Frequency Multiplier Market Size & Trends:

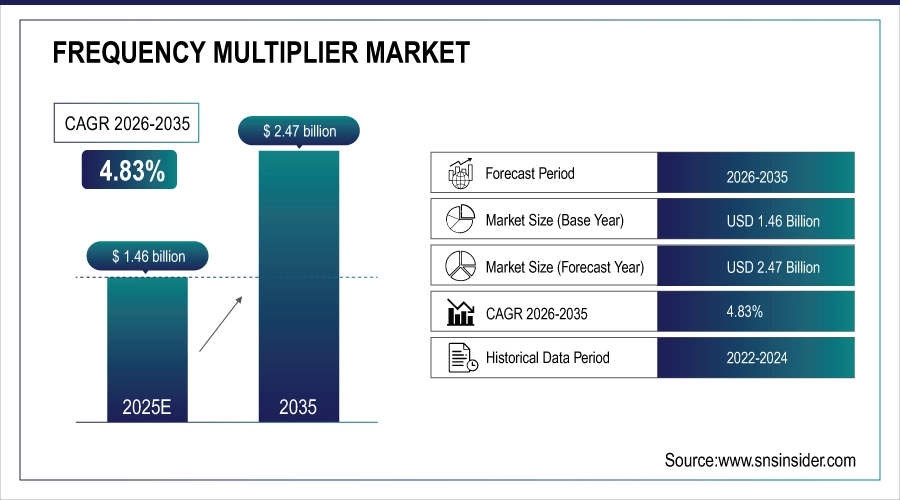

The Frequency Multiplier Market was valued at USD 1.46 billion in 2025 and is expected to reach USD 2.47 billion by 2035, growing at a CAGR of 4.83% from 2026-2035.

The frequency multiplier market is experiencing robust growth, owing to the high requirements of high-frequency signal generation for satellite communications as well as defense, aerospace, and advanced wireless networks. One of the most important blocks for frequency synthesis, upconversion, and radio-frequency (RF) spectrum utilization, frequency multipliers are thus essential for next-generation RF and microwave systems. Adoption of GaN-on-silicon carbide and other high-performance Semiconductor Technologies that improve power density, bandwidth, and signal integrity make possible market expansion.

In June 2025, MACOM announced new RF and optical products at SATCOM in June 2025, including GaN-on-SiC power amplifiers spanning C-, X-, Ku- and Ka-Bands and RF over Fiber solutions up to 70 GHz bandwidth. The launches further strengthen MACOM’s position in.next-gen satellite communications for higher power, higher efficiency, and high-bandwidth signal transmission.

Frequency Multiplier Market Size and Forecast

-

Market Size in 2025: USD 1.46 Billion

-

Market Size by 2035: USD 2.47 Billion

-

CAGR: 4.83% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information on Frequency Multiplier Market - Request Free Sample Report

Frequency Multiplier Market Trends

-

Rising demand for high-frequency signal generation in telecom, aerospace, and defense is driving the frequency multiplier market.

-

Growing deployment of 5G, satellite communication, and radar systems is boosting market growth.

-

Expansion of RF and microwave applications in test & measurement equipment is fueling adoption.

-

Increasing focus on signal stability, low phase noise, and high efficiency is shaping product development trends.

-

Advancements in semiconductor technologies such as GaAs, GaN, and SiGe are enhancing performance and reliability.

-

Rising use in electronic warfare, navigation, and space systems is supporting market expansion.

-

Collaborations between RF component manufacturers, system integrators, and telecom providers are accelerating innovation and global adoption.

Frequency Multiplier Market Growth Drivers:

The frequency multiplier market is experiencing strong growth, owing to the growing demand for next-generation RF test and validation solutions to offer precision, high throughput, and accuracy in hyper Frequency applications. As wireless networks, SATCOM and even defense systems have spread out to wider band mmWave and sub-THz ranges, accurate frequency synthesis has arisen as critical to support wideband functions. Hence, with the increasing complexity in RF front-end components and antennas, harmonic and wideband characterization with high accuracy is becoming essential, and is acting as a key driver for the growth of frequency multipliers, introducing stable upconversion and high frequency ranges. This leads to manufacturers using high-performance frequency multipliers and factors to boost the integrity of signals, accelerate the upcoming 5G/6G implementations, and meet the stringent performance requirements of aerospace and satellite communications.

Rohde & Schwarz (May 2025) – Organized the RF Testing Innovations Forum 2025, a virtual two-day event focused on new developments in mmWave, vector network analysis, load-pull and RF testing. Particularly, engineers learned to learn about next-gen component characterization, antenna analysis, and wideband system validation.

Frequency Multiplier Market Restraints:

-

High Technical & Cost Barriers Slowing Adoption of Frequency Multiplier

The frequency multiplier market is restrained by the complexity and high costs associated with designing, fabricating, and testing devices for mmWave and sub-THz frequencies. Low phase noise, high-efficiency, and wide frequency coverage require advanced semiconductor technologies and precision packaging, which significantly increase R&D and manufacturing costs. Moreover, scalability is limited by the integration issues with RF front-end systems and the need for stable performance over a range of environmental conditions. Higher costs, design challenges, and performance compromises restrict adoption in cost-sensitive markets such as consumer electronics, thus limiting large-scale deployment. Consequently, adoption has remained largely in aerospace, defense, and specialty communication as there are environments and applications where the premium performance is worth the increased spend.

Frequency Multiplier Market Opportunities:

-

Growing Demand for High-Performance RF Systems Expanding Opportunities for Frequency Multiplier

The frequency multiplier market presents strong opportunities as demand for high-performance RF systems continues to rise across aerospace, defense, satellite, radar, and 5G infrastructure. As demands for extreme low phase noise, fast synchronous mode, and broad-band coverage of the required frequency increase, frequency multipliers have emerged as a critical component for stable upconversion and enhanced signal integrity. By facilitating accurate frequency synthesis, their function underpins the development of next-generation wireless networks, secure military communications and space-grade hardware, where reliability is non-negotiable. Additionally, the faster adoption of next-gen test and measurement systems increases the demand for multipliers to test performance at mmWave and sub-THz frequencies, establishing enduring opportunities for both commercial and mission critical applications.

Texas Instruments introduced new RF PLLs and synthesizers to its family of RF devices, providing ultra-low phase noise (–230 dBc/Hz) and high-speed syncing to ultra-low phase power applications for aerospace, defense, satellites, radar, 5G, and test instrumentation and other applications.

Frequency Multiplier Market Challenges:

-

Performance Trade-Offs at High Frequencies Slowing Widespread Adoption

The frequency multiplier market faces significant challenges due to integration complexities and performance limitations at mmWave and sub-THz ranges. Designing multipliers that deliver low phase noise, high linearity, and wide frequency coverage without introducing excessive signal distortion is technically demanding. Thermal management and power efficiency remain persistent issues, especially for high-power applications in aerospace, defense, and SATCOM. Additionally, miniaturization pressures from 5G/6G and portable test equipment require compact designs, which complicates fabrication and packaging. Ensuring compatibility with evolving RF front-end architectures further increases development timelines and costs. Market adoption is also hindered by limited availability of advanced semiconductor materials and stringent validation requirements, restricting scalability in cost-sensitive industries. These factors collectively slow wider deployment despite strong demand for precision frequency solutions.

Frequency Multiplier Market Segmentation Analysis:

By Analog Type

In 2025, the Active frequency multiplier segment accounted for approximately 70% of Frequency Multiplier market share, due to high efficiency, better phase noise performance, and broader frequency range of active multipliers over its passive counter parts. Active multipliers are increasingly being used in the aerospace & defense, satellite communications, and advanced wireless systems markets, stable frequency synthesis along with reliable upconversion are the two key functions for the next-generation high-frequency application.

The Passive frequency multiplier segment is expected to experience the fastest growth in the Frequency Multiplier market over 2026-2035 with a CAGR of 5.15%, This high share and growth rate is attributed to its simpler design, cheaper, and lower power consumption which is ideal for integration in compact and energy-efficient RF systems. This demand has been compounded by rising adoption in consumer electronics, IoT devices, and all cost-sensitive communication applications, with passive multipliers expected to drive a sizeable share of these growth opportunities.

By Frequency Range

In 2025, the Below 75 GHz segment accounted for approximately 54% of Frequency Multiplier market share, This dominance is attributed to the widespread use of sub-75 GHz frequencies in satellite communication, radar systems, aerospace, and wireless networks, where stable and efficient frequency conversion is critical. Strong demand from defense, 5G infrastructure, and test & measurement applications further supported adoption, making this segment the backbone of frequency multiplier deployments worldwide.

The Between 75–110 GHz segment is expected to experience the fastest growth in the Frequency Multiplier market over 2026-2035 with a CAGR of 6.34%, due to the increasing demand for mmWave technologies in 5G/6G networks, advanced radar, aerospace, and satellite communication systems, where high-frequency synthesis is critical for achieving wider bandwidths and improved signal precision. Moreover, the growing demand for accuracy testing and measuring solutions at higher frequency is also driving the early adoption of this band.

By Application

In 2025, the Automotive segment accounted for approximately 38% of Frequency Multiplier market share, driven by the rising integration of advanced driver assistance systems (ADAS), vehicle-to-everything (V2X) communication, and radar-based safety technologies. The growing shift toward autonomous and connected vehicles requires precise high-frequency signal generation for reliable detection, communication, and navigation, positioning frequency multipliers as a critical enabler of next-generation automotive electronics.

The Aerospace segment is expected to experience the fastest growth in the Frequency Multiplier market over 2026-2035 with a CAGR of 7.02%, owing to the increasing requirement for high-frequency and low-phase-noise solutions in satellite communication, radar, and secure defense networks. Frequency multipliers are fundamental in providing stable upconversion, high-quality signal and stable wideband coverage in mission-critical communication and navigation systems as aerospace applications move to ever higher mmWave and sub-THz bands.

By End User

In 2025, the Automotive segment accounted for approximately 29% of Frequency Multiplier market share, driven by the rising adoption of advanced driver-assistance systems (ADAS), vehicle-to-everything (V2X) communication, and radar-based safety technologies. The growing integration of mmWave frequency solutions in next-generation vehicles enhances collision detection, navigation accuracy, and autonomous driving capabilities, positioning frequency multipliers as a crucial enabler of high-performance automotive electronics and intelligent mobility solutions.

The Telecommunications Operators segment is expected to experience the fastest growth in the Frequency Multiplier market over 2026-2035 with a CAGR of 6.80%, due to these factors coupled with the increasing demand to densify network, Frequency multipliers, thus, are considered an attractive solution for intensifying capacity data transmission while enabling low-latency connectivity and wideband spectrum usage for the net-gen wireless infrastructure helping the operators to elevate their network capabilities.

Frequency Multiplier Market Regional Analysis

North America Frequency Multiplier Market Insights

In 2025 North America dominated the Frequency Multiplier Market and accounted for 44% of revenue share, due to large investments in 5G infrastructure, advanced aerospace and defense programs, and satellite communication projects. In addition, the region recognition as a leader for RF and mmWave technology development, plus, also, the presence of leading semiconductor and test equipment vendors, further complement the adoption. Furthermore, the increasing need for high-frequency applications with the modernization of defense along with commercial telecom networks further expands the North America market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Frequency Multiplier Market Insights

Asia-Pacific is expected to witness the fastest growth in the Frequency Multiplier Market over 2026-2035, with a projected CAGR of 6.89%, owing to the rapid spread of 5G technology, broadening satellite communication networks, and increased defense modernization programs across China, India, Japan, South Korea, and other countries. Expanding investment in semiconductor fabrication, consumer electronics, and automotive radar systems are driving increased demand while making the region a significant epicenter of frequency multiplier market growth.

Europe Frequency Multiplier Market Insights

In 2025, Europe emerged as a promising region in the Frequency Multiplier Market, driven by increasing investments in defense modernization, satellite communications, and 5G network deployment. Strong focus on research and development in RF and mmWave technologies, along with growing adoption in aerospace, automotive radar, and industrial test instrumentation, is fueling market growth and positioning Europe as a significant contributor to the global frequency multiplier landscape.

Middle East & Africa and Latin America Frequency Multiplier Market Insights

The Frequency Multiplier Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions owing to rising investment in satellite communication, defense modernization and telecommunication infrastructure. High demand in these regions is facilitated by increasing inclusion of radar systems, wireless networks and test instrumentation within the spaces, whereas increasing industrial automation and aerospace projects are further driving the market, marking LATAM and MEA as budding regional leaders to the global frequency multiplier landscape.

Frequency Multiplier Market Competitive Landscape:

Analog Devices, Inc.

Analog Devices, Inc. (ADI) is a global leader in high-performance analog, mixed-signal, and digital signal processing technologies. The company develops integrated circuits, RF systems, data converters, and precision sensors used across communications, aerospace & defense, industrial automation, automotive, and consumer electronics. ADI’s strengths lie in bridging the physical and digital worlds with solutions that enhance connectivity, signal fidelity, and system efficiency, enabling next-generation electronics in demanding environments.

-

In July 2025, Analog Devices launched a wideband frequency downconverter with integrated multipliers, high-linearity mixers, filters, and digital attenuators, enhancing SDR frontend flexibility and RF performance.

Key Players

Some of the Frequency Multiplier Market Companies

-

MACOM

-

Crystek Corporation

-

Renesas Electronics

-

Texas Instruments

-

Broadcom

-

Richardson RFPD

-

Virginia Diodes

-

Rohde & Schwarz

-

Farran Technology

-

Pasternack

-

Analog Devices

-

Qorvo

-

Skyworks Solutions

-

NXP Semiconductors

-

Mini-Circuits

-

Keysight Technologies

-

Anokiwave

-

Mercury Systems

-

Cobham Wireless

-

Infineon Technologies

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 1.46 Billion |

| Market Size by 2035 | USD 2.47 Billion |

| CAGR | CAGR of 4.83% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Analog Type(Active frequency multiplier, Passive frequency multiplier) • By Frequency Range(Below 75 GHz, Between 75–110 GHz, Above 110 GHz) • By Application(Automotive, Military, Aerospace and Others) • By End User(Automotive OEMs , Aerospace & Defense Companies, Telecommunications Operators, Electronics & Semiconductor Manufacturers, Industrial & Test Equipment Frequency Ranges and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | The Frequency Multiplier Market Companies are MACOM, Crystek Corporation, Renesas Electronics, Texas Instruments, Broadcom, Richardson RFPD, Virginia Diodes, Rohde & Schwarz, Farran Technology, Pasternack, Analog Devices, Qorvo, Skyworks Solutions, NXP Semiconductors, Mini-Circuits, Keysight Technologies, Anokiwave, Mercury Systems, Cobham Wireless, Infineon Technologies and Others. |