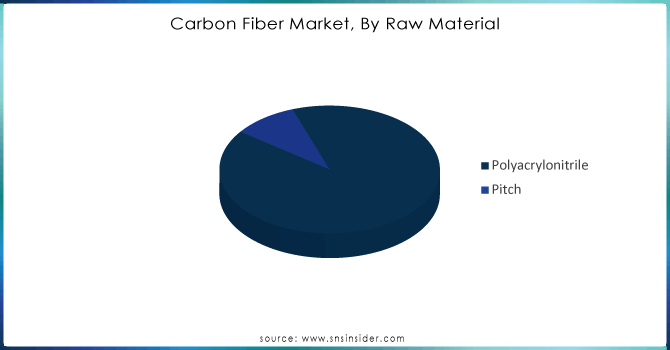

By Raw Material

Polyacrylonitrile (PAN) segments held the largest market share market around 90.45% in 2023. Carbon fibers based on PAN provide a great strength-to-weight ratio, impressive tensile strength, and exceptional thermal stability, which make them perfect for challenging uses in aerospace, automotive, and defense sectors. Furthermore, PAN is a more readily available and affordable raw material in comparison to substances such as pitch, making it the top option for mass carbon fiber manufacturing. The traditional methods of production for PAN-based carbon fibers also play a role in their prevalence, as they guarantee steady quality and performance, reinforcing PAN's top spot in the industry.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

By Tow

In the tow size segment, small tow held the largest market share around 78.63% in 2023. A small tow is characterized by having fewer filaments of carbon fibers, usually around 24,000 per tow, leading to increased strength and stiffness when compared to larger tow fibers. These attributes are what make small-town carbon fibers highly applicable in sectors such as aerospace, automotive, and sports equipment, where accuracy and efficiency are crucial. Furthermore, it is simpler to work with and incorporate small tow fibers into composite materials, which is why they are often chosen for more complex uses. Their dominant market share is also boosted by the fact that they are widely utilized in the production of crucial components like aircraft parts, automotive panels, and high-end sporting goods.

By Application

In the application segment aerospace & defense segment held the largest market share around 34.34% in 2023. The lightweight properties of carbon fiber led to a substantial decrease in fuel usage and improved the strength of aircraft and military gear, making it a crucial component of contemporary aerospace and defense innovations. An illustration would be the widespread utilization of carbon fiber composites in constructing aircraft fuselages, wings, and military vehicles to enhance efficiency and operational performance. The primary use of carbon fiber in the aerospace and defense industries is driven by the industry's emphasis on weight reduction, fuel efficiency improvements, and the need for advanced, high-strength materials. The constant need for new aircraft and advanced defense technologies means that aerospace and defense remain the top users of carbon fiber.

REGIONAL ANALYSIS

Europe held the largest market share in the carbon fiber market about 32.56% in 2023. This dominance is because of its sturdy industrial foundation, highly developed technological skills, and substantial funding in the aerospace and automotive industries. The area is where top aerospace companies such as Airbus and defense firms make extensive use of carbon fiber in producing high-performance parts, including those for airplanes and military gear. Europe also has a strong automotive sector that prioritizes innovation, especially in creating electric and high-performance vehicles that utilize carbon fiber to improve fuel efficiency and overall performance. The generous funding from the European Union for research and development, along with its strict regulations on emissions and environmental standards, continues to boost the need for high-tech materials such as carbon fiber. Europe's strong carbon fiber production infrastructure and focus on high-tech sectors help maintain its leading role in the worldwide market for carbon fiber.

Key players

Mitsubishi Chemical Corporation, Toray Industries Inc., DowAksa, Solvay, Hexcel Corporation, Hyosung Advanced Materials, Zhongfu Shenying Carbon Co., SGL Carbon Ltd, Teijin Limited, Formosa Plastic Corporation and other key players.

RECENT DEVELOPMENTS

-

Toray- In 2023 Toray has announced development of a technology that thermally welds carbon fiber reinforced plastics (CFRP) at high speed. The high-rate production and weight reduction of CFRP airframes will be made possible by this technology. In addition to extending CFRP applications, the company will continue with demonstrations with an eye on commercializing airframes after 2030.

-

In 2023, SGL Carbon launched a fresh carbon fiber manufacturing facility in China, with a focus on satisfying the growing demand in the Asia-Pacific area. This establishment is projected to improve SGL's ability to provide carbon fiber for automotive and industrial uses.

-

Hexcel Corporation- In 2022 Hexcel Corporation has signed an agreement with Dassault to supply carbon fiber prepreg for Dassault F10X program.

-

Mitsubishi Chemical Corporation- In 2021 A cyanate ester carbon Fiber prepreg* that offers high heat resistance and exceptional strength has been developed by Mitsubishi Chemical Corporation. As demand of tightened environmental regulations for lighter aircraft and many other applications which do not harm environment.

| Report Attributes | Details |

| Market Size in 2023 | US$ 6.91 Bn |

| Market Size by 2032 | US$ 13.93 Bn |

| CAGR | CAGR of 8.10% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Raw material (PAN, Pitch) • By Tow (Large, Small) • By Application (Aerospace & Defense, Wind Energy, Automotive, Electronics &Electrical, Sports, Other) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Mitsubishi Chemical corporation, Toray Industries Inc., DowAksa, Solvay, Hexcel Corporation, Hyosung Advanced Materials, Zhongfu Shenying Carbon Co., SGL Carbon Ltd, Teijin Limited, Formosa plastic corporation |

| Key Drivers | • Carbon Fiber is used in the automotive industry for 3D-printed car parts. |

| Market Opportunities | • Carbon fiber is a very expensive material that restrain market growth. |