Vertical Farming Market Size & Overview:

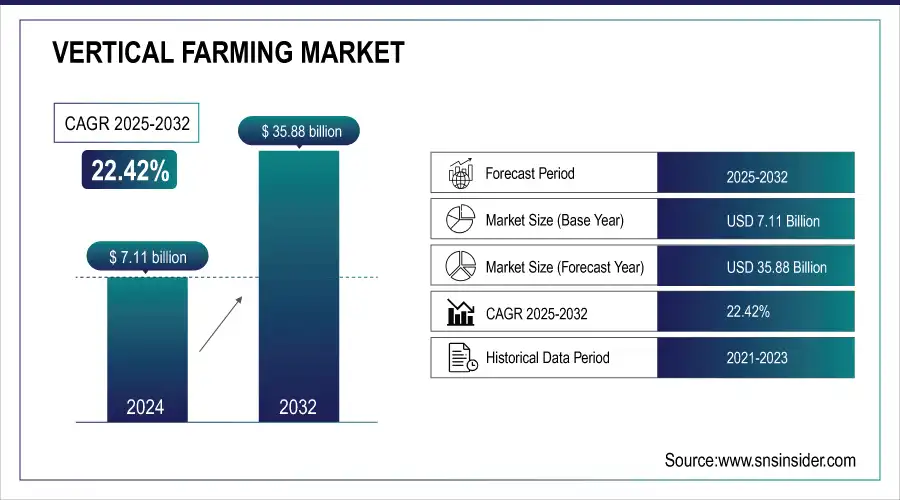

The Vertical Farming Market Size was valued at USD 7.11 Billion in 2024. It is estimated to reach USD 35.88 Billion by 2032, growing at a CAGR of 22.42% during 2025-2032.

The vertical farming market is experiencing rapid growth as urban areas adopt innovative solutions to meet the rising demand for sustainable food production. With urbanization on the rise, it is crucial to bring food production closer to city centers, effectively reducing transportation costs and emissions linked to traditional farming methods. Vertical farms, strategically located within or near urban settings, minimize the distance food travels from farm to table. These farms are designed to be highly efficient, requiring significantly less land and water than conventional agriculture, with the ability to cut water usage by up to 90% while yielding ten times more produce per square foot than traditional farming techniques. In 2022, indoor vertical farming companies attracted substantial investments totaling USD 2.4 billion.

Get more information on Vertical Farming Market - Request Free Sample Report

However, in the first quarter of 2023, they raised USD 75.8 million globally across 14 deals, reflecting a 70% decline in deal value from the previous quarter. Notably, indoor farming startups captured approximately 20% of the USD 4.5 billion invested in ag-tech startups in 2022. A key application of vertical farming lies in the cultivation of leafy greens, herbs, and microgreens, which grow rapidly and can be harvested multiple times throughout the year. This is particularly beneficial for restaurants, grocery stores, and online food delivery services that require a consistent supply of high-quality, fresh produce.

Market Size and Forecast:

-

Market Size in 2024: USD 7.11 Billion

-

Market Size by 2032: USD 35.88 Billion

-

CAGR: 22.42% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025-2032

-

Historical Data: 2021-2023

Vertical Farming Market Highlights:

-

Vertical farming is expanding into pharmaceutical and cosmetic industries by cultivating medicinal plants and herbs, enabling consistent, high-potency ingredients for medicines and wellness products.

-

Sustainability drives vertical farming adoption, as it reduces water usage by up to 90%, minimizes pesticide reliance, lowers carbon footprints through urban proximity, and can integrate renewable energy sources.

-

Advanced technologies like LED lighting, climate control, and data analytics enhance efficiency, energy utilization, and crop yield, supporting environmentally conscious consumers seeking eco-friendly options.

-

Rising health and nutrition awareness boosts market growth, as vertical farming delivers fresh, organic, chemical-free produce with higher nutrient retention and access to specialty crops often unavailable in conventional farming.

-

Vertical farms support urban populations by providing locally sourced, nutritious food, aligning with trends toward healthier lifestyles and sustainable diets.

-

Energy consumption remains a key restraint, as reliance on artificial lighting and non-renewable electricity can increase operational costs and reduce environmental benefits, emphasizing the need for renewable energy integration.

Furthermore, vertical farming is making strides in the pharmaceutical and cosmetic industries by cultivating medicinal plants and herbs known for their specific health and wellness benefits. For instance, herbs like basil, rich in essential oils and antioxidants, can be grown year-round with precise control over light and nutrients, enhancing their potency. This capability enables pharmaceutical companies to produce more consistent ingredients for medicines and natural health products, highlighting the transformative potential of vertical farming in various sectors.

Vertical Farming Market Drivers:

-

Sustainability is a significant driving force behind the adoption of vertical farming.

With growing recognition of climate change and environmental harm, both consumers and businesses are looking for sustainable agricultural methods. Conventional farming is commonly linked to excessive water consumption, soil degradation, and heavy dependence on chemical pesticides and fertilizers. On the other hand, vertical farming reduces these environmental effects. Vertical farms usually require 90% less water than traditional farms because of closed-loop irrigation systems that reuse water. Fewer pesticides are required when soil cultivation is absent, as controlled environments are more resistant to pests and diseases. Furthermore, vertical farming helps lessen carbon footprints by reducing transportation emissions through its proximity to urban areas. Additionally, vertical farms can also operate using renewable energy sources like solar or wind power, which helps to improve their sustainability credentials. Incorporating advanced technologies like LED lighting, climate control systems, and data analytics enhances efficiency and maximizes energy utilization. Vertical farming, meeting the growing demand for sustainable products, caters to environmentally conscious consumers by providing eco-friendly options.

-

The rising awareness of health and nutrition is significantly influencing the vertical farming market.

Consumers are placing a growing emphasis on fresh, organic fruits and vegetables and are exploring options other than conventionally grown foods that may have harmful pesticides or reduced nutritional value from long transportation. Vertical farming addresses these issues by growing crops in controlled settings without chemicals and minimal handling. Vertical farms often result in fresh produce reaching the table quicker, thus preserving more nutrients compared to conventionally grown produce with longer transport times. Furthermore, vertical farms can grow a larger selection of crops, such as herbs and specialty greens that are frequently not found in traditional farming practices. Vertical farming is meeting the increasing demand for organic and locally sourced food by providing high-quality and sustainably grown produce that is also nutritious. Understanding the connections between diet, health, and well-being is influencing changes in consumer preferences. Vertical farming supports urban populations in accessing healthy, nutrient-rich food, in line with the growing trend towards a healthier lifestyle.

Vertical Farming Market Restraints:

-

Despite the sustainability benefits of vertical farming, energy consumption remains a significant concern.

Vertical farms heavily depend on artificial lighting like LED lights to facilitate plant growth in controlled conditions. The ongoing usage of these energy-demanding systems may result in increased electricity expenses, prompting concerns regarding the overall long-term viability of vertical farming practices. Relying on non-renewable energy sources in vertical farming can reduce its environmental advantages. With the increase in energy costs and the growing emphasis on reducing carbon footprints, vertical farming operations may come under closer examination for their sustainability. Even though energy-efficient technologies are advancing and reducing energy use, the challenges remain due to the continued high demand for electricity. Moreover, the way energy is sourced can affect the carbon footprint of vertical farms. If vertical farming relies on electricity from fossil fuels, the environmental benefits may be at risk. Thus, it is imperative to guarantee that vertical farms utilize renewable energy sources for their continued sustainability and widespread adoption in the market.

Vertical Farming Market Segment Analysis:

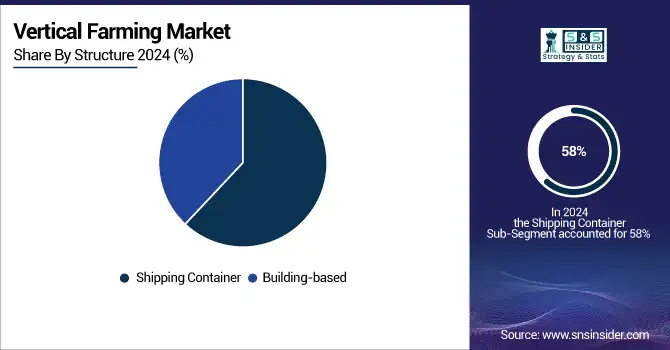

By Structure

The shipping container dominated with a 58% market share in 2024 in the vertical farming industry. This technique involves using refurbished shipping containers with modern technology to enable effective, space-efficient farming in city settings. Shipping containers, which are pre-made, weather-resistant, and portable, are perfect for urban environments with minimal space. Farmbox Foods and Container Farm have effectively implemented shipping container farms to grow fresh, local produce, decreasing the environmental impact of food shipping.

The building-based vertical farming is projected to experience a rapid growth rate during 2025-2032, due to urbanization and the need for sustainable food production in cities. Vertical farms located in buildings have an advantage by being close to consumers, cutting down on transportation expenses, and improving the quality of produce. Well-known entities such as Gotham Greens and Plenty showcase this strategy by converting rooftops and warehouses into efficient farming areas, illustrating how urban infrastructure can be utilized to address food security issues.

By Component

The hardware segment dominated with a 45% market share in 2024, mainly because of the significant investments in cutting-edge agricultural technologies. This section contains necessary supplies like LED grow lights, hydroponic systems, climate control systems, and irrigation technologies. The growing need for effective methods of producing food in cities is pushing the use of these hardware solutions, which allow for optimal plant growth in small areas. Businesses such as Lettuce Grow use advanced hardware configurations to create modular and expandable farming systems, which support sustainable agriculture.

The software segment is expected to have the fastest CAGR during 2025-2032 in the vertical farming market, showcasing the rising significance of data analytics and automation in contemporary agriculture. Sophisticated software solutions provide real-time monitoring, predictive analytics, and farm management tools to maximize resource efficiency and improve crop yields. Farmobile and similar companies create platforms that gather data from different sensors, allowing farmers to make well-informed decisions using practical insights.

Vertical Farming Market Regional Analysis

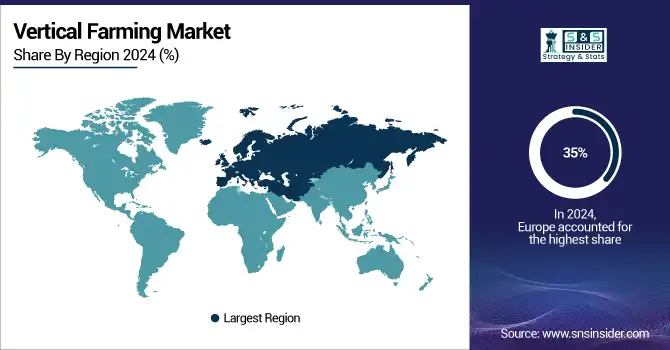

Europe Vertical Farming Market Trends:

Europe held a 35% market share by dominating the market in 2024 and it is anticipated to become the fastest-growing region during 2024-2032, due to its advanced agricultural infrastructure, increasing urbanization, and environmental sustainability initiatives. European countries, including the Netherlands, Germany, and the UK, have adopted vertical farming to address food security and reduce dependency on imports. High consumer demand for fresh, locally grown produce has led to rapid investments in vertical farming technologies, and stringent regulations on sustainable practices have further boosted this sector. Key companies such as Infarm, based in Germany, and Agricool from France, provide modular urban farming solutions to meet rising demand for fresh produce within dense urban areas.

Need any customization research on Vertical Farming Market - Enquiry Now

North America Vertical Farming Market Trends:

North America held significant market share in 2024 driven by technological advancements urban adoption and government support. USA and Canada lead vertical farming to enhance food security and reduce supply chain challenges. Consumers increasingly prefer organic and locally grown produce. Key companies AeroFarms Bowery Farming BrightFarms

Asia-Pacific Vertical Farming Market Trends:

Asia-Pacific is the fastest-growing region during 2024-2032 due to rapid urbanization population growth and limited arable land. Japan China and Singapore heavily invest in vertical farming technologies focusing on year-round fresh produce. Key companies Mirai Co., Ltd. iFarm Sky Greens

Latin America Vertical Farming Market Trends:

Latin America shows gradual adoption supported by government initiatives to modernize agriculture and improve food security. Brazil and Mexico are emerging as key markets. Key companies Kalera Altius Farms

Middle East & Africa Vertical Farming Market Trends:

Middle East and Africa have increasing adoption due to water scarcity and arid climates with focus on food security and reducing import dependency. UAE Israel and South Africa lead implementation. Key companies Square Roots Plantagon

Vertical Farming Market Key Players:

-

AeroFarms (Model X, Dream Greens)

-

Plenty (Farm Stack, Lettuce Mix)

-

Bowery Farming (Bowery Arugula, Bowery Kale)

-

Infarm (Infarm Grow Platform, Infarm Salad Greens)

-

BrightFarms (Sunny Crunch, BrightBerry)

-

Gotham Greens (Gotham Butterhead Lettuce, Gotham Pesto Basil)

-

Freight Farms (Greenery S, Leafy Green Machine)

-

Vertical Harvest (Microgreen Mix, Leafy Blend)

-

Spread Co., Ltd. (Techno Farm Keihanna, Green Leaf)

-

Agricool (Coolberry, Coolgreens)

-

Urban Crop Solutions (Plant Factory, Cropbox)

-

Sky Greens (Sky Urban Systems, Vertical Farming Towers)

-

Kalera (Kale Microgreens, Butterhead Lettuce)

-

Altius Farms (Living Butter Lettuce, Living Basil)

-

Square Roots (Herb Gardens, Square Roots Salad Mix)

-

JungleBox (Modular Farm System, JungleBox Greens)

-

Sky Vegetables (Sky Romaine, Sky Basil)

-

Plantagon (Plantagon CityFarm, Vertical Greenhouse)

-

iFarm (iFarm Growtune, iFarm Leafy Greens)

-

Mirai Co., Ltd. (Mirai Leafy Green, Mirai Romaine)

Suppliers of Raw Materials/Components

-

OSRAM

-

Philips Lighting (Signify)

-

Illumitex

-

General Hydroponics

-

Current (by GE)

-

AgroMax

-

Heliospectra

-

Emerson Electric

-

Argus Controls Systems

-

HydroGarden

Vertical Farming Market Competitive Landscape:

Harvest London, established in 2016, is a UK-based vertical farming company specializing in sustainable urban agriculture. The company focuses on producing fresh, locally grown leafy greens and herbs using advanced controlled environment farming techniques. By integrating technology and eco-friendly practices, Harvest London aims to reduce food miles, enhance food security, and meet growing consumer demand for high-quality, sustainable produce.

-

In April 2023, Harvest London successfully acquired a 140,000-square-foot location in South London to enhance its vertical farming activities. The objective of this new establishment is to generate a range of salads and herbs, backing the local food supply and benefiting from the investment of the Foresight Group.

Nature's Miracle Holding Inc., established in 2010, is a US-based company specializing in pet care products and solutions. The company focuses on providing high-quality, innovative, and eco-friendly products for pet hygiene, health, and nutrition. Nature's Miracle aims to enhance pet well-being while promoting sustainable and responsible practices in the pet care industry.

-

In October 2024, Nature's Miracle Holding Inc., a renowned entity in vertical farming technology and infrastructure, has recently disclosed its partnership with Robostreet Inc. to procure 150 LS450 electric trucks through a Cooperation Agreement.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 7.11 Billion |

| Market Size by 2032 | USD 35.88 Billion |

| CAGR | CAGR of 22.42% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Structure (Shipping Container, Building-based) • By Component (Hardware, Software, Services) • By Growing Mechanism (Hydroponics, Aeroponics, Aquaponics) • By Crop Category (Fruits, Vegetables & Herbs, Flowers & Ornamentals, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | AeroFarms, Plenty, Bowery Farming, Infarm, BrightFarms, Gotham Greens, Freight Farms, Vertical Harvest, Spread Co., Ltd., Agricool, Urban Crop Solutions, Sky Greens, Kalera, Altius Farms, Square Roots, JungleBox, Sky Vegetables, Plantagon, iFarm, Mirai Co., Ltd. |