Satellite Communication Market Size & Trends:

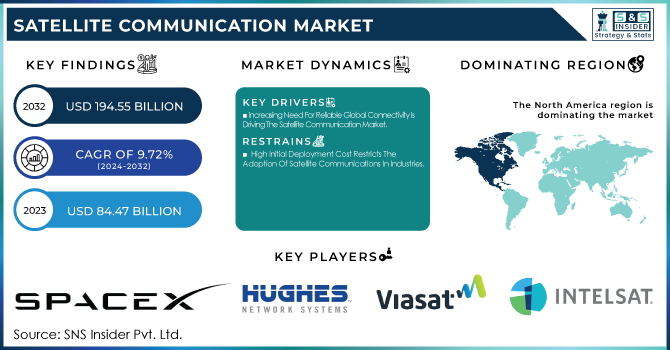

The Satellite Communication Market Size was valued at USD 84.47 Billion in 2023 and is expected to reach USD 194.55 Billion by 2032 and grow at a CAGR of 9.72% over the forecast period 2024-2032.

The Satellite Communication (SATCOM) Market is witnessing rapid growth due to increasing demand for high-speed connectivity, defense applications, and remote sensing. SATCOM plays a crucial role in telecommunications, broadcasting, and navigation, supporting industries such as aerospace, maritime, and military.

To get more information on Satellite Communication Market - Request Free Sample Report

The expansion of Low Earth Orbit (LEO) satellites and advancements in 5G and IoT are further driving market growth. Government investments in space programs and rising demand for satellite-based internet services (e.g., Starlink, OneWeb) are key factors shaping the market. However, challenges like high initial costs and regulatory constraints remain. The market is expected to expand significantly through 2032.

Satellite Communication (SATCOM) Market Dynamics

Drivers:

-

Increasing Need For Reliable Global Connectivity Is Driving The Satellite Communication Market

One of the most important factors driving demand in the satellite communication market is the surge in demand for seamless and reliable global connectivity, particularly in remote and underserved areas. According to government sources, such as the Federal Communications Commission (FCC), around 7.2 million Americans lack access to broadband services. Globally, according to the Internet Society Pulse, approximately 33% of the world's population is not yet online.

Satellite communication will bridge this digital divide by providing high-speed internet connectivity in rural areas and even those geographically secluded. Most industries depend on these uninterrupted communications from satellites, such as maritime, aviation, and defense. In addition, the widespread development of IoT devices and smart systems also requires the need for satellite solutions to support the transfer of large data and real-time communication.

Restrain:

-

High Initial Deployment Cost Restricts The Adoption Of Satellite Communications In Industries.

The key restraint in the satellite communication market is the expensive undertaking in launching, maintaining, and upgrading the satellite systems. A single launch can cost anywhere between USD 150 million and USD 500 million, depending on the size of the satellite, payload, and launch vehicle. NASA data indicate that through reusable rockets, government and private sector collaboration has slightly reduced the per-launch cost, but the savings are not yet widespread enough to lower financial entry barriers. Small businesses and emerging markets do not have adequate resources to install the critical infrastructure that includes ground stations, receiver equipment, and maintenance. This cost factor makes satellite communication less accessible. Hence, industries are preferring less expensive terrestrial variants, such as fiber-optic networks and cellular towers. The challenge can be addressed by technical innovations such as small satellite constellations and shared network infrastructure which reduce the cost of deployment.

Opportunities:

-

Advancements In The Technology Of Small Satellites Provide Strong Market Growth Prospects.

The next opportunity in satellite communications is being found in developing small satellite technologies. Nano, micro, and cubesats form some of these satellites, where due to smaller sizes, higher cost advantages exist along with their low manufacturing and launch costs. These small satellites can be put to earth-observing missions or even used for installing communication networks all over the world, such as broadband delivery and navigation services. High satellites, which cost less than USD 1 million per satellite, became cheaper to build and deploy and are now accessible to smaller companies and emerging economies. Government programs such as the Small Satellite Mission under the European Space Agency and the CubeSat Launch Initiative of NASA focus on innovative solutions and collaborative work around the world. This speed of rocket reusability also increases the feasibility of the small satellite networks for commercial exploitation.

Challenges:

-

Delay In Signal Satellites Is A Crucial Challenge For Satellite Communication Market.

Signal latency is a persistent challenge in the satellite communication market, particularly for GEO satellites that orbit at about 35,786 kilometers from Earth, which translates to approximately 500 milliseconds of round-trip signal delay and potentially impacts real-time applications like voice communications, video conferencing, and other IoT applications relying on low-latency responses. As found by NASA research, although Low Earth orbit satellites can reduce latency to under 50 milliseconds, deploying and maintaining LEO constellations would require a tremendous amount of investment in infrastructure and technical support. The risk of orbital congestion will also add to this challenge as government agencies, such as the Federal Aviation Administration, monitor the growing number of active satellites. Advanced signal processing technologies and strategic GEO, LEO, and MEO satellite combinations are being explored as solutions to address latency while ensuring efficient, reliable communication networks.

Satellite Communication Market Segmentation Analysis

By Frequency Band

In 2023, the market was dominated by the C-band segment, with a share of 34% due to the wide adoption for broadcast and telecommunication services. The C-band is preferred due to its capability to maintain reliable communication in adverse weather conditions, making it favorable for critical operations.

However, the Ka-band segment is expected to grow at the fastest CAGR of 10.54% from 2024 through 2032. The Ka-band will offer higher bandwidth capacities and faster data transmission speeds than broadband applications, high-definition video streaming, and enterprise communication solutions. As the demand for internet services based on satellites increases and satellite technology evolves, there is an increasing expectation that the demand for the Ka band will be realized significantly. The development of satellite constellations that are constantly under expansion and rising deployment of high-throughput satellites (HTS) further supports the growth in this segment.

By Component

In 2023, services dominated with 58% of the market, driven by an increasing demand for satellite-based data, broadcasting, and communication services across multiple industries, including the media, defense, and maritime sectors. The segment for services comprises leasing of satellite capacity, management of networks, and value-added services that are crucial to supporting end-user operations.

However, the equipment segment is expected to advance at the highest CAGR of 10.02% from 2024 to 2032. The growth is due to an increase in the adoption of advanced ground-based satellite communication equipment, such as antennas, modems, and transceivers, while IoT and 5G networks continue their massive spread. The increasing demand for secure and reliable communication infrastructure across industries further fuels the demand for high-performance satellite communication equipment.

By Application

In 2023, the broadcasting segment led the market with a 25% share, mainly due to the continued demand for satellite television, radio broadcasting, and live event coverage. With respect to reliability for streaming uninterrupted content, satellite communication's stronghold over the segment remains consolidated.

During the estimated time frame from 2024-2032, the airtime segment will progress at a rapidly growing rate of 10.78% in terms of the CAGR. This will happen due to high growth of adoption of MSS systems for communication from maritime and aviations besides that of land base remote sites. The demand for satellite airtime services comes from industries needing real-time data transmissions and global connectivity.

By Satellites Constellations

The LEO satellites segment led the market with a share of 44% in 2023, due to low latency and improved communication. LEO satellites are widely used for broadband internet services and Earth observation applications. This segment will also be growing at the highest CAGR of 10.19% from 2024 to 2032. The ever-increasing deployment of mega-constellations by companies such as SpaceX, OneWeb, and Amazon to provide global high-speed internet access greatly contributes to the growth of this segment. LEO satellites are further strengthening their market position with their ability to cover remote and underserved regions.

By Vertical

In 2023, the media & broadcasting segment dominated with a 26% market share, driven by the continued demand for satellite-based content distribution and live event broadcasting. Reliability in content delivery across large geographical areas is said to be a reason for growth in the segment.

However, the government & defense segment will grow at the fastest CAGR of 11.08% during the forecast period from 2024 to 2032. This will be driven by the increasing requirement for secure communication solutions for military operations, surveillance, and disaster response. Advanced satellite systems are being invested in by governments worldwide to boost national security and resilience in communication.

Satellite Communication Market Regional Outlook

In 2023, the North America region held a 43% share in the market, due to the presence of key players in the satellite communication service provision sector and technological advancements in the region. The U.S. government’s investments in satellite technology for defense, communication, and space exploration further contribute to this dominance. The region’s robust infrastructure and high adoption of advanced communication technologies also play a key role.

Asia Pacific is expected to grow at the fastest CAGR of 10.69% during the forecast period of 2024 to 2032. The growth in this region is fueled by increasing demand for satellite-based services within emerging economies in China, India, and Japan. Growth of government efforts toward enhancing the infrastructure of satellite communications, an upsurge in investments on space programs, and increasing internet demands in the countryside are important aspects driving this Asian Pacific market. The advancement in satellite network to be applied to commercial as well as military defense purposes increases growth in this region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the Major Players in the Satellite Communication Market Are

-

SpaceX (Starlink, Satellite Launch Services)

-

Hughes Network Systems (Satellite Internet, Managed Network Services)

-

Viasat Inc. (Broadband Services, Satellite Ground Equipment)

-

SES S.A. (Broadcast Services, Managed Data Services)

-

Intelsat S.A. (Media Distribution, Connectivity Solutions)

-

Eutelsat Communications (Broadcast Distribution, Data Services)

-

Thales Alenia Space (Satellite Manufacturing, Defense Communication)

-

Boeing Defense, Space & Security (Satellite Systems, Network Solutions)

-

Lockheed Martin Corporation (Satellite Systems, Space Exploration Services)

-

Northrop Grumman Corporation (Satellite Payloads, Ground Systems)

-

Cobham SATCOM (Maritime Communication, Land Mobile Solutions)

-

Gilat Satellite Networks (VSATs, Network Infrastructure)

-

Inmarsat (Mobile Satellite Services, Global Connectivity)

-

Globalstar, Inc. (Satellite Messaging, IoT Solutions)

-

Telesat (Broadcast Services, Broadband Solutions)

-

Iridium Communications Inc. (Global Satellite Phones, IoT Applications)

-

Orbital ATK (Satellite Components, Space Launch Vehicles)

-

Kratos Defense & Security Solutions (Ground Station Solutions, RF Monitoring)

-

L3Harris Technologies (Defense Communication, Satellite Electronics)

-

Blue Origin (Satellite Launch Services, Spaceflight Systems)

Major Suppliers (Components, Technologies)

-

Honeywell Aerospace (Antenna Systems, Electronic Components)

-

Raytheon Technologies (Satellite Electronics, Communication Systems)

-

BAE Systems (Satellite Subsystems, Avionics)

-

Cobham Advanced Electronic Solutions (Antenna Solutions, RF Components)

-

Sierra Nevada Corporation (Spacecraft Systems, Electronics)

-

Teledyne Technologies (Satellite Sensors, Imaging Equipment)

-

General Dynamics Mission Systems (Satellite Ground Equipment, RF Solutions)

-

Microchip Technology Inc. (Microcontrollers, Semiconductor Solutions)

-

Analog Devices, Inc. (RF Components, Integrated Circuits)

-

STMicroelectronics (Semiconductor Components, IoT Solutions)

Major Clients

-

Government Defense Agencies

-

Commercial Airlines

-

Maritime Companies

-

Media Broadcasting Networks

-

Internet Service Providers (ISPs)

-

Space Exploration Agencies (NASA, ESA)

-

Emergency Response Organizations

-

Oil & Gas Corporations

-

Telecommunication Companies

-

Global Logistics Firms

Recent Trends

-

January 2025: The partnership between satellite communications provider Nigerian Communications Satellite Limited, and Eutelsat Group, a global leader in satellite communications, has announced what it calls a ground-breaking multi-year, multi-million-dollar partnership to deliver low Earth orbit (LEO) satellite services in Nigeria. According to this strategic agreement, NIGCOMSAT has emerged as the number one satellite service provider in Nigeria through leveraging OneWeb's LEO network for high-speed, low-latency connectivity.

-

February 2025: Space Company SpaceX has launched the next generation of Spanish communications satellite into orbit. The Falcon 9 rocket, carrying the SpainSat Next Generation 1 (SpainSat NG-1) satellite, left Launch Complex 39A at NASA's Kennedy Space Center in Florida. The satellite, designed for secure governmental communications, was delivered to a geostationary transfer orbit. This was also the last flight for the first-stage booster B1073 of Falcon 9, which had completed 20 missions earlier. Because of mission requirements, the booster could not be recovered after launch.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 84.47 Billion |

| Market Size by 2032 | USD 194.55 Billion |

| CAGR | CAGR of 9.72 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Frequency Band (L-band, S-band, C-band, X-band, Ku-band, Ka-band), • By Satellite Constellations (Low Earth Orbit (LEO) Satellites, Medium Earth Orbit (MEO) Satellites, Geostationary Equatorial Orbit (GEO) Satellites), • By Component (Equipment (Satcom Transmitter/Transponder, Satcom Antenna, Satcom Transceiver, Satcom Receiver, Satcom Receive, Satcom Modem/Router, Others (Block-up converters, controllers)), Service), • By Application (Asset Tracking/Monitoring, Airtime (M2M, Voice, Data), Drones Connectivity, Data Backup and Recovery, Navigation and Monitoring, Tele-medicine, Broadcasting, Others), • By Vertical (Energy & Utility, Government & Defense (Government (Civil Uses), Emergency Responders, Defense), Transport & Cargo (Fleet Management, Rail Services), Maritime, Mining and Oil & Gas, Agriculture, Communication Companies, Corporates/Enterprises, Media & Broadcasting, Events, Aviation, Environmental & Monitoring, Forestry, End User - Consumer, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | SpaceX, Hughes Network Systems, Viasat Inc., SES S.A,Intelsat S.A., Eutelsat Communications, Thales Alenia Space, Boeing Defense, Space & Security, Lockheed Martin Corporation, Northrop Grumman Corporation, Cobham SATCOM, Gilat Satellite Networks, Inmarsat, Globalstar, Inc., Telesat, Iridium Communications Inc., Orbital ATK, Kratos Defense & Security Solutions, L3Harris Technologies, Blue Origin. |