Heart Attack Diagnostics Market Size:

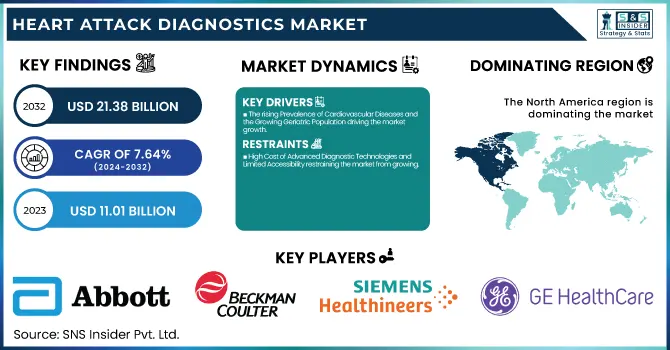

The Heart Attack Diagnostics Market size was valued at USD 11.01 billion in 2023 and is projected to reach USD 21.38 billion by 2032, growing at a CAGR of 7.64% from 2024-2032.

To Get more information on Heart Attack Diagnostics Market - Request Free Sample Report

Heart Attack Diagnostics Market Report provides insights with an in-depth incidence and prevalence study by geographic regions, portraying demographic trends for heart attack occurrence. The report offers diagnostic use trends, portraying regional use trends of ECG, blood biomarker testing (Troponin & CK-MB), and imaging diagnosis. The report also analyzes diagnostic test volume, providing forecasts for the adoption of annual tests and improvements in AI-enabled rapid diagnosis. It gives a detailed healthcare expenditure analysis (2023), breaking down expenditures into government, private insurance, commercial payers, and out-of-pocket expenses, providing a complete financial perspective on heart attack diagnosis globally.

Heart Attack Diagnostics Market Dynamics

Drivers

-

The rising Prevalence of Cardiovascular Diseases and the Growing Geriatric Population driving the market growth.

The growing incidence of cardiovascular diseases (CVDs), such as heart attacks, is a major growth driver for the heart attack diagnostics market. CVDs account for about 17.9 million deaths every year, according to the World Health Organization (WHO), and cause almost 32% of total deaths worldwide. The growing geriatric population also adds to this burden, as age is a major risk factor for heart disease. By 2050, there will be 2.1 billion people over the age of 60 worldwide, as predicted by the United Nations. There have been recent breakthroughs in diagnostic technology, including high-sensitivity troponin assays and AI-based ECG systems, that are making early detection more effective. Beckman Coulter gained FDA approval for its Access NT-proBNP assay in May 2024, and this trend is likely to grow, driving the market forward.

-

Technological Advancements in Cardiac Diagnostic Tools propelling the heart attack diagnostics market.

The heart attack diagnostics market is fueled by ongoing technological innovation across cardiac biomarker testing, imaging modalities, and artificial intelligence-based diagnostic tools. Assays like Roche's Elecsys Troponin T-high sensitive Assay allows early and precise myocardial infarction detection. The application of machine learning and artificial intelligence to ECG analysis is changing the face of diagnostics by lowering false negatives and allowing real-time examination. In August 2024, GE Healthcare also obtained CE mark approval for its AI-powered Vscan Air SL with Caption AI, which increases point-of-care cardiac imaging. Moreover, improved portable and wearable ECG devices enable remote monitoring, enhancing patient outcomes. Such developments, combined with growing R&D expenditure, are anticipated to fuel market growth by delivering quicker, more efficient, and more accessible diagnostic solutions.

Restraint

-

High Cost of Advanced Diagnostic Technologies and Limited Accessibility restraining the market from growing.

The expense of sophisticated diagnostic equipment is a major constraint in the heart attack diagnostics market, especially in low- and middle-income nations. Cardiac biomarker tests using high-sensitivity biomarkers, artificial intelligence-based ECG devices, and imaging techniques like cardiac MRI and CT scans involve huge capital expenditures on equipment, maintenance, and trained personnel. For instance, the prices of high-sensitivity troponin assays and point-of-care testing machines may be too high for small healthcare centers. Also, rural and developing areas usually do not have access to these sophisticated diagnostic solutions because of poor healthcare infrastructure. As per the WHO, almost 50% of the global population does not have access to basic health services, which further restricts early diagnosis and timely treatment for heart attacks. Without affordable solutions and enhanced accessibility, the growth potential of the market remains curtailed.

Opportunities

-

The growing integration of artificial intelligence (AI) and point-of-care testing (POCT) in heart attack diagnostics presents a significant opportunity for market expansion.

The increasing adoption of artificial intelligence (AI) and point-of-care testing (POCT) in heart attack diagnosis offers tremendous opportunities for growth in the market. AI-assisted ECG analysis and machine learning allow quicker and more accurate diagnosis of myocardial infarctions, with decreased diagnostic mistakes and enhanced patient outcomes. Players like GE Healthcare and Philips are in the process of integrating AI into their diagnostic platforms to accelerate real-time decision-making. Further, handheld and portable POCT devices enable quick biomarker testing in emergencies, which cuts the time to diagnosis to a great extent. The growing need for decentralized healthcare options, especially in remote and underdeveloped areas, also hastens the integration of these technologies. With increased investments in POCT and AI, the market is likely to see enhanced accessibility, efficiency, and patient-centric care.

Challenges

-

One of the key challenges in the heart attack diagnostics market is the variability in test sensitivity and specificity across different diagnostic modalities.

Variability in test sensitivity and specificity between diagnostic modalities is one of the main challenges faced in the market for heart attack diagnostics. Although there has been great progress with high-sensitivity troponin assays in terms of improved accuracy of detection of myocardial infarction, differences in biomarker thresholds between manufacturers can cause inconsistency in results. For instance, research has indicated that troponin levels can vary with patient demographics, underlying conditions, and assay sensitivity, resulting in false positives or negatives at times. Likewise, ECG interpretation can differ based on the clinician's level of expertise, resulting in misdiagnosis. The absence of standardization of diagnostic protocols and interpretation criteria continues to be an issue, especially in emergency departments where rapid decision-making is paramount. This problem demands worldwide harmonization of diagnostic standards, enhanced training of clinicians, and ongoing technology improvement in testing accuracy.

Heart Attack Diagnostics Market Segmentation Analysis

By Test

The blood test segment dominated the heart attack diagnostics market with a 55.26% market share in 2023 as a result of its high specificity, quick detection rate, and extensive usage in emergency environments. Blood tests, especially those identifying cardiac biomarkers such as troponin and CK-MB, form a pivotal part of diagnosing myocardial infarction through the detection of heart muscle injury. Of these, high-sensitivity troponin assays have emerged as the gold standard since they allow for early identification of even small cardiac damage, enhancing patient outcomes. Growing implementation of point-of-care blood testing in emergency departments and ambulatory care facilities and advancements in technology concerning assay sensitivity and specificity further consolidated the dominance of the segment. Furthermore, regulatory clearances, including the FDA clearance of Beckman Coulter's Access NT-proBNP assay in 2024, have added to the importance of blood testing in heart attack diagnosis.

The CK-MB segment is witness to grow at the fastest rate during the forecast period owing to its increasing use as a surrogate biomarker for troponin testing, especially in reinfarction cases. Creatine kinase-MB (CK-MB) is a standard marker of myocardial injury and is usually employed when troponin results are inconclusive. New studies indicate that CK-MB testing can be useful in assessing the degree and timing of heart muscle damage, particularly in the case of recurrent cardiac events. The increasing need for fast and affordable cardiac biomarker tests in developing economies is also driving the growth of the segment. In addition, improvements in automated immunoassay platforms, combined with growing awareness regarding the need for multi-biomarker testing for holistic cardiac evaluation, are likely to propel the use of CK-MB diagnostics in the forecast years.

By End-use

The Ambulatory Surgical Centers (ASCs) segment dominated the heart attack diagnostics market with a 53.29% market share in 2023 as more cardiac diagnostic procedures moved out of the hospital and into the outpatient environment. ASCs provide inexpensive, effective, and convenient diagnostic services, taking pressure off emergency departments and inpatient hospital facilities. With improvements in point-of-care diagnostics and handheld diagnostic devices, ASCs have emerged as centers of choice for immediate cardiac biomarkers testing, such as troponin and CK-MB testing. Moreover, favorable reimbursement rules and shorter waiting times for patients have also played a significant role in the broad-based adoption of ASCs for the diagnosis of heart attacks. The increasing number of cardiovascular disorders, along with patient preference for minimally invasive and rapid diagnostic tests, also supported the supremacy of the segment in 2023.

The Ambulatory Surgical Centers segment is anticipated to grow the most in the forecast period, fueled by the continued development of outpatient care models and the growing adoption of sophisticated diagnostic technologies. Governments and providers are committing funds to ASCs to improve early detection of cardiac disease and lower readmission rates. The increasing use of portable electrocardiograms (ECGs), quick blood biomarker tests, and artificial intelligence (AI)-driven diagnostic devices in ASCs is also driving their growth further. ASCs are also providing major cost benefits over hospital-based diagnostics, thus emerging as a desirable choice in developed and emerging economies alike. As regulatory authorities continue to encourage outpatient care with beneficial policies and insurance coverage, the ASC segment is expected to grow significantly in the next few years.

Heart Attack Diagnostics Market Regional Insights

North America dominated the heart attack diagnostics market with 38.56% market share in 2023, because of its established healthcare infrastructure, high burden of cardiovascular diseases, and heavy investments in medical technology. It has a high number of heart attacks, and the American Heart Association (AHA) estimates that nearly 805,000 individuals in the U.S. suffer from heart attacks annually. Furthermore, the dominant position of major players like Abbott, Siemens Healthineers, and GE Healthcare ensures ongoing innovation in diagnostic equipment, such as high-sensitivity troponin assays and AI-based ECG devices. Favorable reimbursement policies, widespread use of point-of-care testing in emergency departments, and government programs for lowering cardiovascular mortality further consolidate North America's position in this market.

Asia Pacific is the fastest growing region during the forecast period with 8.75% CAGR in the heart attack diagnostics market, fueled by a fast-growing aging population, increasing burden of cardiovascular disease, and growing healthcare expenditure. China, India, and Japan are seeing an upsurge in heart disease cases as a result of lifestyle changes, increased obesity, and growing rates of diabetes and hypertension. The increasing utilization of advanced diagnostic technologies, combined with the government-led efforts to enhance the accessibility of healthcare, is driving growth in the market. Also, medical tourism in India and Thailand is encouraging demand for cost-efficient and high-quality diagnostics. The rise of point-of-care diagnostics and AI-based diagnostics, combined with increasing awareness regarding early diagnosis, is likely to drive market growth in the region in the years to come.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Heart Attack Diagnostics Market

-

Abbott Laboratories (ARCHITECT STAT High Sensitivity Troponin-I Assay, i-STAT System)

-

Beckman Coulter (Access hsTnI Assay, DxI 800 Immunoassay System)

-

Bio-Rad Laboratories, Inc. (Cardiac Marker Control, Liquichek Cardiac Markers Plus Control)

-

Siemens Healthineers (ADVIA Centaur TnI-Ultra Assay, Atellica IM 1300 Analyzer)

-

GE Healthcare (MAC 2000 Resting ECG System, CardioSoft Diagnostic System)

-

Hitachi Medical Systems (HI VISION Avius Ultrasound System, Noblus Portable Ultrasound)

-

Schiller AG (CARDIOVIT AT-102 G2 ECG Device, MAGLIFE RT-1 Patient Monitor)

-

Koninklijke Philips N.V. (PageWriter TC70 Cardiograph, IntelliVue MX700 Patient Monitor)

-

F. Hoffmann-La Roche Ltd. (Elecsys Troponin T-high sensitive Assay, Cobas h 232 POC System)

-

Bayer AG (CONTOUR Blood Glucose Monitoring System, Multistix 10 SG Reagent Strips)

-

bioMérieux, Inc. (VIDAS Troponin I Ultra Assay, VIDAS NT-proBNP Assay)

-

Danaher Corporation (Triage Cardiac Panel, Dimension EXL with LM Integrated Chemistry System)

-

Life Sign LLC (Status DS Troponin I Test, Status First Aid Rapid Test)

-

Toshiba Corporation (Aquilion ONE CT Scanner, Aplio i-series Ultrasound)

-

FUJIFILM Holdings (FDR Go PLUS Portable X-ray System, Arietta 850 Ultrasound)

-

Midmark Corporation (IQecg Digital ECG, IQvitals Zone Vital Signs Monitor)

-

Hill-Rom Services (Welch Allyn) (CP 150 Resting ECG, Connex Spot Monitor)

-

Canon Medical Systems Corporation (Aquilion Prime SP CT System, Aplio i800 Ultrasound)

-

Bionet Co., Ltd. (CardioTouch 3000 ECG, BM3 Patient Monitor)

-

Edwards Lifesciences Corporation (FloTrac Hemodynamic Monitoring System, ClearSight System)

Suppliers (These suppliers play a crucial role in the availability and performance of heart attack diagnostic products worldwide.)

-

Thermo Fisher Scientific

-

Merck KGaA

-

Agilent Technologies

-

PerkinElmer Inc.

-

Sysmex Corporation

-

Randox Laboratories

-

Sekisui Diagnostics

-

Trinity Biotech

-

Diazyme Laboratories, Inc.

-

QuidelOrtho Corporation

Recent Development

-

May 2024 – Beckman Coulter, a worldwide leader in clinical diagnostics, has obtained U.S. Food and Drug Administration (FDA) clearance for its Access NT-proBNP (N-terminal Pro B-type Natriuretic Peptide) assay. Compatible with the DxI 9000 Immunoassay Analyzer, the assay provides results within less than 11 minutes, greatly enhancing diagnostic efficiency. It serves a vital purpose in the determination of heart failure severity, risk stratification, and assisting in the diagnosis of acute heart failure in emergency conditions.

-

August 2024 – GE HealthCare has received CE mark clearance for its Vscan Air SL wireless handheld ultrasound system with Caption AI, an artificial intelligence (AI)-based software intended for fast cardiac evaluation at the point of care. The company also has introduced ECG-less Cardiac CT scanning on the Revolution Apex platform, allowing clinicians to acquire cardiac images without using patients' electrocardiogram (ECG) signals. Both innovative technologies will be featured during the European Society of Cardiology (ESC) Congress in London from August 30 to September 2, 2024.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 11.01 billion |

| Market Size by 2032 | US$ 21.38 billion |

| CAGR | CAGR of 7.64% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Test (Electrocardiogram, Blood Test [Troponin, CK-MB], Others) • By End-use (Hospitals, Ambulatory Surgical Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott Laboratories, Beckman Coulter, Bio-Rad Laboratories, Inc., Siemens Healthineers, GE Healthcare, Hitachi Medical Systems, Schiller AG, Koninklijke Philips N.V., F. Hoffmann-La Roche Ltd., Bayer AG, bioMérieux, Inc., Danaher Corporation, Life Sign LLC, Toshiba Corporation, FUJIFILM Holdings, Midmark Corporation, Hill-Rom Services (Welch Allyn), Canon Medical Systems Corporation, Bionet Co., Ltd., Edwards Lifesciences Corporation, and other players. |