Gluten Free Bakery Market Report Scope & Overview:

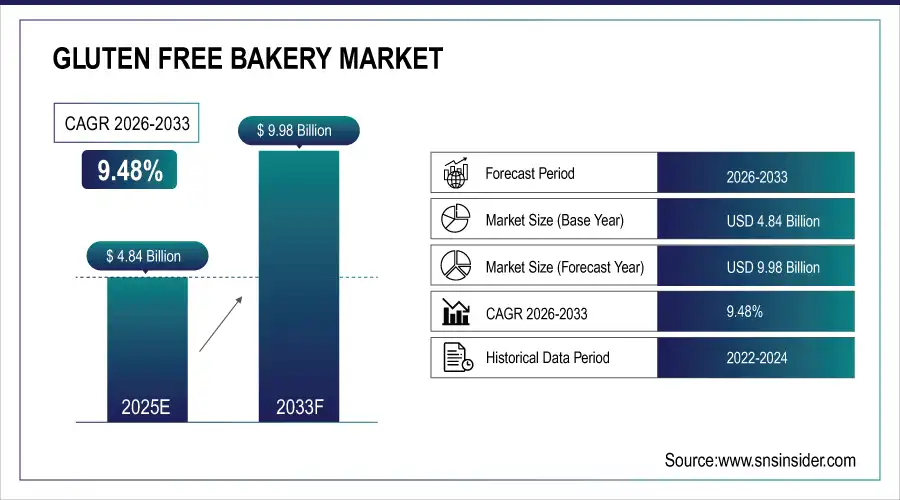

The Gluten Free Bakery Market Size was valued at USD 4.84 Billion in 2025E and is expected to reach USD 9.98 Billion by 2033 and grow at a CAGR of 9.48% over the forecast period 2026-2033.

The Gluten Free Bakery Market analysis, driven by increase in incidence of celiac diseases and gluten intolerance and higher health consciousness among consumers, with preference for free-from foods such as vegan products. The increase in variety of gluten-free products, innovation in alternative flours such as rice, almond and quinoa is also driving the market demand for bakery products with improved taste and texture. According to analysis, around 1 in 100 people globally suffer from celiac disease, driving sustained demand for gluten-free bakery products.

Market Size and Forecast:

-

Market Size in 2025: USD 4.84 Billion

-

Market Size by 2033: USD 9.98 Billion

-

CAGR: 9.48% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Gluten Free Bakery Market - Request Free Sample Report

Gluten Free Bakery Market Trends

-

Rising demand for clean-label and naturally sourced gluten-free bakery products.

-

Increased consumer preference for nutrient-rich flours like almond, quinoa, and buckwheat.

-

Growing adoption of online retail platforms for gluten-free bakery purchases.

-

Expansion of personalized, subscription-based gluten-free bakery delivery models.

-

Innovation in product texture and taste to match conventional bakery quality.

-

Health-driven lifestyle shifts boosting demand among non-celiac, wellness-focused consumers.

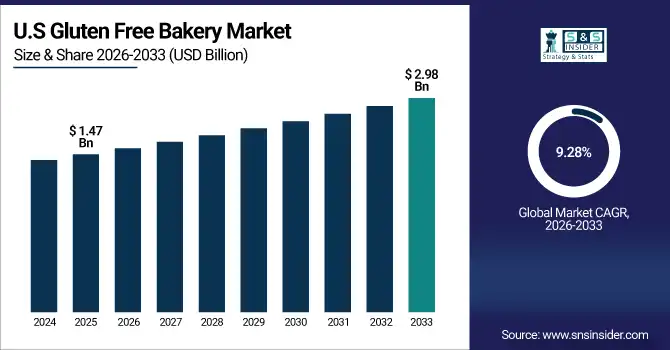

The U.S. Gluten Free Bakery Market size was USD 1.47 Billion in 2025E and is expected to reach USD 2.98 Billion by 2033, growing at a CAGR of 9.28% over the forecast period of 2026-2033, driven by high consumer awareness of celiac disease, strong health consciousness, and demand for clean-label products. Widespread retail availability, product innovation, and e-commerce adoption drive sustained growth and market dominance.

Gluten Free Bakery Market Growth Drivers:

-

Health-Conscious Consumers Fuel Demand for Natural, Clean-Label Bakery Products

Gluten Free Bakery Market Growth Due to the The increasing concern for health and well-being of customers. Flatt says that many people are coming around to gluten-free diets not just for celiac disease or gluten intolerance, but also out of a belief in digestive and energy related health benefits. Increasing demand for natural and organic gluten-free baked goods clean label products, free from artificial color and additives, preservatives, allergens are boosting the market of gluten free bakery. Brands that have been sourcing healthy ingredients, such as almond, quinoa or even the trendy buckwheat flour, are reaching both those going to healthy foods and mainstream consumers.

Around 68% of consumers consider health and wellness as a primary factor when choosing bakery products.

Gluten Free Bakery Market Restraints:

-

High Production Costs and Complex Processes Challenge Market Expansion

One of the key restraints is the higher production cost of gluten-free bakery items compared to conventional bakery products. Alternative flours like almond, coconut, and quinoa are quite expensive plus, gluten does a lot of work to make baked goods chewy and elastic so replicating it is not an easy or inexpensive task. There's also the risk of cross-contamination within production areas, which can increase costs for machinery and certifications. Such conditions tend to translate into higher price points, with the implication that a reduced affordability exists among those most sensitive to price.

Gluten Free Bakery Market Opportunities:

-

E-Commerce and Subscriptions Unlock New Growth for Gluten-Free Bakeries

Increasing e-commerce wide network and increasing demand for subscription-based gluten-free bakery are the lucrative opportunities available in market. consumers looking for allergen-free or specialty baked goods have access via the internet to brands irrespective of their home town. Repeat purchase and loyalty is driven by subscription models that offer personalized gluten-free boxes or fresh bakery deliveries to the door. Besides, online data-driven marketing helps companies to predict trends, develop quality products and expand into new markets with minimal risks.

Over 60% of gluten-free bakery consumers now prefer purchasing through online retail platforms. With Nearly 45% of online bakery sales come from allergen-free and specialty gluten-free products.

Gluten Free Bakery Market Segmentation Analysis:

-

By Product Type, in 2025, Bread led the market with a share of 36.30%, while Biscuits & Cookies is the fastest-growing segment with a CAGR of 12.02%.

-

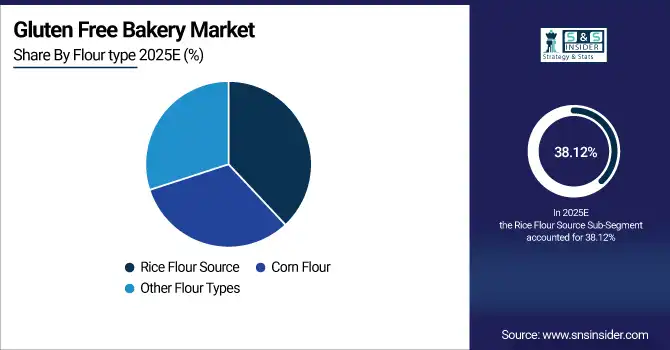

By Flour Type, in 2025, Rice Flour led the market with a share of 38.12%, while Corn Flour is the fastest-growing segment with a CAGR of 7.81%.

-

By Distribution Channel, in 2025, Supermarkets/Hypermarkets led the market with a share of 34.10%, while Online Retail is the fastest-growing segment with a CAGR of 14.83%.

-

By End-User, in 2025, Celiac Disease Patients led the market with the largest of 50.60%, while Health-Conscious Consumers is the fastest-growing segment with a CAGR of 11.68%.

By Product Type, Bread Lead Market and Cakes, Biscuits & Cookies Fastest Growth

Bread is the leading segment of Gluten Free Bakery Market in 2025, owing by it is consumed on daily basis and are extensively available in supermarkets, hypermarkets to online channels. Driving this is the expanding market for gluten-free home staples among celiac patients and health-oriented customers. Meanwhile, Cakes, Biscuits & Cookies is the fastest-growing segment due to increasingly indulgent habits and the development of product options such as convenient on-the-go snacks. The proliferation of premium and artisanal bakery options adds appeal to consumers, driving strong growth in both daily and specialty bakery categories.

By Flour Type, Rice Flour Lead Market and Corn Flour Fastest Growth

The Rice Flour segment is dominating the Gluten Free Bakery Market in 2025 due to its versatile use in bread, cakes, and cookies, combined with mild taste and widespread consumer acceptance. Its dominance is reinforced by the preference of both celiac patients and health-conscious consumers seeking safe, gluten-free alternatives. Meanwhile, Corn Flour is the fastest-growing segment, driven by innovation in bakery formulations, rising demand for high-fiber and nutrient-enriched products, and its application in snacks and specialty baked goods. Expanding product offerings and increasing awareness of corn flour benefits support sustained market growth.

By Distribution Channel, Supermarkets/Hypermarkets Lead Market and Online Retail Fastest Growth

The Supermarkets/Hypermarkets segment dominates the Gluten Free Bakery Market in 2025, due to wide spread outlet chain, variety of products and consumer trust which they prefer for their daily gluten-free consumptions. They are solidified by strategic product merchandising, promotions and offerings of both branded and private-label bakery products. Meanwhile, Online Retail is growing the fastest segment driven by consumers increasingly adapt to online shopping propelled by convenience, subscription-based deliveries, and trendy disruptive options which appeal to niche consumer groups looking for speciality and allergen-free products. The development in this channel is enhanced through digital marketing and individualized offers.

By End-User, Celiac Disease Patients Lead Market and Health-Conscious Consumers Fastest Growth

The Celiac Disease Patients is the leading segment of Gluten Free Bakery Market in 2025, owing to necessity of maintaining a strict gluten-free diet to manage the disease. These gains are further supported by rising diagnosis rates, awareness initiatives and the growing number of certified gluten free products in retail and online channels. Meanwhile, The Health-Conscious Group is the fastest-growing segment, due to the increasing practice of following gluten-free diets based on a perception that gluten free may aid digestion, give Energy and contribute to overall well-being. The development of innovative, clean-label and functional bakery options also drives growth in this overall consumer category.

Gluten Free Bakery Market Regional Analysis:

North America Gluten Free Bakery Market Insights:

The North America dominated the Gluten Free Bakery Market in 2025E, with over 42.10% revenue share, driven by increasing consumer understanding about celiac disease, surge in health awareness and growing preference for clean label and functional bakery products. Key factors such as robust retail system, high penetration of gluten-free products, and development in alternative flours such as rice, almond, and quinoa are propelling the market growth. Moreover, demand for premium and ready-to-eat gluten free bakery products is increasing in the region. Growing e-commerce and subscription-based deliveries Add to the convenience, driving consistent market expansion and steady demand for specialty gluten-free baked goods.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. and Canada in Gluten Free Bakery Market Insights

The U.S. and Canada lead the Gluten-Free Bakery Market due to high consumer awareness of celiac disease, strong health consciousness, and demand for clean-label products. Established retail infrastructure, wide product availability, and rapid adoption of e-commerce and specialty gluten-free bakery items further strengthen market dominance.

Asia Pacific Gluten Free Bakery Market Insights:

The Asia Pacific region is expected to have the fastest-growing CAGR 10.68%, owing to high health consciousness, rising urbanization and increasing disposable incomes. Consumers are showing more interest in gluten-free diets for better digestion and well-being, which is driving the market for creative bread products. E-commerce and modern grocery retailing are growing in the region, making specialty gluten free products more accessible. The growing demand for product variety, such as clean label and functional solutions in the bakery industry along with marketing initiatives focusing on health-conscious consumers, is further bolstering market growth in Asia Pacific.

China and India Gluten Free Bakery Market Insights

China and India are driving growth in the Gluten-Free Bakery Market due to rising health awareness, increasing disposable incomes, and urbanization. Growing demand for digestive health-friendly and clean-label products, along with expanding e-commerce and modern retail channels, is accelerating market adoption in these countries.

Europe Gluten Free Bakery Market Insights

Europe holds a significant share in the Gluten-Free Bakery Market, due to escalated consumer knowledge with regard to celiac sickness, strict food labeling laws and substantial uptake of clean-label and organic bakery products. The area has well-established retailer's networks- super markets, specialty stores and ever-growing on-line options which guarantee extensive product reach. Innovations in alternate flours, indulgent bakery products, and functional types also drive market growth. Growing health awareness and rising prevalence of gluten-free for non-celiac populace is expected to drive demand in Europe in near future.

Germany and U.K. Gluten Free Bakery Market Insights

Germany and the U.K. are growing in the Gluten-Free Bakery Market due to high consumer awareness of celiac disease, strict food labeling regulations, and increasing demand for clean-label and organic products. Innovation in alternative flours and functional bakery items further fuels market expansion.

Latin America (LATAM) and Middle East & Africa (MEA) Gluten Free Bakery Market Insights

The Latin America (LATAM) and Middle East & Africa (MEA) regions are witnessing gradual growth in the Gluten Free Bakery Market, owing to the increased health consciousness among individuals, large urban population and disposable incomes. Demand for gluten free options to benefit digestion health and well-being is growing, as are clean-label and functional bakery products. Modern retail chains, supermarkets and e-commerce increase product availability. Introduction of various type of alternative flours and ready-to-bake bakery goods, in combination to marketing strategies focused on health-conscious consumers are spurring adoption which is growing steadily for LATAM and MEA market.

Gluten Free Bakery Market Competitive Landscape

Kinnikinnick Foods Inc. is a leading manufacturer of gluten-free and allergen-free baked goods, including breads, cookies, and snacks. The company is committed to producing high-quality products that cater to individuals with celiac disease and other dietary restrictions. Kinnikinnick Foods Inc. focuses on innovation and quality assurance to meet the evolving needs of the gluten-free community. Their dedication to safe and delicious gluten-free products has established them as a trusted brand in the market.

-

In July 2025, Kinnikinnick Foods introduced a new line of gluten-free and allergen-free baked goods, expanding its product offerings to meet the increasing consumer demand for safe and delicious gluten-free options.

BFree Foods offers a diverse range of gluten-free, dairy-free, and allergen-friendly baked products, including breads, wraps, and pitas. The company focuses on providing convenient and nutritious options for individuals with dietary restrictions. BFree Foods aims to enhance consumers' health without compromising on taste, catering to the growing demand for gluten-free alternatives in the bakery market. Their products are designed to meet the needs of health-conscious consumers seeking allergen-free options.

-

In June 2025, BFree Foods launched "Dutch Crunch Rolls," a gluten-free and vegan travel-friendly bread fortified with calcium and vitamins B & D, catering to the growing demand for nutritious and convenient gluten-free options.

The Smart Baking Company specializes in low-calorie, sugar-free, and gluten-free baked goods, including Smartcakes, SmartBuns, and SmartMuf'ns. Their products are designed to cater to health-conscious consumers, offering options that are non-GMO, high in fiber, and low in carbs. The company emphasizes innovation in creating nutrient-dense snacks that satisfy cravings without compromising on health. Their commitment to quality and health-conscious baking has positioned them as a notable player in the gluten-free bakery market.

-

In July 2025, The Smart Baking Company launched a new line of low-carb, gluten-free baked goods, focusing on providing healthier alternatives for consumers seeking to reduce their carbohydrate intake while enjoying delicious baked treats.

Gluten Free Bakery Market Key Players:

Some of the Gluten Free Bakery Market Companies are:

-

Dr. Schär AG/SpA

-

General Mills, Inc.

-

Hain Celestial Group

-

Grupo Bimbo SAB de CV

-

Hero Group AG

-

Flowers Foods Inc. (Canyon Bakehouse)

-

Warburtons Ltd.

-

Amy's Kitchen Inc.

-

Bob's Red Mill Natural Foods

-

Dawn Food Products Inc.

-

The Kellogg Company

-

Mission Foods

-

Genius Foods Ltd.

-

BFree Foods

-

Kinnikinnick Foods Inc.

-

Toufayan Bakeries

-

Nairn's Oatcakes Ltd.

-

WOW Baking Company

-

The Smart Baking Company

-

Ener-G Foods

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 4.84 Billion |

| Market Size by 2033 | USD 9.98 Billion |

| CAGR | CAGR of 9.48% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Bread, Biscuits & Cookies, Cakes, Pastries & Muffins, Others – Doughnuts, Puddings, Rolls) • By Flour Type (Corn Flour, Rice Flour, Other Flour Types) • By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others) • By End-User (Celiac Disease Patients, Gluten-Sensitive Consumers, Health-Conscious Consumers, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Dr. Schär AG/SpA, General Mills, Inc., Hain Celestial Group, Grupo Bimbo SAB de CV, Hero Group AG, Flowers Foods Inc. (Canyon Bakehouse), Warburtons Ltd., Amy's Kitchen Inc., Bob's Red Mill Natural Foods, Dawn Food Products Inc., The Kellogg Company, Mission Foods, Genius Foods Ltd., BFree Foods, Kinnikinnick Foods Inc., Toufayan Bakeries, Nairn's Oatcakes Ltd., WOW Baking Company, The Smart Baking Company, Ener-G Foods, and Others. |