Grow Lights Market Size & Overview

Get More Information on Grow Lights Market - Request Sample Report

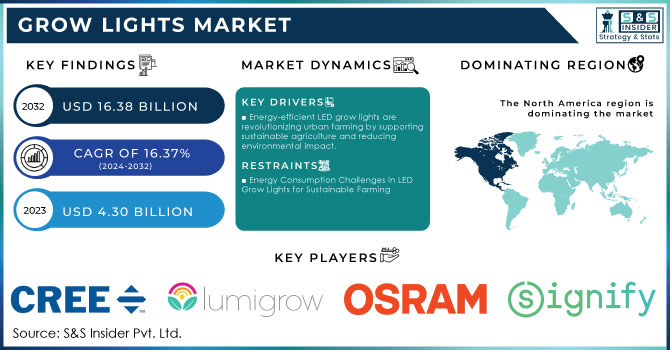

The Grow Lights Market Size was valued at USD 4.30 billion in 2023 and is expected to grow to USD 16.38 billion by 2032 and grow at a CAGR of 16.37% over the forecast period of 2024-2032.

The grow lights market is thriving, propelled by the expansion of indoor and vertical farming, particularly in urban areas where space for traditional agriculture is limited. Vertical farming methods, such as those employed by companies like plenty, are revolutionizing the way food is produced. These systems use AI-driven technology to optimize growing conditions for crops like strawberries, enabling year-round production. This innovation not only reduces land use—up to 97% less than conventional farming—but also dramatically cuts water consumption by up to 90%. These advancements align with growing environmental concerns and the need for more sustainable farming practices, as vertical farms can be set up in urban centers, cutting down on food transportation and greenhouse gas emissions. A major challenge with indoor vertical farming is its energy consumption, particularly from artificial lighting, which accounts for more than 50% of energy costs in some setups. Research has identified that energy usage in domestic vertical gardens while providing local, fresh produce year-round can be inefficient, particularly with artificial lighting and ventilation systems.

For instance, domestic vertical farming appliances can consume up to five times more energy than professional setups. Studies suggest that energy management and the adoption of more efficient technologies, such as LED lighting, are key to improving the sustainability of these systems. Moreover, transitioning to renewable energy sources could further reduce the carbon footprint of these farming methods. The future looks promising for the grow lights market, especially with the increasing demand for energy-efficient solutions. Innovations like electro-agriculture, which uses renewable energy and carbon dioxide to grow crops indoors, could play a pivotal role in further reducing land and water use in agriculture. This technique could potentially reduce U.S. agricultural land requirements by 94%, freeing up vast areas for ecosystem restoration. As the technology behind LED grow lights improves, and vertical farming systems become more energy-efficient, they are expected to contribute significantly to feeding the growing global population while minimizing environmental impact. While energy consumption remains a concern, the grow lights market is poised for continued growth, driven by innovations in sustainable farming technologies, improved energy management, and increased adoption of LED and smart lighting systems. These trends align with the broader push for sustainable urban agriculture and could redefine the future of food production.

Grow Lights Market Dynamics

Drivers

-

Energy-efficient LED grow lights are revolutionizing urban farming by supporting sustainable agriculture and reducing environmental impact.

As cities grow and available land diminishes, the need for space-efficient farming methods like vertical farming becomes critical. LED grow lights are at the forefront of this movement, offering energy-efficient, low-carbon solutions that significantly reduce land and water usage. Studies show that LED lighting can reduce energy consumption by up to 80%, making them a key component in sustainable farming practices. Additionally, businesses in agriculture and urban farming are investing heavily in smart lighting solutions, aligning with global sustainability goals. In sectors like cannabis production, LED grow lights have been shown to enhance yields while minimizing environmental impacts. As demand for locally grown, pesticide-free crops increases, the market for energy-efficient grow lights is expected to continue expanding, playing a vital role in urban agriculture’s future. With the global push for carbon neutrality and resource-efficient farming methods, grow lights powered by renewable energy are poised to shape the future of food production.

Restraints

-

Energy Consumption Challenges in LED Grow Lights for Sustainable Farming

A significant restraint in the grow lights market is the energy consumption of these systems, despite their energy-efficient nature. While LED grow lights are designed to be energy saving compared to traditional lighting, their application in large-scale indoor farming can still lead to high electricity usage, especially in regions where energy prices are rising. For instance, the energy consumption of LED lights in grow operations is still considerable, with some systems using up to 0.6 kW per square meter per day, depending on the type of crops grown and lighting intensity. This ongoing energy demand may discourage adoption among smaller, cost-sensitive operations, particularly in areas struggling with energy shortages or high utility costs. Furthermore, despite advancements in solar energy and other renewables, solar solutions may not always be viable for all types of indoor farms, exacerbating concerns about long-term operational costs. As such, managing energy consumption remains a key challenge for the market, and addressing this issue is crucial for improving the sustainability and affordability of LED grow lights in large-scale farming systems.

Grow Lights Market Segmentation Overview

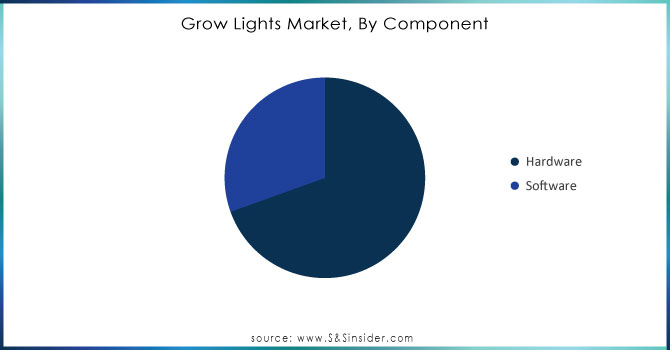

By Component

In 2023, the hardware segment of the grow lights market, which includes lighting solutions such as LEDs, high-intensity discharge (HID) lights, and plasma lights, accounted for about 70% of the total market share. This growth is primarily driven by the demand for energy-efficient and durable lighting solutions for both small and large-scale agricultural applications. Companies like Signify Holding have made strides in this area, collaborating with Infinite Acres B.V. to enhance vertical farming with advanced LED technology that prioritizes sustainability. Additionally, product innovation is accelerating, with companies such as OSLON offering a diverse range of light options suited for vertical farming and horticultural needs. As energy-efficient solutions become increasingly important, hardware continues to play a central role in the evolution of grow lights market.

Need Any Customization Research On Grow Lights Market - Inquiry Now

By Application

In 2023, the indoor farming application segment dominated the grow lights market, capturing around 35% of the total revenue share. This dominance is attributed to the increasing adoption of controlled environment agriculture (CEA) methods, where indoor farming plays a vital role in meeting the growing demand for fresh produce in urban settings. The segment benefits from technological advancements, including energy-efficient lighting solutions such as LED grow lights, which help optimize plant growth while minimizing energy costs. Moreover, urbanization and the shift toward sustainable farming practices have further bolstered the growth of indoor farming. Companies like Signify Holding and Philips Lighting have been actively expanding their product offerings, introducing specialized LED systems designed for indoor farming. These innovations are critical as they help farmers maintain optimal growing conditions year-round. Additionally, the rise of vertical farming and hydroponics in urban areas further supports the increasing demand for indoor grow lights

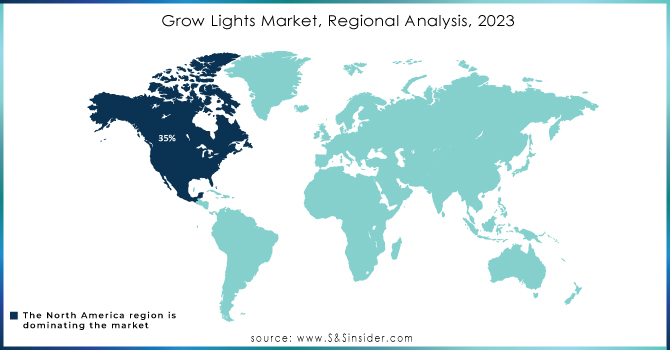

Grow Lights Market Regional Analysis

In 2023, North America led the grow lights market, capturing around 35% of the global revenue, largely driven by rising adoption in commercial and residential farming applications. The demand for energy-efficient grow lights is significant due to increased indoor farming and controlled environment agriculture (CEA) practices in urban areas. Key players, such as Signify Holding and OSRAM, have contributed to this growth with advanced LED technologies. For instance, Signify launched horticultural lighting solutions focused on optimizing energy efficiency and crop productivity for North American farmers. The United States and Canada are key countries in this market, leveraging vertical farming technologies to address urban food production challenges. In the U.S., government support and funding initiatives in sustainable agriculture have further encouraged the adoption of grow lights, while smart farming technologies, including IoT-enabled systems, are increasingly popular to enhance automation and efficiency. Companies have also responded to demand with specific product innovations. Fluence Bioengineering, for example, launched high-performance LED solutions designed to support large-scale commercial farming, further strengthening the market's dominance.

In 2023, the Asia Pacific region became the fastest-growing market for grow lights, driven by rapid urbanization, increasing food demand, and the widespread adoption of advanced farming methods such as vertical farming and controlled environment agriculture (CEA). Countries like China, India, and Japan are seeing heightened demand for energy-efficient and compact grow lights to cater to the needs of urban agriculture. Significant product developments have been made, with companies like OSRAM and Fluence Bioengineering introducing advanced LED lighting solutions designed for indoor and vertical farming. OSRAM launched a new range of horticultural LEDs in 2023, optimizing light distribution for diverse crops. Additionally, China remains a major producer of LED grow lights, while India is adopting these technologies to boost urban food production. The rise of IoT-enabled grow lights is also enhancing automation in farming practices, supporting the growing trend. With strong government backing and environmental concerns, Asia Pacific is set to maintain its leadership in the global grow lights market.

Key Players in Grow Lights Market

Some of the major players in Grow Lights market with product:

-

Signify (Philips Lighting) – (Philips GreenPower LED)

-

Osram Licht AG – (OSRAM Oslon Square)

-

General Electric (GE) – (GE HyGrow LED)

-

Lumigrow Inc. – (Lumigrow Pro 650)

-

Cree Inc. – (Cree XLamp)

-

Everlight Electronics Co. Ltd. – (Everlight LED Grow Lights)

-

Hydrofarm Inc. – (Active Grow LED Fixtures)

-

Kessil (Daiwa) Inc. – (Kessil A360X)

-

Gaia LED – (Gaia LED Grow Lights)

-

Heliospectra AB – (Heliospectra LED Grow Lights)

-

Growbright – (Growbright LED Full Spectrum Lights)

-

HortiLED – (HortiLED Full Spectrum Lighting)

-

Illumitex Inc. – (Illumitex LED Grow Lights)

-

Samsung Electronics – (Samsung LM301H LED Grow Lights)

-

Advanced Nutrients – (Advanced Nutrients LED Grow Lights)

-

Valoya – (Valoya L Series)

-

Black Dog LED – (Black Dog PhytoMAX-2)

-

California LightWorks – (SolarSystem LED Grow Lights)

-

Greengo Technologies – (Greengo LED Grow Light)

-

Urban Gro – (Urban Gro LED Grow Lights)

List of potential customer companies for the grow lights market, across various industries that rely on grow lights for agricultural, commercial, and industrial applications:

Indoor Farming and Vertical Farming Companies

-

AeroFarms

-

Plenty

-

Farm.One

-

Gotham Greens

-

Infarm

Commercial Greenhouse Operators

-

SunOpta

-

Greenhouse Megastore

-

American Hydroponics

-

The Greenhouse People

Agricultural Research Institutes

-

International Food Policy Research Institute (IFPRI)

-

National Institute of Agricultural Botany (NIAB)

-

USDA Agricultural Research Service (ARS)

Agricultural Equipment Suppliers

-

John Deere

-

Trimble

-

Kubota Corporation

Hydroponic and Aquaponic Systems Providers

-

Hydrofarm

-

Hydroponics.net

-

Gotham Greens

Cannabis Producers

-

Aurora Cannabis

-

Canopy Growth

-

Tilray

-

Curaleaf

Retailers and E-commerce Platforms

-

Walmart

-

Amazon

-

Home Depot

-

Lowe’s

Agricultural Technology Companies

-

Ripe Robotics

-

Agri-Tech East

-

BrightFarms

Recent News

-

On October 23, 2024, Gooing Top’s best-selling grow light is highlighted as a solution for houseplant care during the shorter daylight hours of winter. On sale for USD26.99, it features adjustable settings, a timer, and energy-efficient LED lights that mimic full-spectrum sunlight, making it perfect for plant care and even doubling as a reading lamp.

Recent Development

-

In February 2024, Aero Garden unveiled the Harvest 2.0, an upgraded version of its popular Harvest unit. With a sleek design, detachable 15W full-spectrum LED grow light, and automatic timer, it promotes faster plant growth and offers gentle, efficient lighting in black and white, with more color options coming soon.

-

In October 2023, Québec-based Proplant Propagation adopted Sollum’s dynamic smart LED fixtures in its greenhouses. This strategic move leverages precision lighting with customized light recipes to improve product quality.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.24 Billion |

| Market Size by 2032 | USD 17.18 Billion |

| CAGR | CAGR of 20.36% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software) • By Technology (High Intensity Discharge (HID),LED, Fluorescent, Plasma) • By Spectrum (Partial Spectrum, Full Spectrum) • By Application (Indoor Farming, Vertical Farming, Commercial Greenhouse, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Signify (Philips Lighting), Osram Licht AG, General Electric (GE), Lumigrow Inc., Cree Inc., Everlight Electronics Co. Ltd., Hydrofarm Inc., Kessil (Daiwa) Inc., Gaia LED, Heliospectra AB, Growbright, HortiLED, Illumitex Inc., Samsung Electronics, Advanced Nutrients, Valoya, Black Dog LED, California LightWorks, Greengo Technologies, and Urban Gro. |

| Key Drivers | • Energy-efficient LED grow lights are revolutionizing urban farming by supporting sustainable agriculture and reducing environmental impact. |

| Restraints | • Energy Consumption Challenges in LED Grow Lights for Sustainable Farming |