BCD Power IC Market Report Scope & Overview:

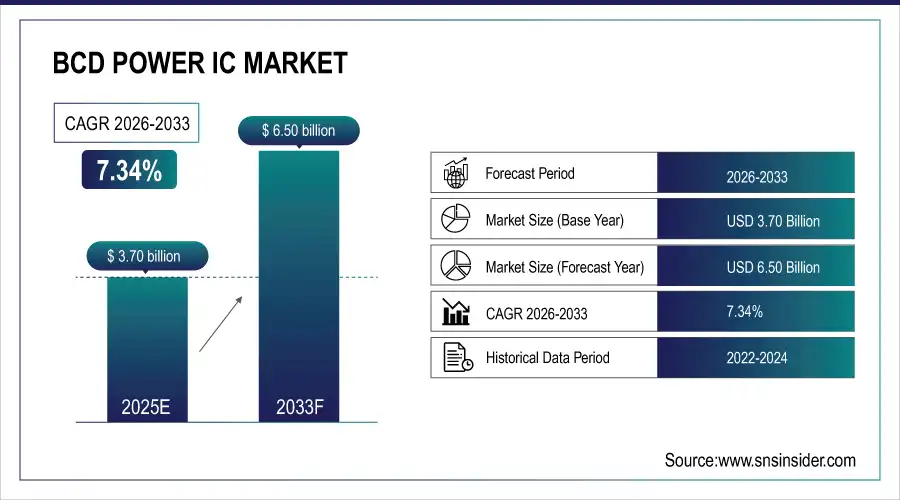

The BCD Power IC Market size was valued at USD 3.70 Billion in 2025E and is projected to reach USD 6.50 Billion by 2033, growing at a CAGR of 7.34% during 2026-2033.

The BCD Power IC market is growing due to rising demand for efficient power management solutions across automotive, industrial, consumer electronics, and telecommunications sectors. Increasing adoption of electric vehicles, ADAS, and advanced driver systems is driving high-voltage and mixed-signal integration. Growth in industrial automation, robotics, and renewable energy systems further supports demand. Additionally, miniaturization trends, higher integration of analog and digital functions, and the need for reliable, energy-efficient power devices are accelerating BCD Power IC adoption globally.

Market Size and Growth Projection:

-

Market Size in 2025E USD 3.70 Billion

-

Market Size by 2033 USD 6.50 Billion

-

CAGR of 7.34% From 2026 to 2033

-

Base Year 2025E

-

Forecast Period 2026-2033

-

Historical Data 2021-2024

To Get more information On BCD Power IC Market - Request Free Sample Report

Key BCD Power IC Market Trends

-

Rapid adoption of electric and hybrid vehicles is driving demand for high-voltage and mixed-signal BCD Power ICs for motor control, battery management, onboard chargers, and ADAS systems.

-

Expansion of industrial automation, robotics, renewable energy systems, and smart factories is increasing the need for compact, reliable, and integrated BCD Power IC solutions.

-

Advanced BCD process technologies enabling higher voltage ratings, improved thermal performance, and increased functional integration are creating significant market opportunities.

-

Growing deployment of 5G infrastructure, data centers, and smart grids is boosting demand for efficient and reliable power management ICs.

-

Emerging markets in Asia Pacific are expanding semiconductor fabrication capacity and electronics manufacturing, supported by government initiatives, driving regional growth and adoption of BCD Power ICs.

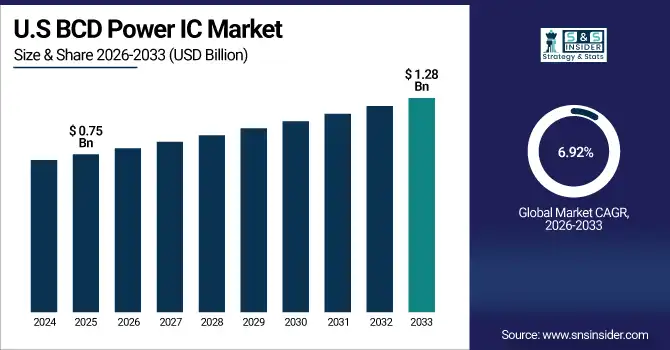

The U.S. BCD Power IC Market size was valued at USD 0.75 Billion in 2025E and is projected to reach USD 1.28 Billion by 2033, growing at a CAGR of 6.92% during 2026-2033. The U.S. BCD Power IC market is growing due to strong demand from electric vehicles, ADAS, and industrial automation, supported by advanced semiconductor R&D, expanding power electronics adoption, and increasing investments in energy-efficient, high-performance power management solutions.

BCD Power IC Market Growth Drivers:

-

Rising Demand for Efficient Power Management Drives Global BCD Power IC Market Growth

The global BCD Power IC market is primarily driven by the rising demand for efficient, high-performance power management solutions across automotive, industrial, consumer electronics, and telecommunications sectors. Rapid growth in electric vehicles (EVs) and hybrid electric vehicles (HEVs) has significantly increased the need for robust high-voltage and mixed-signal power ICs for applications such as motor control, battery management systems, onboard chargers, and ADAS modules. In addition, expanding industrial automation, robotics, renewable energy systems, and smart factories is accelerating adoption of BCD Power ICs due to their ability to integrate analog, digital, and power functions on a single chip, improving efficiency, reliability, and space utilization. Growing demand for energy-efficient consumer electronics, power adapters, and fast-charging solutions further supports market growth.

Electric vehicle adoption has surged globally, with more than 17 million EVs sold worldwide in 2024, reflecting strong consumer and manufacturer momentum toward electrification. EVs accounted for over 20 % of all vehicle sales that year

BCD Power IC Market Restraints:

-

Design Complexity and Reliability Challenges Restrain BCD Power IC Market Growth

A key restraint in the BCD Power IC market is the increasing design complexity associated with integrating high-voltage, analog, and digital functions on a single chip while maintaining reliability and thermal performance. Longer qualification cycles, especially for automotive and industrial applications, strict regulatory and safety standards, and challenges related to heat dissipation and device reliability can delay product commercialization and limit rapid adoption across certain end-use industries.

BCD Power IC Market Opportunities:

-

Advanced BCD Technologies Drive Global BCD Power IC Opportunities Electrification and 5G Expand Market Potential

Significant opportunities exist as semiconductor manufacturers focus on advanced BCD process technologies to support higher voltage ratings, improved thermal performance, and increased functional integration. The ongoing transition toward electrification in transportation, including EV charging infrastructure and power distribution systems, presents strong long-term growth potential. Emerging markets in Asia Pacific are creating new opportunities through expanding semiconductor fabrication capacity, rising electronics manufacturing, and supportive government initiatives. Additionally, increasing deployment of 5G infrastructure, data centers, and smart grids is expected to boost demand for reliable power management ICs. Continuous innovation in wide-bandgap compatibility, advanced packaging, and system-in-package solutions will further expand application areas and create sustained opportunities for market participants globally.

Countries worldwide have advanced smart grid programs: for example, the U.S. has committed billions in grid modernization funding under recent infrastructure legislation, and the EU has funded cross-border smart energy projects

BCD Power IC Market Segment Analysis

-

By Device/Component Type, BCD Power Management ICs dominated with 30.86% in 2025E, and BCD High‑Voltage Drivers is expected to grow at the fastest CAGR of 9.32% from 2026 to 2033.

-

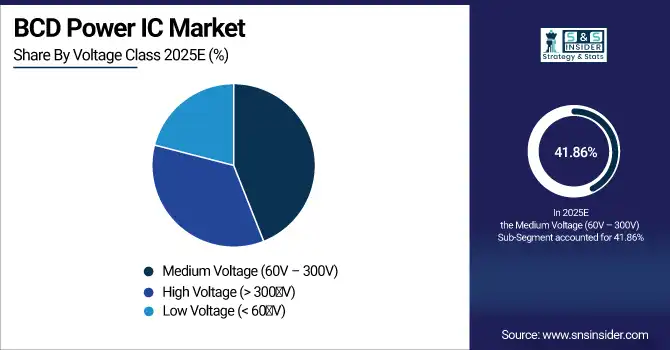

By Voltage Class, Medium Voltage (60 V – 300 V) dominated with 41.86% in 2025E, and High Voltage (> 300 V) is expected to grow at the fastest CAGR of 7.96% from 2026 to 2033.

-

By Application, Automotive Electronics (e.g., ADAS, motor control, EV/HEV systems) dominated with 34.97% in 2025E, and Industrial & Power Electronics (e.g., motor drives, UPS, robotics) is expected to grow at the fastest CAGR of 8.13% from 2026 to 2033.

-

By End-User, Automotive OEMs & Tier‑1 Suppliers dominated with 35.69% in 2025E, Industrial Equipment Manufacturers is expected to grow at the fastest CAGR of 7.96% from 2026 to 2033.

By Device/Component Type, BCD Power Management ICs Lead Market High‑Voltage Drivers Set for Rapid Growth 2026‑2033

BCD Power Management ICs dominated the market in 2025, driven by their widespread use in automotive power systems, industrial power supplies, and consumer electronics applications requiring efficient voltage regulation and power control. These ICs benefit from high integration of analog, digital, and power functions, enabling compact and reliable designs. Meanwhile, BCD High-Voltage Drivers are expected to witness the strongest growth from 2026 to 2033, supported by increasing adoption in electric vehicles, industrial motor drives, renewable energy systems, and high-voltage power distribution applications.

By Voltage Class, Medium Voltage Leads BCD Power IC Market High Voltage Segment Poised for Rapid Growth 2026‑2033

By Voltage Class, Medium Voltage (60 V–300 V) led the BCD Power IC market in 2025 due to its broad applicability across automotive electronics, industrial power systems, consumer power supplies, and motor control applications. This voltage range offers an optimal balance between performance, efficiency, and cost, making it suitable for a wide range of power management designs. Looking ahead from 2026 to 2033, High Voltage (>300 V) BCD Power ICs are expected to gain stronger traction, driven by growing adoption in electric vehicles, renewable energy inverters, industrial power conversion systems, and high-voltage infrastructure applications.

By Application, Automotive Electronics Drives BCD Power IC Market Industrial Power Electronics Set for Rapid Growth 2026‑2033

Automotive Electronics led the BCD Power IC market in 2025, supported by strong demand from electric and hybrid vehicles, advanced driver-assistance systems, motor control units, and onboard power management solutions. The automotive sector increasingly relies on highly integrated and reliable power ICs to meet performance, safety, and efficiency requirements. From 2026 to 2033, Industrial & Power Electronics is expected to experience the most rapid expansion, driven by rising adoption of industrial automation, robotics, renewable energy systems, motor drives, and uninterruptible power supplies, all of which require robust and efficient power control solutions.

By End-User, Automotive Leads BCD Power IC Market Industrial Equipment Set for Rapid Growth 2026‑2033

Automotive OEMs and Tier-1 Suppliers led the BCD Power IC market in 2025, driven by increasing integration of power electronics in electric vehicles, advanced driver-assistance systems, body electronics, and powertrain applications. The automotive sector’s focus on safety, reliability, and energy efficiency continues to support strong adoption of BCD technologies. From 2026 to 2033, Industrial Equipment Manufacturers are expected to witness the fastest growth, supported by expanding industrial automation, robotics, renewable energy installations, motor control systems, and modernization of industrial power infrastructure worldwide.

North America BCD Power IC Market Insights

North America accounted for 26.47% of the global BCD Power IC market in 2025, supported by strong demand from automotive, industrial, telecommunications, and data center applications. The region benefits from advanced semiconductor R&D capabilities, high adoption of electric vehicles, and early deployment of ADAS and autonomous technologies. Growing investments in industrial automation, renewable energy systems, and smart grid modernization further contribute to demand. In addition, the presence of leading semiconductor manufacturers and fabless design companies continues to strengthen North America’s position in high-performance power management solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. BCD Power IC Market Insights

The United States dominated the North America BCD Power IC market in 2025, driven by strong automotive electrification, advanced industrial automation, large-scale data center deployments, and robust semiconductor R&D. The presence of leading chip designers, automotive OEMs, and defense and telecom infrastructure further reinforces U.S. market leadership.

Europe BCD Power IC Market Insights

Europe accounted for 21.52% of the global BCD Power IC market in 2025, driven by strong demand from automotive, industrial, and renewable energy applications. The region’s leadership in automotive manufacturing, particularly in electric vehicles and advanced powertrain technologies, supports widespread adoption of BCD Power ICs. Increasing investments in industrial automation, smart factories, and energy-efficient power systems further contribute to growth. Additionally, stringent energy efficiency and emission regulations across the region encourage the use of advanced power management and high-voltage semiconductor solutions.

Germany BCD Power IC Market Insights

Germany dominated the European BCD Power IC market in 2025, supported by its strong automotive manufacturing base, leadership in electric vehicle powertrain technologies, and advanced industrial automation sector. The presence of major automotive OEMs, Tier-1 suppliers, and power electronics manufacturers reinforces Germany’s leading position in the region.

Asia Pacific BCD Power IC Market Insights

Asia Pacific dominated the BCD Power IC market with a 36.97% share in 2025, driven by rapid industrialization, growing consumer electronics production, and strong automotive electrification, particularly in electric vehicles and hybrid systems. The region hosts major semiconductor manufacturing hubs in China, Taiwan, South Korea, and Japan, supporting high adoption of BCD technologies. From 2026 to 2033, Asia Pacific is expected to grow at the fastest CAGR of 7.83%, fueled by expanding semiconductor fabrication capacity, government initiatives, industrial automation, renewable energy deployment, and rising demand for smart electronic devices.

China BCD Power IC Market Insights

China dominated the Asia Pacific BCD Power IC market in 2025, driven by its vast automotive and consumer electronics industries, rapid adoption of electric vehicles, and expanding semiconductor manufacturing infrastructure. Strong government support for domestic chip production and industrial electrification further reinforces China’s leadership in the regional market.

Latin America (LATAM) and Middle East & Africa (MEA) BCD Power IC Market Insights

Latin America (LATAM) and the Middle East & Africa (MEA) collectively represent a smaller but growing segment of the BCD Power IC market. In 2025, demand is driven by increasing industrial automation, renewable energy projects, and expanding automotive electronics adoption. Government initiatives to modernize power infrastructure, coupled with rising investments in EVs and smart grids, are supporting growth. While market penetration is moderate compared to other regions, LATAM and MEA offer emerging opportunities for BCD Power IC manufacturers through industrial, automotive, and energy applications.

Competitive Landscape for BCD Power IC Market:

STMicroelectronics is a global semiconductor leader specializing in BCD Power ICs and advanced power management solutions. The company serves automotive, industrial, consumer electronics, and telecommunications sectors, offering high-voltage, mixed-signal, and energy-efficient ICs. Its innovations in GaN, SiC, and integrated BCD technologies support electrification, industrial automation, and smart power applications worldwide.

-

In November 2025, ST unveiled GaNSPIN GaN‑based power ICs optimized for motion control in appliances and industrial drives, boosting energy efficiency and enabling lighter, more compact power modules.

Texas Instruments is a leading semiconductor company focused on power management and BCD Power IC solutions for automotive, industrial, data center, and communications markets. It delivers high‑performance power management, integration, and efficiency through advanced analog and mixed‑signal ICs, supporting electrification, automation, and energy‑efficient systems globally.

-

In March 2025, TI introduced advanced power‑management devices including the industry’s first 48 V integrated hot‑swap eFuse and a family of integrated GaN power stages to address high power density and efficiency needs in modern data centers driven by AI and high‑performance computing.

BCD Power IC Market Key Players:

-

Texas Instruments

-

Infineon Technologies

-

NXP Semiconductors

-

Maxim Integrated

-

Analog Devices (ADI)

-

ON Semiconductor (onsemi)

-

Renesas Electronics

-

Rohm Semiconductor

-

Diodes Incorporated

-

Power Integrations

-

Alpha & Omega Semiconductor (AOS)

-

Magnachip Semiconductor

-

GlobalFoundries

-

TSMC (Taiwan Semiconductor Manufacturing Company)

-

UMC (United Microelectronics Corporation)

-

Vishay Intertechnology

-

Tower Semiconductor

-

Hua Hong Semiconductor

-

Presto Engineering

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 3.70 Billion |

| Market Size by 2033 | USD 6.50 Billion |

| CAGR | CAGR of 7.34% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device/Component Type (BCD Discretes, BCD Analog ICs, BCD Mixed‑Signal ICs, BCD Power Management ICs, and BCD High‑Voltage Drivers) • By Voltage Class (Low Voltage (< 60 V), Medium Voltage (60 V – 300 V), and High Voltage (> 300 V)) • By Application (Automotive Electronics (e.g., ADAS, motor control, EV/HEV systems), Industrial & Power Electronics (e.g., motor drives, UPS, robotics), Consumer Electronics (e.g., adapters, power supplies) • By Telecommunications (e.g., base station power modules)), and End-User (Automotive OEMs & Tier‑1 Suppliers, Industrial Equipment Manufacturers, Consumer Electronics Brands, and Telecom & Networking Equipment Makers) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | STMicroelectronics, Texas Instruments, Infineon Technologies, NXP Semiconductors, Maxim Integrated, Analog Devices, ON Semiconductor, Renesas Electronics, Rohm Semiconductor, Diodes Incorporated, Power Integrations, Alpha & Omega Semiconductor, Magnachip Semiconductor, GlobalFoundries, TSMC, UMC, Vishay Intertechnology, Tower Semiconductor, Hua Hong Semiconductor, Presto Engineering. |