Graphics Card Market Size & Growth:

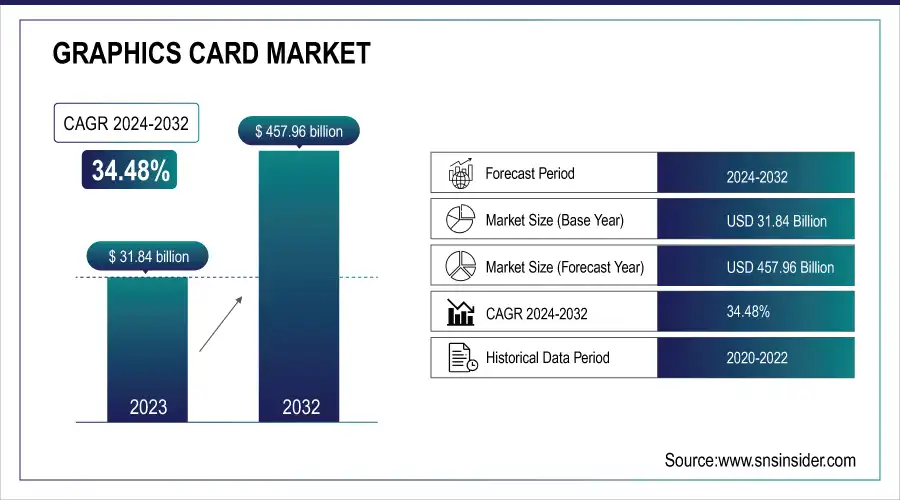

The Graphics Card Market was valued at 31.84 Billion in 2023 and is projected to reach USD 457.96 Billion by 2032, growing at a CAGR of 34.48% from 2024 to 2032.

Key market drivers include the surging demand for high-performance computing in gaming, artificial intelligence (AI), machine learning (ML), data centers, and real-time content creation. The rising GPU utilization rate, especially in cloud-based services and AI inference tasks, is significantly transforming the landscape.

To Get more information on Graphics Card Market - Request Free Sample Report

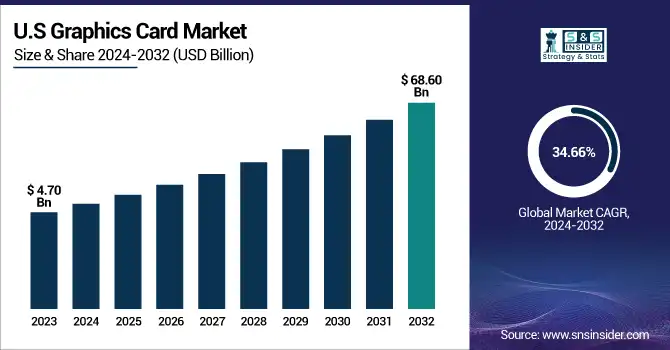

In the U.S., the market stood at USD 4.70 billion in 2023 and is expected to surge to USD 68.60 billion by 2032, driven by a CAGR of 34.66%. Additionally, mining hash rate trends continue to influence GPU demand, particularly during crypto market upswings. Innovations in power efficiency and thermal design are also driving adoption, as manufacturers prioritize performance-per-watt metrics. VRAM capacity evolution further enhances performance in memory-intensive tasks such as 4K gaming and deep learning. These factors collectively position the graphics card market as a critical enabler of next-generation computing technologies.

Graphics Card Market Dynamics:

Drivers:

- Powering the Future with Data Centers and Content Creation Demand

The graphics card market is experiencing rapid acceleration driven by the combined forces of expanding data center infrastructure and escalating content creation needs. Major players like Microsoft are building vast GPU-powered data centers some projected to house over 1 million GPUs to support the surging demand for cloud services, AI, and data analytics. Simultaneously, global infrastructure providers like Equinix are scaling operations through major acquisitions, including a USD 705 million deal with Entel. On the creative front, professionals working in 3D rendering, animation, and high-resolution video editing increasingly depend on powerful GPUs, as highlighted by Puget Systems’ benchmarks. This convergence is making GPUs indispensable across both enterprise-level operations and creative workflows.

Restraints:

-

AI, machine learning, and VR drive GPU demand, but integration challenges slow adoption.

The rapid advancement of AI, machine learning, and virtual reality has driven demand for powerful GPUs, but integrating these technologies into consumer products presents significant challenges. The save that there are a huge amount of work to make handheld units for these models and make it compatible with dissolvable VR systems will also require time. Besides, continuous innovation of GPU architecture is required to catch up with the growing computational demand of these technologies, which drives the developments to more costly and prolonged time-to-market. It is a challenge on not just consumer-facing products but enterprise applications as well, where seamless integration is key to getting performance right. Consequently the total addressable market (TAM) for GPUs is still bigger than the semiconductor industry, but the market will only adjust from the adoption of these technologies to all of these efforts fit into affordable solutions that can run on consumer devices.

Opportunities:

-

Autonomous vehicles are creating growth opportunities in the graphics card market, as GPUs are crucial for processing data generated by self-driving technology.

The rise of autonomous vehicles presents a significant growth opportunity for the graphics card market, as GPUs are essential for processing the vast amounts of data generated by self-driving systems. With advancements in AI and machine learning, GPUs are pivotal in enabling real-time data processing for navigation, object recognition, and decision-making in autonomous vehicles. As these collaborations, which embed cutting-edge GPU technology into self-driving car systems, emerge among companies like GM and NVIDIA, value-added features will be necessary to compete, reported by sources like Reuters and Techcrunch. Moving ahead, autonomous vehicle technology leverage will all the more, and to enable that, high-performance graphics processing units would be necessary to convert complex algorithms and large datasets into powerful simulations, driving the graphics processing unit market. This offers a promising avenue for the graphics card market, especially in the automotive sector, where cutting-edge computing solutions are critical for the future of transportation.

Challenges:

-

Managing power consumption and environmental impact is a key challenge in the growing demand for high-performance GPUs in gaming, AI, and data centers.

As GPUs become more powerful to meet the requirements of complex tasks, such as real-time ray tracing in gaming and deep learning processes in AI, their energy requirements have skyrocketed. High-power consumption not only causes high operational costs, but also increases the environmental footprint in tech industries. This challenge is especially acute for data centers that have thousands of GPUs on hand for tasks such as cloud computing and AI applications. GPUs generate a lot of heat and, as a result, need to be cooled so you can use energy-consuming cooling systems to prevent them from frying the chips. Moreover, the environmental costs of such energy usage have come under deservingly increasing scrutiny and with many sectors now working towards supporting sustainability goals. This has created a demand for innovations in energy-efficient designs, including low-power GPUs and advanced cooling technologies. These concerns have driven companies to pursue AI-based energy management systems, dynamic power adjustments, and the development of more power-efficient architectures to alleviate these challenges.

Graphics Card Industry Segmentation Overview:

By Type

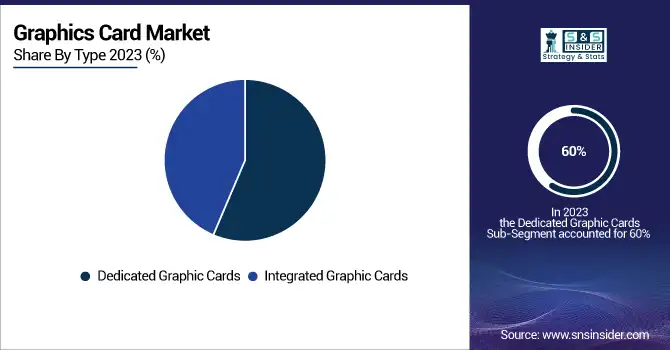

The dedicated graphics card segment is expected to dominate the market, capturing around 60% of the share by 2023. The growth is spurred by triple Intersection of increasing demand for elite performance graphics in gaming, AI, data centers, and professional content creation. Dedicated graphics cards excel in processing power, which translates into smoother graphics rendering, better gaming experiences, and faster processing of data for heavy workloads. With industries like gaming, virtual reality, and artificial intelligence growing, so will the demand for specialized hardware in the form of dedicated graphics cards, solidifying their dominance in the market for many years. This segment’s growth is also supported by advancements in GPU technologies, which continuously push the limits of performance and efficiency.

The integrated graphics card segment is projected to experience the fastest growth in the market between 2024 and 2032. Integrated graphics are increasingly favored for their cost-effectiveness and power efficiency, making them ideal for budget-friendly consumer devices like laptops, desktops, and entry-level gaming PCs. These integrated cards provide adequate performance for everyday activities like browsing the web, playing media files, and light gaming. With the demand for integrated graphics increasing as more consumers downsize to compact, energy-efficient devices. Moreover, advances in processor technology have dramatically enhanced the performance of integrated graphics, offering a much broader market opportunity for growth and setting the last period for APC such as graphics processors.

By Connectivity

The PCIe (Peripheral Component Interconnect Express) segment dominated the graphics card market with the largest revenue share of approximately 69% in 2023 The PCIe interface is favored for its high data transfer rates, and is critical to high-performance graphics processing for gaming, AI and data centers. Compared to NVMe and SAS, PCIe-based graphics cards are still the best solution for low-latency operations, facilitating high-bandwidth data transfer. The segment is likely to remain dominant as the sector strives to increase processing speed and powerful graphical potential, particularly for virtual reality, 4K/8K gaming, and deep learning programs.

The external graphics card segment is experiencing the fastest growth within the graphics card market from 2024 to 2032. with external graphics cards in particular expected to register the highest growth during this period. This growth is propelled by the rise of portable and scalable computing solutions, particularly among gamers and content creators who need high-performance graphics but do not want to upgrade their entire system. It would be cumbersome to go through the trouble of upgrading a laptop, and external graphics cards (eGPUs) are a great solution that delivers desktop GPU power in a size that fits with laptops and space-saving PCs. With the increasing number of people working from home, playing games, and creating content, the market for eGPUs is anticipated to expand rapidly while allowing users to leverage their hardware without adding an internal GPU. The segment is expected to witness major growth from the increasing demand for mobility and from technological advancements in connectivity.

By Application

The gaming segment dominated the graphics card market with the largest revenue share of approximately 37% in 2023. With the gaming industry experience explosive growth, more and more gamers are turning to high-performance hardware to up their game, and this is beginning to drive this dominance. High-resolution and high-frame-rate environments across anything from everyday games to graphically demanding applications require advanced graphics cards, making them a central component for casual gamers and professionals alike. Demand has only been fuelled further by the rise of esports, virtual reality (VR) gaming and streaming platforms. Additionally, the trend of gaming laptops and desktops equipped with powerful GPUs has contributed to the gaming segment's substantial revenue share. The market is expected to continue growing as gaming technology and user expectations evolve.

The AI & ML segment is projected to experience the fastest growth in the graphics card market from 2024 to 2032. This growth is being driven by the increasing demand for AI and machine learning applications (deep learning, data analytics, and AI-powered automation). GPUs are key to accelerating these workloads with their parallel processing capabilities, allowing for faster and more efficient data processing and model training. With growing adoption of AI in sectors from healthcare to financial services to self-driving, demand for high-performance GPUs is only set to grow. Moreover, the increasing adoption of artificial intelligence in applications such as robotics and data centers creates new opportunities for the growth of AI & ML segment in the graphics card market.

By End-Use

The desktop segment dominated the graphics card market with the largest revenue share of approximately 47% in 2023. This dominance can be attributed to the continued popularity of desktop computers, which offer superior performance, upgradeability, and customization compared to laptops. High-performance GPUs are essential for running demanding applications such as gaming, content creation, and professional design work. Desktops are often favored by gamers, professionals, and tech enthusiasts who require powerful graphics cards for optimized performance. With growing demand for immersive gaming experiences, advanced 3D rendering, and video editing, the desktop segment remains a key contributor to the overall market revenue and is expected to maintain its strong position in the coming years.

The laptop segment is the fastest-growing region in the graphics card market from 2024 to 2032. This growth is fueled by the increasing need for portable, high-performance systems that can support gaming, professional design, and AI workloads. This demand for ultra-portable systems paved the way for high-performance GPUs. This growth has also been driven by innovative laptop construction with lighter builds and improved cooling systems. The rise of mobile gaming, remote work, and cloud computing further the demand for GPUs in laptops, making it a key area for market expansion in the upcoming years.

Graphics Card Market Regional Analysis:

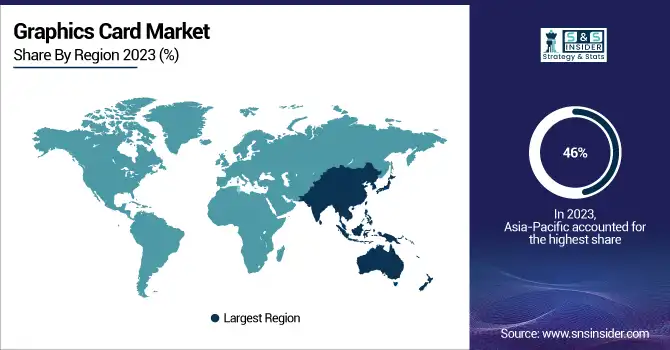

The Asia-Pacific region dominated the largest share of the graphics card market, accounting for approximately 46% of the revenue in 2023. This dominance is driven by the rapid technological advancements, the strong presence of major manufacturing hubs, and the growing demand for high-performance computing in countries like China, Japan, and South Korea. The region’s robust gaming culture, increasing adoption of artificial intelligence (AI), and significant investments in data centers contribute to the continued growth of the market. Moreover, the expansion of eSports and mobile gaming in the region, coupled with the rise of gaming PCs and laptops, strengthens the demand for graphics cards, positioning Asia-Pacific as a crucial player in the global market.

Get Customized Report as per Your Business Requirement - Enquiry Now

The North America region is expected to witness the fastest growth in the graphics card market from 2024 to 2032. The strong presence of Nvidia, AMD, and Intel, along with the growing demand for high-performance computing solutions within the gaming, artificial intelligence (AI), and data center sectors, have contributed to this growth. Additionally, the growth of the cloud computing and gaming technologies, across industries, and the early embrace of AI apps, which are multiplying, has accelerated the growth of the market. North America is also a growing market on account of strong demand for high-efficiency and powerful graphics cards driven by increasing investments in modern infrastructure for the seamless deployment of 5G services and growing consumer interest for next-gen gaming consoles and high-end PCs.

Key Players Listed in Graphics Card Market are:

-

NVIDIA Corporation (USA) - Graphics Processing Units (GPUs), AI hardware, and software solutions.

-

Advanced Micro Devices, Inc. (AMD) (USA) - GPUs, CPUs, and APUs.

-

Intel Corporation (USA) - CPUs, GPUs, and data center solutions.

-

ASUSTeK Computer Inc. (ASUS) (Taiwan) - Graphics cards, motherboards, and gaming laptops.

-

Gigabyte Technology Co., Ltd. (Taiwan) - Graphics cards, motherboards, and gaming peripherals.

-

MSI (Micro-Star International Co., Ltd.) (Taiwan) - Graphics cards, gaming laptops, and motherboards.

-

EVGA Corporation (USA) - Graphics cards, power supplies, and accessories.

-

Zotac International (Hong Kong) - Graphics cards, mini-PCs, and storage solutions.

-

Palit Microsystems Ltd. (Taiwan) - Graphics cards and GPUs.

-

SAPPHIRE Technology Ltd. (Hong Kong) - Graphics cards and gaming solutions.

-

XFX Technology (USA) - Graphics cards and power supplies.

-

PNY Technologies, Inc. (USA) - Graphics cards, memory modules, and storage solutions.

-

GALAX (formerly Galaxy Microsystems Ltd.) (Hong Kong) - Graphics cards and computer components.

-

Inno3D (Hong Kong) - Graphics cards and hardware solutions.

-

HIS (Hightech Information System Limited) (Hong Kong) - Graphics cards and computing products.

Lists of Suppliers who Provide Raw Material and component in Graphics Card Market:

-

Samsung Electronics (South Korea)

-

SK Hynix (South Korea)

-

Micron Technology (USA)

-

Taiwan Semiconductor Manufacturing Company (TSMC) (Taiwan)

-

Intel Corporation (USA)

-

ASML Holding (Netherlands)

-

Infineon Technologies (Germany)

-

On Semiconductor (USA)

Recent Development:

-

January 6, 2025: NVIDIA's Blackwell GeForce RTX 50 Series introduces groundbreaking AI-driven rendering, doubling performance with DLSS 4, neural shaders, and real-time ray tracing, while boosting mobile computing efficiency and reducing latency with Reflex 2.

-

December 3, 2024: Intel launches the Arc B-Series graphics cards, featuring the B580 and B570 GPUs, offering top-tier performance, modern gaming features, and AI acceleration with XeSS 2 technology, starting at USD 249.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 31.84 Billion |

| Market Size by 2032 | USD 457.96 Billion |

| CAGR | CAGR of 34.48% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Dedicated Graphic Cards, Integrated Graphic Cards) • By Connectivity (PCLe, External Graphic cards) • By Application (Gaming, Content Creation & Multimedia Reality, Virtual Reality(VR) & Augmented Reality (AR), AI & ML) • By End Use (Desktops, Laptops, Workstations, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | NVIDIA Corporation (USA), Advanced Micro Devices, Inc. (AMD) (USA), Intel Corporation (USA), ASUSTeK Computer Inc. (ASUS) (Taiwan), Gigabyte Technology Co., Ltd. (Taiwan), MSI (Micro-Star International Co., Ltd.) (Taiwan), EVGA Corporation (USA), Zotac International (Hong Kong), Palit Microsystems Ltd. (Taiwan), SAPPHIRE Technology Ltd. (Hong Kong), XFX Technology (USA), PNY Technologies, Inc. (USA), GALAX (formerly Galaxy Microsystems Ltd.) (Hong Kong), Inno3D (Hong Kong), and HIS (Hightech Information System Limited) (Hong Kong). |