Fuel Transfer Pumps Market Report Scope & Overview:

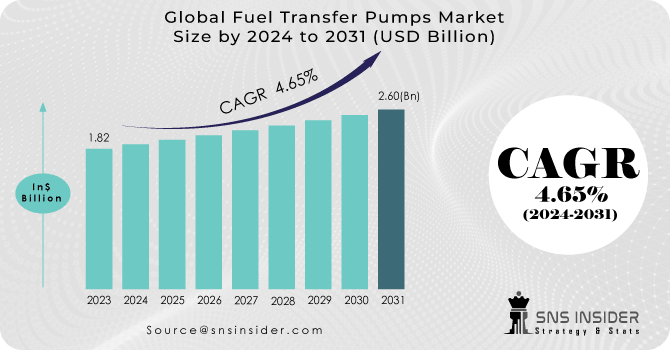

The Fuel Transfer Pumps Market Size was estimated at USD 1.90 billion in 2023 and is expected to arrive at USD 2.83 billion by 2032 with a growing CAGR of 4.54% over the forecast period 2024-2032. This report offers unique insights into capacity utilization rates across key regions, highlighting operational efficiency trends in the Fuel Transfer Pumps Market. It further covers downtime and maintenance patterns, providing a clear picture of reliability and lifecycle costs. The study also tracks technological adoption rates regionally, showcasing the shift towards automated and IoT-enabled pump systems. Additionally, it analyzes import-export dynamics, reflecting global trade patterns and supply chain shifts. The report uniquely integrates emerging trends like the rise of electric fuel transfer solutions and predictive maintenance adoption, giving a forward-looking operational perspective.

To get more information on Fuel Transfer Pumps Market - Request Free Sample Report

The Fuel Transfer Pumps Market in the United States is projected to witness steady growth over the forecast period. In 2023, the market size stood at USD 0.31 billion and is expected to reach approximately USD 0.47 billion by 2032. This growth reflects a Compound Annual Growth Rate (CAGR) of 4.91% during the period from 2023 to 2032. The consistent rise in demand can be attributed to factors such as the growing need for efficient fuel handling systems across industrial, commercial, and agricultural sectors, along with increasing investments in fuel infrastructure across the country. Moreover, the adoption of advanced fuel transfer technologies and the emphasis on safety and operational efficiency are further supporting market expansion.

Market Dynamics

Drivers

-

Rising fuel demand across key industries like oil & gas, mining, and transportation is driving the need for efficient and safe fuel transfer solutions.

The growing demand for efficient fuel distribution is a key driver propelling the growth of the fuel transfer pumps market. Major industry sectors, including oil & gas, mining, agriculture, construction, and transportation, depend on the quick and secure transportation of fuel that will power machinery, vehicles, and equipment. With the growth in global energy consumption, the demand for reliable fuel transfer solutions has increased which aids in minimizing the spillage, reducing wastage, and enhancing operational efficiency. Moreover, this growth is also fueled by the swift growth of industrial infrastructure and increasing numbers of fuel stations in emerging economies. Meanwhile, the need for greater precision and user convenience has also been shaping market trends, with the introduction of automated pumps, digital flow meters, and portable fuel transfer systems. Additionally, a trend towards energy-efficient and long-lasting pump systems to achieve sustainability targets can also be seen in the market. All these aspects together signal a positive growth attitude for the fuel transfer pumps market over the upcoming years.

Restraint

-

High maintenance and replacement costs of fuel transfer pumps increase operational expenses and impact overall profitability.

High maintenance and replacement costs pose a significant restraint in the fuel transfer pumps market. These pumps are used to handle highly flammable and corrosive liquids, making them prone to wear and tear over time. Cleaning a fuel storage tank regularly is crucial for providing operational safety and preventing leakage and contamination risk due to poor conditions, especially in cases where the fuel quality is critical to the end process. But with this routine maintenance comes periodic inspection, part replacement, lubrication, and cleaning, increasing downtime and adding to the overall cost of operations. Also, if a pump fails or malfunctions, the cost of sealing, hose, motor, or unit replacements can be significant. Among the small fuel station owners, farmers, or fleets, these recurring expenses may dent profitability and inhibit investment in advanced pump systems. Additionally, the requirement of maintenance, which needs to be performed by certified professionals only, adds to the excessive costs, making it difficult for companies with a limited budget.

Opportunities

-

Rising fuel consumption in the aviation and marine sectors is driving demand for efficient, high-capacity fuel transfer pump systems.

The growing aviation and marine sectors are significantly driving the demand for advanced fuel transfer pump systems. The increasing number of international flights, growing cargo shipments, and increased business through land and sea routes have led to a significant increase in fuel consumption in these sectors of the economy. In that respect, international airports or seaports that cover long distances need highly effective and fast fuel transfer systems to ensure adequate operation through and through. As a result, the demand for safe, swift, and accurate transfer of fuel has increased to decrease the downtime and improve the productivity of operations. In line with these demands, modern fuel transfer pumps with automation, digital monitoring, and high-flow capabilities are being increasingly adopted. Also, the increase in commercial and defense fleets in both sectors adds to the increasing demand. The combined focus on minimizing fuel wastage, increasing safety standards, and adopting strict environmental standards is motivating stakeholders to adopt steadfast technology in the form of advanced fuel transfer solutions, which, in turn, is one of the key influencing factors, anticipating positive growth of the market in the forthcoming years.

Challenges

-

The demand for fuel transfer pumps is vulnerable to decline due to the global shift towards renewable energy and reduced reliance on fossil fuels.

The Fuel Transfer Pumps market is heavily dependent on the fossil fuel industry, as these pumps are primarily used for the transfer of fuels such as diesel, petrol, kerosene, and other petroleum-based products. Any global transition to renewable energy sources can be a significant threat to the long-term demand for fuel transfer pumps, given the rising focus on controlling carbon emissions. Governments across the globe are encouraging electric vehicles, greener energy sources, and tougher environmental protections, thereby creating a gradual downward trend in fossil fuel use. Furthermore, oil price volatility and a reduction in fossil fuel infrastructure investment can impact the path of market growth. The energy transition towards more sustainable solutions can generate a slowdown in demand for fuel transfer pumps in critical sectors such as transportation, mining, and agriculture. This dependence poses an enormous problem for market players; among them, innovation and diversity will have to be adopted to adapt to the changing international energy landscape and lessen the use of fossil fuels.

Segmentation Analysis

By Product

The DC fuel transfer pump segment dominated with a market share of over 49% in 2023. This is primarily attributed to its extensive usage in mobile and remote fuel transfer applications where a direct AC power supply is not accessible. DC fuel transfer pump manufacturers, for instance, are also gaining immense popularity amongst construction sites, agricultural fields, and emergency fueling operations, among others, due to their portability, fast and easy installation, along with battery-operated functionality. These pumps are fantastic fuel dispensing solutions for off-road vehicles and heavy machinery or equipment working in remote locations. Moreover, their uniformity with various types of fuel, including diesel, gasoline, and kerosene, further increases their demand. This segment’s dominance is only being fueled as the demand for flexible, efficient, and cost-effective refueling options continues to grow.

By Mounting

The fixed segment dominated with a market share of over 54% in 2023. This dominance is primarily attributed to the widespread adoption of fixed fuel transfer pumps in industrial, commercial, and large-scale fuel storage facilities. This makes these pumps the preferred option in applications that require safe, efficient, and uninterrupted transfer operations. They are suited for long-term and heavy-duty applications, due to their ability to manage enormous amounts of fuel with virtually no upkeep, coupled with improved operational stability. Furthermore, fixed pumps thus deliver a good flow rate and are better in terms of durability and provide with advanced safety features which propels the demand for the fixed pumps. Fixed Fuel Transfer Pumps are extensively used in industries like oil & gas for ensuring continuous and reliable fuel supply in mining, manufacturing, and transportation.

By Motor

The 12V DC segment dominated with a market share of over 34% in 2023, due to its widespread application and reliability. As this motor type can be directly integrated into the regular vehicle electrical system, it is frequently used in light commercial automobiles, agricultural machines, construction tools, etc. Its popularity is also driven by its transportability, making it ideal for mobile fueling applications. The 12V DC motor is easy to install and easy to implement, enabling the simplest integration of blower pumps into any fueling systems. The low-power requirement of the device makes it perfect for smaller scale operations as well, further cementing its place in the market. Thus, the 12V DC segment still holds the top spot as the most trusted fuel transfer pumps segment across industries.

By Application

The Transportation segment dominated with a market share of over 32% in 2023, driven by the substantial demand for fuel across the automotive, aviation, and marine industries. As transportation fleets continue to grow, encompassing cars, trucks, airplanes, and ships, the demand for fuel transfer emerged as a crucial aspect of this process. For a smooth and safe vehicle fuelling process, if you're carrying away fuel in your car, whether refuelling or for on-site fuelling, there are fuel transfer pumps. Moreover, shifting towards fuel-efficient technologies and increasing transportation networks contribute to the increasing demand for these pumps. With a constant evolution and expansion of world transportation, advanced fuel transfer pumps remain an essential for the sector and as a result remain the number one share holding application in the market.

Key Regional Analysis

The Asia-Pacific region dominated with a market share of over 46% in 2023, primarily due to rapid industrialization and urbanization. Such dynamics include the growing automotive fleet, infrastructure developments, and mining activities in further countries along with China, India, and Japan. The dominance of this region can be attributed to the growing construction projects in the region where heavy machinery and construction equipment demand reliable fuel transfer solutions. Additionally, the rising adoption of efficient fuel management systems and safety regulations in these industries has also proliferated the usage of fuel transfer pumps. The top observation in the global market is that Asia-Pacific is leading in the fuel transfer pumps market and this trend is likely to continue in the upcoming years owing to needs of industrial growth in the region.

North America is the fastest-growing region in the fuel transfer pumps market, driven by several key factors. Fuel Transfer is used in heavy machinery and it is probably high in demand as construction is on the rise in the region. In addition, the demand for advanced and reliable fuel transfer pumps is rising due to the adoption of fuel-efficient technologies. The growth is also driven up by the increasing transport fleet, including commercial vehicles and aviation. Moreover, the demand for efficient fuel transfer systems is also being complemented by the tightening regulatory framework on fuel storage handling and safety in the U.S. and Canada. All of these factors combined allow North America to be rapidly increasing in this market segment.

Need any customization research on Fuel Transfer Pumps Market - Enquiry Now

Key players in the Fuel Transfer Pumps Market

- Great Plains Industries, Inc (Fuel Transfer Pumps, DEF Pumps, Flow Meters)

- Tuthill Transfer Systems (TTS) (Fill-Rite Fuel Transfer Pumps, Rotary Vane Pumps)

- Graco Inc. (Electric Fuel Transfer Pumps, Pneumatic Fuel Pumps)

- Piusi S.p.A (Panther AC Diesel Transfer Pump, Bi-Pump Diesel Transfer Pump)

- INTRADIN (FLOFAST Fuel Transfer Systems, Manual & Electric Fuel Pumps)

- YUANHENG MACHINE CO., LTD (Diesel Transfer Pumps, Oil Pumps)

- ARO (Ingersoll-Rand plc) (Air-Operated Diaphragm Fuel Pumps)

- GESPASA - TOT COMERCIAL S.A, (Diesel Transfer Kits, Manual & Electric Transfer Pumps)

- Creative Engineers (Malhar Pumps) (Rotary Gear Fuel Transfer Pumps)

- MACH POWERPOINT PUMPS INDIA PVT. LTD (Diesel Transfer Pumps, Fuel Transfer Kits)

- Fill-Rite (A Division of Tuthill) (Heavy Duty Fuel Transfer Pumps, DEF Pumps)

- ZVA (ELAFLEX) (Automatic Fuel Nozzles, Transfer Systems)

- Horn Tecalemit (Germany) (Fuel Transfer Units, Dispensing Pumps)

- SEAFLO (U.S./China) (Portable Fuel Transfer Pumps)

- Procon Products (U.S.) (Rotary Vane Pumps for Fuel Transfer)

- Liquip International (Australia) (Fuel Transfer Equipment & Pumps)

- DuroMax Power Equipment (U.S.) (Portable Fuel Transfer Pumps)

- DieselTek (Australia) (High-Flow Diesel Transfer Pumps)

- Roughneck (Northern Tool + Equipment, U.S.) (Diesel & Kerosene Transfer Pumps)

- CEMO GmbH (Germany) (Portable & Stationary Fuel Transfer Pumps)

Suppliers for (Known for high-quality fuel transfer pumps and fluid handling equipment for commercial and industrial use) on the Fuel Transfer Pumps Market

- PIUSI S.p.A.

- Fill-Rite (a brand of Tuthill Corporation)

- Graco Inc.

- GPI (Great Plains Industries, Inc.)

- Pentair Plc

- YuanHeng Machine Co., Ltd.

- Tera Pump

- GROZ Engineering Tools Pvt. Ltd.

- Intradin (Shanghai) Machinery Co., Ltd.

- Zhejiang Yonjou Technology Co., Ltd.

Graco Inc-Company Financial Analysis

Recent Development

In October 2023: Great Plains Industries (GPI) introduced the GPRO V20, a modular vane pump designed for large equipment fueling. It offers a 20 GPM flow rate, dual voltage options (115V AC / 230V AC), and high-pressure performance (up to 25 PSI). The pump features easy installation with modular adapters, leak-proof seals, and is compatible with E15 gasoline, B20 diesel, and kerosene, meeting UL standards for the U.S. and Canada.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.90 Billion |

| Market Size by 2032 | USD 2.83 Billion |

| CAGR | CAGR of 4.54% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

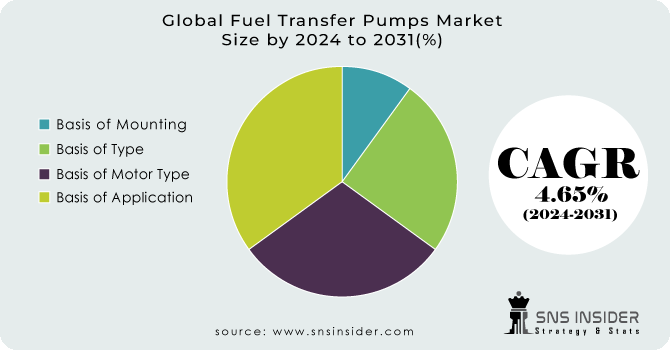

| Key Segments | • By Product (AC Fuel Transfer Pump, DC Fuel Transfer Pump, Hand Fuel Transfer Pump) • By Mounting (Fixed, Portable) • By Motor (12V DC, 24V DC, 115V AC, 230V AC, Others) • By Application (Transportation, Construction, Mining, Agriculture, Chemical, Food & Beverage, Military, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Great Plains Industries, Inc., Tuthill Transfer Systems (TTS), Graco Inc., Piusi S.p.A, INTRADIN, YUANHENG MACHINE CO., LTD, ARO (Ingersoll-Rand plc), GESPASA - TOT COMERCIAL S.A, Creative Engineers (Malhar Pumps), MACH POWERPOINT PUMPS INDIA PVT. LTD., Fill-Rite, ZVA (ELAFLEX), Horn Tecalemit, SEAFLO, Procon Products, Liquip International, DuroMax Power Equipment, DieselTek, Roughneck, CEMO GmbH |