Energy Management Systems Market Report Scope and Overview:

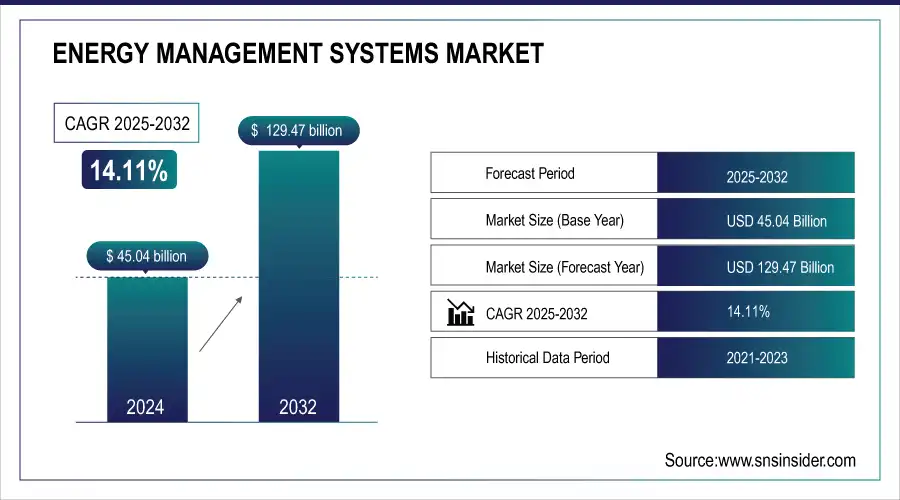

The Energy Management Systems Market size was valued at USD 45.04 Billion in 2024. It is estimated to reach USD 129.47 Billion by 2032, growing at a CAGR of 14.11% during 2025-2032.

The energy management systems (EMS) market has seen significant growth as organizations increasingly seek to optimize their energy usage and reduce costs. These systems offer immediate information on energy usage, pinpoint inefficiencies, and empower informed decisions on energy consumption. One primary factor driving the EMS market's expansion is the increasing understanding of environmental sustainability and the necessity for organizations to lessen their carbon footprint. Governments and regulatory agencies around the globe are implementing more stringent energy efficiency guidelines and rules, leading to an increased uptake of EMS solutions. Significant funding and investments have been made by the U.S. government for the development of EMS. In 2023, the Department of Energy (DOE) at the federal level has been a significant contributor, with the Office of Energy Efficiency and Renewable Energy (EERE) providing approximately USD 4 billion per year for energy efficiency initiatives, including EMS. The American Recovery and Reinvestment Act (ARRA) of 2009 provided major funding for smart grid technologies with a USD 4.5 billion smart grid investment grant program and USD 3.1 billion through the state energy program. In 2023, the Infrastructure Investment and Jobs Act (IIJA) upheld this pattern by allocating significant funds for energy efficiency and conservation initiatives. Companies in different industries are utilizing these systems to meet regulations, reach sustainability targets, and save money by enhancing energy management.

Get More Information on Energy Management Systems Market - Request Sample Report

Energy Management Systems Market Size and Forecast:

-

Market Size in 2024: USD 45.04 Billion

-

Market Size by 2032: USD 129.47 Billion

-

CAGR from 2025 to 2032: 14.11%

-

Base Year: 2024

-

Forecast Period: 2025–2032

- Historical Data: 2021–2023

Energy Management Systems Market Highlights:

-

Nearly 50% of major U.S. manufacturing firms adopted EMS in 2023 enabling up to 15% annual energy savings and better operational efficiency

-

EMS supports corporate sustainability initiatives by lowering greenhouse gas emissions reducing waste and helping achieve eco-certifications

-

Government regulations such as the EU Energy Efficiency Directive and the U.S. Energy Policy Act along with subsidies tax benefits and the Paris Agreement are driving global EMS adoption

-

Integration and implementation remain challenging as high customization needs system compatibility and skilled personnel requirements can increase costs

-

Data security and privacy concerns including risks of cyber threats data breaches and unauthorized access make some organizations hesitant to adopt EMS

-

EMS solutions support renewable energy integration by balancing solar wind and conventional power sources

Energy management systems are vital in maximizing energy usage within the industrial sector as manufacturing plants frequently use big machinery and equipment that require substantial amounts of energy. In 2023, around 50% of the major manufacturing companies in the United States have implemented EMS, with smaller and mid-sized firms also showing a significant rise in adoption. As stated by the U.S. Department of Energy, companies that adopt EMS can save 15% on energy each year, leading to significant cost savings and better operational effectiveness. For instance, General Electric's Digital Wind Farm initiative uses EMS to improve energy production efficiency by 10%, and Siemens' Smart Infrastructure division utilizes EMS to simplify energy management across various sites, leading to a 15% decrease in total energy consumption. Furthermore, EMS solutions can help in incorporating renewable energy sources like solar or wind power by managing their inputs together with conventional energy sources.

Energy Management Systems Market Drivers:

-

Environmental Management Systems (EMS) drive sustainable practices and certification amidst growing awareness of environmental issues.

The EMS market is driven by the growing awareness of environmental issues and the need for sustainable practices. As the concern for ‘global warming’, pollution, and depletion of resources soar, organizations are under increased pressure to establish eco-friendly practices that are aimed at lowering greenhouse gas emissions and reducing their environmental footprint. Hence, based on this scenario, helps organizations to meet sustainability goals. As it lowers the consumption of energy resources and reduces waste, EMS results in lowering greenhouse gas emissions and therefore, helps the organizations to have a reduced environmental footprint. As a part of CSR goals such as GO Green, an EMS solution is of prime importance. On the other hand, with a focus on sustainability and increased concern for the environment, organizations are looking for certification to do the same. In the process, the focus on environmental-friendly practices is an addition to the manufacturing and business requirements of modern-day organizations that help their products and services to meet the expectations of customers, who are more aware of the consequences of global warming.

-

Government policies and regulations driving the adoption of energy management systems as a global perspective on compliance and incentives.

Government policies and regulations promoting energy efficiency and sustainability play an equally important role as other drivers. Numerous countries have already imposed rather stringent regulations to cut down energy consumption and reduce greenhouse gas emissions, which, in turn, has provided a solid background for EMS to be implemented. For instance, there are regulations such as the Energy Efficiency Directive in the European Union and the Energy Policy Act in the United States, with many other countries having their counterparts. All of these docs require that proper energy management and periodic reporting be implemented. In many cases, the state provides certain incentives, subsidies, and tax benefits for companies investing in energy-efficient equipment, tools, and software. In addition, many international agreements and obligations such as the Paris Agreement made it clear that the signatory countries have to reduce their carbon emissions, and it is up to each government on how to incentivize the legal entities to adopt EMS. Therefore, even if the adopted regulations do not require energy management software to be used, it is still a strategy for many companies to stay ahead of the curve and invest in modern EMS solutions to be fully compliant in the potential future.

Energy Management Systems Market Restraints:

-

Overcoming integration challenges in energy management systems by balancing benefits and costs.

The market can be hindered due to the complexity of integration and implementation of EMS. It is viable to integrate any energy management system with the existing infrastructure of any organization, and technologies, possessing a plethora of both advantages and weak points. The former implies data integration and its compatibility with other platforms and devices, as well as the necessity of hiring personnel with the required qualifications in the field. The way to perform the integration is liable for simplification, including the addition of a supervisory program together with time slides, giving administrators time to come up with a possible conclusion, thus avoiding any abrupt disturbances to technologies and networking. The downside, however, remains the need for EMS customization surrounding specific customers’ requirements, which can increase the cost of implementation and effectiveness.

-

Addressing data security and privacy concerns by ensuring compliance and protection against cyber threats.

One of the major restraints for the EMS market is related to data security and privacy concerns. Energy management systems are used to collect, generate, and process data regarding energy consumption, assets operations, devices, and users. The management and security of this data are crucial since broken data protections could result in unauthorized access, data leakage, or data misappropriations. Before acquiring an energy management system, the organization should ensure that data security is compliant with data protection requirements and that the operator has implemented relevant systems and measures that secure the data from various cyber threats or violations. When the organization is not confident in these issues, it is reluctant to adopt an EMS system due to potential data security breaches. This issue could be addressed by paying more attention to security features, constant auditing, and updating of EMS systems according to the best practices and in compliance with standards.

Energy Management Systems Market Segment Analysis:

By Type

The industrial energy management systems (IEMS) segment dominated in 2024 with over 65% because of the high energy needs and possible cost reductions in manufacturing, oil and gas, and other sectors. IEMS solutions assist industrial facilities in maximizing energy efficiency, cutting operational expenses, and meeting strict environmental guidelines. For example, Siemens' SIMATIC Energy Manager allows for monitoring energy consumption in real-time in industrial facilities, assisting in reducing expenses and emissions. The EMS market is led by the industrial sector's ongoing emphasis on sustainability and energy efficiency.

The home energy management systems (HEMS) are accounted to have a rapid growth rate during the forecast period. HEMS solutions enable homeowners to supervise and manage energy usage using connected devices such as smart thermostats, lighting, and appliances. Key players in the HEMS market, such as Google Nest and Honeywell, offer products that can easily be integrated into home networks. For example, the thermostat from Google Nest changes energy usage depending on how many people are in the house, which has made it a well-liked application in the expanding smart home industry.

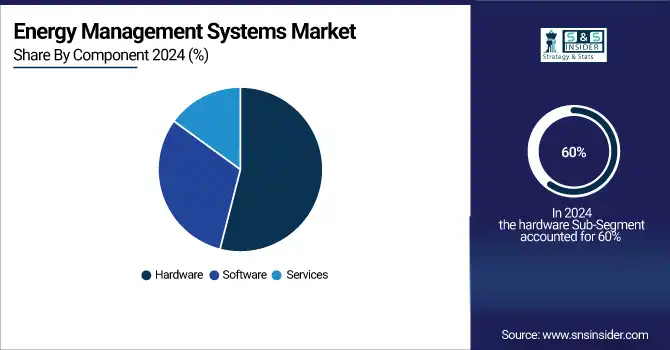

By Component

The hardware segment held a market share of 60% in 2024 and led the market. This is because hardware components like sensors, meters, controllers, and smart devices form the backbone of any energy management system. These components enable real-time data collection, monitoring, and control of energy use, making them indispensable in industrial, commercial, and residential applications. For instance, Schneider Electric provides hardware solutions such as energy meters and IoT sensors, which are integral to energy-saving operations in manufacturing plants.

The software segment is the fastest-growing in the EMS market from 2025-2032. Software solutions, such as energy analytics platforms, allow for deeper insights into energy usage patterns, facilitating predictive maintenance, optimization, and regulatory compliance. Cloud-based energy management software, like Siemens' Desigo CC, enables remote monitoring and real-time data analytics, offering businesses the flexibility to manage energy consumption efficiently.

By Deployment

The on-premises segment had a major market share of 55% in 2024 as it allows businesses to have more oversight of their energy data and infrastructure. Organizations choose on-premises EMS for strict data privacy rules and sectors like manufacturing and utilities needing direct energy system control. It offers great flexibility, enabling businesses to customize solutions to fit their specific requirements, particularly when managing substantial energy usage. Siemens Desigo CC is an extensive on-site EMS used by big buildings to enhance energy usage, cut expenses, and fulfill compliance standards.

The cloud segment is to become the fastest-growing segment during the forecast period because of its ability to scale, adapt, and minimize initial expenses. Cloud-based EMS provides real-time monitoring and analytics, enabling businesses to remotely access data, optimize energy usage, and lower operational expenses. Cloud EMS solutions are popular among SMEs and companies with multiple sites because they are easy to deploy and require minimal hardware. Organizations frequently use Schneider Electric’s EcoStruxure, a cloud-based platform for managing energy, to easily, remotely, and affordably handle energy needs.

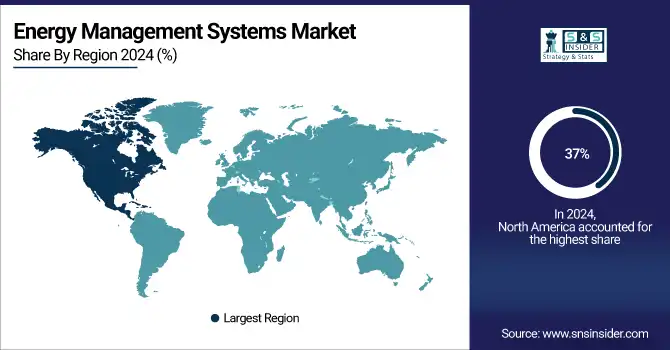

Energy Management Systems Market Regional Analysis:

North America Energy Management Systems Market Trends:

North America led the energy management systems (EMS) market in 2024 with a 37% market share because of its advanced technology and supportive energy efficiency regulations. Both the United States and Canada play important roles by providing encouragement and requirements to implement energy-efficient systems. High levels of energy usage in the industrial and commercial sectors in the region lead to a need for EMS solutions in various industries such as manufacturing, retail, and data centers. Honeywell and Johnson Controls are important participants, offering combined EMS solutions to enhance energy efficiency in commercial buildings and industrial sites.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Asia-Pacific Energy Management Systems Market Trends:

Asia-Pacific is going to experience rapid growth during 2025-2032 due to fast urbanization, industrialization, and rising energy consumption. Nations such as China, India, and Japan are making significant investments in smart grid infrastructure and sustainable energy solutions to address increasing energy needs and environmental guidelines. Government efforts in APAC to decrease carbon emissions and encourage the adoption of renewable energy are driving growth in the region. Major companies such as Siemens and ABB offer EMS solutions for overseeing energy distribution and consumption in significant undertakings like smart cities and renewable energy farms.

Europe Energy Management Systems Market Trends:

Europe holds a strong position in the EMS market due to stringent energy efficiency regulations and a focus on sustainability. Countries such as Germany, France, and the UK are promoting smart building technologies and industrial energy optimization. The region’s emphasis on carbon neutrality and renewable integration encourages adoption of EMS solutions in commercial, industrial, and public infrastructure. Companies like Schneider Electric and Siemens are prominent providers in the European EMS market.

Latin America Energy Management Systems Market Trends:

Latin America is experiencing steady EMS market growth, supported by industrial expansion and rising electricity costs. Countries such as Brazil, Mexico, and Chile are investing in smart grids and energy efficiency initiatives. EMS adoption is driven by the need to monitor and reduce energy consumption in manufacturing plants, commercial buildings, and utility operations. Companies like Johnson Controls and Siemens provide comprehensive energy management solutions across the region.

Middle East & Africa (MEA) Energy Management Systems Market Trends:

MEA is witnessing gradual adoption of EMS solutions, driven by growing industrialization, energy demand, and smart city initiatives. Nations like UAE, Saudi Arabia, and South Africa are investing in energy-efficient infrastructure and renewable energy projects. EMS solutions are increasingly deployed in commercial, industrial, and government facilities to optimize energy usage and reduce costs. Key players include ABB and Honeywell, offering tailored energy management solutions.

Energy Management Systems Market Key Players:

-

Siemens (Desigo CC, Sentron Power Manager)

-

Schneider Electric (EcoStruxure Power, PowerLogic ION9000)

-

General Electric (GE) (GE Digital Energy, GE Grid Solutions)

-

Honeywell (Honeywell Forge, Energy Manager)

-

Johnson Controls (Metasys, BCPro)

-

ABB (ABB Ability Energy Manager, OPTIMAX)

-

Emerson (DeltaV, Ovation)

-

Rockwell Automation (FactoryTalk EnergyMetrix, PowerFlex Drives)

-

Eaton (Power Xpert, Foreseer)

-

IBM (TRIRIGA, Maximo Asset Management)

-

Hitachi (Hitachi Energy Management Platform)

-

Delta Electronics (DeltaGrid EMS, Delta Energy Online)

-

Honeywell International (Building Management Solutions, Tridium)

-

Mitsubishi Electric (EneScope, EcoWebServer III)

-

Enel X (JuiceNet, EMS Virtual Power Plant)

-

GridPoint (GridPoint Energy Manager, Advanced Energy Storage)

-

Panasonic (Smart Energy Gateway, RESU Home Battery)

-

Cisco (EnergyWise, Connected Grid)

-

Huawei (FusionSolar Smart PV, eM3000 Smart Meter)

-

Legrand (Energy Intelligence, WattStopper)

Energy Management Systems Market Competitive Landscape:

ABB, established in 1988, is a global technology leader specializing in electrification, robotics, automation, and industrial digital solutions. The company delivers innovative products and services, including ABB Ability Energy Manager and OPTIMAX, to optimize energy efficiency, enhance operational performance, and support sustainable industrial and commercial infrastructure worldwide.

-

June 2024: Advancing its commitment to bringing smart, sustainable technologies to homes in the U.S. and Canada, ABB today launches the new ReliaHome Smart Panel, its first residential energy management software platform in these markets.

Honeywell, established in 1906, is a multinational technology and manufacturing company specializing in aerospace, building technologies, safety, and industrial automation. The company offers solutions like Honeywell Forge and Energy Manager to improve energy efficiency, operational performance, and safety, supporting smart buildings, industrial processes, and connected infrastructure globally.

-

January 2024: Honeywell launched Advance Control for Buildings, a building management system that can use a building’s existing wiring “to give building managers more control over the efficiency of their buildings.

| Report Attributes | Details |

| Market Size in 2024 | USD 45.04 Billion |

| Market Size by 2032 | USD 129.47 Billion |

| CAGR | CAGR of 14.11% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Industrial energy management systems (IEMS), Building energy management systems (BEMS), Home energy management systems (HEMS)) • By Component (Hardware, Software, Services) • By Deployment (Cloud, On-premises) • By End User (Residential, Energy & Power, Telecom & IT, Manufacturing, Retail, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Siemens, Schneider Electric, General Electric (GE), Honeywell, Johnson Controls, ABB, Emerson, Rockwell Automation, Eaton, IBM, Hitachi, Delta Electronics, Honeywell International, Mitsubishi Electric, Enel X, GridPoint, Panasonic, Cisco, Huawei, Legrand |