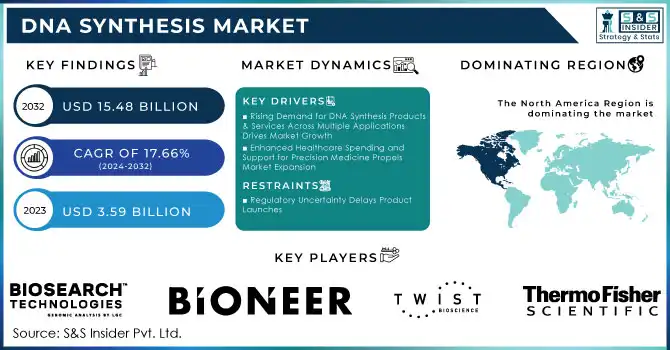

DNA Synthesis Market Size & Overview:

Get more information on DNA Synthesis Market - Request Sample Report

The DNA Synthesis Market was valued at USD 3.59 billion in 2023 and is expected to reach USD 15.48 billion by 2032, growing at a CAGR of 17.66% over the forecast period 2024-2032.

The DNA synthesis market is accelerating significantly due to its expanding applications in molecular biology, genetic engineering, and clinical diagnostics. With the increasing demand for drug discovery and personalized medicine, DNA synthesis has become crucial in understanding of genetic underpinnings of diseases, precise diagnostics, and support of targeted treatment approaches. DNA synthesis is crucial in mapping tumor genomes, identifying mutations, and guiding targeted therapies in cancer genomics, which highlights its role in precision medicine.

Furthermore, synthetic biology has fueled the demand for DNA synthesis as it facilitates the design and construction of biological components and systems. CRISPR-Cas9 technologies rely on custom gene synthesis to synthesize therapeutic genes and their gene editing tools, which typifies the growing role of synthetic DNA in gene therapy and genome editing. A strategic program like the Precision Medicine Initiative coupled with companion diagnostics is fueling the applications of gene expression studies, thus rapidly increasing the demand for synthetic DNA probes and primers.

Regulatory changes affect market trends as countries update genetic research policies to encourage innovation in medicine and healthcare. The dynamic regulatory scenario has removed restrictions on genetic studies and created a research-friendly and drug-therapy-appropriate environment. Industry players are responding to these trends by expanding product portfolios and launching advanced gene synthesis services that meet the increasing demands in the market. For instance, GenScript launched GMP double-strand and single-strand services in 2022 to support cell and gene therapy. The company's 2023 GenTitan Gene Fragments service improves synthesis cost-effectiveness.

Strategic collaborations and mergers also fuel the market growth because they are trying to leverage the added expertise in diagnostics and therapeutics. Companies such as Twist Bioscience are innovating through partnerships, for example, partnering with Astellas Pharma in 2023 for immunotherapy research. Regional expansions also work as the accelerating factor for market growth in which access to biotechnology is one of the primary reasons. For example, NunaBio received USD 2.4 million in funding in 2023 to take their synthetic DNA production to the next step and underpin the growth of access to DNA synthesis technologies across various fields of science. Continuous improvements in technologies related to molecular separation and protein purification also contribute to faster, cost-effective solutions across applications in medicine, diagnostics, and academic research.

DNA Synthesis Market Dynamics

Drivers

-

Rising Demand for DNA Synthesis Products & Services Across Multiple Applications Drives Market Growth

The demand for synthetic DNA is surging, greatly influencing advancements in enzyme production, novel protein synthesis, and new drug discoveries. The integration of synthetic biology in drug development and innovative treatment options has further boosted the need for synthetic DNA, prompting the creation of technologies that offer enhanced DNA purity, increased yield, and reduced production costs. This demand has shifted commercial priorities from natural DNA isolation to synthetic DNA production. The growing prevalence of chronic diseases and increasing awareness of personalized treatment options have further driven global demand for synthetic DNA products and services. For instance, data from the American Cancer Society in 2024 projected around 2,001,140 new cancer cases in the U.S., underscoring the need for precise diagnostic methods, thereby increasing the adoption of synthetic DNA services. Additionally, approvals of gene-based therapies for rare diseases are accelerating market growth. In December 2023, the FDA approved Casgevy and Lyfgenia as the first cell-based gene therapies for sickle cell disease, with Casgevy utilizing advanced genome editing technology. Such regulatory endorsements and innovative launches are major contributors to market expansion.

-

Enhanced Healthcare Spending and Support for Precision Medicine Propels Market Expansion

With rising healthcare costs, there is an increasing demand from providers and patients for precision medicine, alongside investments in R&D for new treatments. Gene synthesis, which facilitates tailored treatments for complex diseases, such as cancer and genetic disorders, is becoming a key component in clinical research and therapeutic interventions. Government support for precision medicine and drug innovation also fuels market growth. For example, the U.K. Department for Business and Trade announced in 2021 a public spending increase of USD 27.36 billion for R&D, focusing on precision medicine, with 2.4% of the GDP earmarked for research by 2027. These initiatives aim to make advanced treatments more accessible and cost-effective, promoting market expansion. Moreover, increased fundraising by industry leaders for investments in advanced technology and modern facilities further propels market growth, enhancing the availability of advanced DNA synthesis solutions.

Restraints

-

Regulatory Uncertainty Delays Product Launches

-

Shortage of Skilled Workforce in Synthetic Biology

DNA Synthesis Market - Key Segmentation

By Service

The oligonucleotide synthesis segment was the dominant segment in 2023, driven strongly by a focus on genomics research, personalized medicine, and the exploration of mechanisms of genetic diseases. Oligonucleotides are very important for molecular biology, genetics, and genomics applications, such as PCR, DNA sequencing, and gene expression studies. Greater recognition of genetic disorders has also increased demand for oligonucleotides, both in diagnostics and therapeutic applications. For example, in August 2023, UC San Diego launched a Gene Therapy Initiative, supported by a USD 5 million gift from the Nancy and Geoffrey Stack Foundation, that aims to develop new treatments for rare genetic diseases that afflict both children and adults.

The gene synthesis segment is expected to have the highest CAGR of 16.7% in the forecast period. This segment includes custom gene synthesis and gene library synthesis. Gene synthesis supports gene therapy approaches, introducing new genes into cells to treat or prevent diseases. Other techniques include manipulation of the mutated genes through selective reverse mutation, repair of damaged genes, or substitution of mutated genes with functional ones. Also, gene synthesis allows the cloning of synthetic therapeutic genes to custom viral vectors, optimizing expression and improving specificity in gene delivery.

By Application

In 2023, the research and development segment accounted for the dominant share of the market at 63.3%, primarily due to the growing demand for DNA synthesis in global research projects. Oligonucleotides are fundamental reagents in molecular biology research genetic testing and drug discovery. DNA synthesis is highly important in many R&D areas such as biopharmaceuticals, synthetic biology, gene synthesis, and genome editing. Additionally, the market growth has significantly increased with the rapid acceptance of CRISPR technology. Scientists have been using CRISPR for a wide array of applications including gene knockout studies and therapeutic interventions that encourage industrial growth.

Therapeutics is the fastest-growing segment and offers the highest CAGR at 16.41% over the forecast period. DNA synthesis has always supported research in therapeutics across geographies continuously with the capability to synthesize DNA rapidly and with great accuracy, which allows for effective profiling of quite diverse targets: synthesizing whole synthetic gene circuits as well as creating and screening therapeutic enzymes, among others. The requirement of customized treatment of different genetic disorders as well as cancers has brought the sector of therapeutics in front of DNA synthesis applications.

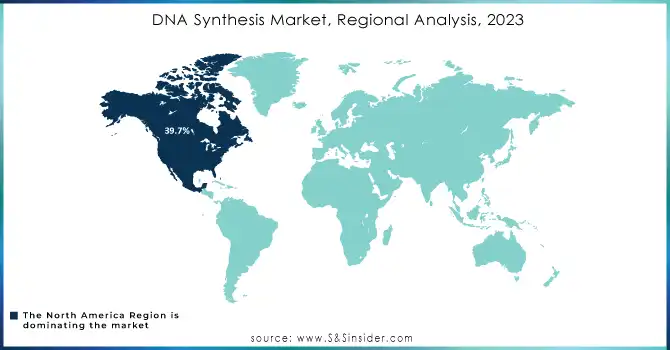

DNA Synthesis Market Regional Analysis

North America was a dominant region in the DNA synthesis market in 2023, accounting for 39.7% of revenue due to high public awareness, well-developed healthcare facilities, and high investments in R&D. High incidence of chronic diseases and strong research efforts on gene synthesis and therapy are additional factors driving growth in this region. In the US market, demand for synthetic DNA and RNA is increasing in research, diagnostics, and therapeutics. Competitive landscape factors include the established players as well as new entrants.

Europe has a lot of potential due to government support, good research infrastructure, and increasing gene therapy practice. The UK has good prospects in growth and related areas because of strong genetic research, government initiatives, and health infrastructure; one example that features a mark of progress in gene editing is the approval for CRISPR-based Casgevy. It has a good R&D environment and government support for biotechnology, thus offering scope for expansion. On the other hand, the demand for DNA synthesis in France is propelled by research into cancer and cardiovascular diseases. The potential applications of oligonucleotides in diagnostics and personalized treatments are critical to its growth.

The Asia Pacific region is anticipated to experience the fastest growth during this period, a CAGR of 17.5% from 2024 to 2032, resulting from the high demand for synthetic DNA in research and diagnostics. China leads with a forecasted 21.4% CAGR, fueled by the growth of CROs and facility expansions, like GenScript's in Jiangsu. Japan's aging population and focus on personalized medicine contribute to market growth, while India’s high birth rate and genetic disorder prevalence, alongside government initiatives, foster a promising environment for DNA synthesis.

Do You Need any Customization Research on DNA Synthesis Market - Enquire Now

Key Players

-

Thermo Fisher Scientific Inc. - DNA synthesis reagents and oligonucleotide synthesis services

-

Twist Bioscience Corporation - Synthetic DNA and oligonucleotide pools

-

BIONEER CORPORATION - Custom gene synthesis and oligonucleotides

-

Eton Bioscience, Inc. - DNA sequencing and synthesis services

-

LGC Biosearch Technologies - Oligonucleotide synthesis and nucleic acid synthesis solutions

-

IBA Lifesciences GmbH - Custom DNA and RNA oligonucleotide synthesis

-

Eurofins Scientific - Genomics services including gene synthesis and oligonucleotide production

-

Integrated DNA Technologies, Inc. - DNA and RNA oligonucleotides, gene synthesis, and CRISPR solutions

-

Quintara Biosciences - Gene synthesis and molecular biology services

-

GenScript Biotech Corporation - Gene synthesis, plasmid preparation, and peptide synthesis

-

Biomatik - Custom gene synthesis, protein production, and molecular biology reagents

-

Kaneka Eurogentec S.A. - DNA synthesis and custom oligonucleotide production

-

OriGene Technologies, Inc. - Custom gene synthesis and molecular cloning services

-

ProMab Biotechnologies, Inc. - Gene synthesis and antibody production

-

ProteoGenix - Gene synthesis and antibody production for synthetic biology applications

-

Synbio Technologies - Custom gene synthesis and synthetic biology solutions

Recent Development

-

In May 2024, Molecular Assemblies, Inc. debuted a Partnering Program that will license its Full Enzymatic Synthesis (FES) technology to select partners. Through the program, the company's automated synthesis platform, alongside any enhancements to the FES technology, will be made available, along with necessary licenses to support in-house research applications.

-

In November 2023, QIAGEN reported that it had entered into a strategic collaboration with Element Biosciences, Inc. to offer combined NGS workflows compatible with the AVITI System, Element's next-generation sequencing platform.

-

Eurofins BioPharma Product Testing (Eurofins Scientific) greatly expanded its Stability Services in April 2023 at its facility in Lancaster, PA, an expansion expected to drive demand for DNA synthesis production.

-

TECAN partnered with Element Biosciences in February 2023, with the company then offering a benchtop NGS solution that now also comprises the MagicPrep NGS, along with an innovative DNA sequencing platform called the AVITI System, developed by Element Biosciences.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.59 Billion |

| Market Size by 2032 | USD 15.48 Billion |

| CAGR | CAGR of 17.66% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service (Oligonucleotide Synthesis, Custom Oligonucleotide Synthesis, Pre-designed Oligonucleotide Synthesis, Gene Synthesis) • By Application (Research and Development, Therapeutics, Diagnostic) • By End-User (Biopharmaceutical Companies, Academic and Research Institutes, Contract Research Organizations) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific Inc., Twist Bioscience Corporation, BIONEER CORPORATION, Eton Bioscience, Inc, LGC Biosearch Technologies, IBA Lifesciences GmbH, Eurofins Scientific, Integrated DNA Technologies, Inc., Quintara Biosciences, GenScript Biotech Corporation, Biomatik, Kaneka Eurogentec S.A., OriGene Technologies, Inc., ProMab Biotechnologies, Inc., ProteoGenix, Synbio Technologies, and Others |

| Key Drivers | • Rising Demand for DNA Synthesis Products & Services Across Multiple Applications • Enhanced Healthcare Spending and Support for Precision Medicine |

| RESTRAINTS | • Regulatory Uncertainty Delays Product Launches • Shortage of Skilled Workforce in Synthetic Biology |