Digital Health Market Report Scope & Overview:

Get More Information on Digital Health Market - Request Sample Report

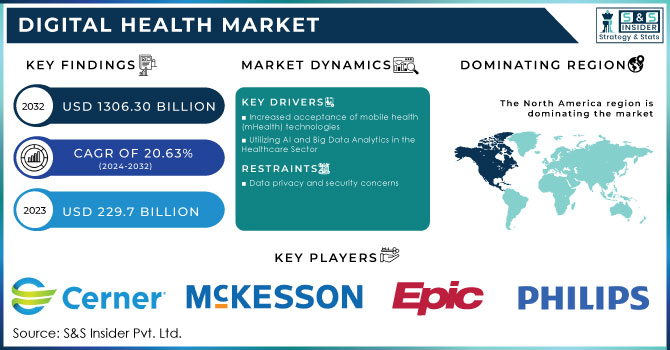

The Digital Health Market Size was valued at USD 229.7 billion in 2023 and is expected to reach USD 1306.30 billion by 2032, growing at a CAGR of 20.63% from 2024-2032.

The Digital Health Market is rapidly expanding, powered by the merging of technology and healthcare. There is a wide variety of digital health solutions in the pharmaceutical industry, such as telemedicine, mHealth, wearable devices, AI, and digital therapeutics. These advancements are changing the way healthcare is provided, enhancing patient results, and boosting the overall effectiveness of healthcare systems.

The increasing use of telemedicine and remote patient monitoring is a crucial factor driving the growth of the pharmaceutical digital health market. With the global trend towards patient-focused healthcare systems, digital technologies enable patients to receive remote care, control chronic illnesses, and keep in touch with healthcare professionals.

Apart from telemedicine, wearable devices, and mobile health apps have also given patients the ability to monitor their health metrics in real-time. Wearable devices like fitness trackers, smartwatches, and medical-grade gadgets offer ongoing tracking of important signals such as heart rate, blood pressure, and glucose levels. These tools allow for the detection of possible health problems in advance, aid in preventive care, and offer healthcare professionals important data for treatment decisions.

Pharmaceutical companies are also adopting digital health technologies to improve drug development and patient engagement. For instance, digital therapeutics provide interventions driven by software that can supplement or possibly substitute conventional treatments. AI and big data analytics are being used to make clinical trials more efficient, discover potential new drugs, and customize treatment strategies according to each patient's unique profile.

Furthermore, the landscape of digital health is being significantly shaped by government financing and efforts. There is a strong push for healthcare digitization in nations like India, where the National Digital Health Mission seeks to provide digital health records for all inhabitants. Similarly, with USD 15 billion raised in 2023 alone, the United States is witnessing significant investment in digital health firms. All things considered, the pharmaceutical digital health market is poised for revolutionary expansion, propelled by innovation and the pressing demand for more effective medical treatments.

Digital Health Market Dynamics

Drivers

- Increased acceptance of mobile health (mHealth) technologies

The increased utilization of smartphones, wearables, and health apps has greatly enhanced the acceptance of digital health solutions. Due to the rise in mobile device usage, patients are increasingly involved in their health management using tools such as mHealth apps for remote monitoring and better management of chronic diseases. It is estimated that by the year 2032, mHealth apps will dominate a market share of over 20-25% due to increasing interest in self-tracking, telehealth, and managing personal health data. It is anticipated that over 1.5 billion individuals will be using mHealth by 2032, which will continue to encourage the utilization of digital health solutions. This pattern allows pharmaceutical companies to provide more customized care, improve treatment adherence, and collect up-to-date data for research and development, ultimately improving healthcare results.

- Utilizing AI and Big Data Analytics in the Healthcare Sector

At the same time, AI and big data analysis in healthcare are changing the pharmaceutical digital health field. Artificial intelligence is used for drug discovery, predictive diagnostics, personalized medicine, and improving treatment pathways. These technologies enhance clinical results while also cutting costs and facilitating better decision-making. It is anticipated that from 2023 to 2032, the healthcare analytics industry will experience a growth rate of 20%, with AI and healthcare analytics expected to make up 15-20% of the digital health market by 2032. Pharmaceutical companies are more and more utilizing these advancements to improve the effectiveness of clinical trials, simplify drug manufacturing, and more precisely identify patient groups, ultimately resulting in quicker drug development and enhanced patient treatment.

Restraints

- Data privacy and security concerns

One major restraint for the pharmaceutical digital health market is data privacy and security concerns. With the increasing reliance on digital platforms, including mHealth apps, telehealth, and electronic health records (EHRs), vast amounts of sensitive health data are being generated and shared across systems. This creates significant challenges in ensuring the protection of patient data against breaches, cyberattacks, and unauthorized access.

Digital Health Market Segmentation Overview

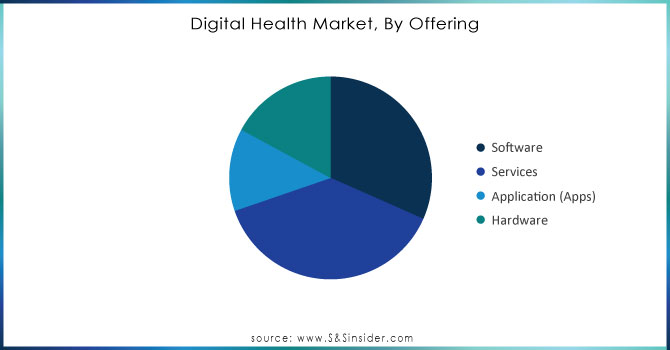

By Offerings

The services segment dominated the market in 2023 in terms of revenue share by 38%, because of the increasing need for services like installation, staffing, training, maintenance, and other services. Market participants are offering these services either on their own or as part of bundles. The rising need for advanced software solutions like Electronic Medical Records (EMRs) and EHR, along with the growing demand for upgrades and training to operate these solutions, is fueling the growth of this segment. According to a report from HealthIT.gov in 2021, almost 88% of doctors in U.S. offices utilize EHRs, with 80% using certified ones. Important stakeholders offer a variety of services before and after installation, including project planning, staffing, implementation, training, and resource allocation and optimization.

The software sector is expected to experience the highest CAGR of 22% between 2024 and 2032, driven by the quick uptake of software systems by patients, healthcare facilities, providers, and insurance payers. The increase in healthcare costs and the shift towards digitalizing healthcare are both helping to boost the software industry. The increase in consumer interest in personalized medicine and the shift towards value-based care is fueling growth in the sector. In developing countries, medical institutions easily embrace these modern software solutions and platforms to simplify their internal procedures and improve their medical, administrative, and financial results.

Need any customization research on Digital Health Market - Enquiry Now

By Technology

Based on technology, the telehealthcare segment led the market with the largest revenue share of 23% in 2023 and is also expected to register the fastest CAGR over the forecast period. This growth rate can be attributed to advancing internet connectivity, growing smartphone penetration, advanced technology readiness, a growing shortage of healthcare providers, increasing medical expenses, easy availability of telehealth applications, and rising adoption of these technologies by patients & physicians. The constant evolution of telehealth applications and rapid technological innovations further boost segment growth. Government support, policies promoting healthcare digitization, and growing healthcare IT spending are major factors driving segment growth.

The mHealth segment held the second-largest position in terms of revenue share in 2023 in the global market by a CAGR of 25%. Growing penetration of smartphones & internet connectivity and rising adoption of mHealth technologies by physicians & patients are factors driving segment growth. As per Uswitch Limited's calculations, the UK had approximately 71.8 million mobile connections at the beginning of 2022, surpassing the country's population by 4.2 million. which is equivalent to around 2.6 million new mobile connections. Increasing trend of preventive healthcare & rising funding for mHealth startups are other factors boosting the market.

By Application

Based on applications, the chronic disease management segment led the market with the largest revenue share of 33% in 2023 and is expected to register the fastest CAGR of 22% from 2024 to 2032. The prevalence of diabetes and its associated complications has positioned it as the largest segment in the digital health space. Digital health technologies offer innovative solutions to address the needs of individuals with diabetes. Digital health tools, ranging from smartphone applications for glucose monitoring to wearable devices that track physical activity and offer real-time health data, enable patients to actively engage in managing their diabetes. Moreover, these technologies facilitate remote patient monitoring, enabling healthcare providers to receive timely data, make informed decisions, and offer timely interventions, ultimately contributing to more effective diabetes management.

The health and fitness segment are fastest growing in application due to high global prevalence and the rising need for effective weight management solutions. Digital health technologies offer personalized interventions, ranging from mobile applications for dietary tracking to wearable devices monitoring physical activity, driving the segment's growth.

By End-use

In 2023, the Hospitals & Clinics segment dominated the market with a revenue share of 42% and is projected to experience the quickest CAGR from 2024 to 2032 due to the focus on patient-centered care and increased awareness of health management among individuals. Digital health technologies have transformed the healthcare field by giving patients tools for remote monitoring, self-care, and access to health information. The industry's dedication to improving patient engagement and promoting proactive health management is seen in mobile health apps tracking vital signs and telehealth platforms enabling virtual consultations for patients.

The Patients & Consumers sector growing rapidly in the worldwide market and is projected to sustain its market share throughout the forecast timeframe. In terms of revenue share in 2023 in the global market, it contributed 17% in 2023. The rise is fueled by the extensive use of new technologies like telemedicine and digital therapeutics. Healthcare professionals are more and more using digital tools to provide remote consultations, customized treatment plans, and scientifically proven therapies beyond traditional healthcare environments. The use of digital tools enables providers to offer more personalized and readily available care, leading to enhanced patient results.

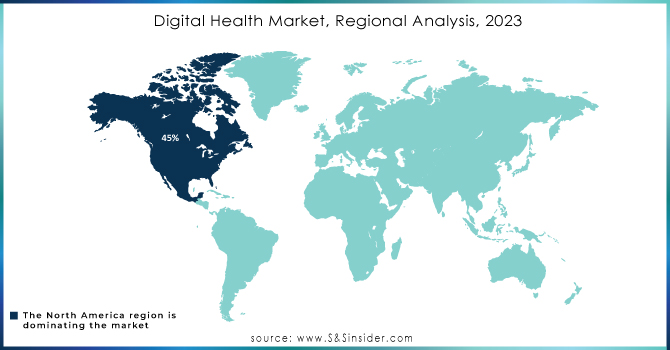

Digital Health Market Regional Analysis

North America led the digital health market, with the largest market share of around 45% in 2023. In the year 2023, digital health startups in North America received more than USD 10.7 billion in venture capital funding. The United States stands out primarily because of various reasons, such as having a strong healthcare system, substantial healthcare spending, and significant advancements in digital health technologies such as telemedicine, mobile health, and healthcare data analysis. Government programs such as the HITECH Act have promoted the extensive use of electronic health records (EHR), pushing the market to progress.

Moreover, the region's position is fortified by the involvement of major companies like GE Healthcare, IBM Watson Health, and Cerner Corporation. In 2032, North America's dominance will persist as it continues to lead the way with technological advancements, increased use of AI in healthcare, and supportive regulations, even though its share may dip slightly to 40-42%.

It is expected that the Asia-Pacific region will experience the highest growth in the digital health market, with its market share forecasted to rise from 20% in 2023 to approximately 23-25% by 2032. Nations such as China, India, and Japan are leading in this expansion, propelled by higher smartphone usage, growing knowledge of digital health options, and an increased emphasis on telemedicine and healthcare management systems.

In India, the government is working on transforming healthcare by implementing the National Digital Health Mission (NDHM) and Ayushman Bharat Digital Mission to provide digital health records for every citizen. Likewise, in China, the medical industry is quickly adopting telemedicine and artificial intelligence, fueled by governmental backing and the necessity to care for an increasing number of elderly individuals with long-term illnesses. Moreover, the increasing elderly population in Japan is driving the use of remote patient monitoring and digital therapeutics to control healthcare expenses and enhance patient results.

Key Players in Digital Health Market

-

Cerner Corporation (Cerner Millennium, PowerChart)

-

IBM Watson Health (Watson for Oncology, Watson Health Cloud)

-

McKesson Corporation (McKesson Connect, Pharmacy Management Solutions)

-

Epic Systems (EpicCare, MyChart)

-

Allscripts Healthcare Solutions (TouchWorks HER, FollowMyHealth)

-

Philips Healthcare (Philips IntelliSpace, Wearable Biosensor)

-

Siemens Healthineers (syngo.via,Digital Health Solutions)

-

Health Catalyst (Data Operating System, Analytics Apps)

-

Qualcomm Life (96North, SnapTrack)

-

SAS Institute (SAS Health, Health Analytics)

-

ResMed (AirSense 10, myAir)

-

Medtronic (Guardian Connect, MiniMed)

-

Roche Diagnostics (Accu-Chek, m-Health Solutions)

-

Apple Inc. (Apple Health, ResearchKit)

-

Google Health (Google Fit, DeepMind Health)

-

Siemens AG (Clinical Decision Support, Digital Twin of the Patient)

-

Teladoc Health (Teladoc, BetterHelp)

-

Babylon Health (Babylon App, AI Symptom Checker)

-

Zocdoc (Zocdoc App, Telehealth Services)

-

Doximity (Doximity App, Doximity Dialer)

Key Suppliers

-

Intel Corporation

-

Qualcomm Technologies

-

Microsoft Azure

-

Amazon Web Services (AWS)

-

NVIDIA Corporation

-

GE Healthcare

-

Cisco Systems

-

IBM Cloud

-

Bosch Healthcare Solutions

-

Oracle Corporation

Recent Developments

-

In July 2024, Felix Lee, Sanofi's leader in organization capability and transformation, talks about how the pharmaceutical company is utilizing digital therapeutics firm DarioHealth to improve patient care and self-management while also enhancing its drug portfolio.

-

In July 2024, the FDA approved Eversana's Prescription Drug Use-Related Software (PDURS) framework, which is a major achievement for healthcare in the US. Developed to simplify the connectivity of software with prescription medications, this framework is poised to revolutionize how pharmaceutical companies improve the clinical effectiveness of their products.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 229.7 Billion |

| Market Size by 2032 | US$ 1306.30 Billion |

| CAGR | CAGR of 20.63% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offerings: (Software, Services, Application (Apps), Hardware) • By Technology: (mHealth, mHealth Devices, mHealth Apps, Telehealth, Telecare, Digital Therapeutics, Preventive Therapeutics, Treatment Therapeutics, Healthcare Management Systems, EHR, Healthcare Analytics, E-prescribing) • By Application: (Chronic Disease Management, Behavioral Health, Health & Fitness, Other Applications) • By End User: (Provider, Hospitals & Clinics, Long-term Care Facilities & Assisted Living, Patients & Consumers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cerner Corporation, IBM Watson Health, McKesson Corporation, Epic Systems, Allscripts Healthcare Solutions, Philips Healthcare, Siemens Healthineers, Health Catalyst, Qualcomm Life, SAS Institute, ResMed, Medtronic, Roche Diagnostics, Apple Inc., Google Health, Siemens AG, Teladoc Health, Babylon Health, Zocdoc, Doximity |

| Key Drivers | • Increased acceptance of mobile health (mHealth) technologies • Utilizing AI and Big Data Analytics in the Healthcare Sector |

| Restraints | • Data privacy and security concerns. |