Hydraulic Fracturing Market Key Insights:

Get More Information on Hydraulic Fracturing Market - Request Sample Report

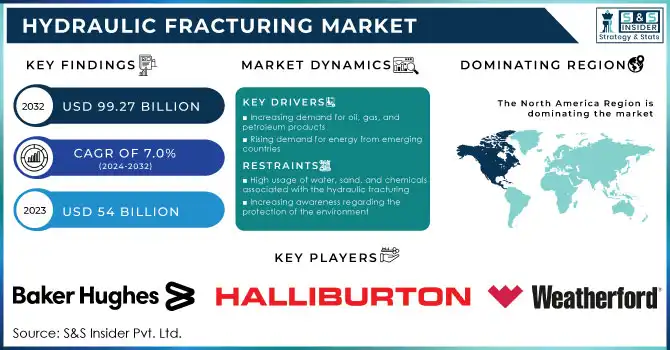

The Hydraulic Fracturing Market size was valued at USD 54 Billion in 2023 and is projected to reach USD 99.27 Billion by 2032, growing at a compound annual growth rate (CAGR) of 7.0% from 2024 to 2032.

Hydraulic fracturing, also known as fracking, is a process used to extract natural gas and oil from shale rock formations deep underground. This technique involves injecting a mixture of water, sand, and chemicals at high pressure into the rock, causing it to fracture and release the trapped gas or oil.

The Hydraulic Fracturing Market is a rapidly growing industry. Despite its potential benefits, hydraulic fracturing has been a controversial topic due to concerns about its environmental impact. Advancements in technology and regulations have made the process safer and more efficient. The chemicals used in the process can contaminate groundwater and air and the large amounts of water required can strain local water resources. However, it has the potential to increase domestic energy production, create jobs, and reduce dependence on foreign oil. The industry is heavily regulated and technological advancements have made the process safer and more efficient. The market for hydraulic fracturing is expected to continue to grow as the demand for natural gas and oil increases. This growth is driven by factors such as population growth, urbanization, and industrialization.

Market Dynamics

Drivers

-

Increasing demand for oil, gas, and petroleum products

-

Rising demand for energy from emerging countries

As the global population continues to expand, the demand for energy to power homes, businesses, and industries also increases. Hydraulic fracturing has emerged as a promising solution to meet this demand, as it enables the extraction of oil and gas from previously unreachable sources. This factor has propelled the growth of the hydraulic fracturing market. The benefits of hydraulic fracturing are numerous. It has reduced the dependence on foreign oil and gas, created jobs, and lowered energy costs for consumers. Additionally, it has enabled the United States to become a net exporter of energy, boosting the economy and enhancing national security.

-

Growing shale gas production and exploration activities

Restrain

-

High usage of water, sand, and chemicals associated with the hydraulic fracturing

-

Increasing awareness regarding the protection of the environment

Opportunities

-

Technological advancement made hydraulic fracturing more efficient and cost-effective

-

Growing demand for natural gas as a cleaner alternative to traditional fossil fuels

Challenges

-

Stringent rules and regulations imposed by the government to reduce the environmental impact

-

Potential Impact on the environment due to the hydraulic fracturing process

Hydraulic fracturing can contaminate groundwater and contribute to air pollution, among other issues. As a result, the hydraulic fracturing market is facing increasing scrutiny and regulation. As such, it is important for companies in the industry must adhere to strict environmental standards and invest in new technologies to minimize their impact on the environment. This has led to higher costs and decreased profitability for some companies.

Impact of COVID-19

The COVID-19 pandemic affected the hydraulic fracturing market negatively. The global economic slowdown, which was caused by the pandemic, has resulted in a decrease in the demand for oil and gas. This decline in demand has led to a reduction in hydraulic fracturing activity. In 2020, Europe experienced a 7% decline in the demand for oil and gas, while global natural gas consumption dropped by 4%. All regions have been affected, with mature markets across Europe, North America, Asia, and Eurasia accounting for approximately 75% of lost gas consumption in 2020. The impact of this decline in demand has been felt throughout the industry, with companies experiencing financial difficulties and job losses. The pandemic has also disrupted supply chains, causing delays in the delivery of equipment and materials needed for hydraulic fracturing operations. This has led to increased costs and further slowed down activity in the market.

Impact of Russia-Ukraine War:

The Russian invasion of Ukraine affected the oil industry, resulting in a surge in oil prices. This, in turn, has led to a decrease in the demand for hydraulic fracturing, making it less cost-effective. As a result, the number of hydraulic fracturing projects has decreased, causing a negative impact on the industry. According to the World Economic Forum, the conflict between Russia and Ukraine has caused oil prices to remain above $100/barrel. Moreover, this war has resulted in a significant decrease in the availability of equipment and supplies required for hydraulic fracturing. Many of the companies that supply equipment and supplies for hydraulic fracturing are based in Russia or Ukraine, and the conflict has disrupted their operations. This has led to delays in the delivery of equipment and supplies, further impacting the industry.

Impact of Recession

The recession has caused a decrease in demand for energy, which has had a significant impact on the hydraulic fracturing market. As a result, companies operating in this industry have experienced a decline in revenue. Additionally, the economic downturn has led to a decrease in investment in hydraulic fracturing. Many investors have become more risk-averse and are hesitant to invest in this industry due to the uncertain economic climate. More insights into the impact of the recession on the hydraulic fracturing market in comprised in the final report.

Market segmentation

By Well Type

-

Horizontal Well

-

Vertical Well

By Technology

-

Sliding Sleeve

-

Plug & Perf

By Application

-

Onshore

-

Offshore

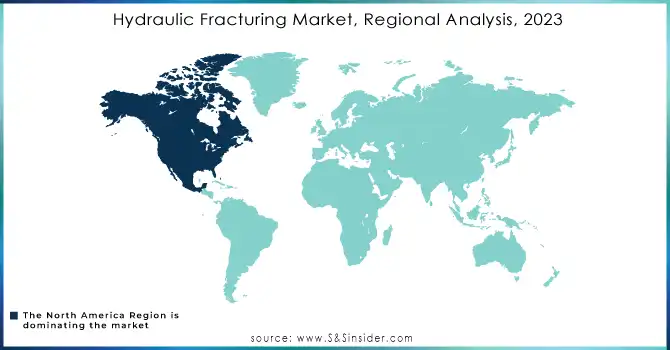

Regional Analysis

North America dominated the hydraulic fracturing market and is expected to grow with a significant CAGR during the forecast period. North America's dominance in the hydraulic fracturing market is attributed to the region's abundant shale reserves, advanced drilling technologies, and favorable regulatory environment. The United States contributes majorly to the growth of the North America region. The United States has an abundance of shale gas reserves, which are extracted using hydraulic fracturing with horizontal drilling techniques. This process is particularly effective for accessing ultra-hard shale deposits located deep underground throughout the country. In fact, natural gas production in the U.S. increased by 4% (4.9 billion cubic feet per day [Bcf/d]) in 2022, with an average of 119 Bcf/d. The Appalachian, Permian, and Haynesville regions were responsible for 60% of all U.S. production in 2022, a proportion similar to that of the previous year. These production and exploration activities are driving significant growth in the hydraulic fracturing market. Furthermore, the increasing demand for energy and the need for cost-effective extraction methods have also contributed to the growth of the hydraulic fracturing market in North America. As a result, the region has become a hub for hydraulic fracturing, attracting investors and companies from around the world.

Need any customization research on Hydraulic Fracturing Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The major players are Baker Hughes Company, Halliburton, Schlumberger Limited, Weatherford, Superior Energy Services, U.S. Well Services, Trican Well Services Ltd., Basic Energy Services, Propetro Holding Corp., RockPile Energy Services, FTS International, and other players

Recent Development:

-

In April of 2023, Halliburton Company made an announcement regarding the implementation of their Auto Pumpdown™ service within their hydraulic fracturing business. This innovative service allows for wireline and pump automation during unconventional completion operations, revolutionizing the industry.

-

In September of 2022, Trican Well Service Ltd. announced its commitment to expanding its fleet of next-generation, low-emissions fracturing equipment. They plan to upgrade their fourth set of existing pumping equipment with CAT Tier 4 dynamic gas blending engines, further solidifying their position as a leader in the industry.

-

In December of 2022, ProPetro Holding Corp. announced a significant contract with a leading independent Permian operator for the use of their first electric-powered hydraulic fracturing fleet, known as the "e-fleet." This exciting development marks a major step forward in the industry's efforts to reduce emissions and promote sustainability. Under this agreement, ProPetro has committed to providing services for a period of three years after the delivery of the e-fleet.

| Report Attributes | Details |

| Market Size in 2023 | US$ 54.0 Bn |

| Market Size by 2032 | US$ 99.27 Bn |

| CAGR | CAGR of 7.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Well Type (Horizontal Well and Vertical Well) • By Technology (Sliding Sleeve and Plug & Perf) • By Application (Onshore and Offshore) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Baker Hughes Company, Halliburton, Schlumberger Limited, Weatherford, Superior Energy Services, U.S. Well Services, Trican Well Services Ltd., Basic Energy Services, Propetro Holding Corp., RockPile Energy Services, FTS International |

| Key Drivers | • Increasing demand for oil, gas, and petroleum products • Rising demand for energy from emerging countries |

| Market Opportunities | • Technological advancement made hydraulic fracturing more efficient and cost-effective • Growing demand for natural gas as a cleaner alternative to traditional fossil fuels |