Gene Synthesis Market Size Analysis:

Get More Information on Gene Synthesis Market - Request Sample Report

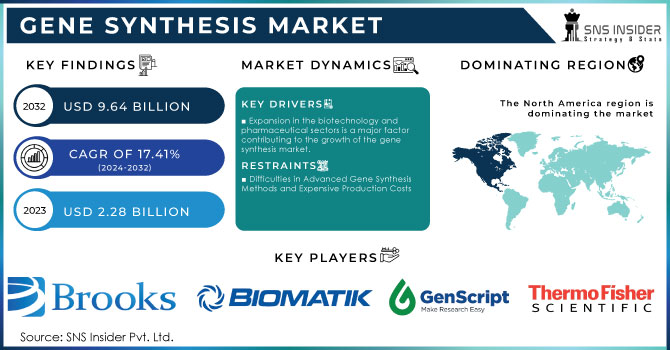

The Gene Synthesis Market size was valued at USD 2.28 billion in 2023 and is expected to grow to USD 9.64 billion by 2032 and grow at a CAGR of 17.41% over the forecast period of 2024-2032.

The gene synthesis market has seen notable expansion because of advancements in biotechnology and increased use in sectors like medicine, agriculture, and industrial biotechnology. The process of gene synthesis entails generating synthetic genes in a lab environment for applications in research, therapy, and business. The increasing need for personalized medicine, progress in synthetic biology, and the demand for new genetic disorder treatments are all factors propelling this market. Technological advances like high-throughput sequencing and CRISPR-based gene editing have decreased the time and cost needed for gene synthesis in the market. Leading companies in the industry, such as GenScript, Integrated DNA Technologies, and Twist Bioscience, provide a variety of services including gene construction and large-scale production. The growing use of gene synthesis in drug discovery and development, as well as in the production of genetically modified organisms (GMOs) for agriculture, continues to drive market expansion.

The changing regulatory environment for artificial DNA is expected to have a major effect on the gene synthesis market. Due to the improvement and affordability of synthetic DNA technology, strict regulations have been put in place to control the risks of misuse when ordering genetic material through mail. The new regulations demand DNA manufacturers to use strict screening methods to detect dangerous sequences, indicating a move towards increased supervision in the sector. At present, these rules mainly affect organizations receiving federal funding, highlighting an overall shift towards stricter governance in gene synthesis. Recent regulatory measures point to increasing worries about the possible abuse of synthetic DNA, with major effects on the gene synthesis industry. Due to the swift progress in synthetic DNA technologies, which has made the process quicker, less expensive, and more available, the capacity to generate innovative gene sequences and even possibly dangerous pathogens has become an urgent concern. This has resulted in the implementation of new regulations with the goal of enhancing the safety and security of mail-order genetic material, specifically by emphasizing the screening and evaluation of sequences that may present biological hazards. With the increasing availability of synthetic DNA and numerous global companies involved in its manufacturing and delivery, there is a greater focus on the responsible use of these technologies. The regulations mandate DNA producers to adopt screening procedures to detect worrisome sequences, like those that may lead to disease or harm. While these regulations currently only affect organizations receiving federal funding, they highlight a significant move towards stricter regulations in the gene synthesis industry. Most of the sector, which includes approximately 80% of DNA suppliers involved in the International Gene Synthesis Consortium, already follows certain screening procedures.

Gene synthesis is an advanced technique used in the lab to produce customized DNA sequences by organizing nucleotides in a precise order to generate desired genetic sequences. This method allows scientists to generate new genes, modify existing ones, or produce complex DNA structures without relying on traditional cloning methods. Gene synthesis accelerates genetic research and provides unprecedented authority over genetic material by removing the necessity for live cells. It is commonly utilized in industries such as biotechnology, healthcare, drugs, and farming. Research utilizes gene synthesis to study gene functions, create novel proteins, and build model organisms. In the medical field, advancements in gene therapies, vaccines, and diagnostics are essential. The technique holds the same level of significance within the realm of synthetic biology, which focuses on creating artificial biological systems like modified organisms capable of synthesizing biofuels or drugs.

Global Gene Synthesis Market Dynamics

Drivers

- Innovation in Precision Medicine and Gene Therapies Driven by Gene Synthesis Market

Advancements in personalized medicine and gene therapies have driven substantial expansion in the gene synthesis market, as demonstrated by the recent FDA endorsements of Casgevy and Lyfgenia for sickle cell disease (SCD). Gene synthesis is essential for developing new therapies through tailor-made DNA sequences that correspond to particular genetic mutations. These technologies are crucial in addressing genetic disorders as they allow scientists to manipulate, modify, or replace faulty genes. For instance, Casgevy and Lyfgenia show how synthetic DNA could revolutionize therapies for severe diseases by using CRISPR/Cas9 and lentiviral vector technologies, respectively. Gene synthesis is essential for precision medicine as it allows for the creation of synthetic DNA needed for these treatments. Moreover, the growing prevalence of genetic disorders and the increasing need for personalized treatments are fueling investments in gene synthesis technologies. The U.S. government, through the National Institutes of Health (NIH), continues to offer substantial funding for genomics research, further boosting the market. NIH announced that funding for genomics research exceeded $1 billion in 2023, showing the increasing importance of gene synthesis in advancing medicine. The increase in gene therapies being developed and approved is anticipated to lead to a significant rise in the demand for synthetic DNA. Additionally, advancements in automation and artificial intelligence in gene synthesis procedures are enhancing the rate, accuracy, and cost-effectiveness of DNA production. This predicted change is expected to accelerate drug discovery, vaccine development, and biopharmaceutical creation processes.

- Expansion in the biotechnology and pharmaceutical sectors is a major factor contributing to the growth of the gene synthesis market.

The rapid growth of the biotechnology and pharmaceutical industries greatly influences the gene synthesis market, highlighting their crucial role in improving drug discovery, development, and production. Gene synthesis is vital for these procedures, providing a flexible base for creating tailored DNA sequences essential for developing groundbreaking therapeutic treatments and products. Gene synthesis is vital for the process of finding and developing drugs as it helps to generate synthetic proteins that play a crucial role in identifying and verifying new drug targets. These proteins are employed in high-throughput screening tests to assess how they interact with possible drug candidates, speeding up the drug discovery process. In addition, gene synthesis allows for the creation of monoclonal antibodies and other biologics that are commonly used in targeted treatments for diseases like cancer and autoimmune disorders. Due to an influx of funding for research and development (R&D) and a rise in pharmaceuticals moving through the clinical pipeline, the biotechnology and pharmaceutical sectors are undergoing an unprecedented surge in growth. This significant investment is leading to an increase in demand for gene synthesis services, which assist in developing new therapeutic molecules and biologics. The increase in gene synthesis demand is a result of the growing popularity of personalized medicine and precision therapies tailored to specific genetic characteristics. The employment of synthetic genes in these therapies directly aims at certain genetic mutations or changes, underscoring the significance of gene synthesis in creating individualized treatments. The growth of the biotechnology sector is driving advancements in synthetic biology, where gene synthesis is utilized to create organisms for a range of purposes in medicine, agriculture, and environmental science. The rising popularity of gene synthesis technologies in different industries highlights their growing range of applications.

Restraints

- Difficulties in Advanced Gene Synthesis Methods and Expensive Production Costs

The gene synthesis market is facing significant obstacles due to the complex procedures involved in gene synthesis and the subsequent costly processes. Gene synthesis involves the accurate construction of long DNA sequences from single nucleotides, employing sophisticated technology. The intricate methods required for precise nucleotide assembly, error correction, and synthesis of extensive and complex genes add more complexity to the procedure. Developing artificial genes with substantial size or intricate sequences necessitates advanced technology and complex methods, leading to higher costs. Moreover, the high cost of gene synthesis can be attributed to a variety of factors such as the use of high-quality reagents, specialized software for sequence design, and strict quality control measures to ensure the accuracy and efficiency of the synthesized genes. The advanced gene synthesis technology may not be easily accessible to many research institutions and smaller biotech companies due to its complexity and cost, limiting its usage. The rising demand for cost-effective and scalable gene synthesis options is fueled by the increasing interest in custom medicine, genetic treatments, and biological products. However, the high cost of these sophisticated techniques could impede creativity and limit the access of gene synthesis technology to larger, financially stable institutions. Constantly improving gene synthesis technology is vital for addressing these issues by increasing productivity, reducing expenses, and broadening gene synthesis availability in the biotechnology and pharmaceutical sectors.

Gene Synthesis Market Segmentation Analysis

By Method

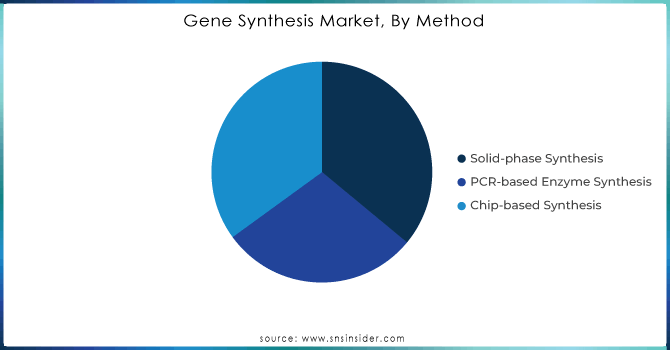

By 2023, solid-phase synthesis dominated the gene synthesis market, accounting for a significant 36% of revenue. This method continues to be the main way for gene synthesis because it is efficient and flexible in producing various Method s of nucleic acid polymers, such as RNA and DNA, whether they are modified or traditional. Solid-phase synthesis consists of adding nucleotides in order to a chain attached to a solid support, facilitating the accurate assembly of intricate gene sequences. This technique is commonly used because it can create synthetic genes with customizable sequences of high purity and quality. Agilent Technologies, Blue Heron Biotech, and Sloning Biotechnology are utilizing solid-phase synthesis to enhance their products, leading the gene synthesis industry. Agilent Technologies has recently launched new synthesis platforms that improve the scalability and accuracy of solid-phase synthesis, enhancing the efficiency of large-scale gene production. Blue Heron Biotech has advanced its exclusive technologies that simplify the synthesis process, allowing for quicker creation of lengthy, intricate genes with reduced errors. Sloning Biotechnology has made progress by incorporating automation and high-throughput capabilities into its solid-phase synthesis processes, leading to a notable decrease in turnaround times and operational expenses. Furthermore, there has been a significant effort to integrate advanced computational tools and bioinformatics in solid-phase synthesis to enhance sequence design and reduce synthesis errors. These advancements increase gene synthesis productivity and cost-effectiveness, while also broadening the potential uses of synthetic genes in areas like therapeutic development, personalized medicine, and advanced research. The continuous progress in solid-phase synthesis technologies highlights its crucial impact on driving the expansion and development of the gene synthesis market.

Need any customization research on Gene Synthesis Market - Enquiry Now

By Services

In the gene synthesis market of 2023, antibody DNA synthesis dominated with a substantial 61% revenue share. This prominent position highlights the importance of antibody DNA synthesis in a range of uses, such as drug development, diagnostic tests, and producing therapeutic antibodies. The technique is mainly popular because it helps with cloning and synthesizing antibody chain sequences into vectors, which is crucial for creating a variety of antibody libraries and designing specific treatments. Numerous essential individuals have played a crucial role in progressing this field. In April 2022, Twist Bioscience Corporation introduced a new high-throughput antibody production platform as an example. This new platform helps researchers convert digital DNA sequences into purified IgG antibodies quickly, improving antibody development and speeding up research timelines. In the same way, Codex DNA, Inc. demonstrated its automated synthetic biology technologies at the Antibody Engineering and Therapeutics conference in Europe in June 2022. This technology aims to improve the process of discovering new antibodies, resulting in a shorter time needed to create and evaluate them. The incorporation of automation and advanced computational tools in antibody DNA synthesis enables quick validation of antibody candidates, benefiting biotech and pharmaceutical firms with increased production efficiency. Ongoing advancements in this field are meeting the increasing need for personalized antibodies and pushing the capabilities of gene synthesis services. These advancements are strengthening the dominant role of antibody DNA synthesis in the market and also enabling wider uses in research and therapeutic development through enhanced efficiency and scalability.

Regional Insights

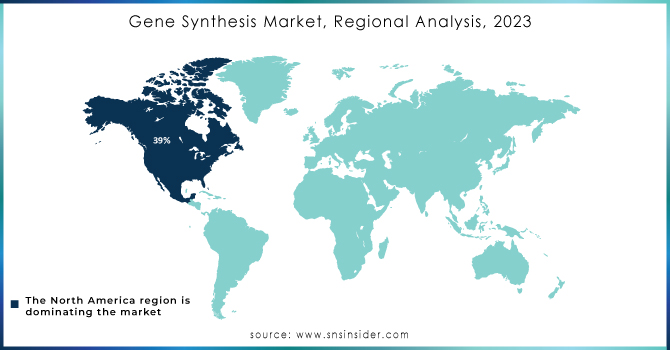

North America held the largest share of revenue in the gene synthesis market with 34% in 2023. Several factors, such as the strong presence of major market players, growing investments in biotechnology and pharmaceutical research, and a flourishing synthetic biology sector, contribute to this dominance. The area's importance is further enhanced by its wide range of contract research organizations (CROs) providing specialized gene synthesis services. Companies such as GenScript demonstrate this pattern by conducting significant business in North America. GenScript has strengthened its position through the offering of various services including custom gene synthesis, antibody drug development, and cell line development, making a substantial impact on the market share in the region. The increasing presence of synthetic biology in North America is also a key driver of market expansion. Recent advancements involve the creation of cutting-edge gene synthesis platforms and technologies that improve the accuracy and effectiveness of genetic alterations. For example, advanced gene synthesis methods have allowed quick and expandable creation of synthetic genes, enabling advancements in gene and cell therapy. Moreover, businesses are increasingly utilizing automation and digital tools in order to simplify gene synthesis processes, ultimately leading to decreased turnaround times and expenses. The increasing interest in gene and cell therapy development by leading biotechnology and pharmaceutical companies in the U.S. and Canada is also increasing the need for gene synthesis services. This can be seen in the growing amount of partnerships and collaborations between industry experts and research organizations working to improve medical treatments.

By 2023, the Asia-Pacific area is expected to see the highest growth rate in the gene synthesis market, due to a mix of rising research efforts, increasing focus on synthetic biology, and a growing prevalence of lifestyle-related illnesses. This progress is driven by significant improvements in healthcare infrastructure, enabling more advanced research and development (R&D) endeavors. Furthermore, the area is experiencing an increase in the number of major biotechnology firms and a strong growth of local companies at the forefront of advancements in gene synthesis technologies. In recent years, cutting-edge platforms that enhance gene synthesis capabilities have been introduced by companies like BGI Group and Genomatix. The high-throughput gene synthesis technologies of BGI Group, one of the largest genomics organizations globally, have been improved to enable quicker and more precise synthesis of complex genetic constructs. Likewise, Genomatix has introduced new bioinformatics tools aimed at simplifying the creation and enhancement of artificial genes to meet the rising need for accuracy in genetic research and therapeutic progress. Rising rates of chronic illnesses and the demand for successful treatments are leading to an increase in investments in gene synthesis services throughout Asia-Pacific. Nations such as China and India stand out for their growing biotechnology industries and rising research efforts, backed by government incentives and private investments. China has recently invested a significant amount of money into genomic research and the development of advanced research facilities in order to boost its biotech industry. In India, there has been a notable increase in biotechnology startups specializing in gene synthesis and synthetic biology, further propelling market expansion. In general, the healthcare and biotechnology sectors in Asia Pacific are progressing rapidly, making it a leading center for gene synthesis innovation and implementation.

Gene Synthesis Market Key Players

The Major Players are GenScript, Brooks Automation, Inc. (GENEWIZ), Boster Biological Technology, Twist Bioscience, ProteoGenix, Inc, Biomatik, ProMab Biotechnologies, Inc., Thermo Fisher Scientific, Inc., Integrated DNA Technologies, Inc., OriGene Technologies, Inc. & Other Players

Recent Development in the Gene Synthesis Market

-

In January 2023, Twist Bioscience and Astellas start a partnership for multitarget antibody discovery research. This collaboration aims to find antibodies for various targets and healing treatments for patients with diseases with no available treatments. It is anticipated that this plan will improve the company's service offerings.

-

In April 2022DNA Script introduced a fresh initiative for users of their SYNTAX System. This enables companies to gain early entry to the newest developments in their EDS technology. This approach enabled the company to speed up the diversification of applications for their SYNTAX System and grow their customer base, leading to an increase in revenue.

| Report Attributes | Details |

| Market Size in 2023 | USD 2.28 Billion |

| Market Size by 2032 | USD 9.64 Billion |

| CAGR | CAGR of 17.41% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Method (Solid-phase Synthesis, PCR-based Enzyme Synthesis, Chip-based Synthesis) • By Services (Antibody DNA Synthesis, Viral DNA Synthesis, Others) • By Application (Gene & Cell Therapy Development, Disease Diagnosis, Vaccine Development, Others) • By End User(Academic and Research Institutes ,Biopharmaceutical Companies ,Contract Research Organizations) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GenScript ,Brooks Automation, Inc. (GENEWIZ) ,Boster Biological Technology ,Twist Bioscience, ProteoGenix, Inc ,Biomatik ,ProMab Biotechnologies, Inc.,Thermo Fisher Scientific, Inc.,Integrated DNA Technologies, Inc.,OriGene Technologies, Inc. & Others |

| Key Drivers | • Innovation in Precision Medicine and Gene Therapies Driven by Gene Synthesis Market • Expansion in the biotechnology and pharmaceutical sectors is a major factor contributing to the growth of the gene synthesis market. |

| RESTRAINTS | • Difficulties in Advanced Gene Synthesis Methods and Expensive Production Costs |