GaAs HEMTs Market Report Scope & Overview:

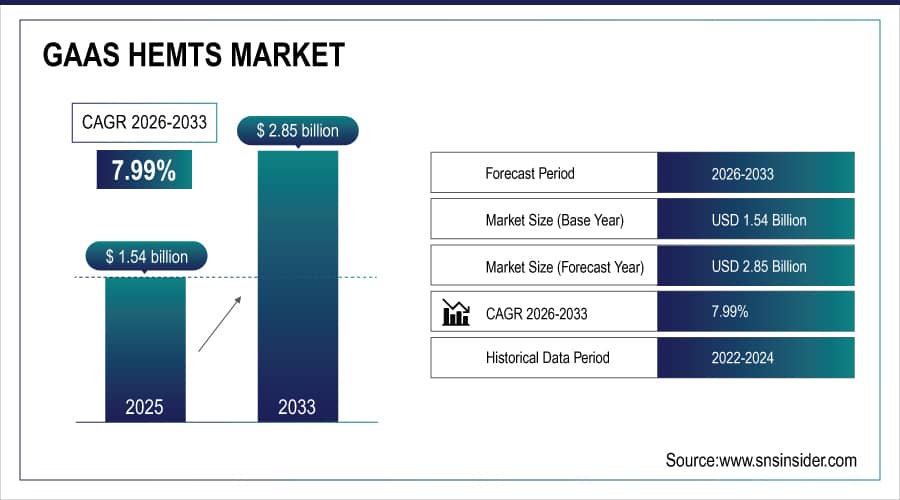

The GaAs HEMTs Market size was valued at USD 1.54 Billion in 2025E and is projected to reach USD 2.85 Billion by 2033, growing at a CAGR of 7.99% during 2026–2033.

The GaAs HEMTs market is experiencing steady growth due to rising demand for high-frequency, low-noise, and high-power electronic components across telecommunications, aerospace, defense, and consumer electronics. These transistors are commonly used in low-noise amplifiers, GPS modules, TVRO systems, and other RF applications. Market trends include the increasing adoption of both enhancement-mode and depletion-mode GaAs HEMTs and advancements in epitaxial growth techniques such as MBE and MOCVD. The market is expanding globally, with North America, Europe, and Asia-Pacific leading in production and consumption, driven by the need for reliable, high-performance semiconductor devices.

September 23, 2025 – Ammonia MBE growth of ScAlN on GaN enhances GaN-based HEMTs, improving electron density, reducing lattice stress, and boosting high-frequency device performance.ScAlN’s ferroelectric properties enable threshold voltage tuning and open opportunities for memory applications in advanced HEMTs.

GaAs HEMTs Market Size and Forecast:

-

Market Size in 2025: USD 1.54 Billion

-

Market Size by 2033: USD 2.85 Billion

-

CAGR: 7.99% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On GaAs HEMTs Market - Request Free Sample Report

GaAs HEMTs Market Highlights:

-

Growth in smartphones, mobile devices, and emerging 6G networks is driving adoption of GaAs HEMTs for high-performance, energy-efficient mobile RF applications

-

Advances such as gate recessing, InAlN barriers, and improved epitaxial growth enhance gain, efficiency, and output power at high frequencies above 10 GHz

-

Complex fabrication processes, expensive GaAs substrates, and stringent quality standards increase manufacturing costs and limit scalability

-

GaN-on-Si transistors offer comparable performance with potentially lower costs, creating competition for traditional GaAs HEMTs

-

Rising demand for efficient, high-voltage semiconductor components in EV charging, solar, and wind power applications is creating market opportunities

-

Innovations in high-voltage, high-density HEMTs enable cost-effective, reliable, and sustainable solutions, expanding applicability beyond traditional RF uses

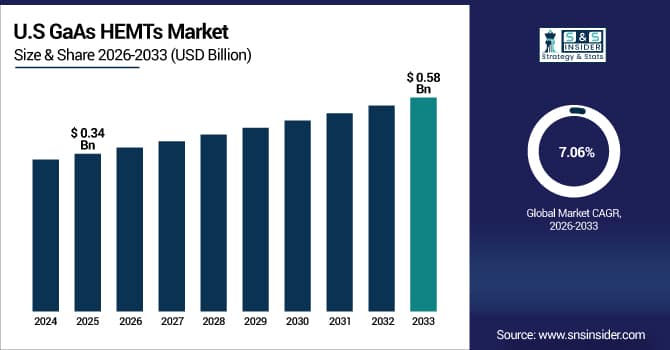

The U.S. GaAs HEMTs Market size was valued at USD 0.34 Billion in 2025E and is projected to reach USD 0.58 Billion by 2033, growing at a CAGR of 7.06% during 2026–2033.

Growth is driven by increasing demand for high-frequency, low-noise, and high-power electronic devices in telecommunications, aerospace, defense, and consumer electronics, coupled with the rising adoption of enhancement-mode and depletion-mode GaAs HEMTs in advanced RF and satellite applications.

GaAs HEMTs Market Drivers:

-

Rising Demand for High-Efficiency Mobile RF Amplifiers Drives GaAs HEMTs Market

The growing need for high-performance, energy-efficient RF amplifiers in smartphones and mobile devices is driving the GaAs HEMTs market. Traditional GaAs HBTs face efficiency and output power limitations at higher frequencies (above 10 GHz), prompting the adoption of alternative transistor technologies that maintain high gain and low battery drain. Applications targeting emerging 6G networks require devices capable of delivering high power at mobile-compatible voltages. This demand for enhanced performance, coupled with innovations like gate recessing and advanced barrier materials, is propelling market growth and fostering continuous development in high-frequency, high-efficiency GaAs HEMTs.

In July 2025 – imec introduced a GaN-on-Si transistor technology for 6G smartphone power amplifiers, offering high output power and improved efficiency at 10–20 GHz.The solution uses gate recessing and an InAlN barrier to enhance performance over traditional GaAs HEMTs while remaining cost-effective for mobile applications.

GaAs HEMTs Market Restraints:

-

High Production Costs and Material Limitations Restrain GaAs HEMTs Market

The GaAs HEMTs market faces challenges due to high manufacturing costs and complex fabrication processes. Gallium arsenide substrates and advanced epitaxial growth techniques such as MBE and MOCVD require significant capital investment, limiting scalability for some applications. Additionally, material limitations, including lattice mismatch and thermal management issues, can affect device reliability and yield. Competing technologies, such as GaN-on-Si transistors, offer comparable performance at potentially lower costs, creating pricing pressures. Strict quality standards in high-frequency and aerospace applications further increase production complexity, making cost and process constraints a key restraint for the GaAs HEMTs market.

GaAs HEMTs Market Opportunities:

-

Expanding Applications in Renewable Energy and EV Infrastructure Drive GaAs HEMTs Market Opportunities

The GaAs HEMTs market presents significant growth opportunities through the rising adoption of high-performance, energy-efficient semiconductor components in electric vehicles, renewable energy systems, and energy storage solutions. Advancements such as GaN-on-Si and vertical GaN HEMTs enable higher blocking voltages, improved efficiency, and cost-effective alternatives to SiC MOSFETs, expanding their applicability in charging infrastructure, solar, and wind power plants. Continuous innovation in epitaxial growth and processing techniques supports development of high-voltage, high-density HEMTs, offering manufacturers a chance to cater to the accelerating demand for reliable, efficient, and sustainable electronic components in the energy transition.

June 10, 2024 – Fraunhofer IAF developed GaN-on-Si HEMTs with blocking voltages over 1200 V, enabling high-performance, efficient, and cost-effective power components for electric vehicles, renewable energy, and energy storage applications.The technology offers an alternative to costly SiC MOSFETs, supporting high-voltage, high-efficiency solutions critical for the energy transition.

GaAs HEMTs Market Segment Highlights:

-

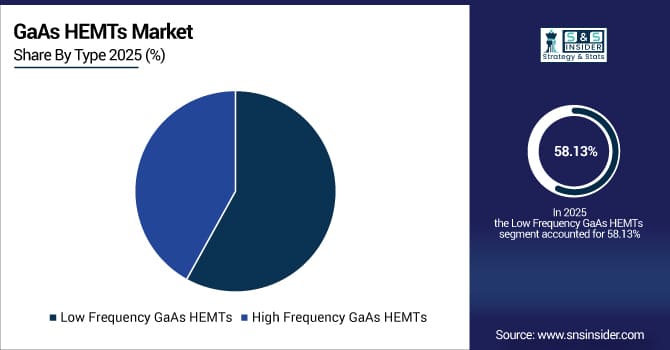

By Type: Dominant – Low Frequency GaAs HEMTs (58.13% in 2025 → 46.88% in 2033); Fastest-Growing – High Frequency GaAs HEMTs (CAGR 11.20%)

-

By Application: Dominant – Low Noise Amplifiers (48.13% in 2025 → 36.88% in 2033); Fastest-Growing – GPS (CAGR 11.72%)

-

By Technology: Dominant – Enhancement-mode (E-mode) GaAs HEMTs (55.63% in 2025 → 59.38% in 2033); Fastest-Growing – Enhancement-mode (E-mode) GaAs HEMTs (CAGR 8.87%)

-

By End-Use Industry: Dominant – Telecommunication (44.38% in 2025 → 40.63% in 2033); Fastest-Growing – Aerospace & Defense (CAGR 9.83%)

GaAs HEMTs Market Segment Analysis:

By Type, Low Frequency GaAs HEMTs are Dominating and High Frequency GaAs HEMTs are Fastest-Growing

Low Frequency GaAs HEMTs hold market dominance due to their widespread use in low-noise amplifiers, GPS modules, and standard RF applications, offering reliability and established performance. In contrast, High Frequency GaAs HEMTs are the fastest-growing segment, driven by rising demand for high-frequency, high-performance applications in aerospace, defense, and advanced telecommunications systems.

By Application, Low Noise Amplifiers are Dominating and GPS is Fastest-Growing

Low Noise Amplifiers dominate the market due to their essential role in RF signal processing and widespread deployment across communication and electronic systems. GPS applications are the fastest-growing segment, driven by increasing adoption in navigation, satellite communication, and location-based services.

By Technology, Enhancement-mode (E-mode) GaAs HEMTs are Dominating and Fastest-Growing

Enhancement-mode GaAs HEMTs hold market dominance because of their superior efficiency, stability, and broad applicability in high-frequency electronics. They are also the fastest-growing segment due to rising use in advanced RF and high-performance systems.

By End-Use Industry, Telecommunication is Dominating and Aerospace & Defense is Fastest-Growing

Telecommunication leads the market with extensive use in mobile networks, satellites, and wireless infrastructure. Aerospace & Defense is the fastest-growing end-use segment, driven by demand for high-performance, reliable, and high-frequency GaAs HEMTs in radar, defense communication, and satellite applications.

GaAs HEMTs Market Regional Highlights:

-

North America: 33.31% → 31.54%, Dominant region in 2025, supported by robust R&D infrastructure, strong industrial automation, and early adoption of GaAs HEMTs across telecom, aerospace, and defense sectors.

-

Asia-Pacific: 31.57% → 35.58%, Fastest-growing region, driven by rapid semiconductor expansion, industrial electrification, and heavy investments in telecommunications, EVs, and renewable energy infrastructure.

-

Europe: 21.79% → 21.16%, Stable region, sustained by energy-efficiency regulations, advanced automotive electronics, and steady industrial demand.

-

Latin America: 7.75% → 7.15%, Emerging market, benefiting from moderate industrial growth, telecom expansion, and increasing adoption of electronic systems.

-

Middle East & Africa: 5.58% → 4.57%, Smallest region, limited by industrial penetration but gradually growing through energy and infrastructure projects.

GaAs HEMTs Market Regional Analysis:

North America GaAs HEMTs Market Insights:

North America leads the GaAs HEMTs market, driven by advanced R&D infrastructure, early adoption across telecommunications, aerospace, and defense sectors, and strong industrial automation. The region benefits from high-performance semiconductor deployment, extensive technological expertise, and growing demand for high-frequency electronic components, ensuring sustained market dominance and steady growth.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S GaAs HEMTs Market Insights:

The U.S. leads the GaAs HEMTs market, driven by advanced R&D, strong industrial infrastructure, early adoption in telecom and defense, and growing demand for high-performance, high-frequency electronic components.

Asia-Pacific GaAs HEMTs Market Insights:

Asia-Pacific is the fastest-growing region in the GaAs HEMTs market, fueled by rapid semiconductor expansion, increasing industrial electrification, and significant investments in telecommunications, electric vehicles, and renewable energy. Strong government initiatives, manufacturing capacity growth, and rising adoption of high-frequency electronic components are driving robust market growth across the region.

China GaAs HEMTs Market Insights:

China is the dominant country in the GaAs HEMTs market, supported by extensive semiconductor manufacturing capabilities, strong government initiatives, growing telecom infrastructure, and increasing adoption of high-frequency electronic components.

Europe GaAs HEMTs Market Insights:

The Europe GaAs HEMTs market is witnessing emerging trends driven by energy-efficiency regulations, advancements in automotive electronics, and steady industrial demand. Growing investments in telecom infrastructure and renewable energy applications are fostering innovation, while manufacturers focus on high-performance, cost-effective solutions to strengthen the region’s presence in the global high-frequency semiconductor market.

Germany GaAs HEMTs Market Insights:

Germany is the dominant country in the GaAs HEMTs market, driven by advanced industrial automation, strong R&D capabilities, robust semiconductor manufacturing, and growing adoption in automotive, telecom, and defense applications.

Latin America GaAs HEMTs Market Insights:

The Latin America GaAs HEMTs market is steadily expanding, supported by moderate industrial growth, increasing telecommunications infrastructure, and rising adoption of electronic systems. Investments in renewable energy projects and emerging technology initiatives are further driving demand for high-frequency GaAs HEMTs across the region’s industrial and commercial sectors.

Brazil GaAs HEMTs Market Insights:

Brazil is the dominant country in the GaAs HEMTs market, supported by growing telecom infrastructure, expanding industrial applications, and increasing adoption of high-frequency electronic components across aerospace, defense, and commercial sectors.

Middle East & Africa GaAs HEMTs Market Insights:

The Middle East and Africa GaAs HEMTs market is witnessing moderate growth, driven by gradual industrial expansion, increasing adoption of energy and infrastructure projects, and rising demand for high-frequency electronic components in telecom, defense, and automotive applications. Emerging initiatives and technology investments are supporting steady regional market development.

Saudi Arabia GaAs HEMTs Market Insights:

Saudi Arabia is considered the dominant country, driven by investments in telecom infrastructure, energy projects, and growing adoption of high-frequency electronic components.

GaAs HEMTs Market Competitive Landscape:

MACOM Technology Solutions, established in 1950, is a leading semiconductor company specializing in high-performance RF, microwave, and millimeter-wave solutions. The company provides GaAs and GaN process technologies, amplifiers, switches, and foundry services for aerospace, defense, telecommunications, and SATCOM applications, supporting the full product lifecycle from design to high-volume manufacturing.

-

In May 2025 – MACOM showcased its advanced RF, microwave, and mmWave solutions at IMS 2025, featuring new LNAs, PAs, linearizers, and TRMs for EW, radar, and SATCOM applications.

WIN Semiconductors Corp., founded in October 1999, is a Taiwan‑based pure‑play GaAs foundry specialising in GaAs HBT and pHEMT technologies. It offers wafer fabrication, MMIC foundry services, and optoelectronic manufacturing across frequencies up to ~150 GHz for RF, wireless, automotive, and optical markets.

-

In June 2024 – WIN Semiconductors released its moisture‑rugged 0.1µm GaAs pHEMT technology (PP10‑29), supporting E-band amplifier designs with wafer-level moisture resistance. The platform offers 145 GHz fₜ / 180 GHz fₘₐₓ, versatile packaging options, and will reach full production in late Q3 2024.

GaAs HEMTs Market Key Players:

-

Qorvo, Inc.

-

Sumitomo Electric Industries, Ltd.

-

Mitsubishi Electric Corporation

-

Analog Devices, Inc.

-

MACOM Technology Solutions Holdings, Inc.

-

WIN Semiconductors Corp.

-

NXP Semiconductors N.V.

-

Skyworks Solutions, Inc.

-

IQE plc

-

II‑VI Incorporated

-

AXT, Inc.

-

Infineon Technologies AG

-

Broadcom Inc.

-

Cree, Inc.

-

Toshiba Corporation

-

Fujitsu Limited

-

Transphorm Inc.

-

Wolfspeed, Inc.

-

Murata Manufacturing

-

GlobalFoundries Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 1.54 Billion |

| Market Size by 2033 | USD 2.85 Billion |

| CAGR | CAGR of 7.99% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(Low Frequency GaAs HEMTs and High Frequency GaAs HEMTs) • By Application(Low Noise Amplifiers, GPS, TVRO and Others) • By Technology(Enhancement-mode (E-mode) GaAs HEMTs and Depletion-mode (D-mode) GaAs HEMTs) • By End User(Telecommunication, Aerospace & Defense, Consumer Electronics and Automotive) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Qorvo, Inc., Sumitomo Electric Industries, Ltd., Mitsubishi Electric Corporation, Analog Devices, Inc., MACOM Technology Solutions Holdings, Inc., WIN Semiconductors Corp., NXP Semiconductors N.V., Skyworks Solutions, Inc., IQE plc, II‑VI Incorporated, AXT, Inc., Infineon Technologies AG, Broadcom Inc., Cree, Inc., Toshiba Corporation, Fujitsu Limited, Transphorm Inc., Wolfspeed, Inc., Murata Manufacturing Co., Ltd., GlobalFoundries Inc. |