Fruit and Vegetable Processing Market Report Scope & Overview:

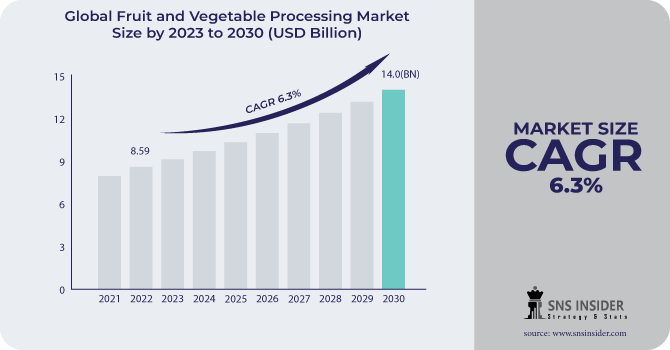

The Fruit and Vegetable Processing Market size was USD 8.59 billion in 2022 and is expected to Reach USD 14.0 billion by 2030 and grow at a CAGR of 6.3% over the forecast period of 2023-2030.

Fruit and vegetable processing involve grading and processing the raw vegetables and fruits into pieces, paste, and usually packed in cans. Fruits and vegetables are also frozen, cooled, and dried to increase their shelf life using various procedures such as freeze-dry, sun-dry, and others.

Based on product, the market is segmented into fresh, fresh-cut, canned, frozen, and dried. Canned food is cooked and sealed in cans, and Frozen and Dried fruits & vegetables are fruits and vegetables These above methods are used to preserve their nutrients and flavor. This process provides a long shelf life and is a convenient way to store fruits and vegetables.

Based on processing equipment, the market is segmented into pre-processing, processing, washing, filling, seasoning, and packaging. These processes use various equipment such as blanching, labeling machines, and many others.

Additionally, the industry is anticipated to expand at a faster rate over the forecast period due to the introduction of high-end technologies and an increase in demand for food processing equipment from emerging economies like China, Brazil, India, and South Africa as a result of changes in consumer lifestyle patterns.

MARKET DYNAMICS

KEY DRIVERS

-

Increase in need for convenience food products

Changing consumer preference in developing countries like China, brazil, India, has witnessed a shift from traditional homemade foods to packaged foods. processed food has gained demand due to busy lifestyles. Further growing per capita income has resulted in demand for read-to-cook items. Convenience food products are gaining popularity among consumers due to their ease of preparation and consumption. Fruit and vegetable processing helps to extend the shelf life of fruits and vegetables, making them ideal for use in convenience food products.

RESTRAIN

-

Decline in quality of processed Food & vegetables

-

Adulteration of food or food recalls

Food recalls occur when food products become contaminated as a result of adulteration or breach in the supply chain. This food recall was launched as a consequence of a report or complaint regarding the product's quality. Food recalls can harm food manufacturers' and retailers' reputations, resulting in lost sales and consumer trust. They can also cause supply chain disruption and financial losses. In 2021, there will be over 4,000 food recalls in the United States, according to the Food and Drug Administration (FDA). The most common grounds for food recalls were as follows: Contamination by pathogenic bacteria including Salmonella, Listeria, and E. coli: These bacteria can cause food poisoning. These bacteria can cause foodborne illness, which can lead to hospitalization or even death.

OPPORTUNITY

-

Raising demand for plant-based foods products

There is a current trend of increased interest in the production of meat substitutes made from plants. A vegan diet is one that only consists of plants and excludes all animal products, such as meat, dairy, eggs, and honey. Additionally, vegans avoid putting on leather and fur. Numerous health advantages, including a decreased risk of heart disease, stroke, type 2 diabetes, and various cancers, have been associated with vegan diets. Concerns about how animals are treated in the food sector are widespread. Being a vegan is one method to prevent adding to this issue.

CHALLENGES

-

Maintenance, and quality assessment of processed food

-

Physical degradation and infections

The natural aging process of fruits and vegetables is known as physiological deterioration, and it can cause alterations in the texture, flavor, and nutritional value of produce. Bacterial, fungal, or viral infections can result in food deterioration, foodborne disease, or even death. For fruit and vegetable processors, physiological decline and illnesses can both result in losses. While infections can result in product recalls and legal action, physiological decline can impair yields and quality.

IMPACT OF RUSSIAN UKRAINE WAR

Russia's invasion startled the world's food & vegetable markets because Russia and Ukraine combined account for one-third of the world's wheat trade, 17% of the world's maize trade, and over 75% of the world's sunflower oil trade. The FAO Food Price Index reached an all-time high right after Russia invaded in February 2022, and it then reached a second all-time high in March 2022. Even though they have already dropped from this peak, global food costs are still much higher than they were in 2021. First, despite the fact that Russia's conflict in Ukraine has decreased exports of grains and oilseeds, it has had an impact on consumer demand for other, healthier foods. A local basket of food now costs more than 55 percent more than it did a year ago in the WFP's East Africa region, according to their report.

IMPACT OF ONGOING RECESSION

Due to a continuous rise in packaging costs and insufficient cost savings on oil and industrial fuel, consumer prices of packaged goods will continue to rise despite recent government efforts to curb food inflation. Households and small restaurant owners are scrambling to balance their budgets as a result of a sharp increase in retail prices of several essential food items over the past month FY23, including the basic cereals of rice and wheat, tur dal, the most popular source of protein in vegetarian households, and even loose tea. Price increases of up to 10% are expected for a number of consumer goods, including packaged food and dairy products, refrigerators, and alcohol. Hence, this rise in the prices of essential items has impacted the food and vegetable processing market.

KEY MARKET SEGMENTS

by Product

-

Fresh

-

Canned

-

Fresh-Cut

-

Frozen

-

Dried & Dehydrated

by Equipment

-

Pre-processing

-

Processing

-

Filling

-

Washing

-

Packaging

-

Seasoning

.png)

REGIONAL ANALYSIS

North America is the dominating region due to increased imports of processed fruits and vegetables, as well as growing awareness about the benefits of eating fruits and vegetables, and high consumer spending on convenience foods, which will drive product demand across the market. There are various companies in the United States, Canada, and other nations that manufacture fruits and vegetable processing machinery. The majority of these manufacturers are small and medium-sized firms (SMEs), although many large, publicly traded corporations and iconic American brands do business on a worldwide basis.

Asia Pacific has significant growth in the world market and is predicted to have a considerable increase during the forecast period. This can be ascribed to rising disposable income levels and increased consumer awareness of the health benefits of processed fruits and vegetables, particularly in developing nations like China, India, and Indonesia. Additionally, the regional market will expand as a result of changing lifestyles and an increase in packaged food demand.

Europe has sustainable growth in the fruits and vegetable processing market. Dole Food Company, Kraft Heinz, Seneca Foods, Simplot, The JM Smucker Co., AGRANA, Bonduelle, Del Monte Pacific, Greenyard, La Doria, and McCain Foods are among the leading participants in the European fruit and vegetable processing sector. These companies are investing in R&D to create new goods and technology to meet Europe's growing demand for processed fruits and vegetables.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Nestlé, Kraft Heinz Company, GEA Group, Bosch, Buhler, JBT Corporation, Conagra Brands, Krones, Kroger, Olam International, Haith Tickhill, Greencore Group, Dole Food Company, and other key players are mentioned in the final report.

Bosch-Company Financial Analysis

RECENT DEVELOPMENTS

In 2023 Nestle India is ready to set up a food processing unit with an investment capital of Rs 894 crore in Odisha FMCG major. The IPICOL (Industrial Promotion & Investment Corporation of Odisha Ltd) has given it preliminary approval to establish a food processing business in Odisha, India.

In 2023 A Dutch vegetable processor begins commercial production at a new location in the Netherlands. Hessing SuperVers has officially opened its new production facility in the Netherlands.

In 2022 In Waseca, Minnesota, Conagra Brands, Inc. opened a new vegetable processing plant. The 245,000-square-foot plant will be used to process fresh veggies for the company's frozen meal division and the Birds Eye brand.

| Report Attributes | Details |

| Market Size in 2022 | US$ 8.59 Billion |

| Market Size by 2030 | US$ 14.0 Billion |

| CAGR | CAGR of 6.3 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Fresh, Canned, Fresh-Cut, Frozen, Dried & Dehydrated) • By Equipment (Pre-processing, Processing, Filling, Washing, Packaging, Seasoning) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Nestlé, Kraft Heinz Company, GEA Group, Bosch, Buhler, JBT Corporation, Conagra Brands, Krones, Kroger, Olam International, Haith Tickhill, Greencore Group, Dole Food Company |

| Key Drivers | • Increase in need for convenience food products |

| Market Opportunity | • Raising demand for plant-based foods products |