Grid Connected Battery Energy Storage Market Report Scope & Overview:

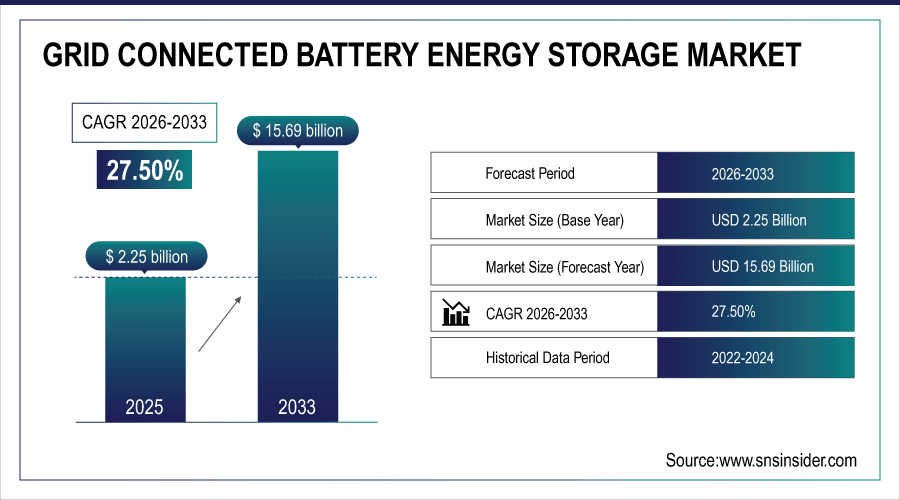

The Grid Connected Battery Energy Storage Market size was valued at USD 2.25 Billion in 2025E and is projected to reach USD 15.69 Billion by 2033, growing at a CAGR of 27.50% during 2026–2033.

The Grid Connected Battery Energy Storage Market analysis highlights accelerating deployments to balance variable renewable generation, provide grid services (frequency/voltage regulation), defer transmission & distribution upgrades, and enable capacity firming. Technology advances (high-energy-density lithium-ion, long-duration flow batteries, and emerging sodium-ion) combined with falling system costs, favorable market rules for ancillary services, and utility procurement programs are driving adoption. Both front-of-the-meter utility projects and behind-the-meter aggregations for commercial & industrial customers are expanding.

By 2025, over 75% of new utility-scale solar projects in the U.S. and EU will be co-located with 4+ hour BESS to meet grid stability mandates. BESS will supply >25% of primary frequency response in ISO markets like PJM and Australia’s NEM up from 9%.

To Get More Information On Grid Connected Battery Energy Storage Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 2.25 Billion

-

Market Size by 2033: USD 15.69 Billion

-

CAGR: 27.50% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Grid Connected Battery Energy Storage Market Trends

-

Rapid cost declines in lithium-ion cells and BOS (balance of system) components are enabling attractive economics for many storage use cases.

-

Shift toward long-duration energy storage (LDES) for multi-hour discharge is increasing interest in flow and alternative chemistries.

-

Aggregated BTM assets via virtual power plants (VPPs) participate in wholesale and ancillary markets.

-

Grid modernization programs and capacity-adequacy auctions drive utility procurements of large FTM battery parks.

-

Project financing is maturing with green bonds and structured PPAs for storage-plus-renewables.

-

Supply-chain geopolitics and cell material constraints (Li, Ni, Co) spur regional sourcing strategies and investments in alternative chemistries.

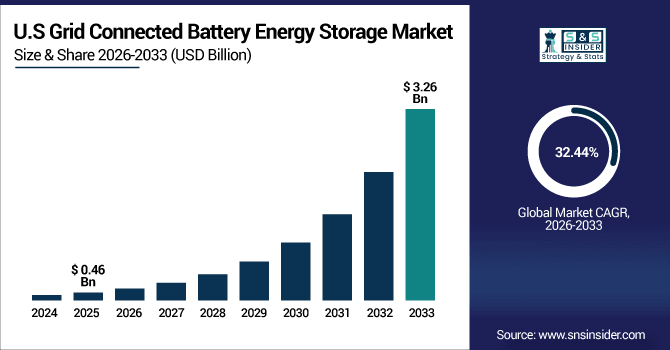

The U.S. Grid Connected Battery Energy Storage Market size was valued at USD 0.46 Billion in 2025E and is projected to reach USD 3.26 Billion by 2033, growing at a CAGR of 32.44% during 2026-2033. Grid Connected Battery Energy Storage Market growth is driven by increasing deployment of renewable energy and the need for grid reliability and flexibility. Capacity markets and resilience programs provide strong financial incentives for both utility-scale and behind-the-meter projects. Advancements in battery technologies, including lithium-ion and emerging long-duration solutions, support efficient and cost-effective storage. Private-sector investment and innovation in system integration and software optimization further accelerate adoption.

Grid Connected Battery Energy Storage Market Growth Drivers:

-

Rising Renewables Demand Firm, Dispatchable Storage for Grid Stability & Savings

Rising renewable penetration demands firm, dispatchable storage to balance intermittency and stabilize grids. Batteries deliver fast frequency response, black-start capability, and voltage support, enhancing reliability. They defer costly transmission and distribution upgrades, generating significant CAPEX savings for utilities. Falling system costs and improved round-trip efficiencies make storage increasingly competitive across applications. Revenue stacking—enabled by evolving markets and policy incentives—boosts project bankability and ROI. Regulatory tailwinds and decarbonization mandates further accelerate grid-scale storage deployment globally.

By 2025, over 40% of new U.S. interconnection requests will include co-located battery storage to manage solar/wind variability — up from 22%. Globally, 120+ GW of renewables will be paired with storage to meet grid code stability requirements.

Grid Connected Battery Energy Storage Market Restraints:

-

High Costs, Supply Risks, Regulatory Hurdles Delay Deployment & Raise Expenses

High upfront capital costs remain a barrier, especially where conventional generation is cheaper. Supply chain constraints for lithium, cobalt, and nickel inflate prices and extend project lead times. Safety, recycling, and end-of-life compliance add operational complexity and ongoing cost burdens. Interconnection backlogs and uncertain market rules delay commissioning and revenue realization. Variable ancillary service pricing and lengthy procurement cycles complicate financing and risk modeling. Lack of standardized regulations across regions creates deployment friction and investor hesitation.

Grid Connected Battery Energy Storage Market Opportunities:

-

Long-Duration, AI-Optimized, Hybrid & Second-Life Solutions Unlock New Value Streams

Long-duration energy storage (LDES) technologies like flow and zinc batteries address multi-day needs. Repurposing EV batteries for grid use reduces costs and promotes circular, sustainable deployment. AI-driven optimization boosts asset performance, cuts O&M, and maximizes revenue through smart dispatch. Emerging markets offer leapfrog potential via behind-the-meter systems and virtual power plants. Hybrid models pairing storage with green hydrogen or flexible loads unlock seasonal and industrial value. New policy frameworks and digital marketplaces enable innovative business models and diversified income streams.

An estimated 50 GWh of used EV batteries will reach end-of-vehicle-life by 2025, with ~30% (15 GWh) deemed suitable for stationary grid storage repurposing.

Grid Connected Battery Energy Storage Market Segment Analysis

-

By Technology, lithium-ion batteries led the market in 2025E with a share of 70.5%, while flow batteries are projected to be the fastest growing segment, expanding at a CAGR of 18.5%.

-

By Application, renewable integration dominated the market in 2025E with 45.31% share, whereas microgrids are expected to register the fastest growth with a CAGR of 16.0%.

-

By End-User, utilities accounted for the largest share of 55.72% in 2025E, while the commercial and industrial sector is anticipated to witness the highest growth, advancing at a CAGR of 17.0%.

-

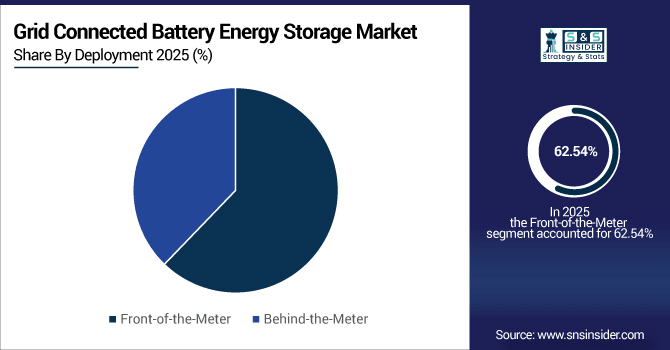

By Deployment, front-of-the-meter installations held the majority share of 62.54% in 2025E, while behind-the-meter systems are forecasted to grow at the fastest pace with a CAGR of 16.5%.

By Deployment, Front-of-the-Meter Lead While Behind-the-Meter Grow Fastest

Deployment models in the battery storage market are generally categorized into front-of-the-meter and behind-the-meter solutions. Front-of-the-meter projects are typically large utility-scale installations, designed to support grid operations, integrate renewable generation, and provide capacity reserves. Behind-the-meter deployments are smaller, serving commercial, industrial, and residential users directly at the point of consumption. These systems are often aggregated into virtual power plants, creating distributed energy resources that can participate in wholesale markets. Front-of-the-meter deployments highlight centralized control and grid efficiency, while behind-the-meter systems emphasize consumer autonomy and localized benefits.

By Technology, Lithium-ion Leads Market While Flow Batteries Registers Fastest Growth

The technology landscape of the grid connected battery energy storage market is shaped by multiple chemistries, each with distinct advantages. Lithium-ion remains the most widely adopted due to its high efficiency, strong energy density, and rapidly declining system costs. Flow batteries are increasingly gaining traction as long-duration storage solutions, particularly for applications where multi-hour discharge and deep cycling are required. Sodium-ion is emerging as a promising alternative with potential benefits in cost and supply chain diversification. Other chemistries, including lead-acid, zinc-based, and metal-air technologies, continue to serve niche applications where durability and cost sensitivity are important.

By Application, Renewable Integration Dominate While Microgrids Shows Rapid Growth

Applications for grid connected battery energy storage are diverse, addressing the evolving requirements of modern power systems. Renewable integration is a leading use case, enabling stable power delivery from intermittent sources such as wind and solar. Peak shaving supports grid operators and utilities by reducing load during demand spikes, avoiding costly infrastructure upgrades. Frequency regulation remains a critical application, offering fast response to stabilize power quality and reliability. Microgrids increasingly employ storage to enhance resilience in isolated or disaster-prone regions.

By End-User Industry, Utilities Lead While Commercial & Industrial Registers Fastest Growth

End-user adoption of battery storage varies depending on energy requirements and business models. Utilities are the largest adopters, deploying storage for capacity support, renewable balancing, and deferral of transmission and distribution investments. Commercial and industrial users increasingly deploy systems to reduce peak charges, ensure power reliability, and align with corporate sustainability commitments. Residential adoption is also growing, particularly when paired with rooftop solar or in regions with frequent outages, enabling households to achieve greater energy independence. Government facilities, data centers, and institutional campuses also use storage to meet operational continuity and efficiency targets.

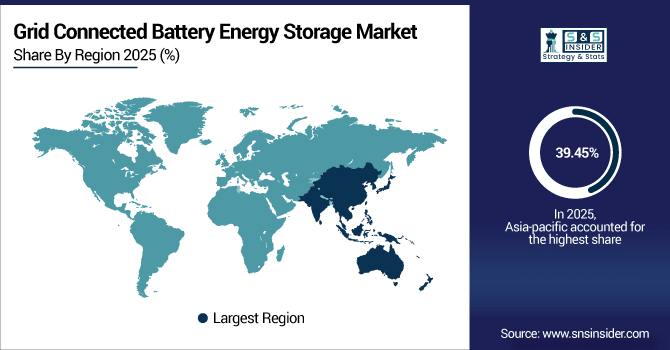

Grid Connected Battery Energy Storage Market Regional Analysis:

Asia-pacific Grid Connected Battery Energy Storage Market Insights

In 2025E Asia-Pacific dominated the Grid Connected Battery Energy Storage Market and accounted for 39.45% of revenue share, this leadership is due to rapid renewable energy growth, supportive policies, and large-scale deployments. Countries such as China, Japan, India, and South Korea are investing heavily in both front-of-the-meter and behind-the-meter projects. Local manufacturing capacity and integrated supply chains provide a competitive advantage for the region.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China Grid Connected Battery Energy Storage Market Insights

China is a leading market for grid connected battery energy storage, driven by large-scale utility deployments and strong government policy support. The country benefits from extensive local manufacturing and supply chain capabilities.

North America Grid Connected Battery Energy Storage Market Insights

North America is expected to witness the fastest growth in the Grid Connected Battery Energy Storage Market over 2026-2033, with a projected CAGR of 28.25% due to battery storage, driven by renewable energy mandates and supportive regulatory frameworks. The United States leads with large utility procurements, capacity market participation, and resilience initiatives. Canada and Mexico are also seeing steady adoption in renewable integration and remote community projects. Market growth is further supported by private investment and advanced technology innovation.

U.S. Grid Connected Battery Energy Storage Market Insights

The U.S. is a major adopter of battery energy storage, with both front-of-the-meter and behind-the-meter projects expanding rapidly. Capacity markets and resilience programs incentivize large-scale deployments. Private-sector investment and innovation in software and system integration support growth.

Europe Grid Connected Battery Energy Storage Market Insights

Europe has established itself as a mature market for energy storage, supported by ambitious climate goals and renewable integration policies. Countries like Germany, the United Kingdom, Spain, and the Nordic nations are leading adopters. Storage plays a central role in balancing intermittent wind and solar resources, especially in interconnected grids. Regulatory frameworks encourage flexibility markets and cross-border energy sharing, increasing opportunities for storage projects.

Germany Grid Connected Battery Energy Storage Market Insights

Germany has established itself as a mature market for grid connected battery energy storage. Adoption is primarily driven by the need to balance intermittent renewables and improve grid flexibility. Regulatory incentives and government support encourage both utility-scale and distributed storage projects.

Latin America (LATAM) and Middle East & Africa (MEA) Grid Connected Battery Energy Storage Market Insights

The Grid Connected Battery Energy Storage Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the rising solar and wind adoption alongside efforts to improve grid stability. Countries in Latin America, including Brazil, Chile, and Mexico, are piloting storage projects to support renewable integration and remote grid operations, with mining and industrial users also exploring behind-the-meter opportunities. Similarly, Middle Eastern nations are aligning storage with ambitious renewable targets, while African markets leverage microgrids and off-grid systems to address energy access gaps.

Grid Connected Battery Energy Storage Market Competitive Landscape:

NGK Insulators Ltd. is a key player in the battery energy storage market, specializing in sodium-sulfur (NaS) battery solutions for grid-scale applications. The company focuses on long-duration storage projects that enhance renewable integration and stabilize transmission networks. NGK’s technology supports utilities in frequency regulation, peak shaving, and renewable firming.

-

In April 2024, launched upgraded NaS battery system with 15-year lifespan, targeting EU and U.S. grid operators. Signed MoU with Canadian utility for 100MWh project. Enhances safety protocols and thermal efficiency for extreme climates.

BYD Company is a leading manufacturer of lithium-ion batteries and integrated energy storage solutions. The company supplies both front-of-the-meter and behind-the-meter systems, enabling renewable energy integration and load management. BYD’s solutions are deployed in large-scale utility projects, commercial facilities, and microgrids.

-

In March 2024, Unveiled “BYD Cube Pro” modular 2.8MWh LFP ESS with 92% round-trip efficiency. Secured 1.2GWh U.S. utility contract. Partnered with Sunrun for residential VPP rollout. Enhanced liquid cooling and AI-driven predictive maintenance features.

NEC Corporation provides advanced battery energy storage systems designed for grid support, renewable integration, and microgrid applications. Its solutions combine high-efficiency lithium-ion technology with intelligent control software for optimized dispatch. NEC focuses on utility-scale deployments that improve reliability, reduce operational costs, and enable peak load management.

-

In February 2024, Deployed 80MWh “NEC Grid Storage 2.0” in Texas with AI-EMS for ERCOT. Partnered with Fluence on hybrid control software. Added cybersecurity layer for grid-edge assets. Targets 30% cost reduction in O&M via digital twin tech.

Samsung SDI Co. is a prominent provider of lithium-ion battery solutions for stationary energy storage and electric mobility. The company delivers high-performance, scalable systems suitable for grid-scale, commercial, and industrial applications. Its technologies enable renewable energy integration, frequency regulation, and energy arbitrage.

-

In January 2024, Launched “Super E-Storage” 5MWh containerized LFP system with UL9540A certification. Signed 800MWh supply deal with AES. Introduced second-life battery program with BMW. Boosts cycle life to 12,000 cycles at 80% DoD.

Grid Connected Battery Energy Storage Market Key Players:

Some of the Grid Connected Battery Energy Storage Market Companies are:

-

NGK Insulators Ltd.

-

BYD Company

-

NEC Corporation

-

Samsung SDI Co.

-

LG Electronics Inc.

-

Xtreme Power

-

Saft Groupe.SA.

-

AES Energy Storage

-

Alevo

-

Delco

-

Altair Nanotechnologies Inc.

-

EnerDel

-

GNB Corporation

-

Ecoult

-

Powertree Services Inc.

-

Tesla Energy

-

Fluence

-

Mitsubishi Power

-

Wärtsilä

-

Sonnen

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 2.25 Billion |

| Market Size by 2033 | USD 15.69 Billion |

| CAGR | CAGR of 27.50% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Lithium-ion, Flow Batteries, Sodium-ion and Others) • By Application (Renewable Integration, Peak Shaving, Frequency Regulation, Microgrids and Others) • By End-User (Utilities, Commercial & Industrial, Residential and Others) • By Deployment (Front-of-the-Meter and Behind-the-Meter) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | NGK Insulators Ltd., BYD Company, NEC Corporation, Samsung SDI Co., LG Electronics Inc., Xtreme Power, Saft Groupe.SA., AES Energy Storage, Alevo, Delco, Altair Nanotechnologies Inc., EnerDel, GNB Corporation, Ecoult, Powertree Services Inc., Tesla Energy, Fluence, Mitsubishi Power, Wärtsilä, Sonnen |