Cardiac Biomarker Testing Market Size & Overview:

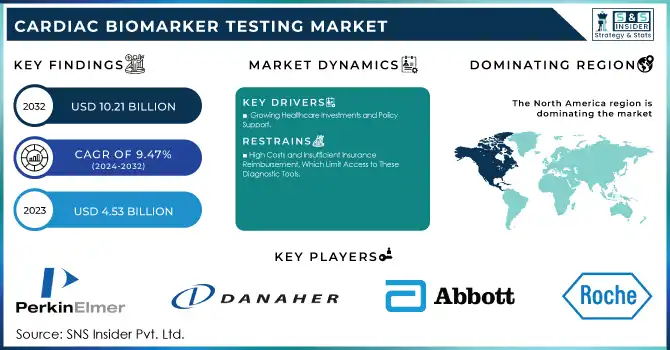

The Cardiac Biomarker Testing Market was valued at USD 4.53 billion in 2023 and is expected to reach USD 10.21 billion by 2032 with a growing CAGR of 9.47% over the forecast period of 2024-2032.

To get more information on Cardiac Biomarker Testing Market - Request Free Sample Report

The Cardiac Biomarker Testing Market is witnessing substantial growth, driven by the rising global prevalence of cardiovascular diseases, advancements in diagnostic technologies, and growing public awareness regarding heart health. Cardiovascular diseases remain the leading cause of death globally, responsible for an estimated 17.9 million deaths annually, according to the World Health Organization. This has underscored the need for accurate, accessible diagnostic tools to detect heart conditions early, enabling timely intervention. Biomarker tests, such as troponins, B-type natriuretic peptides, and high-sensitivity C-reactive protein, have become invaluable for diagnosing heart attacks, heart failure, and other CVDs, making them essential in clinical practice worldwide.

Technological advancements in cardiac biomarker testing have significantly enhanced diagnostic accuracy. For instance, high-sensitivity assays now allow for detecting low troponin levels, which are critical for diagnosing myocardial injury at early stages, even in patients presenting with ambiguous symptoms. Approving point-of-care devices, such as the Abbott i-STAT System and Roche’s Cobas platforms, has made biomarker testing more convenient and cost-effective, particularly in emergency settings where rapid results can be life-saving. These innovations have led to the increased use of biomarker testing in over 90% of heart attack cases in developed countries, streamlining emergency responses and reducing diagnostic delays.

The aging global population is another factor accelerating the demand for cardiac biomarker tests. As life expectancy increases, cardiovascular conditions become more prevalent among the elderly. For example, studies indicate that one in four individuals aged 65 and older in the U.S. suffer from heart disease. This demographic shift has led to greater healthcare focus on preventive measures, risk stratification, and continuous monitoring, all facilitated by biomarker testing.

Moreover, lifestyle factors like poor diets, physical inactivity, and smoking are contributing to the increasing incidence of CVDs, especially in younger populations. A 2019 study by the American Heart Association found that poor dietary habits and lack of exercise were significant contributors to heart disease in individuals under the age of 50. As a result, individuals are increasingly seeking regular check-ups, fueling demand for cardiovascular screening and biomarker testing.

Government initiatives have further bolstered the market's growth. For instance, the U.S. National Institutes of Health has been actively funding cardiovascular research, which has led to breakthroughs in cardiac biomarker identification and testing. In emerging markets, such as India and China, improving healthcare infrastructure drives greater access to advanced diagnostic technologies, including cardiac biomarker tests, ensuring that even underserved populations can benefit from early disease detection.

Cardiac Biomarker Testing Market Dynamics

Drivers

-

Growing Healthcare Investments and Policy Support

Governments worldwide are investing significantly in healthcare infrastructure, contributing to the growth of the cardiac biomarker testing market. Policies like the U.S. Affordable Care Act have increased access to preventive healthcare services, encouraging widespread adoption of diagnostic tools, including biomarker testing. These investments enable the development of cutting-edge technologies that enhance diagnostic capabilities and improve early disease detection. As healthcare systems become more equipped to handle complex cardiovascular diseases, integrating advanced biomarker tests into routine clinical practice has become more common. This increased access to testing has been crucial in reducing diagnostic delays and improving the outcomes of cardiovascular treatments, particularly in emergency settings. Consequently, healthcare funding and progressive health policies are essential drivers supporting cardiac biomarker testing market growth.

-

Rising Prevalence of Comorbidities

The increasing prevalence of comorbidities such as diabetes, hypertension, and obesity plays a significant role in driving the demand for cardiac biomarker testing. These conditions elevate the risk of cardiovascular diseases, prompting the need for regular and early detection of heart-related issues. Biomarker testing provides an efficient and non-invasive means to assess cardiovascular risk and detect potential heart events early, even in patients with subtle or no symptoms. With the global rise in lifestyle-related health conditions, more individuals are at risk for heart disease, which in turn boosts the demand for preventive diagnostic tools. This growing burden of comorbidities has led to an increase in healthcare screenings, including biomarker tests, ensuring early intervention and better management of cardiovascular conditions, thus accelerating the market’s growth.

-

Shift Towards Personalized Medicine and Remote Monitoring

The transition toward personalized medicine is a key driver of the cardiac biomarker testing market. With healthcare increasingly focusing on tailored treatments based on individual genetic profiles and biomarkers, the demand for specific, personalized diagnostic tests has surged. Cardiac Biomarker Testing is crucial in enabling physicians to customize treatment plans and improve patient outcomes, particularly for heart disease patients. Additionally, the rise of remote patient monitoring and telemedicine has expanded the use of portable biomarker testing solutions. These innovations allow patients to undergo testing from home or during routine check-ups without needing to visit healthcare facilities, making it easier to track and manage heart conditions. The ability to monitor and adjust treatments in real-time using biomarker data has led to more precise interventions, driving demand for these testing solutions and further accelerating market growth.

Restraints

-

High Costs and Insufficient Insurance Reimbursement, Which Limit Access to These Diagnostic Tools

A major constraint in the cardiac biomarker testing market is the significant cost of diagnostic tools, including testing equipment, reagents, and laboratory services. These expenses can be prohibitive for healthcare providers, particularly in low- and middle-income regions, limiting their ability to implement advanced biomarker tests. This financial challenge restricts access to such testing, especially in emerging markets with limited healthcare resources. Additionally, reimbursement policies for cardiac biomarker tests often remain inadequate or unclear, creating further barriers to their widespread adoption. In some cases, insurance companies may not fully cover the costs associated with these tests, placing a financial burden on patients. These economic obstacles slow the integration of biomarker testing into routine clinical practice, hindering its broader use and ultimately limiting its potential to improve cardiovascular care and outcomes on a global scale.

Cardiac Biomarker Testing Market Segmentation Analysis

By Product Type

Reagents and kits were the dominant segment in 2023, accounting for 65% of the market. Their widespread adoption is attributed to their critical role in detecting and quantifying Cardiac Biomarker Testing across multiple testing platforms. These products ensure high sensitivity and specificity in diagnostic results, making them a cornerstone of biomarker testing. The increasing prevalence of cardiovascular diseases and the need for frequent and rapid diagnostic tests further boosted their demand. The growing use of point-of-care testing, which heavily relies on reagent kits, also contributed to their dominance.

Instruments are expected to be the fastest-growing segment due to advancements in testing technologies, such as high-throughput analyzers and portable devices, which enhance diagnostic accuracy and efficiency. The rising adoption of automated systems in clinical laboratories and POC devices in remote healthcare settings is driving this growth.

By Biomarker Type

Troponin I and T biomarkers held a 40% market share in 2023, owing to their unparalleled accuracy in diagnosing acute myocardial infarction or heart attacks. These biomarkers are considered the gold standard for cardiac injury detection, significantly improving the ability to make early and reliable diagnoses. Their dominance is further supported by the widespread use of high-sensitivity troponin assays in hospitals and diagnostic centers globally.

BNP or NT-proBNP biomarkers are expected to grow at the fastest rate due to their crucial role in diagnosing heart failure and stratifying risk in patients with cardiovascular conditions. Increasing awareness of heart failure as a global health challenge and the growing adoption of biomarker-guided management protocols are key drivers for this segment.

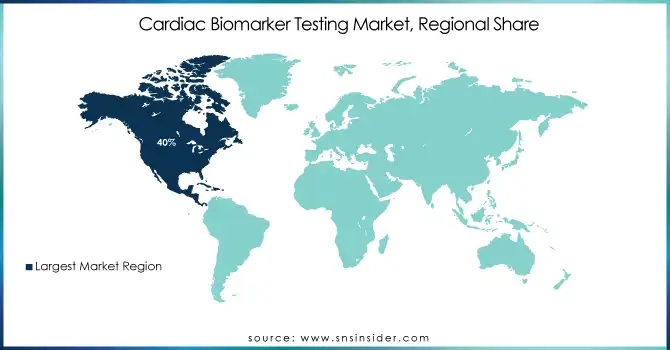

Cardiac Biomarker Testing Market Regional Outlook

North America dominated the cardiac biomarker testing market in 2023, accounting for 40% of the global market share. This leadership is attributed to the high prevalence of cardiovascular diseases, which affect nearly 48% of adults in the U.S., as reported by the American Heart Association. Advanced healthcare infrastructure and early adoption of innovative diagnostic technologies, such as high-sensitivity troponin assays, contribute significantly to this dominance. For example, prominent institutions like the Cleveland Clinic have integrated cardiac biomarker testing into their protocols to improve early detection and management of heart conditions. Government funding for healthcare innovation and favorable reimbursement policies further support the region’s leadership.

Asia-Pacific is the fastest-growing region due to the increasing burden of cardiovascular diseases and expanding healthcare investments. In India and China, cardiovascular conditions account for nearly 30% of all deaths, fueling demand for biomarker testing. Initiatives such as India’s National Programme for Prevention and Control of Non-Communicable Diseases and China’s Healthy China 2030 plan have boosted the adoption of diagnostic tools like troponin and myoglobin assays, particularly in urban hospitals.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players and Cardiac Biomarker Testing Products

-

F. Hoffmann-La Roche AG

-

Elecsys Troponin T, Elecsys NT-proBNP, Elecsys CK-MB assays.

-

-

-

ARCHITECT STAT High-Sensitivity Troponin-I, Alinity i STAT Troponin-I assay, i-STAT System.

-

-

-

Beckman Coulter Access hs-TnI, Access BNP, Access Myoglobin.

-

-

-

ADVIA Centaur High-Sensitivity Troponin I assay, Dimension EXL NT-proBNP assay.

-

-

PerkinElmer, Inc.

-

DELFIA immunoassays for Cardiac Biomarker Testing, EnVision Detection Platforms.

-

-

bioMérieux SA

-

VIDAS Troponin I Ultra, VIDAS NT-proBNP assays.

-

-

Becton, Dickinson, and Company

-

BD Veritor System, BD Multitest reagents for Cardiac Biomarker Testing.

-

-

Thermo Fisher Scientific Inc.

-

Procalcitonin and cardiac panel assays, Thermo Scientific B·R·A·H·M·S biomarkers.

-

-

Bio-Rad Laboratories, Inc.

-

Liquichek Cardiac Markers Control, Cardiac Marker Assays.

-

-

DiaSorin

-

LIAISON BNP, LIAISON NT-proBNP assays.

-

-

Tosoh Corporation

-

AIA-PACK Troponin I, AIA-PACK BNP assay.

-

-

LSI Medience Corporation

-

LSI Cardiac Marker Testing Solutions, BNP testing kits.

-

-

Quidel Corporation

-

Triage MeterPro Cardiac Panel, Triage BNP assay.

Recent Developments

In June 2024, Siemens Healthineers expanded its cardiac testing portfolio by introducing the NT-proBNPII (PBNPII) assay on the Atellica Solution platform. This addition aims to enhance heart failure diagnostics, leveraging NT-proBNP and BNP as key biomarkers of cardiac stress in response to increased ventricular filling pressure.

In 2023, Roche, the global leader in in vitro diagnostics, invested CHF 13.2 million in research and development, launching six new platforms, 21 diagnostic tests, and seven digital solutions. The company also accelerated its cardiometabolic disease (CMD) pipeline through strategic partnerships and acquisitions, further advancing patient care and outcomes.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.53 Billion |

| Market Size by 2032 | USD 10.21 Billion |

| CAGR | CAGR of 9.47% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type [Reagents and Kits, Instruments (Chemiluminescence, Immunofluorescence, ELISA, Immunochromatography)] • By Biomarker Type [Troponin I and T, Creatine kinase-MB(CK-MB), Brain Natriuretic Peptide (Bnp Or Nt-Probnp), Myoglobin, High-sensitivity C-reactive protein(hs-CRP), Other Cardiac Biomarkers] • By Diseases [Myocardial Infarction, Congestive Heart Failure, Acute Coronary Syndrome, Atherosclerosis, Ischemia] • By End User [Laboratory Testing Facilities (Hospital Labs, Reference Labs, Contract Testing Labs), Point-Of-Care Testing Facilities, Academic Institutions] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | F. Hoffmann-La Roche AG, Abbott Laboratories, Danaher Corporation, Siemens Healthineers AG, PerkinElmer, Inc., bioMérieux SA, Becton, Dickinson and Company, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., DiaSorin, Tosoh Corporation, LSI Medience Corporation, and Quidel Corporation |

| Key Drivers | • Growing Healthcare Investments and Policy Support • Rising Prevalence of Comorbidities • Shift Towards Personalized Medicine and Remote Monitoring |

| Restraints | • High Costs and Insufficient Insurance Reimbursement, Which Limit Access to These Diagnostic Tools |