Gas Separation Membranes Market Report Scope & Overview:

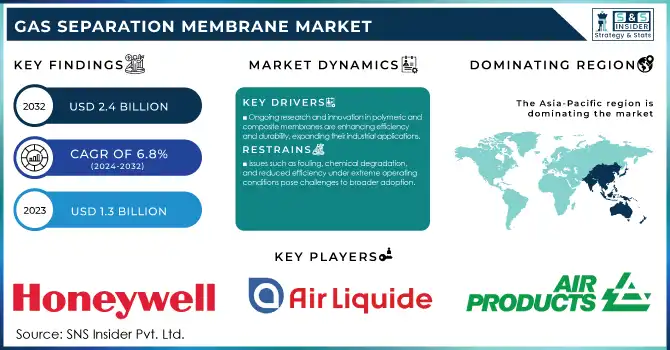

Gas Separation Membrane Market was valued at USD 1.38 Billion in 2025 and is expected to reach USD 2.66 Billion by 2035, growing at a CAGR of 6.8% from 2026-2035.

The gas separation membranes market is expected to continue its rapid expansion led by government initiatives geared toward reducing greenhouse gas emissions and increasing energy efficiency. To help address these priorities, governments around the world have launched many programs and funding opportunities targeted at developing membrane technology. As an illustration, this year the U.S. Department of Energy initiated a new program called the "Advanced Materials for Energy-Efficient Separations," which provides $25 million in funding toward the development of breakthrough membranes in applications with industrial relevance. Likewise in 2023, the European Union's Horizon Europe program introduced €50 million in funding in support of sustainable membrane technology innovation, aiming to attain carbon neutrality by 2050.

Market Size and Forecast:

-

Market Size in 2025 USD 1.38 Billion

-

Market Size by 2033 USD 2.66 Billion

-

CAGR of 6.8% From 2026 to 2035

-

Base Year 2025

-

Forecast Period 2026-2035

-

Historical Data 2022-2024

Get more information on Gas Separation Membranes Market - Request Sample Report

The gas separation membranes market is expected to continue its rapid expansion led by government initiatives geared toward reducing greenhouse gas emissions and increasing energy efficiency. To help address these priorities, governments around the world have launched many programs and funding opportunities targeted at developing membrane technology. As an illustration, this year the U.S. Department of Energy initiated a new program called the "Advanced Materials for Energy-Efficient Separations," which provides $25 million in funding toward the development of breakthrough membranes in applications with industrial relevance. Likewise in 2023, the European Union's Horizon Europe program introduced €50 million in funding in support of sustainable membrane technology innovation, aiming to attain carbon neutrality by 2050.

The U.S. Gas Separation Membrane market size was estimated at USD 0.52 billion in 2025 and is projected to reach USD 0.90 billion by 2035, growing at a CAGR of 5.4% from 2026 to 2035. The U.S. Gas Separation Membrane market is driven by the growing demand for efficient gas separation technology in various industries such as oil & gas, chemical, power, and environmental. The demand for carbon capture, hydrogen separation, and natural gas processing, as well as the need for energy-efficient and cost-effective gas separation technology, is driving the growth of the U.S. Gas Separation Membrane market. Additionally, the advancements in polymeric and inorganic gas separation membrane materials, the growth of industrial gas usage, and the substantial investments in clean energy and emission control programs are also adding to the positive growth momentum of the U.S. Gas Separation Membrane market.

Gas Separation Membranes Market Trends:

-

Growing adoption of gas separation membranes for carbon capture to meet stringent environmental regulations.

-

Increasing use in natural gas processing for CO₂ removal and methane recovery.

-

Advancements in polymeric and composite membrane technologies improving efficiency and durability.

-

Rising deployment of membrane-based carbon capture in heavy industries like power generation, cement, and steel.

-

Expansion of hydrogen production applications requiring membranes for purification and lower carbon footprints.

Gas Separation Membranes Market Growth Drivers:

The increasing global attention on greenhouse gas emissions reduction and carbon capture technology has made remarkable progress and investment. Gas separation membranes are a key component during this phase, allowing for the effective separation of CO₂ from industrial emissions. Membrane-based carbon capture, for example, is envisaged for mass adoption in power generation and in other major CO₂ emitting industries such as cement and steel. New research shows that emissions from the global cement industry alone represent nearly 8% of annual CO₂ emissions worldwide. This challenge has seen the increasing deployment of membrane-based systems over traditional methods based on chemical absorption, due to the lower energy cost of membranes. Combining technologies including high-efficiency membranes for CO₂ capture, the Norwegian Northern Lights CCS project is a global model, aimed at sequestering more than 1.5 million metric tons of CO₂ annually.

In addition, the transition towards sustainable energy, such as hydrogen, requires gas separation membranes to purify hydrogen. Meanwhile, better technologies such as polymeric and mixed-matrix membranes are developed for more efficient separation for lower carbon footprints in hydrogen production. These trends highlight the reasons why separate gas membranes are critical to meeting all global economy net-zero emission goals by 2050. Gas separation membranes are an integral part of solutions enabling sustainability in valuable climate change mitigation enablers, supported by national trends and technological progress.

Gas Separation Membranes Market Restraints:

The strong performance of gas separation membranes in harsh operating conditions is among the key factors that hinder the growth of the gas separation membranes market. Gas separation membranes are susceptible to fouling, which is the accumulation of molecules on the surface of the gas separation membrane. This leads to a reduction in the permeability of the gas separation membrane and, in the end, its performance. Another factor is the degradation of the gas separation membrane when it comes into contact with reactive gases such as hydrogen sulfide and ammonia.

In addition, the membranes are prone to damage from extreme pressure and temperature conditions. For instance, the integrity of the membranes becomes a major concern in high-pressure natural gas separation. Gas Separation Membranes Market Segment Analysis:

Gas Separation Membranes Market Segment Analysis:

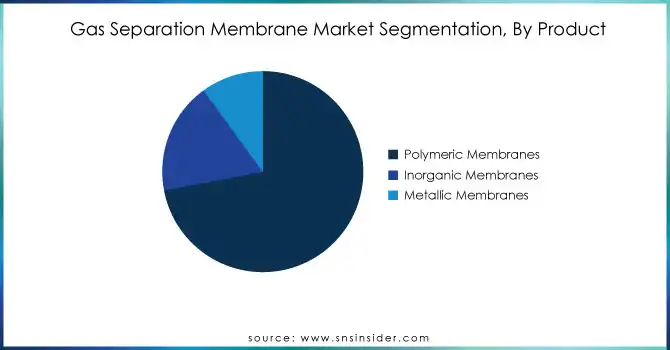

By Product

The polymeric membrane separation segment accounted for the largest share of the global revenue at 72% in 2025. High selectivity, robustness, and cost competitiveness in polymeric membranes for air separation, CO2 removal, and hydrogen recovery. In 2024, polymeric membranes were in use in more than 70% of the CO2 capture projects across Japan, as evidenced by the Ministry of Economy, Trade, and Industry (METI). Moreover, recent developments in polyimide and polysulfone membranes have improved their efficiency, thus fueling their adoption in the market.

By application

In 2025, the nitrogen separation market contributed more than 22% to the revenue share. This can be attributed to the increasing use of nitrogen in inerting, blanketing, and purging processes. Strict safety measures led to the 2025 figures from the European Chemicals Agency indicating that over 40% of chemical plants in Europe were employing nitrogen-based solutions. In the United States, nitrogen separation membranes also became popular in the semiconductor industry, where purity requirements have been becoming more stringent. According to a new report published by the International Energy Agency in 2024, the use of nitrogen-based solutions recorded a year-over-year increase of 10%, thanks to the launch of government-initiated pilot projects. This is a significant driving factor behind the provision of nitrogen separation in the gas separation membranes market.

By end-use

Petrochemicals and oil & gas segment dominated the market in 2025, with a revenue share of about 27.0%. It has been the most popular with numerous applications, including hydrogen recovery, carbon dioxide removal, and natural gas dehydration, which drove the membrane dominance. According to the U.S. Energy Information Administration's recent data hydrogen recovery applications accounted for almost 60% of the membrane installations in the oil & gas industry in 2024. Likewise, Saudi Arabia and other Arab countries are also significantly investing in research on membrane techniques for the improvement of petrochemical production. For example, The Saudi Ministry of Energy has announced a $3 billion investment in 2024 for the conversion of facilities utilizing membrane-based CO2 capture technologies under its Vision 2030 initiatives.

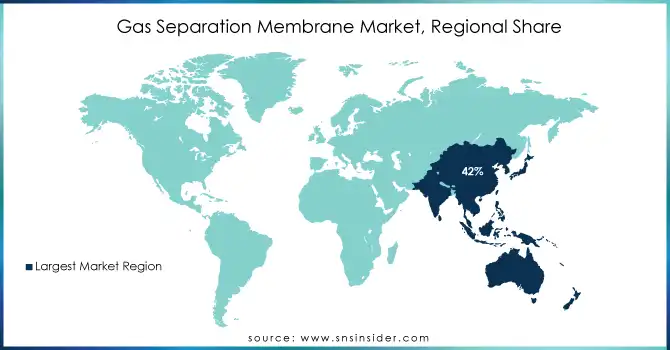

Gas Separation Membranes Market Regional Analysis:

Asia Pacific Gas Separation Membranes Market Insights

The global market was dominated by the Asia Pacific which also captured the highest revenue share of 42% in 2025. This was the case why some countries like China, India, and Japan racing ahead with their rapid industrialization and also making incredible investments in natural gas processing and carbon capture technology. China's Ministry of Ecology and Environment recently announced integrated projects, offering US$2 billion in further funding to support applications for innovative membrane solutions to improve industrial gas separation processes while ensuring peak carbon emissions by 2030.

North America Gas Separation Membranes Market Insights

The North American gas separation membrane market is expected to grow at a rapid pace over the forecast period owing to the growing adoption of carbon capture and storage (CCS) technologies and the availability of government incentives. The region is already solidifying its position as a leader in sustainability, as evidenced by a recent announcement in which the U.S. Department of Energy allocated up to $50 million for carbon capture and storage (CCS) demonstrations.

Europe Gas Separation Membranes Market Insights

The Europe gas separation membranes market is growing owing to the increasing focus on environmental regulations and investments in carbon capture technology. The gas separation membranes market is driven by its use in power generation, natural gas processing, and hydrogen production. Advancements in polymeric and composite gas separation membranes are enhancing efficiency and longevity. Environmental policies and sustainable practices in the Europe market are accelerating the adoption of gas separation membranes, making Europe a prominent destination for innovative gas separation membrane solutions.

Latin America (LATAM) and Middle East & Africa (MEA) Gas Separation Membranes Market Insights

The LATAM and MEA gas separation membranes market is expanding steadily, and this is due to the increasing awareness and concern for the environment. The market is also driven by the need for carbon capture, natural gas processing, and clean energy production. Technological advancements and development are also improving the growth of the market. The regions are becoming key emerging markets in the gas separation membranes market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Gas Separation Membranes Market Key Players:

Some of the Gas Separation Membranes Market Companies are

-

Air Products and Chemicals, Inc. (PRISM® Membrane Separators, GasGuard® Membranes)

-

Air Liquide Advanced Separations (Medal™ Membranes, OXYTRAP® Membranes)

-

Honeywell UOP (Separex™ Membranes, Polysep™ Membranes)

-

Membrane Technology and Research, Inc. (MTR) (VaporSep® Systems, BioSep® Membranes)

-

Parker Hannifin Corporation (Balston® Nitrogen Generators, Membrane Dryers)

-

Evonik Industries AG (SEPURAN® Green, SEPURAN® Noble Membranes)

-

Schlumberger Limited (Cynara® CO2 Membranes, PoroFlex™ Membranes)

-

Generon IGS (Nitrogen Membranes, CO2 Membrane Systems)

-

DIC Corporation (Neosepta® Membranes, Aqualife™ Membranes)

-

Global CCS Institute (Carbon Capture Membrane Solutions)

Competitive Landscape for Gas Separation Membranes Market:

-

In March 2024, the U.S. Department of Energy announced a collaboration with a leading manufacturer of membranes to develop next-generation polymeric membranes to improve hydrogen separation efficiency. The $10 million project is anticipated to enhance hydrogen production volumes.

UBE Corporation is a leading Japanese chemical and materials company specializing in advanced membrane technologies for gas separation applications. The company develops high-performance polymeric membranes for carbon capture, natural gas processing, and hydrogen purification. With a strong focus on innovation, UBE delivers efficient, durable, and sustainable solutions. Its expertise supports global environmental goals, making it a key player in advancing gas separation membrane technologies for energy transition and climate change mitigation.

-

In January 2023, UBE Corp. announced the expansion of its production capacity for gas separation membrane hollow fibers and membrane modules. The expansion will add a production capacity of approx. 1.8 times the existing production capacity and is being built to cater to the growing demand from environmental and energy sectors with commissioning expected by mid-2025.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 1.38 Billion |

| Market Size by 2035 | USD 2.66 Billion |

| CAGR | CAGR of 6.8% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Polymeric Membranes, Metallic Membranes, Inorganic Membranes) • By Application (Nitrogen Separation, Hydrogen Separation, Oxygen Separation, Acid gas Separation, Others) • By End-use (Chemicals, Power Generation, Petrochemicals and Oil & Gas, Pollution Control, Food & Beverage, Pharmaceuticals, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Air Products and Chemicals, Inc., Air Liquide Advanced Separations, Honeywell UOP, Membrane Technology and Research, Inc. (MTR), Parker Hannifin Corporation, Evonik Industries AG, Schlumberger Limited, Generon IGS, DIC Corporation, Global CCS Institute. |