U.S. Cold Storage Market Size & Overview:

Get More Information on U.S. Cold Storage Market - Request Sample Report

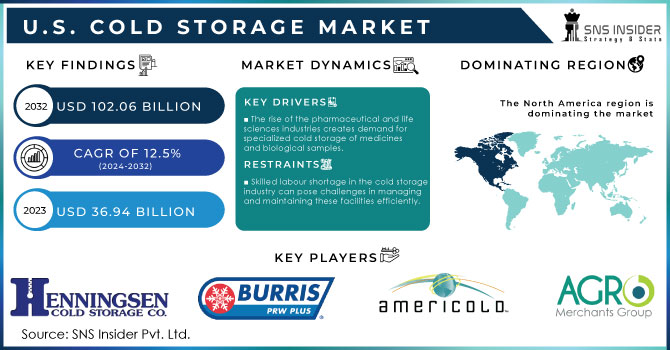

The U.S. Cold Storage Market Size was valued at USD 36.94 Billion in 2023 and is expected to reach USD 102.06 Billion by 2032 and grow at a CAGR of 12.5% over the forecast period 2024-2032.

Rising consumer demand for fresh and healthy produce, along with an expanding preference for convenience foods, requires efficient cold storage solutions to maintain product quality and extend shelf life. Perishable things like natural products, vegetables, and pre-made meals depend on cold storage to remain fresh and reach shoppers in ideal condition. The burgeoning pharmaceutical and healthcare sectors are altogether expanding demand for cold storage. These industries require specialized storage for temperature-sensitive medications, vaccines, and organic tests, guaranteeing their adequacy and safety.

Automation and robotics are playing a major part, with advances like Automated Storage and Retrieval Systems (ASRS) optimizing storage density and recovery times, driving the improved efficiency and reduced labour costs. Internet of Things (IoT) integration permits for real-time temperature checking and remote management of facilities, guaranteeing ideal conditions and minimizing product spoilage. These advancements not only enhance operational efficiency but moreover contribute to sustainability by decreasing energy consumption through improved temperature control.

Some Southeastern states, for example, offer tax breaks and incentives forces to encourage investment in cold storage facilities. This cultivates the advancement of much-needed infrastructure in these areas, especially those flourishing agricultural sectors producing natural products, vegetables, and poultry. Similarly, some West Coast states are offering grants or funding to modernize existing cold storage facilities.

U.S. Cold Storage Market Dynamics:

Key Drivers:

-

The rise of the pharmaceutical and life sciences industries creates demand for specialized cold storage of medicines and biological samples.

-

Advancements in automation and robotics are optimizing storage capacity, improving efficiency, and reducing labour costs in cold storage facilities.

-

E-commerce and home delivery services are significantly increasing the demand for cold storage to maintain product quality during transportation.

-

Growing consumer preference for fresh, healthy, and convenient food options is driving demand for cold storage.

Consumers are looking for the fresh, healthy and helpful nourishment alternatives. This has driven the rise in demand for cold storage facilities. People are eating more healthier, which implies more natural products, vegetables, dairy items, and pre-made meals require to be kept fresh at particular temperatures. Cold storage helps these things remain nutritious and high-quality from cultivate to table, meeting consumer desires for both freshness and security. Busy lives lead people to look for out ready-to-eat or quick-to-prepare choices that are still fresh. This trend isn't just for individual consumers, but moreover for businesses like restaurants and grocery stores that require effective ways to store fresh food to meet customer demand. Even better, innovation is making cold storage facilities more energy-efficient and feasible, which is great for the environment. Hence, more money is being contributed in building modern cold storage facilities. This is all driven by the changing habits of buyers and stricter rules around food security. The desire for fresh, healthy and convenient food is a major reason why cold storage is getting to be more and more important. It's changing the food supply chain and driving to development in storage and transportation.

Restraints:

-

Skilled labour shortage in the cold storage industry can pose challenges in managing and maintaining these facilities efficiently.

-

Fluctuations in energy prices can significantly impact the operational costs of running cold storage facilities.

Cold storage facilities are like giant refrigerators, constantly keeping food fresh at low temperatures. This means they utilize a lot of energy, and the cost of that energy can jump around a lot. This fluctuations in energy costs makes it difficult for cold storage businesses to arrange their budgets. When energy costs go up, the cost of running the fridges goes up as well, which decreases their profits. Businesses might at that point attempt to spare cash by utilizing less energy, which could risk spoiling the food. Thus, if the energy costs drop, cold storage businesses can make more cash and possibly lower their costs for clients. The issue is that no one knows for sure which way energy prices will go. This uncertainty makes it difficult for cold storage businesses to plan for the future.

U.S. Cold Storage Market Segments:

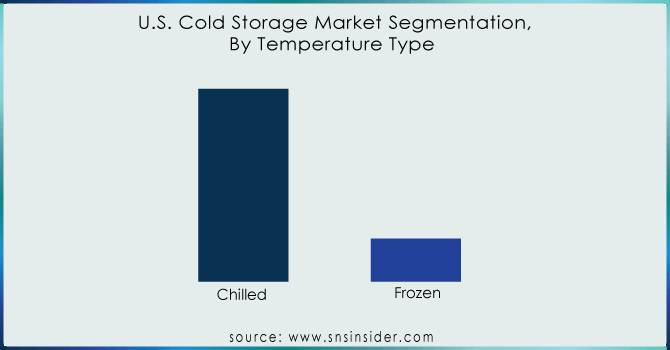

By Temperature Type

-

Chilled

-

Frozen

The frozen is the dominating sub-segment in the U.S. cold storage market by temperature type holding around 80-85% of market share. The frozen temperatures offer the longer shelf life for wider variety of the products including meat, seafood, vegetables and pre-made meals. This extended storage period allows for greater flexibility in managing inventory and reducing the spoilage. The demand for frozen convenience foods remains high due to the busy lifestyles and the increasing popularity of the pre-packaged meals. Advancements in freezing technology have ensured that, frozen food retains its quality and nutritional value which makes it viable alternative to fresh produce for many consumers. Thus, chilled storage plays a crucial role in the market as well, catering to products like fruits, vegetables, and dairy items that requires specific temperature control to maintain freshness and prevent spoilage.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Warehouse Type

-

Private & Semi-private

-

Public

The Public cold storage is the dominating sub-segment in the U.S. cold storage market by warehouse type. Public warehouses offer greater flexibility for the businesses of all sizes, as they can rent space on demand without the high upfront costs associated with building and maintaining their own facilities. The public storage providers often specialize in specific temperature ranges or product types, catering to the diverse needs of various clients. These facilities benefit from economies of scale, allows them to invest in the advanced technologies and automation systems that might be cost-prohibitive for smaller players. Thus, private and semi-private storage offer advantages such as greater control over storage conditions and security measures, which make them a suitable option for businesses with specific requirements or high-value products.

By Construction Type

-

Bulk Storage

-

Production Stores

-

Ports

By Application

-

Fruits & Vegetables

-

Dairy

-

Fish, Meat & Seafood

-

Processed Food

-

Pharmaceuticals

U.S. Cold Storage Market Country Analyses:

The Southeast region, encompassing states like Florida, Georgia, and North Carolina, is experiencing a rise in cold storage development due the flourishing agricultural sector producing fruits, vegetables, and poultry necessitates robust cold storage infrastructure for preservation. Rapid population growth increases demand for fresh produce and ready-to-eat meals, all reliant on cold storage. Proximity to major Atlantic Coast ports facilitates import and export of temperature-controlled goods, further boosting demand. Some Southeastern states offer tax breaks and incentives to encourage investment in cold storage facilities, further accelerating growth.

The West Coast, comprising California and other Pacific states, is another prominent growing region. The major agricultural producer, supplies a significant portion of the nation's fresh produce. Efficient cold storage infrastructure is crucial for maintaining quality during long-distance transportation. The West Coast is a hub for e-commerce activity, with a growing demand for cold storage facilities to support the efficient delivery of temperature-controlled food items. Some West Coast states offer grants or funding to modernize existing cold storage facilities, promoting energy efficiency and sustainability.

U.S. Cold Storage Market Key Players

The major key players are Americold Logistics, Inc., AGRO Merchants Group North America, Burris Logistics, Henningsen Cold Storage Co., Lineage Logistics Holdings, LLC, Nordic Logistics, Preferred Freezer Services, VersaCold Logistics Services, United States Cold Storage, Wabash National Corporation and other key players.

U.S. Cold Storage Market Recent Development

-

In March 2024: Americold significantly expanded its existing facility in Russellville by building a new 131,000 sq ft automated warehouse. This addition boosts storage capacity by 42,000 pallets and 13 million cubic feet.

-

11 August 2023: Lineage Logistics, a major temperature-controlled storage company, announced a partial joint venture with Hanoi's SK Logistics, a cold storage operator. The agreement expands Lineage's reach into Southeast Asia's growing cold storage market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 36.94 Billion |

| Market Size by 2032 | US$ 102.06 Billion |

| CAGR | CAGR of 12.59% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Temperature Type (Chilled, Frozen) • By Warehouse Type (Private & Semi-Private, Public) • By Construction Type ( Bulk Storage, Production Stores, Ports ) • By Application ( Fruits & Vegetables, Dairy, Fish, Meat & Seafood, Processed Food, Pharmaceuticals ) |

| Regional Analysis/Coverage | USA |

| Company Profiles | Americold Logistics, Inc., AGRO Merchants Group North America, Burris Logistics, Henningsen Cold Storage Co., Lineage Logistics Holdings, LLC, Nordic Logistics, Preferred Freezer Services, VersaCold Logistics Services, United States Cold Storage, Wabash National Corporation |

| Key Drivers | • The rise of the pharmaceutical and life sciences industries creates demand for specialized cold storage of medicines and biological samples. • Advancements in automation and robotics are optimizing storage capacity, improving efficiency, and reducing labour costs in cold storage facilities. |

| Restraints | • Skilled labour shortage in the cold storage industry can pose challenges in managing and maintaining these facilities efficiently. • Fluctuations in energy prices can significantly impact the operational costs of running cold storage facilities. |