Healthcare Information Technology Market Report Scope & Overview:

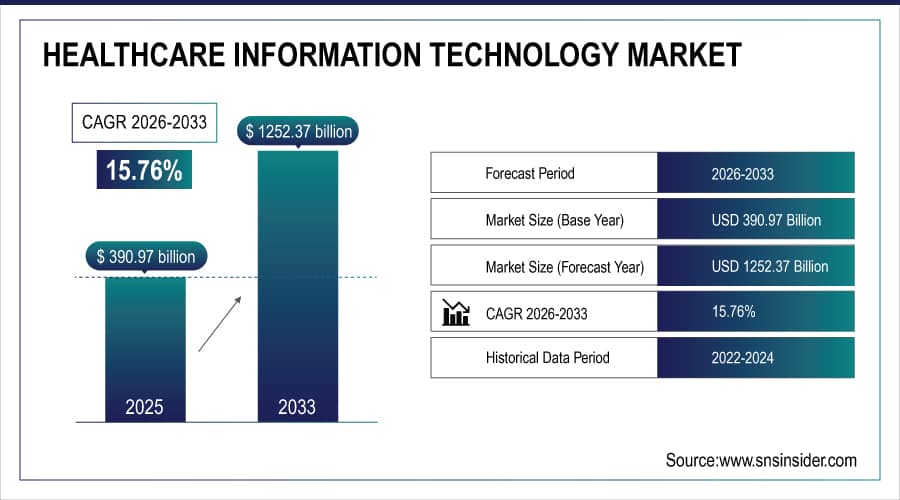

The Healthcare Information Technology Market was valued at USD 390.97 billion in 2025E and is expected to reach USD 1252.37 billion by 2033, growing at a CAGR of 15.76% from 2026-2033.

The Healthcare Information Technology Market is growing rapidly as providers, payers, and life sciences companies accelerate their shift toward digital, data-driven operations. Rising adoption of AI, predictive analytics, and cloud platforms is transforming clinical decision-making, population health, and operational efficiency. Expanding use of EHRs, real-world evidence, genomics, and remote monitoring is generating massive data volumes that require advanced analytics tools. Additionally, value-based care models and regulatory pushes for interoperability are driving continuous investment in modern healthcare data ecosystems.

Regulatory initiatives enacting interoperability, such as the 21st Century Cures Act, complement value-based care by enabling seamless data sharing necessary for coordinated and outcome-driven care delivery.

Examples include UnitedHealth’s USD75 billion payments linked to value-based care and widespread adoption of advanced cloud-based platforms, AI algorithms, and predictive analytics for managing chronic conditions and optimizing care pathways.

Healthcare Information Technology Market Size and Forecast:

-

Market Size in 2025: USD 390.97 Billion

-

Market Size by 2033: USD 1252.37 Billion

-

CAGR: 15.76% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Healthcare Information Technology Market - Request Free Sample Report

Healthcare Information Technology Market Trends:

-

Rapid Expansion of AI and Predictive Analytics

-

Shift Toward Cloud and Hybrid Healthcare Data Platforms

-

Growing Demand for Interoperability and Seamless Data Exchange

-

Rising Adoption of Genomic, IoT, and Real-World Data

-

Strengthening Focus on Data Security, Privacy, and Compliance

-

Increasing Use of Remote Monitoring and Digital Health Tools

-

Surge in Value-Based Care and Data-Driven Healthcare Models

-

Growth in Strategic Partnerships Across Tech and Healthcare Ecosystems

The U.S. Healthcare Information Technology Market was valued at USD 134.21 billion in 2025E and is expected to reach USD 424.65 billion by 2033, growing at a CAGR of 15.58% from 2026-2033.

The U.S. Healthcare Information Technology Market is expanding due to strong adoption of AI, cloud platforms, and advanced analytics across hospitals, payers, and life sciences. Rising demand for interoperable EHR systems, real-world evidence, and digital health tools, along with regulatory support for data modernization, continues to drive sustained investment and growth.

According to CDC data in December 2024, 88.2% of U.S. office-based physicians used an EMR/EHR system, with 77.8% using certified systems, driving demand for healthcare data integration and analytics solutions.

Healthcare Information Technology Market Growth Drivers:

-

Growing Adoption of Electronic Health Records (EHRs) Driving Demand for Advanced Healthcare Data Technologies

The rapid adoption of electronic health records (EHRs) is a major driver of growth in the Healthcare Information Technology Market. As hospitals, clinics, and health systems digitize medical records, the need for secure, scalable, and interoperable data platforms is increasing. EHR integration requires technologies that support real-time data access, seamless information sharing, and strong compliance with regulations such as HIPAA. The shift toward digital documentation improves clinical workflows, enhances patient care coordination, and accelerates the adoption of analytics, cloud solutions, and advanced data management tools across the healthcare ecosystem.

In the United States, EHR adoption is near-universal, with approximately 96% of hospitals and 85% of office-based physicians using certified EHR systems. Large hospitals have higher adoption rates, with about 97% of facilities with more than 300 beds using EHRs. Smaller hospitals and ambulatory care centers also show strong EHR adoption, around 88% and 90% respectivel.

-

Rising Need for Data-Driven Clinical Decision-Making Driving Growth in Healthcare Information Technology

The growing reliance on data-driven clinical decision-making is significantly boosting demand for advanced healthcare data technologies. Providers increasingly use real-time analytics, AI models, and predictive tools to enhance diagnostic accuracy, personalize treatment plans, and improve patient outcomes. As healthcare systems manage more complex conditions and larger patient populations, the ability to analyze clinical data quickly and accurately becomes essential. This shift toward evidence-based medicine drives hospitals and clinics to adopt integrated data platforms that support faster decision-making, reduce medical errors, and enable more efficient, coordinated care delivery.

Data integration reduces manual workflows, cuts claim processing times by 30–50%, and minimizes errors in billing, eligibility checks, and prior authorizations. Integrated claims adjudication platforms cross-reference multiple data sources in real time, preventing fraud and accelerating payments.Top of Form

Bottom of Form

Healthcare Information Technology Market Restraints:

-

Data Privacy and Security Concerns Slowing Adoption of Healthcare Data Technologies

Data privacy and security concerns remain one of the biggest restraints in the Healthcare Information Technology Market. Because healthcare data is extremely sensitive, organizations must comply with strict regulations such as HIPAA, GDPR, and other national data protection laws. However, the rising number of cyberattacks, ransomware incidents, and data breaches has made hospitals and clinics increasingly cautious about adopting new digital systems. Ensuring security requires ongoing investment in cybersecurity tools, staff training, and risk management, which can deter smaller providers and slow down overall technology adoption.

The average healthcare data breach in 2025 exposes about 71,276 records and costs on average USD7.42 million per incident globally, making healthcare one of the costliest sectors for data breaches. Larger breaches, especially those affecting millions of records, can cost upwards of USD127 million per incident.

-

High Implementation and Integration Costs Limiting Adoption of Healthcare Data Technologies

Implementing advanced healthcare data technologies—such as electronic health records (EHRs), cloud platforms, AI-driven analytics, and interoperability solutions—requires significant financial investment. Costs related to software licensing, hardware upgrades, data migration, customization, and long-term maintenance make adoption challenging for smaller hospitals, clinics, and physician practices with limited budgets. Additionally, integrating new systems with legacy infrastructure often demands specialized IT expertise, further increasing expenses. These high upfront and ongoing costs act as a major barrier, slowing widespread deployment of Healthcare Information Technology across resource-constrained healthcare settings.

Large-scale electronic health record (EHR) implementations, such as Epic, can cost USD2 to USD10 million for software installation in hospital projects, plus USD2 to USD10 million for hardware and infrastructure. Additional data migration expenses range from USD1 to USD5 million depending on legacy complexity. Licensing fees, training, maintenance, and customization further add to the financial burden.

Healthcare Information Technology Market Opportunities:

-

Increasing Adoption of Cloud-Based Healthcare Platforms Driving Market Growth

The rapid shift from on-premises systems to cloud-based healthcare platforms is creating significant opportunities in the Healthcare Information Technology Market. Hospitals, clinics, and diagnostic centers are increasingly adopting cloud-based electronic health records (EHRs), data storage solutions, and analytics platforms to improve scalability, reduce operational costs, and enhance accessibility. Cloud systems enable real-time data sharing, streamlined workflows, and better integration across departments. Additionally, the flexibility and remote access offered by cloud infrastructure support telehealth expansion and remote patient monitoring, further accelerating demand for advanced cloud-based healthcare data solutions.

The healthcare sector, responsible for nearly 30% of all global data, is experiencing a data growth rate of 36% annually, leading to higher adoption of cloud solutions for scalable storage and advanced data analysis.

Over 70% of healthcare institutions use cloud computing for real-time data sharing and collaboration, enabling faster diagnoses, coordinated treatment plans, and improved patient outcomes.

-

Expansion of Telehealth and Virtual Care Ecosystems Creating Strong Opportunities for Healthcare Data Technologies

The rapid growth of telehealth and virtual care is generating significant opportunities in the Healthcare Information Technology Market. Telemedicine platforms rely heavily on secure data exchange, real-time analytics, and seamless integration with EHRs, imaging systems, and remote patient monitoring devices. This shift toward virtual care increases the need for robust data management solutions that ensure privacy, interoperability, and efficient clinical workflows. As healthcare providers expand telehealth services to enhance accessibility and reduce in-person visits, demand for advanced digital health technologies and secure data infrastructure continues to rise.

Telemedicine platforms depend heavily on secure data exchange, real-time analytics, and seamless integration with EHRs, imaging systems, and remote patient monitoring devices. Approximately 85% of physicians are currently utilizing telehealth, with nearly 70% motivated to continue or expand its use to improve access and quality of care. Remote patient monitoring uses smart sensors and wearables to enable continuous health status tracking outside traditional healthcare facilities, enhancing chronic disease management and personalized care.

Healthcare Information Technology Market Segment Analysis:

By Component, Software segment led in 2025; Software segment expected fastest growth 2026–2033

The software segment dominated the Healthcare Information Technology Market in 2025 and is expected to grow fastest from 2026–2033 because healthcare providers increasingly rely on digital platforms for data integration, analytics, and real-time decision-making. Rising adoption of electronic health records, AI-driven diagnostic tools, and cloud-based data management strengthens demand. The shift toward interoperability, remote patient monitoring, and value-based care further accelerates software advancements, making it the core enabler of modern healthcare transformation.

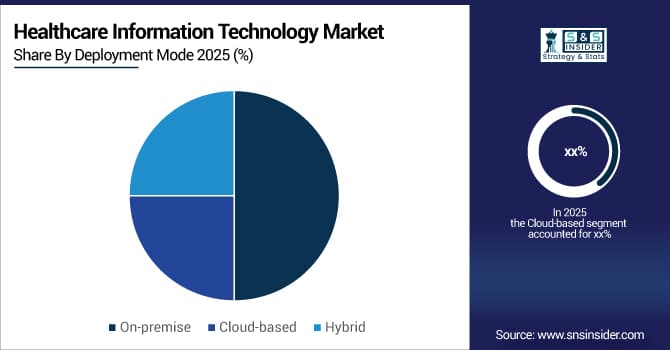

By Deployment Mode, Cloud-based segment led in 2025; Cloud-based segment expected fastest growth 2026–2033

The cloud-based segment dominated the Healthcare Information Technology Market in 2025 and is expected to grow fastest from 2026–2033 due to its scalability, lower upfront costs, and ability to support seamless data sharing across healthcare systems. Increasing adoption of telehealth, AI analytics, and remote patient monitoring relies heavily on cloud infrastructure. Healthcare providers prefer cloud platforms for enhanced interoperability, faster deployment, and improved cybersecurity frameworks, making cloud solutions central to digital transformation initiatives across hospitals and clinics.

By Application, Clinical Data Management segment led in 2025; Predictive Analytics & AI segment expected fastest growth 2026–2033

Clinical Data Management dominated the Healthcare Information Technology Market in 2025 because healthcare organizations increasingly depended on structured, accurate, and compliant data handling to support clinical trials, regulatory submissions, and patient safety monitoring. Growing data volumes, stricter reporting standards, and the need for centralized data repositories strengthened its leading position.

Predictive Analytics & AI is expected to grow fastest from 2026–2033 due to rising demand for advanced insights that improve diagnostics, treatment planning, and operational efficiency. Expanding use of machine learning, real-time risk prediction, and personalized medicine drives rapid adoption across healthcare providers and research institutions.

By End User, Hospitals & Clinics segment led in 2025; Pharma & Biotechnology Companies segment expected fastest growth 2026–2033

Hospitals & Clinics dominated the Healthcare Information Technology Market in 2025 because they generate the largest volume of patient data and rely heavily on digital systems for diagnostics, treatment planning, workflow management, and EHR integration. Increasing investments in health IT infrastructure and the need for real-time data accessibility further strengthened their leadership.

Pharma & Biotechnology Companies are expected to grow fastest from 2026–2033 due to rising adoption of advanced analytics, AI-driven research tools, and digital platforms for drug discovery and clinical trials. The need for faster R&D timelines, regulatory compliance, and efficient data integration accelerates technology adoption across the sector.

By Data Type, EHR Data segment led in 2025; Genomic Data segment expected fastest growth 2026–2033

Electronic Health Records (EHR) Data dominated the Healthcare Information Technology Market in 2025 because hospitals and clinics relied heavily on digitized patient information for clinical workflows, billing, diagnostics, and care coordination. Expanding government mandates for digital recordkeeping and the need for interoperable, centralized patient data systems further solidified its leading position.

Genomic Data is expected to grow fastest from 2026–2033 due to rapid advancements in precision medicine, falling sequencing costs, and rising adoption of genetic testing for disease prediction and personalized treatments. Increasing integration of AI-driven genomic analytics accelerates its use across research institutions, biotech companies, and clinical settings.

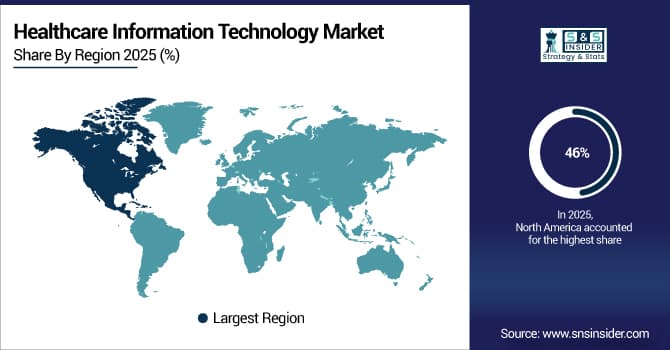

Healthcare Information Technology Market Regional Analysis:

North America Healthcare Information Technology Market Insights

North America dominated the Healthcare Information Technology Market with the highest revenue share of about 46% in 2025 due to its advanced healthcare infrastructure, strong adoption of EHR systems, rapid integration of AI-driven analytics, and high spending on digital health solutions. The presence of leading technology providers and favorable regulatory frameworks further strengthens regional leadership.

A government source perspective, CMS data shows consistent growth in national health expenditures, with digital health being a significant part of healthcare spending trends. This reinforces the trend of high investment in Healthcare Information Technology contributing to North America's market leadership.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Healthcare Information Technology Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 17.68% from 2026–2033 owing to accelerating healthcare digitalization, rising investments in AI and cloud technologies, expanding hospital networks, and government initiatives promoting health IT adoption. Growing patient data volumes and increasing telehealth usage further boost regional market expansion.

Regarding hospital networks, healthcare spending in major Southeast Asian countries is projected to rise by 6%-10% annually from 2022 to 2032, expanding hospital capacity and networks to serve growing populations and increasing middle-class demand. This is evident in countries like Indonesia and Vietnam, where government efforts focus on healthcare access expansion coupled with digital health technology integration.

Europe Healthcare Information Technology Market Insights

Europe showed strong growth in the Healthcare Information Technology Market in 2025, supported by widespread adoption of EHR systems, strict data protection regulations such as GDPR, and increasing investments in healthcare interoperability and analytics. Government-led digital health programs, rising chronic disease burden, and expanding telemedicine usage further contribute to the region’s growing market presence.

Healthcare data breaches remain a critical risk globally. In the US, over 725 large breaches were reported in 2024, exposing protected health information of nearly 277 million individuals. The average cost of a healthcare data breach in 2025 is USD7.42 million globally, with U.S. costs averaging USD10.22 million due to regulatory and legal factors.

Middle East & Africa and Latin America Healthcare Information Technology Market Insights

Middle East & Africa and Latin America are witnessing steady growth driven by increasing investments in digital health infrastructure, rising adoption of cloud-based systems, and expanding telemedicine usage. Both regions are focusing on modernizing healthcare delivery through EHR implementation, AI-based analytics, and supportive government policies. Growing private-sector participation and increasing demand for secure, efficient data management solutions further strengthen their collective market expansion.

Healthcare Information Technology Market Competitive Landscape:

Cerner Corporation (Oracle Health)

Cerner Corporation, now operating under Oracle Health, is a leading global provider of healthcare information technology solutions, specializing in electronic health records (EHR), population health management, clinical decision support, and interoperability platforms. The company focuses on integrating cloud-based systems, improving data accessibility, and enhancing clinical workflows across hospitals and health systems. Following Oracle’s acquisition, Cerner has accelerated innovation in AI-driven insights, real-time analytics, and healthcare automation to support more efficient, scalable, and outcomes-driven care delivery.

-

In March 2024: Oracle Delivers Foundation for More Intelligent Healthcare” – enhancements to the Oracle Health Data Intelligence suite including a generative AI service for care-management and deeper data integration (EHR-agnostic).

Epic Systems Corporation

Epic Systems Corporation is one of the largest healthcare software companies globally, widely recognized for its comprehensive electronic health records (EHR) platform used by major hospitals and health systems. Epic offers integrated modules for clinical workflows, revenue cycle management, patient engagement, telehealth, and population health analytics. Known for its strong interoperability framework, Epic enables seamless health information exchange across providers. The company continues to invest in predictive analytics, AI-powered decision support, and cloud-based solutions to enhance patient care and operational efficiency.

-

October 6, 2025: Epic previewed new developer-tools and interoperability features (API enhancements, patient/provider data-sharing) to simplify exchange and support cloud-native workflows for patients, providers and third-party apps.

McKesson Corporation

McKesson Corporation is a major healthcare services and information technology company offering a broad portfolio including health IT solutions, supply chain management, specialty care technologies, and clinical decision support tools. Its technology systems help providers streamline workflows, enhance medication management, improve patient safety, and optimize financial performance. McKesson also supports oncology care networks, pharmacy automation, and data analytics platforms. With a strong focus on interoperability, digital transformation, and value-based care models, McKesson continues to drive innovation across the healthcare technology ecosystem.

-

May 8, 2025: McKesson reports Fiscal 2025 results with strong revenue and earnings growth; underscores strategic focus on specialty care, digital and data-analytics capabilities.

Allscripts Healthcare Solutions, Inc.

Allscripts Healthcare Solutions, Inc. provides a wide range of healthcare information technology solutions including electronic health records (EHR), revenue cycle management, practice management, population health tools, and patient engagement platforms. The company focuses on improving clinical outcomes through interoperable, cloud-enabled systems and advanced analytics. Allscripts also supports precision medicine and connected care ecosystems through data integration and API-driven innovation. Its technology is used across hospitals, physician practices, and post-acute facilities, enabling more efficient workflows, coordinated care, and better patient experiences.

-

In February 2024: The company’s successor brand (Veradigm) announced acquisition of AI-company ScienceIO to build large language models for healthcare.

Healthcare Information Technology Key Players:

Some of the Healthcare Information Technology Market Companies

-

Cerner Corporation (Oracle Health)

-

Epic Systems Corporation

-

McKesson Corporation

-

Allscripts Healthcare Solutions, Inc.

-

Siemens Healthineers AG

-

IBM Watson Health / Merative

-

UnitedHealth Group (Optum Health IT Solutions)

-

Change Healthcare (UnitedHealth Group)

-

athenahealth, Inc.

-

NextGen Healthcare, Inc.

-

Infor, Inc.

-

Cognizant Technology Solutions

-

Accenture Healthcare

-

Dell Technologies (Healthcare IT Solutions)

-

Amazon Web Services (AWS Healthcare & Life Sciences Cloud)

-

Oracle Corporation

-

Altera Digital Health

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 390.97 Billion |

| Market Size by 2033 | USD 1252.37 Billion |

| CAGR | CAGR of 15.76 % From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services – Consulting, Integration, Maintenance) • By Deployment Mode (On-premise, Cloud-based, Hybrid) • By Application (Clinical Data Management, Predictive Analytics & AI, Population Health Management, Revenue Cycle Management, Patient Engagement & Monitoring) • By End User (Hospitals & Clinics, Healthcare Payers, Diagnostic & Imaging Centers, Pharma & Biotechnology Companies, Government & Public Health Agencies) • By Data Type (Electronic Health Records (EHR) Data, Claims Data, Genomic Data, Real-World Evidence (RWE), IoT & Wearable Health Data) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Cerner Corporation (Oracle Health), Epic Systems Corporation, McKesson Corporation, Allscripts Healthcare Solutions, Inc., Philips Healthcare, Siemens Healthineers AG, GE Healthcare Technologies Inc., IBM Watson Health / Merative, UnitedHealth Group (Optum Health IT Solutions), Change Healthcare (UnitedHealth Group), athenahealth, Inc., eClinicalWorks, NextGen Healthcare, Inc., Infor, Inc., Cognizant Technology Solutions, Accenture Healthcare, Dell Technologies (Healthcare IT Solutions), Amazon Web Services (AWS Healthcare & Life Sciences Cloud), Oracle Corporation, Altera Digital Health |